Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Home n Paste A1 Insert Page Layout X A BIU B Formulas Data Review Server Workbook This file is read-only. To modify the file,

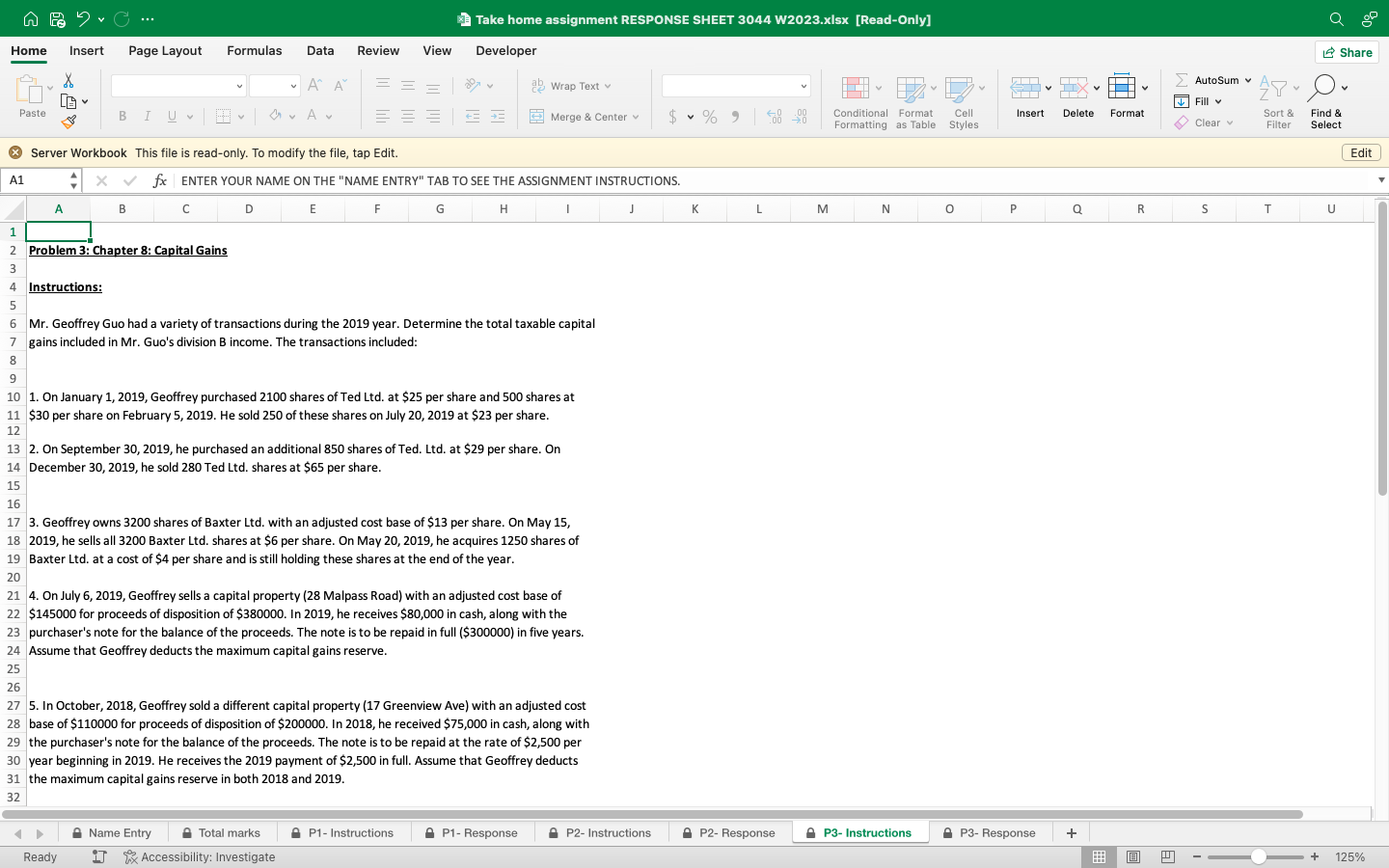

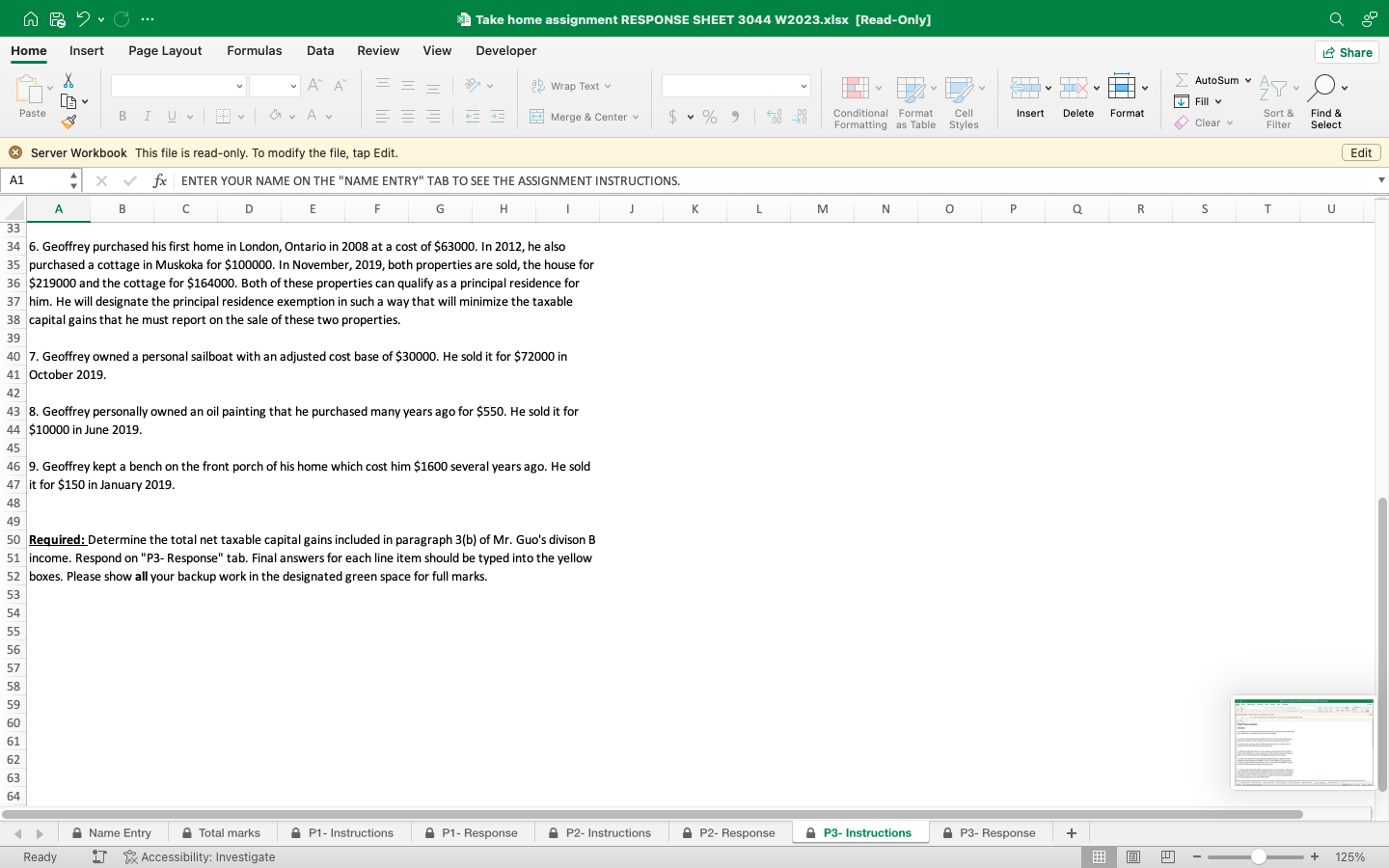

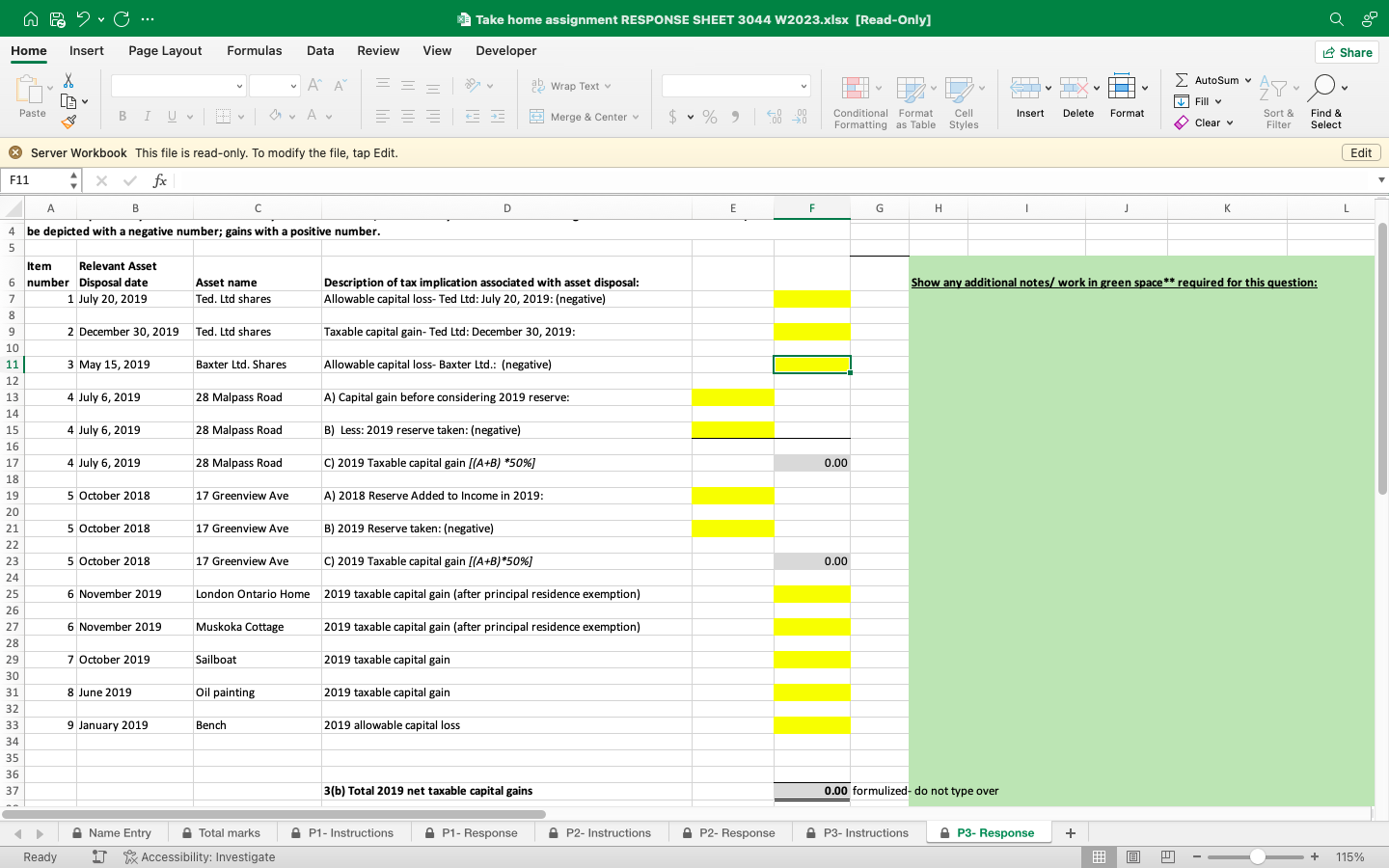

Home n Paste A1 Insert Page Layout X A BIU B Formulas Data Review Server Workbook This file is read-only. To modify the file, tap Edit. C 1 2 Problem 3: Chapter 8: Capital Gains 3 4 Instructions: 5 Ready A A D Av V View === F = Name Entry Total marks 1 Accessibility: Investigate fx ENTER YOUR NAME ON THE "NAME ENTRY" TAB TO SEE THE ASSIGNMENT INSTRUCTIONS. E G H I Take home assignment RESPONSE SHEET 3044 W2023.xlsx [Read-Only] Developer = = = 6 Mr. Geoffrey Guo had a variety of transactions during the 2019 year. Determine the total taxable capital 7 gains included in Mr. Guo's division B income. The transactions included: 8 9 10 1. On January 1, 2019, Geoffrey purchased 2100 shares of Ted Ltd. at $25 per share and 500 shares at 11 $30 per share on February 5, 2019. He sold 250 of these shares on July 20, 2019 at $23 per share. 12 ab Wrap Text v 13 2. On September 30, 2019, he purchased an additional 850 shares of Ted. Ltd. at $29 per share. On 14 December 30, 2019, he sold 280 Ted Ltd. shares at $65 per share. 15 P1- Instructions Merge & Center 16 17 3. Geoffrey owns 3200 shares of Baxter Ltd. with an adjusted cost base of $13 per share. On May 15, 18 2019, he sells all 3200 Baxter Ltd. shares at $6 per share. On May 20, 2019, he acquires 1250 shares of 19 Baxter Ltd. at a cost of $4 per share and is still holding these shares at the end of the year. 20 21 4. On July 6, 2019, Geoffrey sells a capital property (28 Malpass Road) with an adjusted cost base of 22 $145000 for proceeds of disposition of $380000. In 2019, he receives $80,000 in cash, along with the 23 purchaser's note for the balance of the proceeds. The note is to be repaid in full ($300000) in five years. 24 Assume that Geoffrey deducts the maximum capital gains reserve. 25 26 27 5. In October, 2018, Geoffrey sold a different capital property (17 Greenview Ave) with an adjusted cost 28 base of $110000 for proceeds of disposition of $200000. In 2018, he received $75,000 in cash, along with 29 the purchaser's note for the balance of the proceeds. The note is to be repaid at the rate of $2,500 per 30 year beginning in 2019. He receives the 2019 payment of $2,500 in full. Assume that Geoffrey deducts 31 the maximum capital gains reserve in both 2018 and 2019. 32 P1- Response J $ % 9 V P2- Instructions K L P2- Response M Conditional Format Cell Formatting as Table Styles N P3- Instructions O S P Insert Delete X J P3- Response Q + Format B R E Autosum v Fill Clear v S APO Sort & Filter T Share Find & Select U Edit + 125% Home n Paste A1 Insert Page Layout X A 57 58 59 60 61 62 63 64 BIU Server Workbook This file is read-only. To modify the file, tap Edit. Ready B Formulas Data Review C V D Name Entry A A A fx ENTER YOUR NAME ON THE "NAME ENTRY" TAB TO SEE THE ASSIGNMENT INSTRUCTIONS. H E Total marks Accessibility: Investigate F View = Take home assignment RESPONSE SHEET 3044 W2023.xlsx [Read-Only] Developer = = = 33 34 6. Geoffrey purchased his first home in London, Ontario in 2008 at a cost of $63000. In 2012, he also 35 purchased a cottage in Muskoka for $100000. In November, 2019, both properties are sold, the house for 36 $219000 and the cottage for $164000. Both of these properties can qualify as a principal residence for 37 him. He will designate the principal residence exemption in such a way that will minimize the taxable 38 capital gains that he must report on the sale of these two properties. 39 40 7. Geoffrey owned a personal sailboat with an adjusted cost base of $30000. He sold it for $72000 in 41 October 2019. P1- Instructions G 42 43 8. Geoffrey personally owned an oil painting that he purchased many years ago for $550. He sold it for 44 $10000 in June 2019. 45 46 9. Geoffrey kept a bench on the front porch of his home which cost him $1600 several years ago. He sold 47 it for $150 in January 2019. 48 49 50 Required: Determine the total net taxable capital gains included in paragraph 3(b) of Mr. Guo's divison B 51 income. Respond on "P3- Response" tab. Final answers for each line item should be typed into the yellow 52 boxes. Please show all your backup work in the designated green space for full marks. 53 54 55 56 Wrap Text v Merge & Center I P1- Response J $ P2- Instructions V K % 9 L P2- Response M Conditional Format Cell Formatting as Table Styles N P3- Instructions O S Insert P P3- Response X J Delete Q + Format R E Autosum v Fill Clear v S APO Sort & Filter T Find & Select + Share U Edit 125% Home n Paste F11 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 2.0 Insert Page Layout X BIU U Ready A B 4 be depicted with a negative number; gains with a positive number. 5 Item Relevant Asset number Disposal date 1 July 20, 2019 2 December 30, 2019 Server Workbook This file is read-only. To modify the file, tap Edit. fx 3 May 15, 2019 4 July 6, 2019 4 July 6, 2019 4 July 6, 2019 5 October 2018 5 October 2018 5 October 2018 6 November 2019 6 November 2019 7 October 2019 8 June 2019 Formulas Data Review View A A ** A 9 January 2019 V C Asset name Ted. Ltd shares Ted. Ltd shares Baxter Ltd. Shares 28 Malpass Road 28 Malpass Road 28 Malpass Road 17 Greenview Ave 17 Greenview Ave Sailboat V 17 Greenview Ave Muskoka Cottage Bench V Oil painting = = = = = = B) Less: 2019 reserve taken: (negative) C) 2019 Taxable capital gain [(A+B) *50% ] A) 2018 Reserve Added to Income in 2019: B) 2019 Reserve taken: (negative) C) 2019 Taxable capital gain [(A+B)*50% ] London Ontario Home 2019 taxable capital gain (after principal residence exemption) 2019 taxable capital gain (after principal residence exemption) 2019 taxable capital gain 2019 taxable capital gain 2019 allowable capital loss Name Entry Total marks I Accessibility: Investigate Take home assignment RESPONSE SHEET 3044 W2023.xlsx [Read-Only] Developer = = = D P1- Instructions ab Wrap Text Description of tax implication associated with asset disposal: Allowable capital loss- Ted Ltd: July 20, 2019: (negative) Taxable capital gain- Ted Ltd: December 30, 2019: Allowable capital loss- Baxter Ltd.: (negative) A) Capital gain before considering 2019 reserve: Merge & Center v 3(b) Total 2019 net taxable capital gains P1- Response P2- Instructions $ V % 9 E P2- Response F Conditional Format Cell Formatting as Table Styles 0.00 0.00 G H P3- Instructions 0.00 formulized- do not type over S Insert I X P3- Response Delete + H # Format J Show any additional notes/ work in green space** required for this question: B Autosum v Fill " Clear K APO Sort & Filter Find & Select Share + Edit L 115%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the steps to solve this capital gains question 1 Ted Ltd shares July 20 2019 sale Cost of s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started