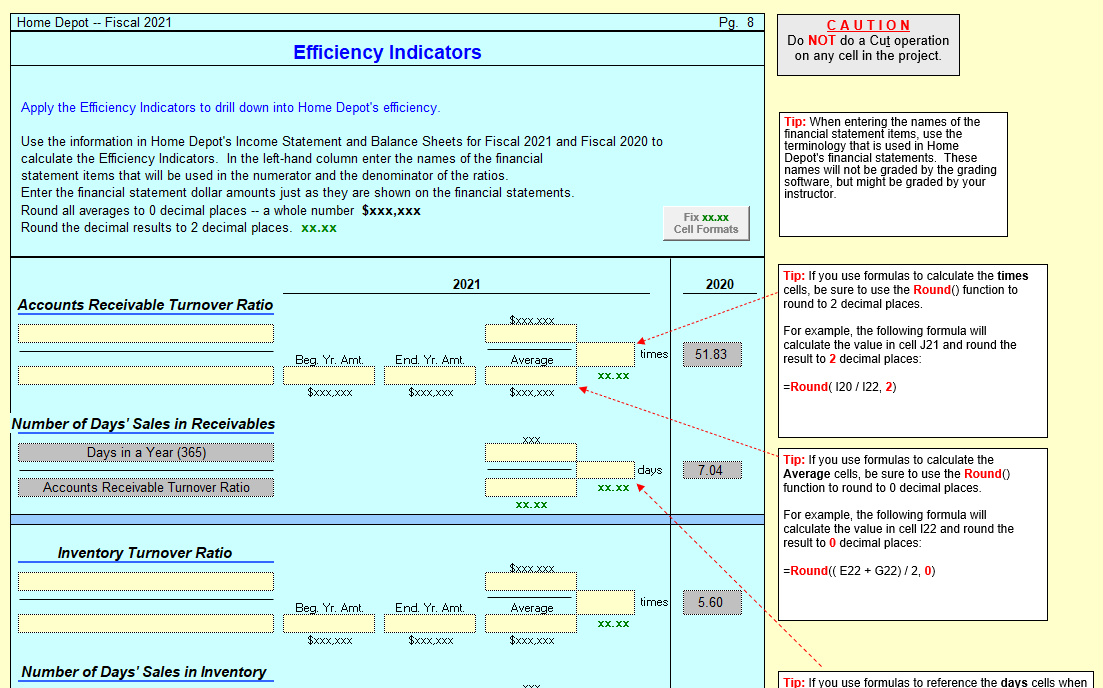

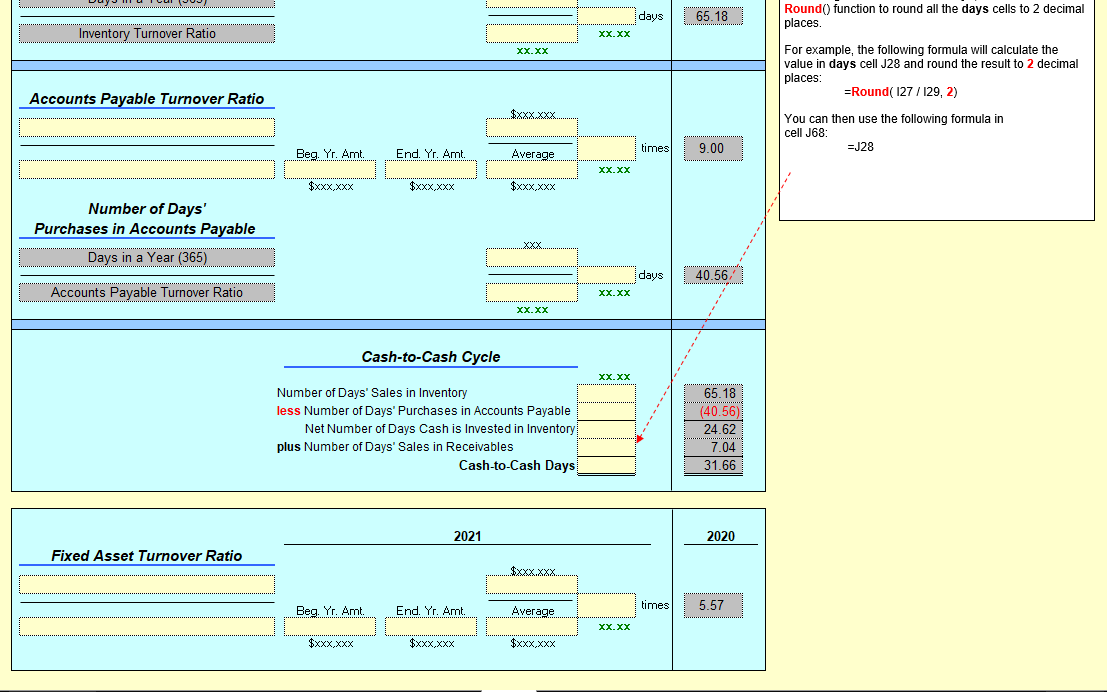

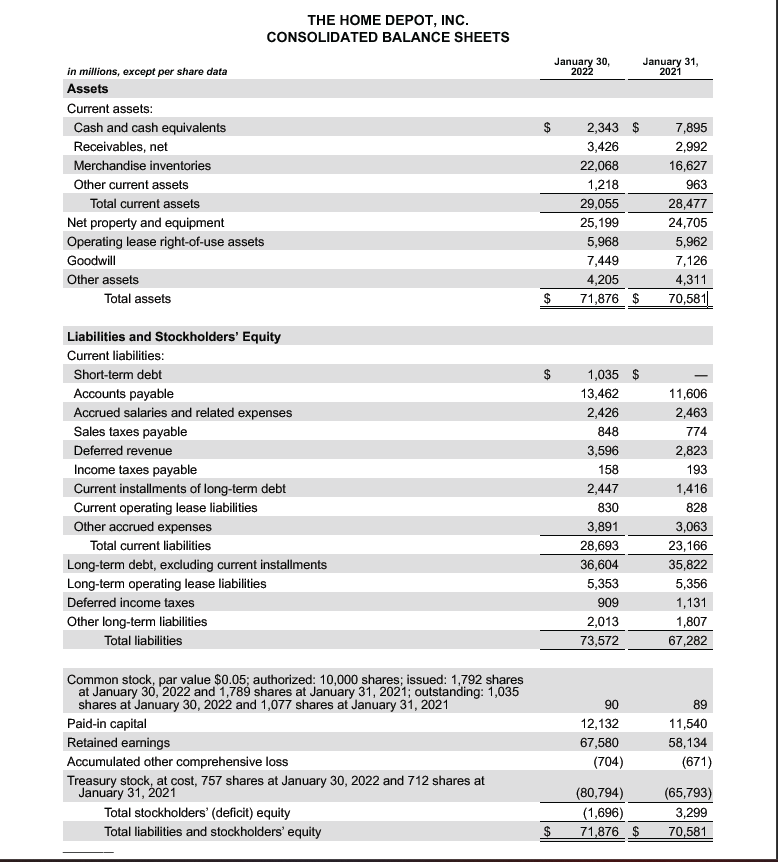

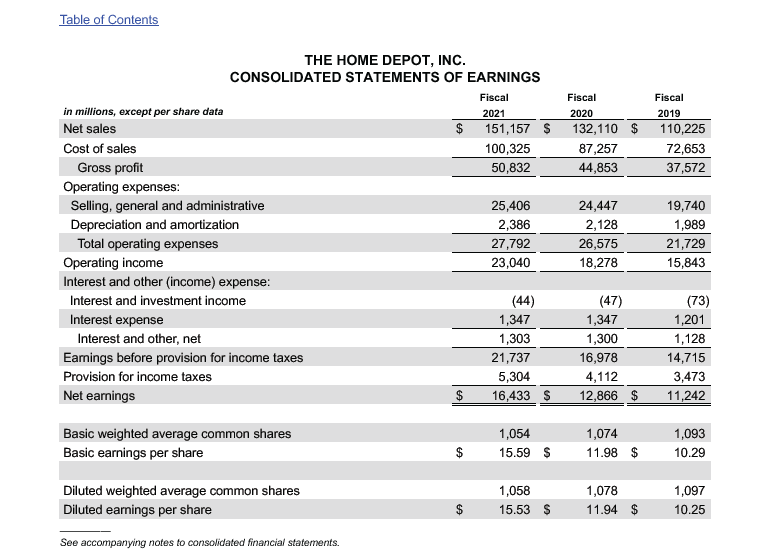

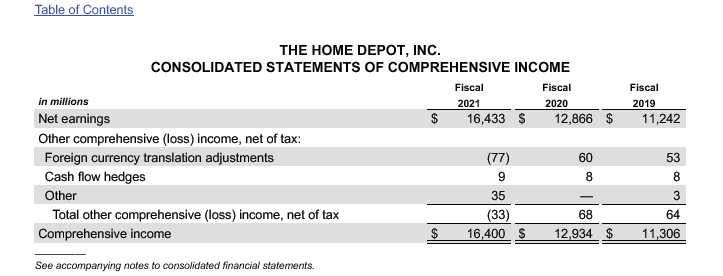

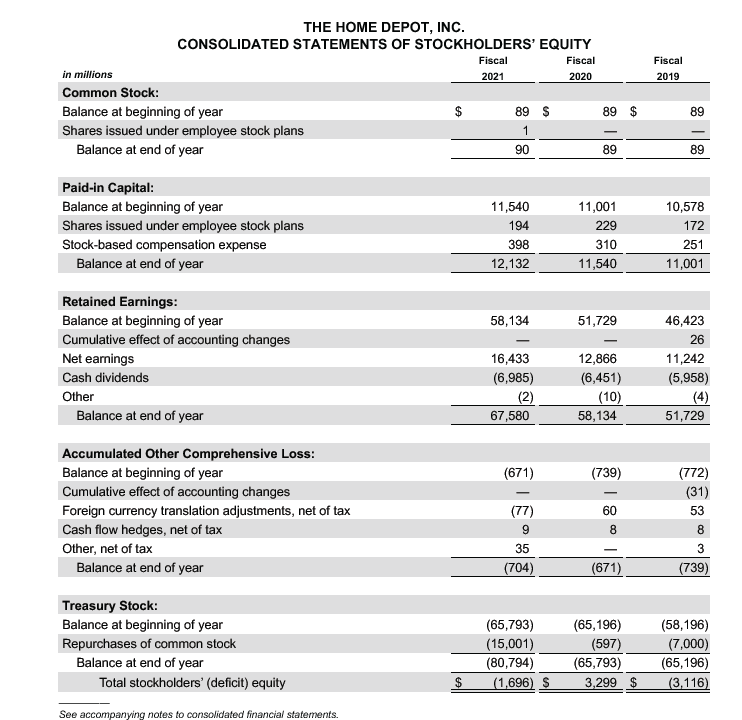

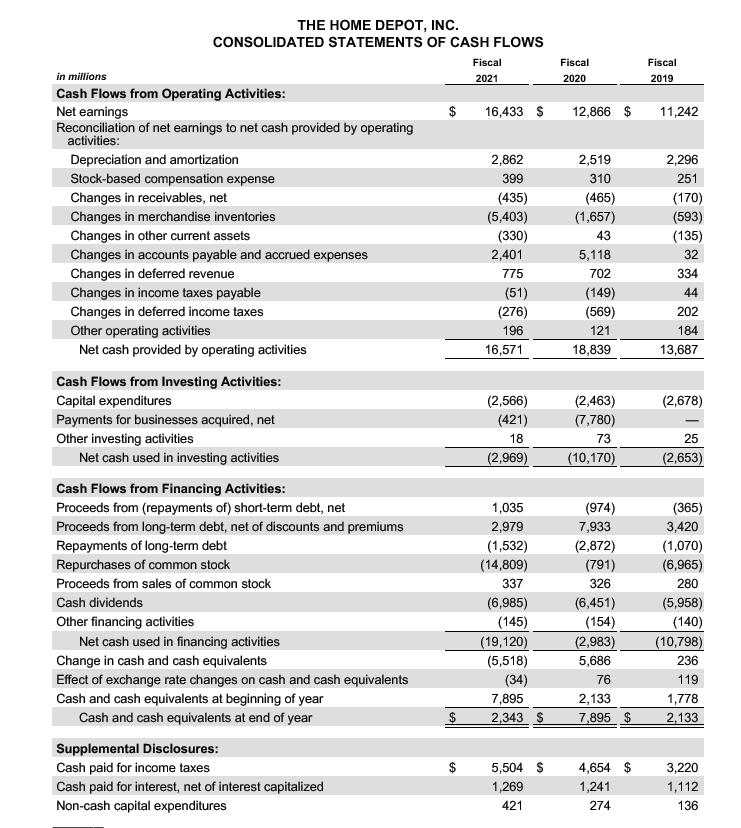

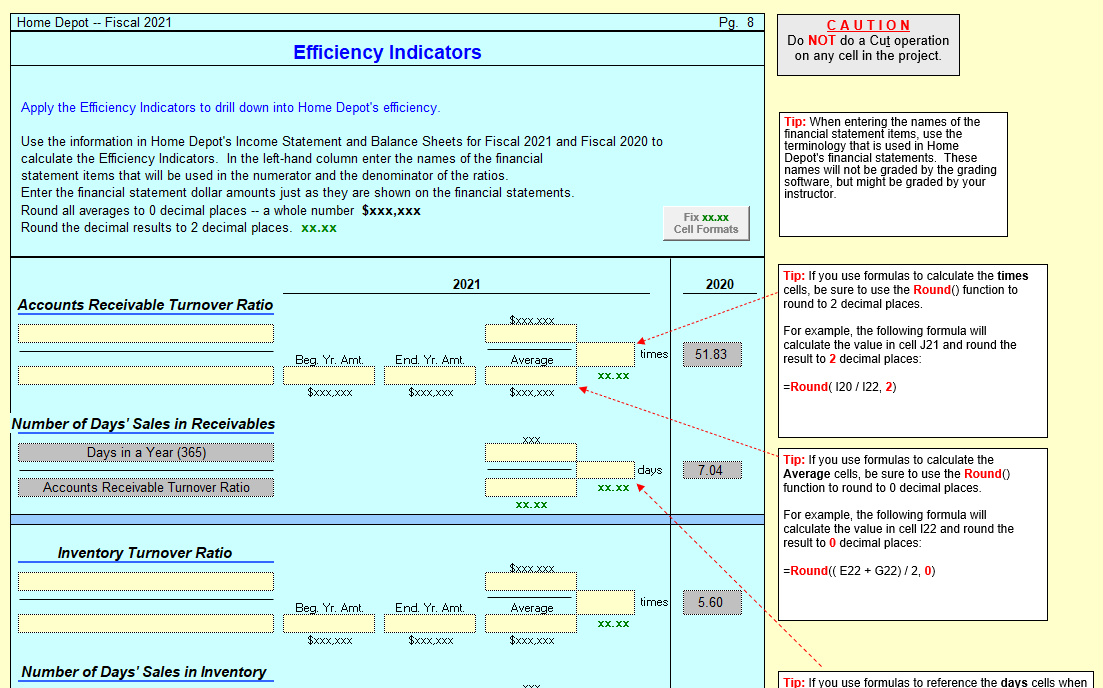

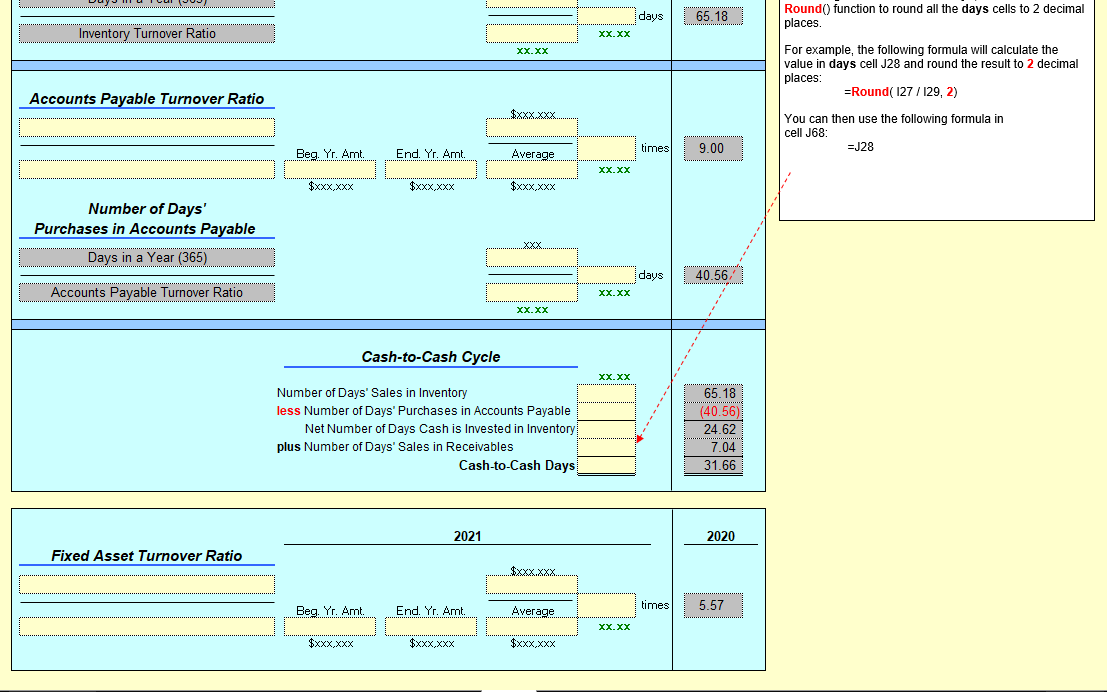

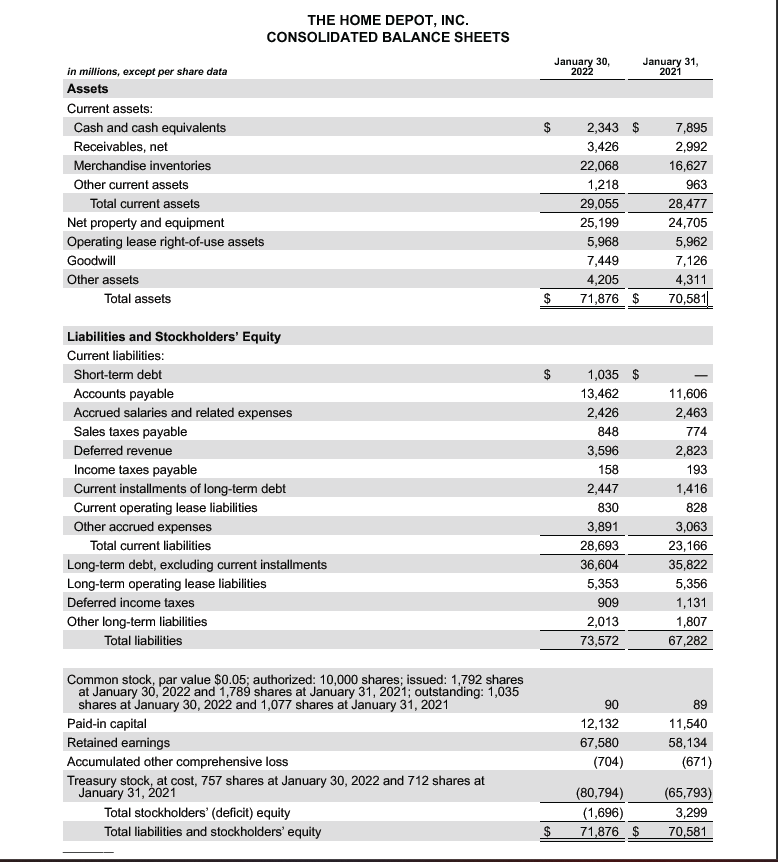

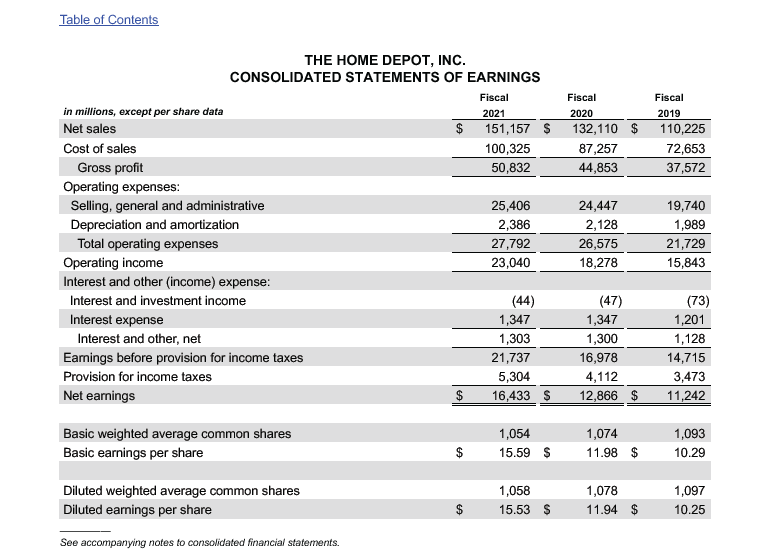

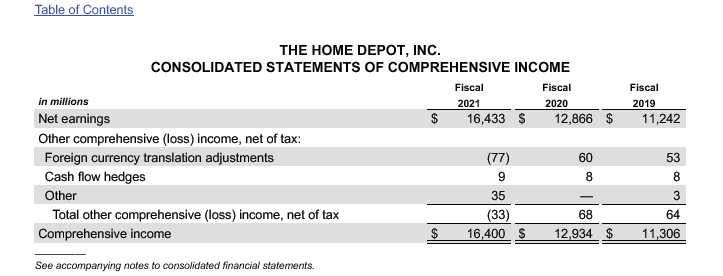

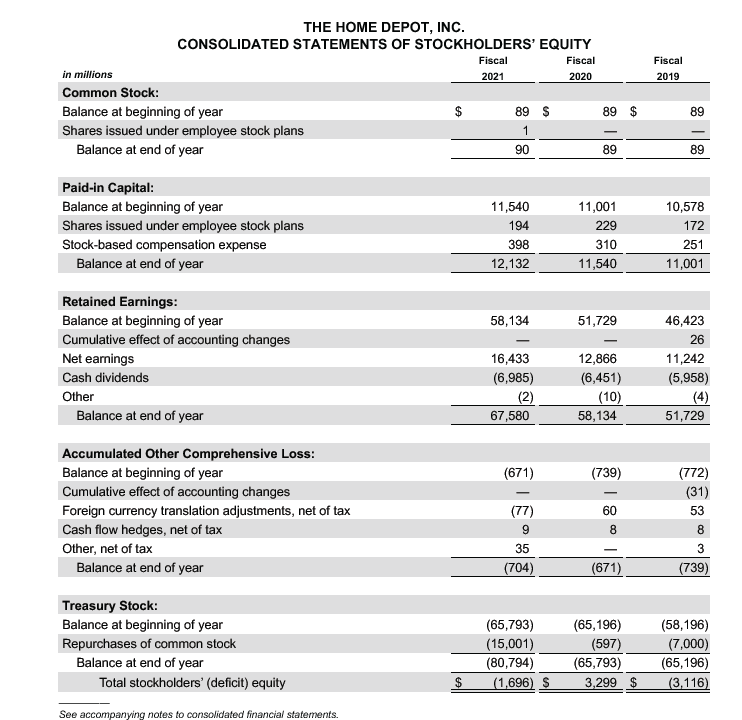

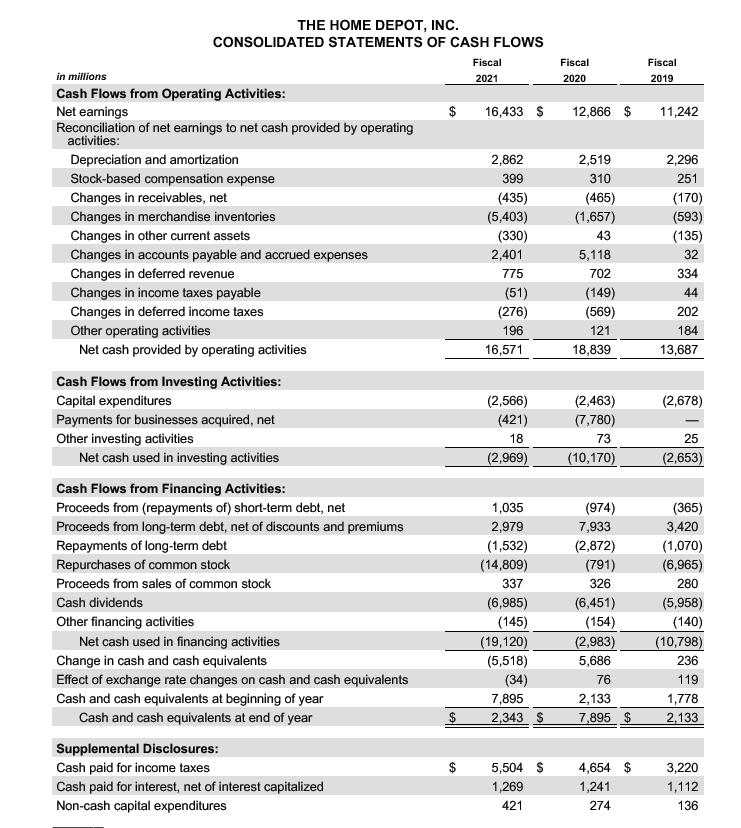

Home Depot - Fiscal 2021 Pg. 8 Efficiency Indicators Do NOT do a Cut operation on any cell in the project. Apply the Efficiency Indicators to drill down into Home Depot's efficiency. Use the information in Home Depot's Income Statement and Balance Sheets for Fiscal 2021 and Fiscal 2020 to calculate the Efficiency Indicators. In the left-hand column enter the names of the financial statement items that will be used in the numerator and the denominator of the ratios. Enter the financial statement dollar amounts just as they are shown on the financial statements. Round all averages to 0 decimal places - a whole number $xxx,xxx Round the decimal results to 2 decimal places. xx.xx Tip: If you use formulas to calculate the times cells, be sure to use the Round() function to round to 2 decimal places. For example, the following formula will calculate the value in cell J21 and round the result to 2 decimal places: =Round( I20//22,2) Tip: If you use formulas to calculate the Average cells, be sure to use the Round0 function to round to 0 decimal places. For example, the following formula will calculate the value in cell I22 and round the result to 0 decimal places: =Round((E22+G22)/2,0) Round() function to round all the days cells to 2 decimal )laces. -or example, the following formula will calculate the alue in days cell J28 and round the result to 2 decimal )laces: =Round(I27/I29,2) You can then use the following formula in :ell J68: =J28 THE HOME DEPOT, INC. CONSOI InATFR RAI DNCF SHFFTS Table of Contents THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF EARNINGS Basic weighted average common shares Basic earnings per share $$1,05415.591,05815.53$$1,07411.981,07811.94$$1,09310.291,09710.25 Diluted weighted average common shares Diluted earnings per share See accompanying notes to consolidated financial statements. THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY \begin{tabular}{lrrr} Paid-in Capital: & & & \\ \hline Balance at beginning of year & 11,540 & 11,001 & 10,578 \\ \hline Shares issued under employee stock plans & 194 & 229 & 172 \\ Stock-based compensation expense & 398 & 310 & 251 \\ \hline Balance at end of year & 12,132 & 11,540 \\ \hline \end{tabular} Retained Earnings: Balance at beginning of year Cumulative effect of accounting changes Net earnings Cash dividends Other Balance at end of year Accumulated Other Comprehensive Loss: Balance at beginning of year \begin{tabular}{rrr} (671) & (739) & (772) \\ & & (31) \\ (77) & 60 & 53 \\ 9 & 8 & 8 \\ 35 & & 3 \\ \hline(704) & (671) \\ \hline \end{tabular} Treasury Stock: Balance at beginning of year Repurchases of common stock Balance at end of year Total stockholders' (deficit) equity See accompanying notes to consolidated financial statements. THE HOME DEPOT. INC