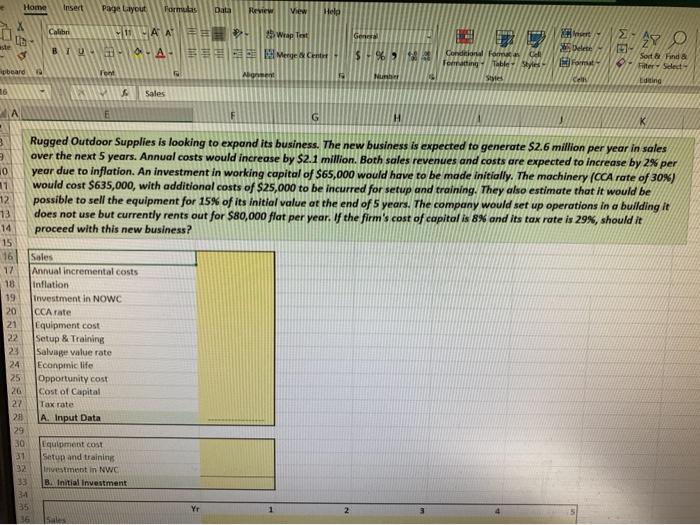

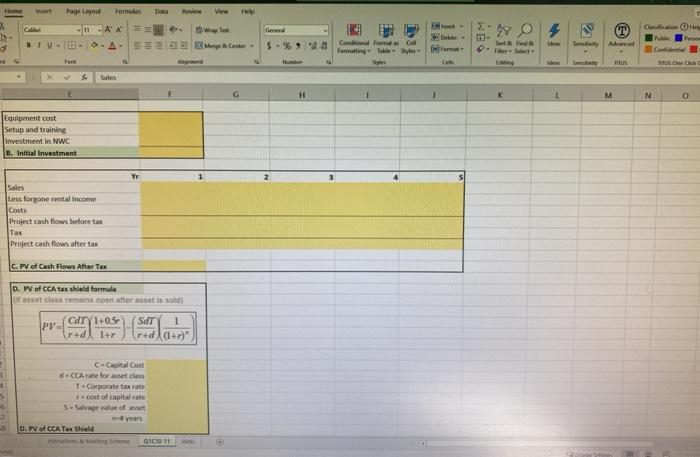

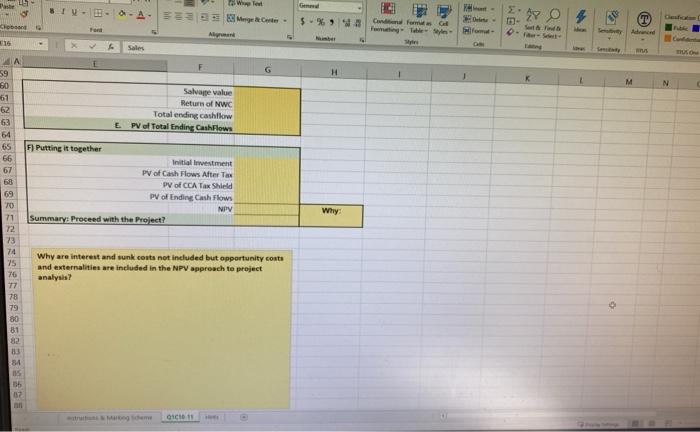

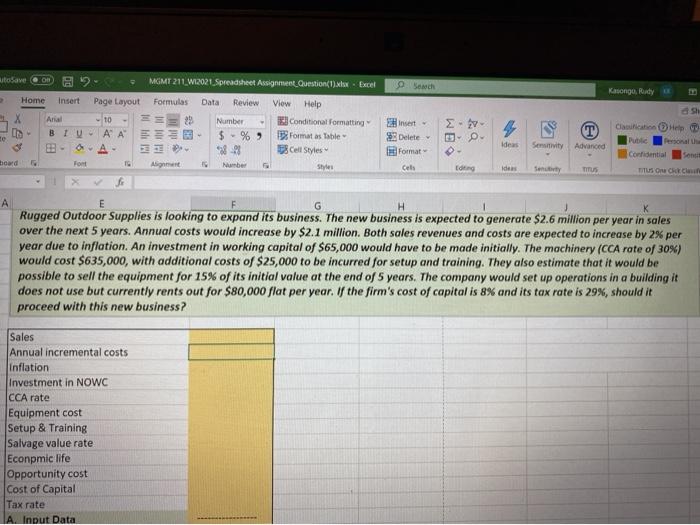

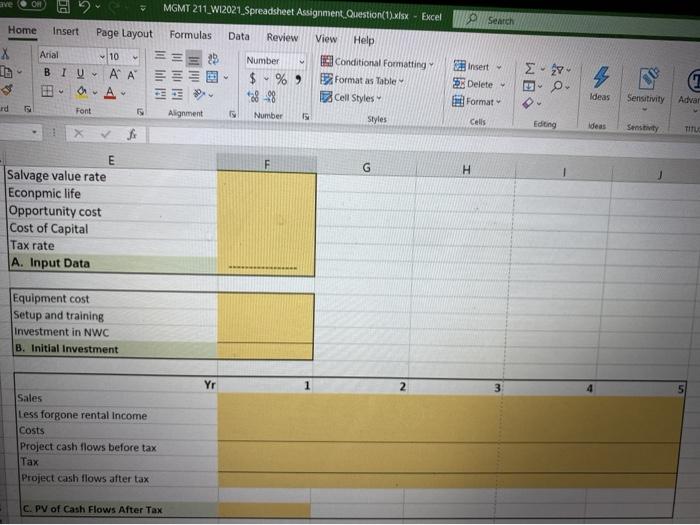

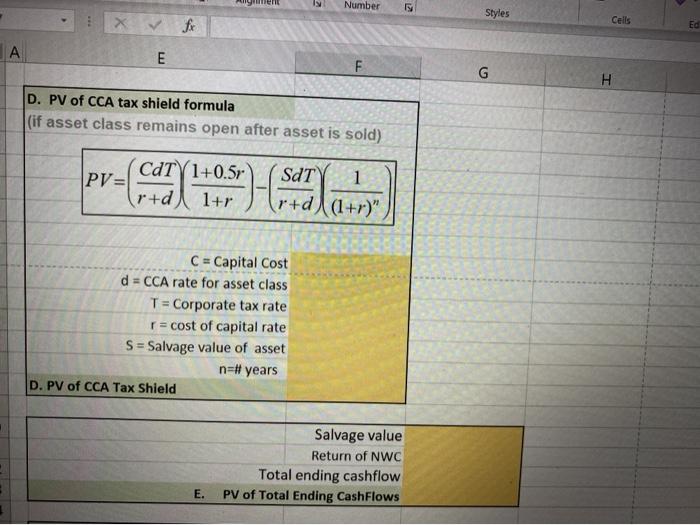

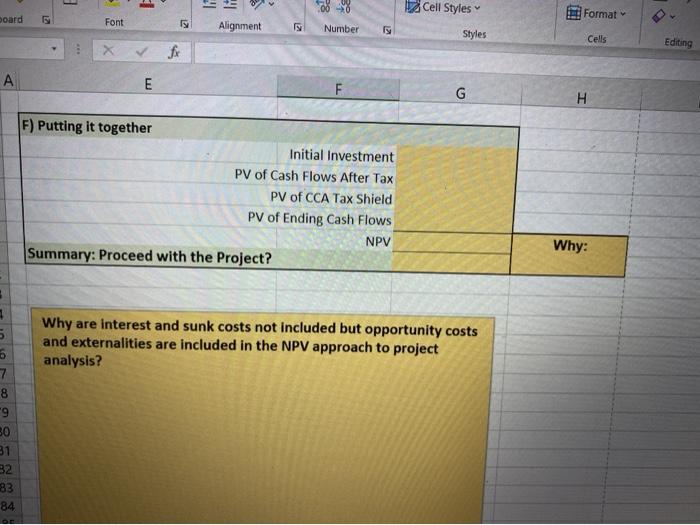

Home Insert Page Layout Formulis Data Review View Help Calibri Ingre UMAA HI Weaplast UM ABB Menje Center 2 O BT 04 Gena $% Condition for Toning able Styles Nuh Style Format pboard Sort & Find a Fiter det Editing Tot Abonnent Sales A E F G H 3 Rugged Outdoor Supplies is looking to expand its business. The new business is expected to generate $2.6 million per year in sales over the next 5 years. Annual costs would increase by $2.1 million. Both sales revenues and costs are expected to increase by 2% per 10 year due to inflation. An investment in working capital of $65,000 would have to be made initially. The machinery (CCA rate of 30%) 11 would cost $635,000, with additional costs of $25,000 to be incurred for setup and training. They also estimate that it would be 12 possible to sell the equipment for 15% of its initial value at the end of 5 years. The company would set up operations in a building it 13 does not use but currently rents out for $80,000 flat per year. If the firm's cost of capital is 8% and its tax rate is 29%, should it 14 proceed with this new business? 15 16 Sales 17 Annual incremental costs 18 inflation 19 Investment in NOWC 20 CCA rate 21 Equipment cost 22 Setup & Training 23 Salvage value rate 24 Economic life 25 Opportunity cost 26 Cost of Capital 27 Tax rate 28 A. Input Data 29 30 Equipment cost 31 Setup and training 32 Investment in NWC 33 B. Initial Investment 34 35 36 Inne Page Layout Tomas View Ged 29 O T Cla Pa Con Fenom Sort Semy Condition a Ct Fomu - Sim Sem fo Sales G M N O Equipment cost Setup and training investment in NWC B. Initial Investment Yr Sales Les for one rental income Costs Project cash flow before Tak Project cash flows after ta C.PV of Cash Flows Alter Tax D. PV of CCA tax shield formula it assets rumis open for at sold) PV Cdry 1+0.5 rud 1+r ST 1 rud (1+)" Capital Cost d-CCA rate for asset des Corporate tax rate cost of capitale S. Salvage value of asset years D.PV of CCA Tex Shield QICHOTI o West . 5%9BC Forms GA 2 O 99M e from H M N Cheb A Sales WA 59 60 Salvappe value 61 Return of NWC Total ending cashflow 63 E PV Total Ending Cash Flows 64 65 F) Putting it together 66 Initialwestment 67 PV of Cash Flows After 68 py of CCA Tax Shield 69 PV of Ending Cash Flows 70 NPV 71 Summaryi Proceed with the Project? 72 73 74 Why are interest and sunk costs not included but opportunity costs 75 and externalities are included in the NPV approach to project 76 analysis 77 78 79 80 81 32 Why 54 IS 35 37 all GICID 11 Senech Katongo, Rudy utoSave . A- MGMT 211, W1.2021 Spreadsheet Assignment Question(1) hox Excel Home Insert Page Layout Formulas Data Review View Help Aria 10 === Number Conditional Formatting BIU A A - $ - % Formatos table ze 3-9 Cell Styles card Font Number Styles DO 4 Insert Delete Format Cells Clinica Hotel Public Confidential Soni ideas Sensitivity Advanced TG F Editing ide MUS SOCC G H E Rugged Outdoor Supplies is looking to expand its business. The new business is expected to generate $2.6 million per year in sales over the next 5 years. Annual costs would increase by $2.1 million. Both sales revenues and costs are expected to increase by 2% per year due to inflation. An investment in working capital of $65,000 would have to be made initially. The machinery (CCA rate of 30%) would cost $635,000, with additional costs of $25,000 to be incurred for setup and training. They also estimate that it would be possible to sell the equipment for 15% of its initial value at the end of 5 years. The company would set up operations in a building it does not use but currently rents out for $80,000 flat per year. If the firm's cost of capital is 8% and its tax rate is 29%, should it proceed with this new business? Sales Annual incremental costs Inflation Investment in NOWC CCA rate Equipment cost Setup & Training Salvage value rate Econpmic life Opportunity cost Cost of Capital Tax rate A. Input Data a MGMT 211_W12021 Spreadsheet Assignment Question(1) xlsx - Excel Search Home Insert Page Layout Formulas Data Review View Help Arial 10 BI ' OA Font Number $ % ) . . Conditional Formatting Format as Table Cell Styles Insert D. Delete Format 4 Ideas Sensitivity Adva Alignment Number styles Cells Editing Ideas Sensitivity TITU F G H E Salvage value rate Econpmic life Opportunity cost Cost of Capital Tax rate A. Input Data Equipment cost Setup and training Investment in NWC B. Initial Investment Yr 1 3 Sales Less forgone rental Income Costs Project cash flows before tax Tax Project cash flows after tax C.PV of Cash Flows After Tax nem Number Styles x fx Cells Ed A E F G H D. PV of CCA tax shield formula (if asset class remains open after asset is sold) PV= CAT 1+0.5r r+d 1+r SITY 1 rud (1+r)" C = Capital Cost d =CCA rate for asset class T = Corporate tax rate r = cost of capital rate S = Salvage value of asset n=#years D. PV of CCA Tax Shield Salvage value Return of NWC Total ending cashflow PV of Total Ending Cash Flows E. 3 1 278 Cell Styles board Format Font Alignment Number Styles Cells Editing A E E G H F) Putting it together Initial Investment PV of Cash Flows After Tax PV of CCA Tax Shield PV of Ending Cash Flows NPV Summary: Proceed with the Project? Why: 5 Why are interest and sunk costs not included but opportunity costs and externalities are included in the NPV approach to project analysis? 7 8 9 30 31 82 83 84