Answered step by step

Verified Expert Solution

Question

1 Approved Answer

home loan formula question cost of home 188,895.00 down payment - 18,889.50 how much will be financed -170,005.50 30 year fixed rates 3.228 and 3.588

home loan formula question

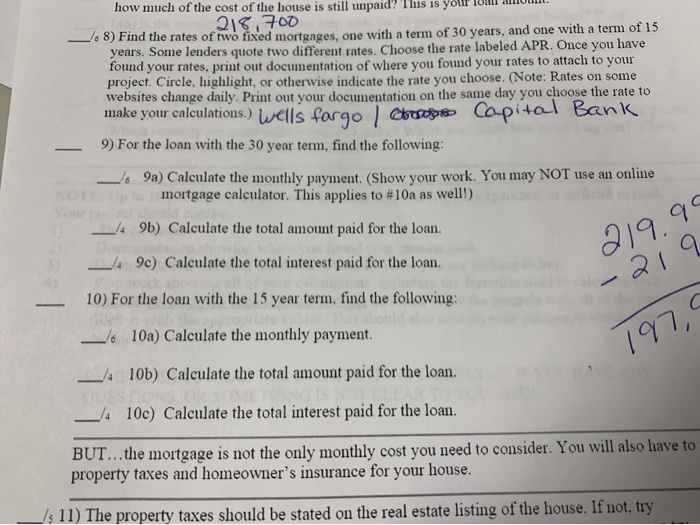

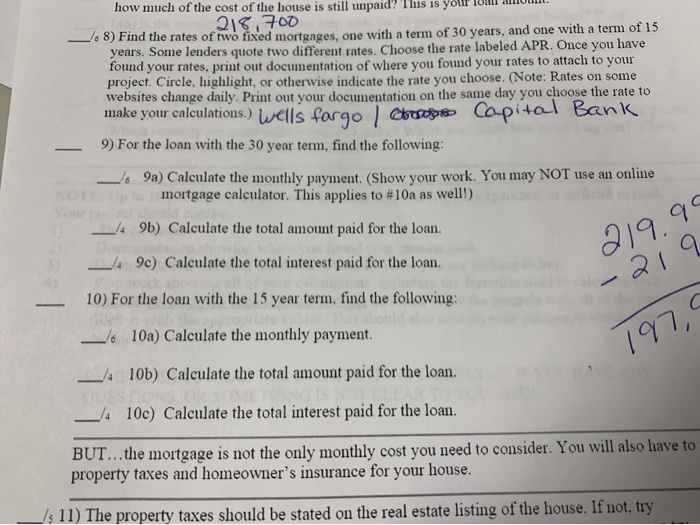

how much of the cost of the house is still unpaid? This is yolll 218.700 - Jo 8) Find the rates of two fixed mortgages, one with a term of 30 years, and one with a term of 15 years. Some lenders quote two different rates. Choose the rate labeled APR. Once you have found your rates, print out documentation of where you found your rates to attach to your project. Circle, highlight, or otherwise indicate the rate you choose. (Note: Rates on some websites change daily. Print out your documentation on the same day you choose the rate to make your calculations.) wells fargo laborale Copital Bank 9) For the loan with the 30 year term, find the following: - 9a) Calculate the monthly payment. (Show your work. You may NOT use an online mortgage calculator. This applies to #10a as well!) ___4 9b) Calculate the total amount paid for the loan. -74 9c) Calculate the total interest paid for the loan. 219.90 -219 10) For the loan with the 15 year term, find the following: __. 10a) Calculate the monthly payment. 1970 -/4 10b) Calculate the total amount paid for the loan. 4 10c) Calculate the total interest paid for the loan. BUT...the mortgage is not the only monthly cost you need to consider. You will also have to property taxes and homeowner's insurance for your house. Is 11) The property taxes should be stated on the real estate listing of the house. If not, try how much of the cost of the house is still unpaid? This is yolll 218.700 - Jo 8) Find the rates of two fixed mortgages, one with a term of 30 years, and one with a term of 15 years. Some lenders quote two different rates. Choose the rate labeled APR. Once you have found your rates, print out documentation of where you found your rates to attach to your project. Circle, highlight, or otherwise indicate the rate you choose. (Note: Rates on some websites change daily. Print out your documentation on the same day you choose the rate to make your calculations.) wells fargo laborale Copital Bank 9) For the loan with the 30 year term, find the following: - 9a) Calculate the monthly payment. (Show your work. You may NOT use an online mortgage calculator. This applies to #10a as well!) ___4 9b) Calculate the total amount paid for the loan. -74 9c) Calculate the total interest paid for the loan. 219.90 -219 10) For the loan with the 15 year term, find the following: __. 10a) Calculate the monthly payment. 1970 -/4 10b) Calculate the total amount paid for the loan. 4 10c) Calculate the total interest paid for the loan. BUT...the mortgage is not the only monthly cost you need to consider. You will also have to property taxes and homeowner's insurance for your house. Is 11) The property taxes should be stated on the real estate listing of the house. If not, try cost of home 188,895.00

down payment - 18,889.50

how much will be financed -170,005.50

30 year fixed rates

3.228 and 3.588

15 year fixed rates

3.156 and 3.588

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started