Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Home is a small open economy with perfect capital mobility. Initially, it is in its long-run equilibrium and domestic and foreign financial assets are

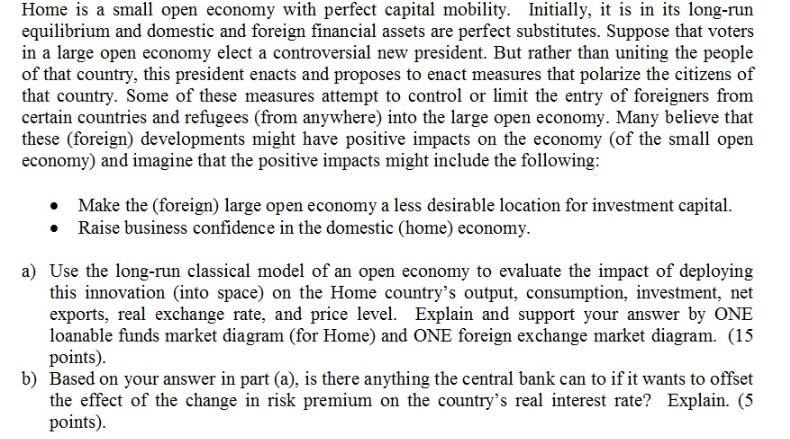

Home is a small open economy with perfect capital mobility. Initially, it is in its long-run equilibrium and domestic and foreign financial assets are perfect substitutes. Suppose that voters in a large open economy elect a controversial new president. But rather than uniting the people of that country, this president enacts and proposes to enact measures that polarize the citizens of that country. Some of these measures attempt to control or limit the entry of foreigners from certain countries and refugees (from anywhere) into the large open economy. Many believe that these (foreign) developments might have positive impacts on the economy (of the small open economy) and imagine that the positive impacts might include the following: Make the (foreign) large open economy a less desirable location for investment capital. Raise business confidence in the domestic (home) economy. a) Use the long-run classical model of an open economy to evaluate the impact of deploying this innovation (into space) on the Home country's output, consumption, investment, net exports, real exchange rate, and price level. Explain and support your answer by ONE loanable funds market diagram (for Home) and ONE foreign exchange market diagram. (15 points). b) Based on your answer in part (a), is there anything the central bank can to if it wants to offset the effect of the change in risk premium on the country's real interest rate? Explain. (5 points).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Impact of Foreign Developments on the Home Country 1 Output In the longrun classical model output is determined by factors such as technology labor ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started