Answered step by step

Verified Expert Solution

Question

1 Approved Answer

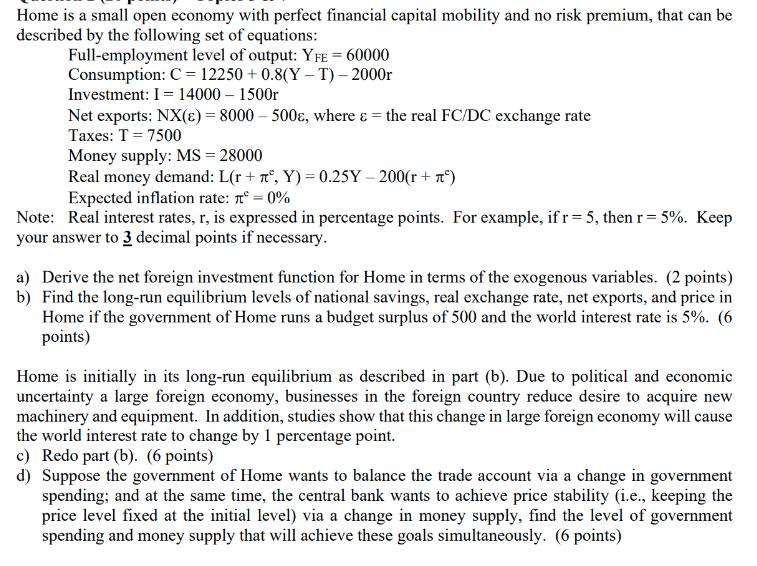

Home is a small open economy with perfect financial capital mobility and no risk premium, that can be described by the following set of

Home is a small open economy with perfect financial capital mobility and no risk premium, that can be described by the following set of equations: Full-employment level of output: YFE = 60000 Consumption: C=12250+ 0.8(Y-T)-2000r Investment: I = 14000 - 1500r Net exports: NX(E)=8000-500, where the real FC/DC exchange rate Taxes: T = 7500 Money supply: MS = 28000 Real money demand: L(r+ , Y) = 0.25Y - 200(r + ) Expected inflation rate: = 0% Note: Real interest rates, r, is expressed in percentage points. For example, if r = 5, then r = 5%. Keep your answer to 3 decimal points if necessary. a) Derive the net foreign investment function for Home in terms of the exogenous variables. (2 points) b) Find the long-run equilibrium levels of national savings, real exchange rate, net exports, and price in Home if the government of Home runs a budget surplus of 500 and the world interest rate is 5%. (6 points) Home is initially in its long-run equilibrium as described in part (b). Due to political and economic uncertainty a large foreign economy, businesses in the foreign country reduce desire to acquire new machinery and equipment. In addition, studies show that this change in large foreign economy will cause the world interest rate to change by 1 percentage point. c) Redo part (b). (6 points) d) Suppose the government of Home wants to balance the trade account via a change in government spending; and at the same time, the central bank wants to achieve price stability (i.e., keeping the price level fixed at the initial level) via a change in money supply, find the level of government spending and money supply that will achieve these goals simultaneously. (6 points)

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a NXE8000500 b In the longrun national savings S will equal investment I S I 14000 1500r 1225...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started