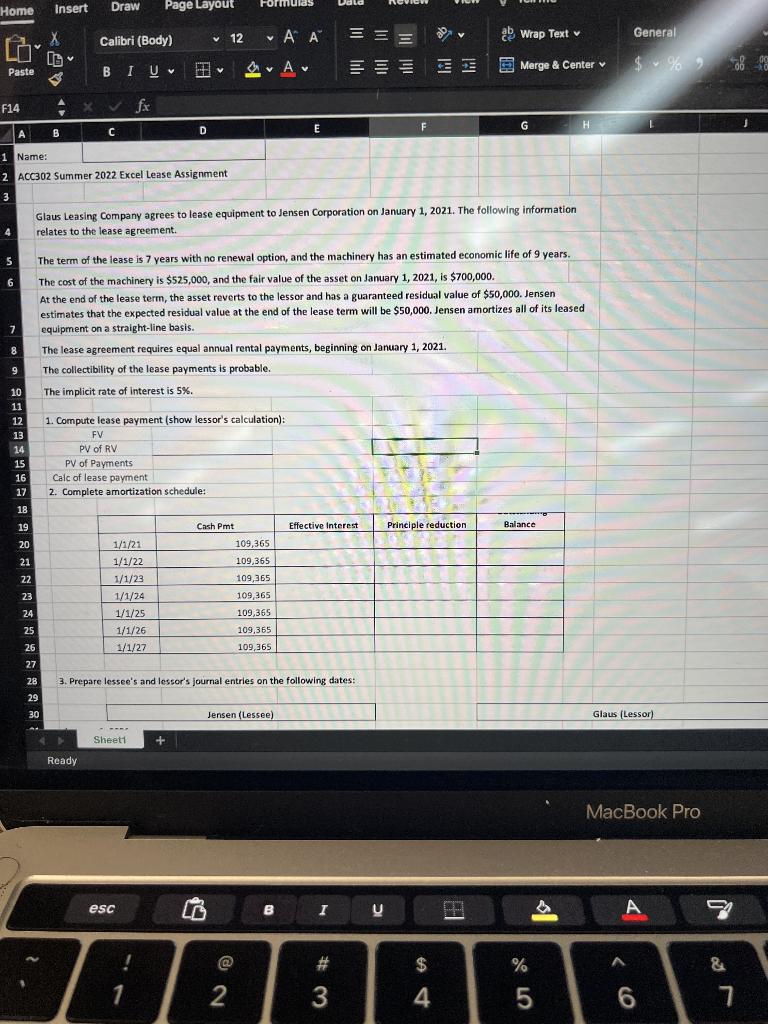

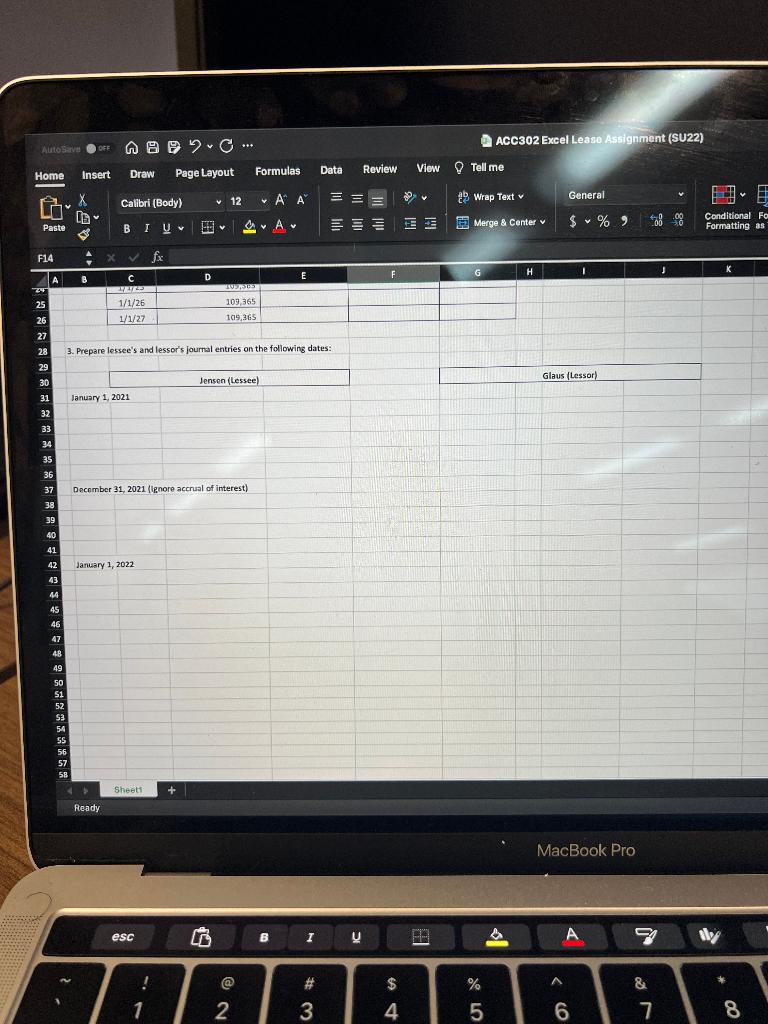

Home Paste F14 5 6 7 8 9 V 10 11 12 13 14 15 16 17 18 Insert X [B P 19 20 21 22 23 24 25 26 27 28 29 30 B V Draw Calibri (Body) BIU x A 1 Name: 2 ACC302 Summer 2022 Excel Lease Assignment. 3 Ready fx Page Layout 1/1/21 1/1/22 1/1/23 1/1/24 1/1/25 1/1/26 1/1/27 V Calc of lease payment 2. Complete amortization schedule: 711 # V Sheet1 D esc 1. Compute lease payment (show lessor's calculation): FV PV of RV PV of Payments ! 1 12 Glaus Leasing Company agrees to lease equipment to Jensen Corporation on January 1, 2021. The following information relates to the lease agreement. The lease agreement requires equal annual rental payments, beginning on January 1, 2021. The collectibility of the lease payments is probable. The implicit rate of interest is 5%. Formulas V The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. The cost of the machinery is $525,000, and the fair value of the asset on January 1, 2021, is $700,000. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $50,000. Jensen estimates that the expected residual value at the end of the lease term will be $50,000. Jensen amortizes all of its leased equipment on a straight-line basis. Cash Pmt 3. Prepare lessee's and lessor's journal entries on the following dates: A A A 2 109,365 109,365 109,365 109,365 109,365 109,365 109,365 E Jensen (Lessee) G B === Effective Interest Review I #3 F U 20 v Principle reduction. $ 54 ab Wrap Text v Merge & Center 44 G Balance % - H 5 General $%908 Glaus (Lessor) MacBook Pro A 6 0800 9 & 7 J AutoSave OFF ABC ... Home Insert Draw Page Layout - Paste F14 29 25 26 27 28 29 30 A 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 V 49 50 51 52 53 54 55 56 57 58 X [- P B 4 2. Calibri (Body) BIU January 1, 2021 C 172725 1/1/26 1/1/27 Ready January 1, 2022 Sheet fx December 31, 2021 (Ignore accrual of interest) esc 3. Prepare lessee's and lessor's journal entries on the following dates: ! 1 D + 12 105,505 109,365 109,365 G Jensen (Lessee) Formulas @ 2 A A A B E I Data #3 == EE Review F $ 4 20 View Tell me EE ab Wrap Text v ACC302 Excel Lease Assignment (SU22) Merge & Center v G % 5 H General $%9 Glaus (Lessor) A I MacBook Pro A 6 & 27 J Conditional For Formatting as K V 00 * 8 Home Paste F14 5 6 7 8 9 V 10 11 12 13 14 15 16 17 18 Insert X [B P 19 20 21 22 23 24 25 26 27 28 29 30 B V Draw Calibri (Body) BIU x A 1 Name: 2 ACC302 Summer 2022 Excel Lease Assignment. 3 Ready fx Page Layout 1/1/21 1/1/22 1/1/23 1/1/24 1/1/25 1/1/26 1/1/27 V Calc of lease payment 2. Complete amortization schedule: 711 # V Sheet1 D esc 1. Compute lease payment (show lessor's calculation): FV PV of RV PV of Payments ! 1 12 Glaus Leasing Company agrees to lease equipment to Jensen Corporation on January 1, 2021. The following information relates to the lease agreement. The lease agreement requires equal annual rental payments, beginning on January 1, 2021. The collectibility of the lease payments is probable. The implicit rate of interest is 5%. Formulas V The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. The cost of the machinery is $525,000, and the fair value of the asset on January 1, 2021, is $700,000. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $50,000. Jensen estimates that the expected residual value at the end of the lease term will be $50,000. Jensen amortizes all of its leased equipment on a straight-line basis. Cash Pmt 3. Prepare lessee's and lessor's journal entries on the following dates: A A A 2 109,365 109,365 109,365 109,365 109,365 109,365 109,365 E Jensen (Lessee) G B === Effective Interest Review I #3 F U 20 v Principle reduction. $ 54 ab Wrap Text v Merge & Center 44 G Balance % - H 5 General $%908 Glaus (Lessor) MacBook Pro A 6 0800 9 & 7 J AutoSave OFF ABC ... Home Insert Draw Page Layout - Paste F14 29 25 26 27 28 29 30 A 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 V 49 50 51 52 53 54 55 56 57 58 X [- P B 4 2. Calibri (Body) BIU January 1, 2021 C 172725 1/1/26 1/1/27 Ready January 1, 2022 Sheet fx December 31, 2021 (Ignore accrual of interest) esc 3. Prepare lessee's and lessor's journal entries on the following dates: ! 1 D + 12 105,505 109,365 109,365 G Jensen (Lessee) Formulas @ 2 A A A B E I Data #3 == EE Review F $ 4 20 View Tell me EE ab Wrap Text v ACC302 Excel Lease Assignment (SU22) Merge & Center v G % 5 H General $%9 Glaus (Lessor) A I MacBook Pro A 6 & 27 J Conditional For Formatting as K V 00 * 8