Answered step by step

Verified Expert Solution

Question

1 Approved Answer

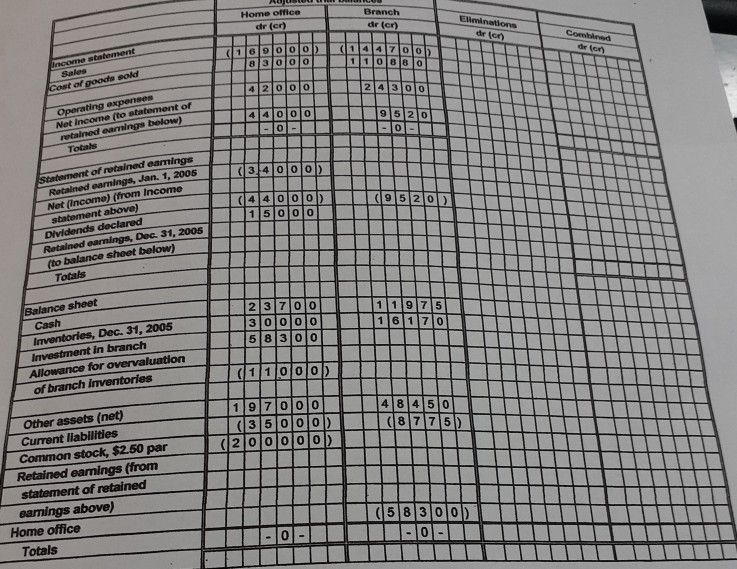

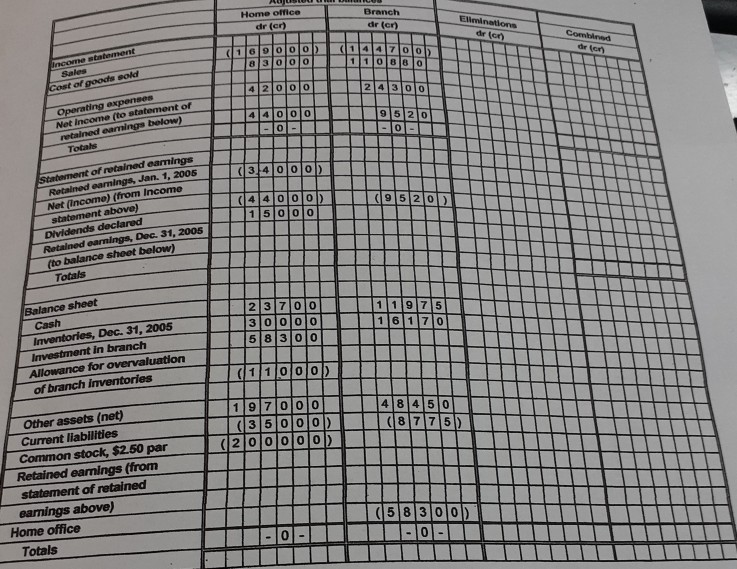

Home offee dr (or) Branch drer) Eliminations Corned den (69000 18 3000 1141470los 110 B810 Income statement Sale Cost of goods sold 2000 2143 00

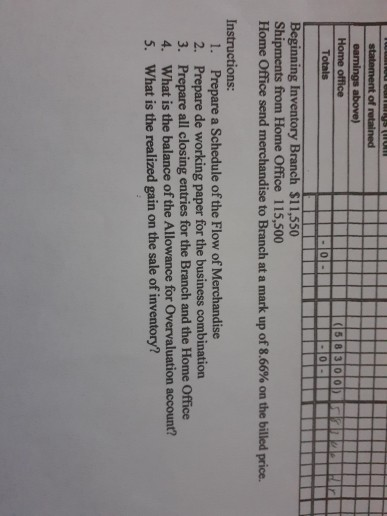

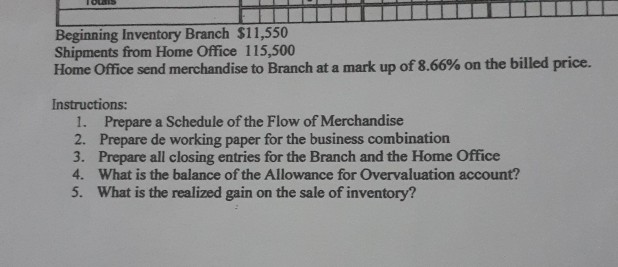

Home offee dr (or) Branch drer) Eliminations Corned den (69000 18 3000 1141470los 110 B810 Income statement Sale Cost of goods sold 2000 2143 00 44000 Operating expenses Net Income (to statement of retained earnings below) Totals (34000) (1951210 (44000) 15 000 Statement of retained earnings Retained earnings, Jan. 1, 2005 Net (Income) (from Income statement above) Dividends declared Retained earnings, Dec. 31, 2005 (to balance sheet below) Totals . Balance sheet 2 3 700 30 000 58300 111975 16 17 01 Cash Inventories, Dec. 31, 2005 Investment in branch Allowance for overvaluation of branch inventories (11000) 1 97 000 (35 000 (2 0 0 0 0 0 Other assets (net) Current liabilities Common stock, $250 par Retained earnings (from statement of retained earnings above) Home office (583 010) 1 INTIIN 1-0-IIIIII O 1 1 Totals statement of retained eamings above) Home office Totals KEG 300 PO Beginning Inventory Branch $11,550 Shipments from Home Office 115,500 Home Office send merchandise to Branch at a mark up of 8.66% on the billed price. Instructions: 1. Prepare a Schedule of the flow of Merchandise 2. Prepare de working paper for the business combination 3. Prepare all closing entries for the Branch and the Home Office 4. What is the balance of the Allowance for Overvaluation account? 5. What is the realized gain on the sale of inventory? Beginning Inventory Branch $11,550 Shipments from Home Office 115,500 Home Office send merchandise to Branch at a mark up of 8.66% on the billed price. Instructions: 1. Prepare a Schedule of the Flow of Merchandise 2. Prepare de working paper for the business combination 3. Prepare all closing entries for the Branch and the Home Office 4. What is the balance of the Allowance for Overvaluation account? 5. What is the realized gain on the sale of inventory? Home offee dr (or) Branch drer) Eliminations Corned den (69000 18 3000 1141470los 110 B810 Income statement Sale Cost of goods sold 2000 2143 00 44000 Operating expenses Net Income (to statement of retained earnings below) Totals (34000) (1951210 (44000) 15 000 Statement of retained earnings Retained earnings, Jan. 1, 2005 Net (Income) (from Income statement above) Dividends declared Retained earnings, Dec. 31, 2005 (to balance sheet below) Totals . Balance sheet 2 3 700 30 000 58300 111975 16 17 01 Cash Inventories, Dec. 31, 2005 Investment in branch Allowance for overvaluation of branch inventories (11000) 1 97 000 (35 000 (2 0 0 0 0 0 Other assets (net) Current liabilities Common stock, $250 par Retained earnings (from statement of retained earnings above) Home office (583 010) 1 INTIIN 1-0-IIIIII O 1 1 Totals statement of retained eamings above) Home office Totals KEG 300 PO Beginning Inventory Branch $11,550 Shipments from Home Office 115,500 Home Office send merchandise to Branch at a mark up of 8.66% on the billed price. Instructions: 1. Prepare a Schedule of the flow of Merchandise 2. Prepare de working paper for the business combination 3. Prepare all closing entries for the Branch and the Home Office 4. What is the balance of the Allowance for Overvaluation account? 5. What is the realized gain on the sale of inventory? Beginning Inventory Branch $11,550 Shipments from Home Office 115,500 Home Office send merchandise to Branch at a mark up of 8.66% on the billed price. Instructions: 1. Prepare a Schedule of the Flow of Merchandise 2. Prepare de working paper for the business combination 3. Prepare all closing entries for the Branch and the Home Office 4. What is the balance of the Allowance for Overvaluation account? 5. What is the realized gain on the sale of inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started