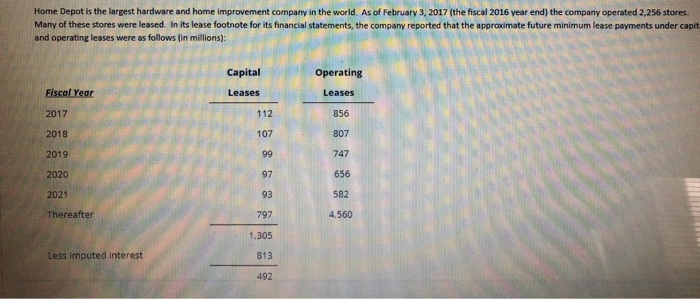

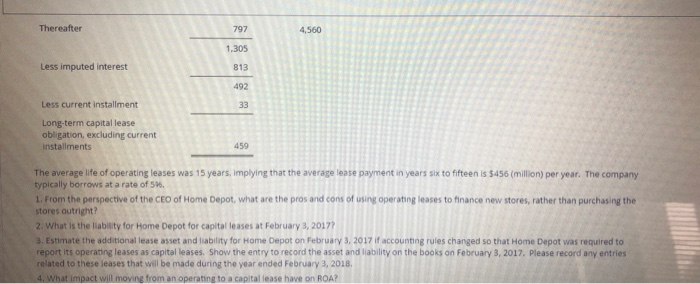

Home Depot is the largest hardware and home improvement company in the world. As of February 3, 2017 (the fiscal 2016 year end) the company operated 2.256 stores Many of these stores were leased. In its lease footnote for its financial statements, the company reported that the approximate future minimum lease payments under capit and operating leases were as follows (in millions) Capital Operating Leases 856 807 747 656 582 4,560 Fiscal Year 2017 2018 2019 2020 2021 Thereafter Leases 112 107 97 93 797 1,305 813 492 Less imputed interest Thereafter 797 ,305 813 492 4,560 Less imputed interest Less current installment Long-term capital lease obligation, excluding current installments 459 The average life of operating leases was 15 years, implying that the average lease payment in years six to fifteen is $456 (million) per year. The company typically borrows at a rate of 5t% 1. From the perspective of the CEO of Home Depot, what are the pros and cons of using operating leases to finance new stores, rather than purchasing the stores outright? 2. What is the liability for Home Depot for capital leases at February 3, 2017? 3. Estimate the additional lease asset and liability for Home Depot on February 3, 2017 if accounting rules changed so that Home Depot was required to report its operaning leases as capital leases. Show the entry to record the asset and liability on the books on February 3, 2017. Please record any entries related to these leases that will be made during the year ended February 3, 2018 What impact will moving from an operating to a capital lease have on ROA? Home Depot is the largest hardware and home improvement company in the world. As of February 3, 2017 (the fiscal 2016 year end) the company operated 2.256 stores Many of these stores were leased. In its lease footnote for its financial statements, the company reported that the approximate future minimum lease payments under capit and operating leases were as follows (in millions) Capital Operating Leases 856 807 747 656 582 4,560 Fiscal Year 2017 2018 2019 2020 2021 Thereafter Leases 112 107 97 93 797 1,305 813 492 Less imputed interest Thereafter 797 ,305 813 492 4,560 Less imputed interest Less current installment Long-term capital lease obligation, excluding current installments 459 The average life of operating leases was 15 years, implying that the average lease payment in years six to fifteen is $456 (million) per year. The company typically borrows at a rate of 5t% 1. From the perspective of the CEO of Home Depot, what are the pros and cons of using operating leases to finance new stores, rather than purchasing the stores outright? 2. What is the liability for Home Depot for capital leases at February 3, 2017? 3. Estimate the additional lease asset and liability for Home Depot on February 3, 2017 if accounting rules changed so that Home Depot was required to report its operaning leases as capital leases. Show the entry to record the asset and liability on the books on February 3, 2017. Please record any entries related to these leases that will be made during the year ended February 3, 2018 What impact will moving from an operating to a capital lease have on ROA