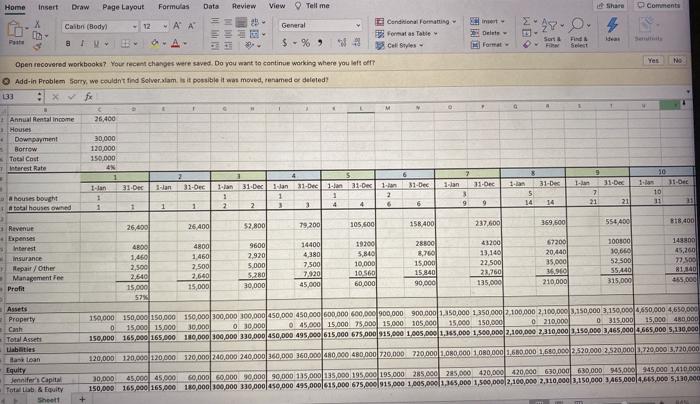

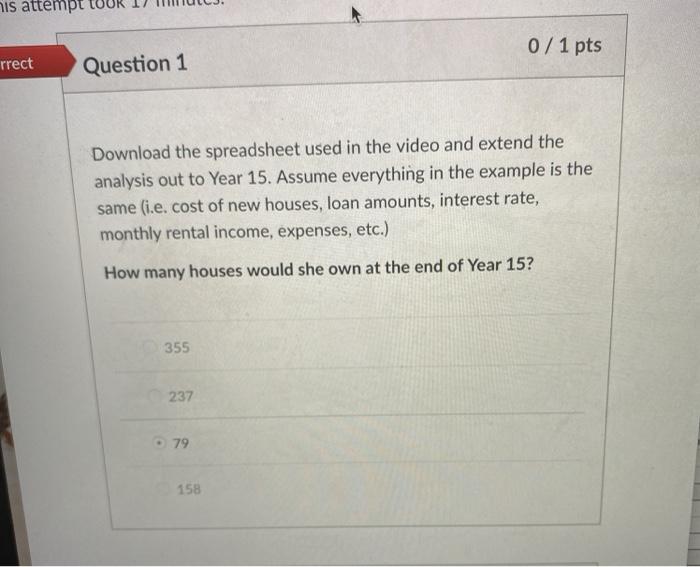

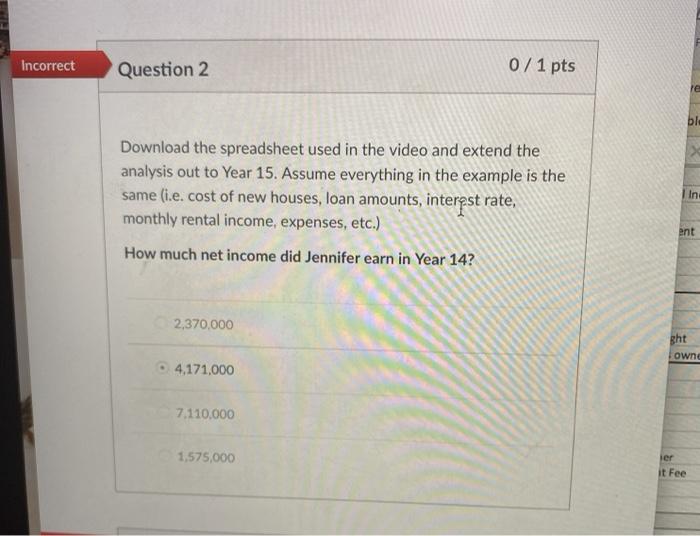

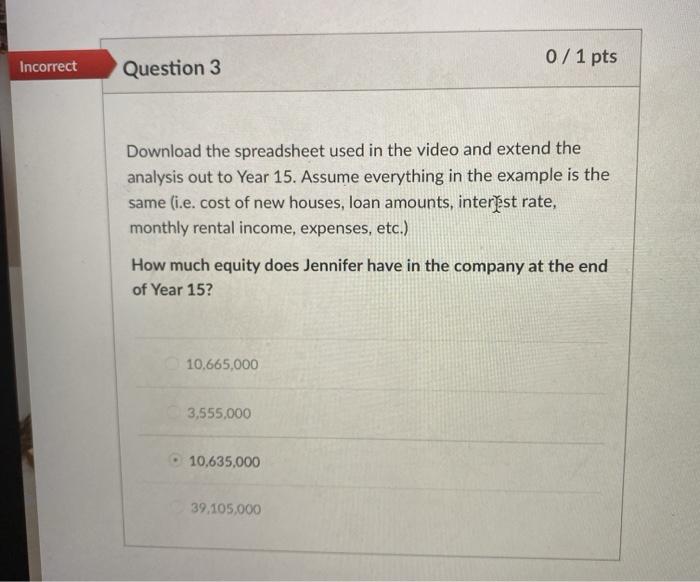

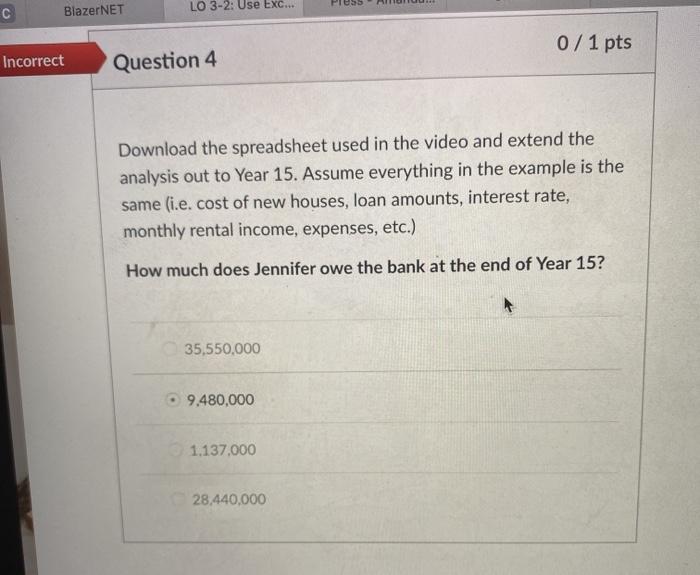

Home Insert Draw Page Layout Formulas Data Review View Tell me share Coments X 2 . Calib (Body General - 12 A A 0-A- Candon Fomatting Formatas Table Delete- F Sort Pat Ideas $ - % ) Yes Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off Add-in Problem Sorry, we couldn't find solver.xlam. is it possible it was moved, renamed or deleted 133 x x 1 26.400 Annual Rental income Hous Downpayment Borrow Total Cost Interest Rate 30,000 120,000 150.000 AN 1 1. dan 6 31-0 11-Dec 31-Dec 1-lan 31-Dec 31-Dec 1 31-Dec 31-Dec1. -L 31-Dec 31-0 1. 2 1-31-Dec1 an 1 1 2 1-an 3 9 7 21 5 14 10 11 A houses bought total houses owned 21 9 3 4 14 1 6 1 1 52,800 79,200 105.600 818400 26,400 26.400 237,600 369,600 1584001 554400 1 Revenue Expenses Interest insurance Repair Other Management Profit 48000 1 460 2,500 2.640 15,000 4800 1,460 2,500 2.640 15,000 57 9600 2.920 5,000 5.280 30,000 14400 4,380 7.500 7.920 45,000 19200 5,840 10 DOD 10.560 60,000 28800 8,760 15.000 15.840 90.000 43200 13,140 22.500 23.760 135,000 57200 20440 35.000 100000 10,660 52 500 S5A40 315,000 143800 45,260 72.500 81.140 455,000 210 000) 150,000 150,000 150.000 150,000 300,000 300,000 450,000 450.000.000.000 600,000 900.000 900.000 1.250,000 1.350.000 2.100,000 2,100,000 3,150,000 3,150,000 4 650.000 4650,000 15.000 15.000 30,000) O 30 000 0 45.000 15.000 75.000 15.000 105.000 15.000 150.000 0 210.000 0315.000 15,000 450000 150,000 165,000 165.000 180,000 300,000 330,000 450,000 495.000 615,000 675,000 915,000 1.005.000 1.165,000 1,500,000 2,100,000 2.310,000 1,150,000 3,465,000 4.665.000 5,130,000 0 Assets Property Cash Total Asset Labeties dan loan Equity Jennifer's Capit Total Lab & Equity Sheet 120,000 120,000 120 000 120.000 240,000 240,000 360,000 160,000 480.000 480.000 720,000 720.000 1.000.000 1 ORO 000 2.680.000 16.80,000 2520.000 2 520.000 1.720,000 3.720.000 30.000 45.000 45.000 60.000 50.000 90000 90000 135.000 135.000 195.000 195.000 285.000 285.000 420,000 420.000 630.000 60.000 9445.000 45.000 1410000 150,000 165,000 165.000 180,000100,000 330,000 450,000 495,000 615,000 675,000 915,000 1,005,000 1,345,000 1,500,000 2,100,000 2,110,000 1,150,000 3A65,000 4,645,000 5,190,000 + his attempt 0 / 1 pts rrect Question 1 Download the spreadsheet used in the video and extend the analysis out to Year 15. Assume everything in the example is the same (i.e. cost of new houses, loan amounts, interest rate, monthly rental income, expenses, etc.) How many houses would she own at the end of Year 15? 355 237 79 158 Incorrect Question 2 0/ 1 pts re bl Download the spreadsheet used in the video and extend the analysis out to Year 15. Assume everything in the example is the same (i.e. cost of new houses, loan amounts, interast rate, monthly rental income, expenses, etc.) I In ent How much net income did Jennifer earn in Year 14? 2,370,000 Rht owne 4.171,000 7.110.000 1,575,000 jer it Fee 0/1 pts Incorrect Question 3 Download the spreadsheet used in the video and extend the analysis out to Year 15. Assume everything in the example is the same (i.e. cost of new houses, loan amounts, interest rate, monthly rental income, expenses, etc.) How much equity does Jennifer have in the company at the end of Year 15? 10.665,000 3,555,000 10,635,000 39.105,000 C BlazerNET LO 3-2: Use EXC... 0/1 pts Incorrect Question 4 Download the spreadsheet used in the video and extend the analysis out to Year 15. Assume everything in the example is the same (i.e. cost of new houses, loan amounts, interest rate, monthly rental income, expenses, etc.) How much does Jennifer owe the bank at the end of Year 15? 35,550,000 9.480,000 1.137.000 28.440,000