Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Home insert Draw Design Layout References Mailings Review View Help 2 x Cut E E the Copy Arial -11 A A Aa A BIU -

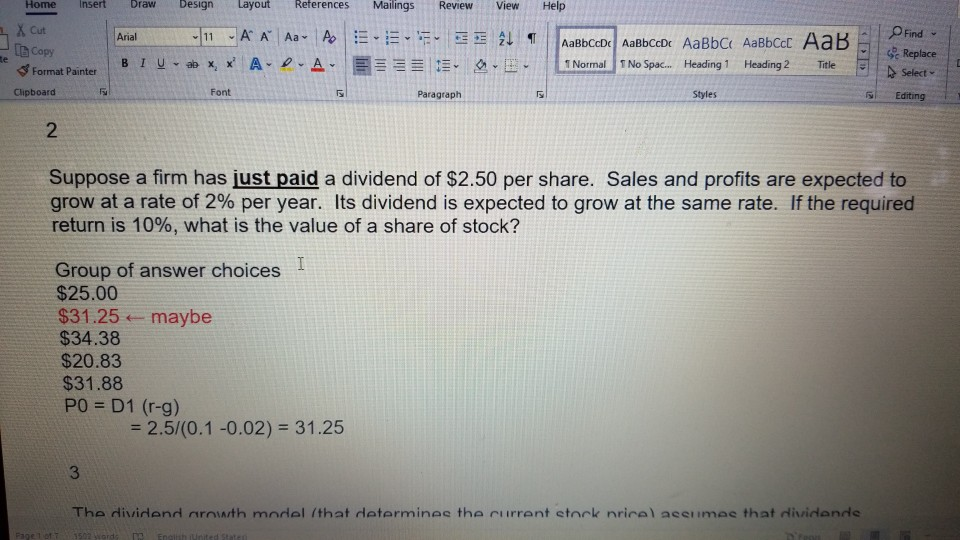

Home insert Draw Design Layout References Mailings Review View Help 2 x Cut E E the Copy Arial -11 A A Aa A BIU - *, * A-D-A- ALTAaBbCcDc AabbCcDc AaBbci AaBbcc AaB - DE 1 Normal 1 No Spac.. Heading 1 Heading 2 Title Find - Se Replace Select- Format Painter Clipboard Font Paragraph Styles Editing Suppose a firm has just paid a dividend of $2.50 per share. Sales and profits are expected to grow at a rate of 2% per year. Its dividend is expected to grow at the same rate. If the required return is 10%, what is the value of a share of stock? Group of answer choices 1 $25.00 $31.25 + maybe $34.38 $20.83 $31.88 PO = D1 (r-g) = 2.5/(0.1 -0.02) = 31.25 The dividend arowth model that determines the current stock nrical acelimee that dividende PageTo son bordo o Footh united senten

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started