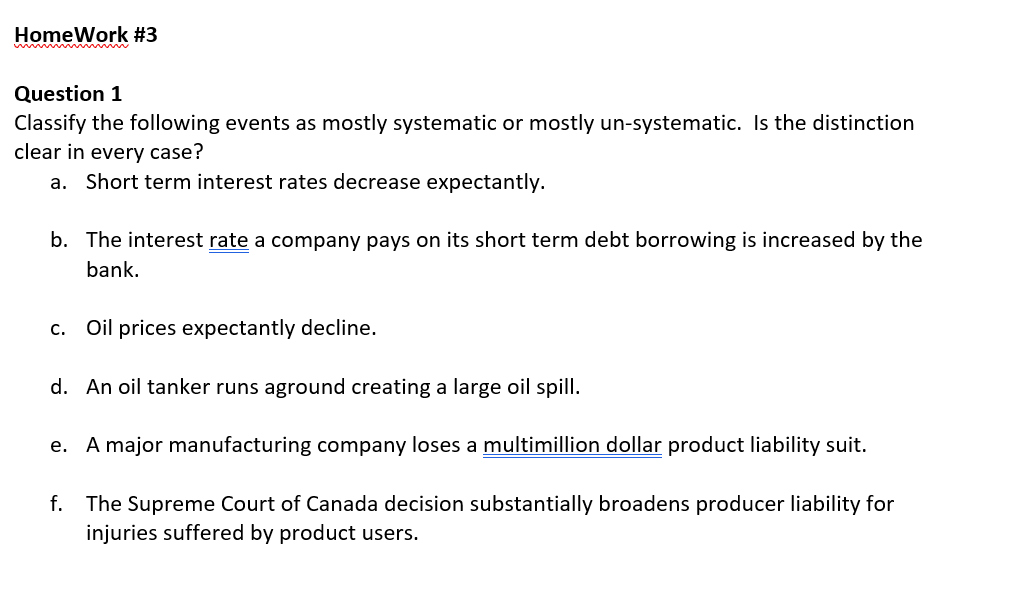

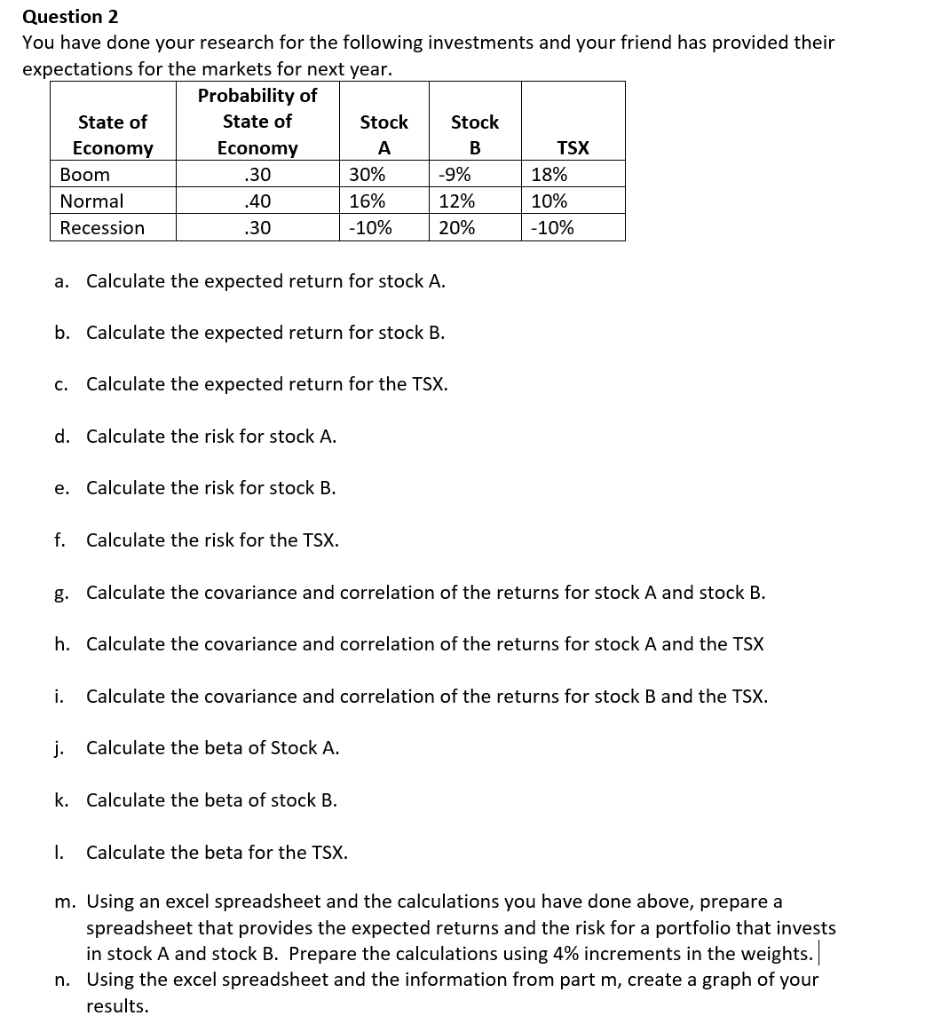

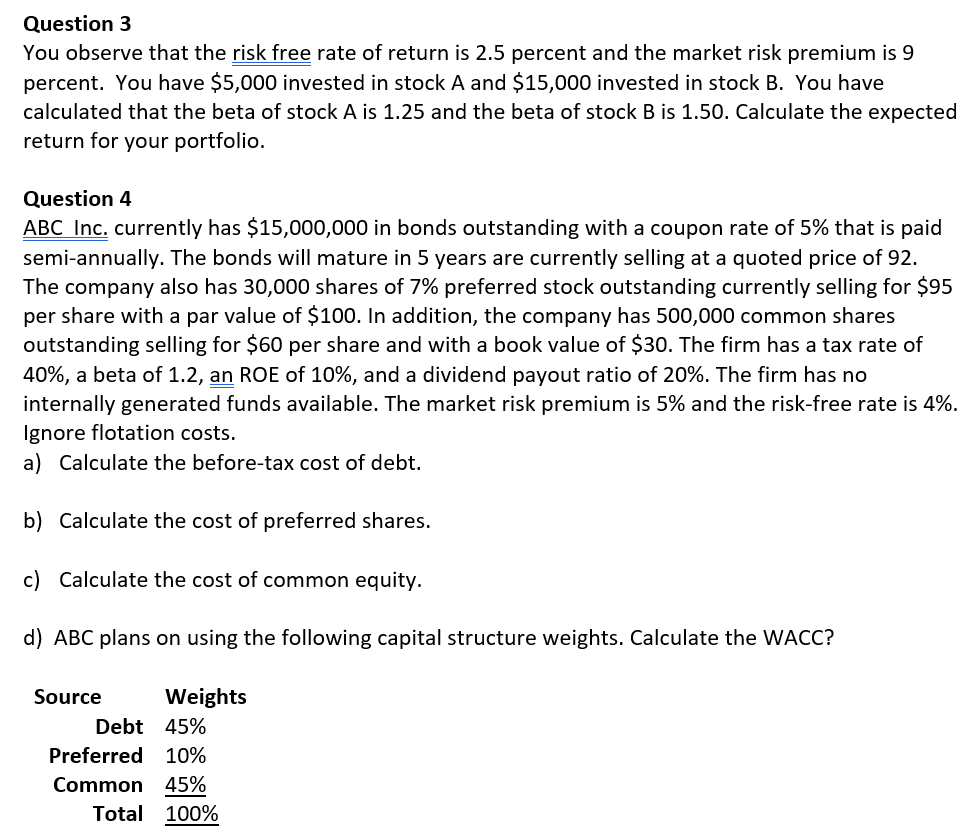

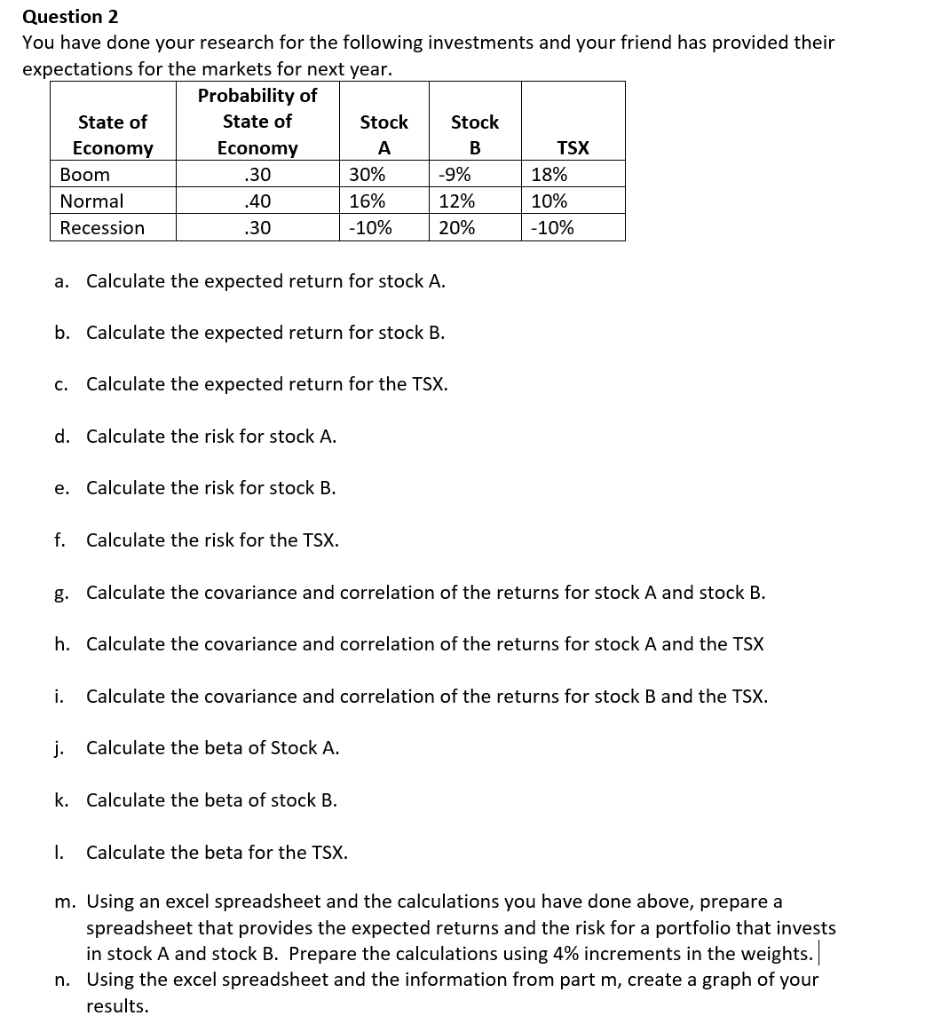

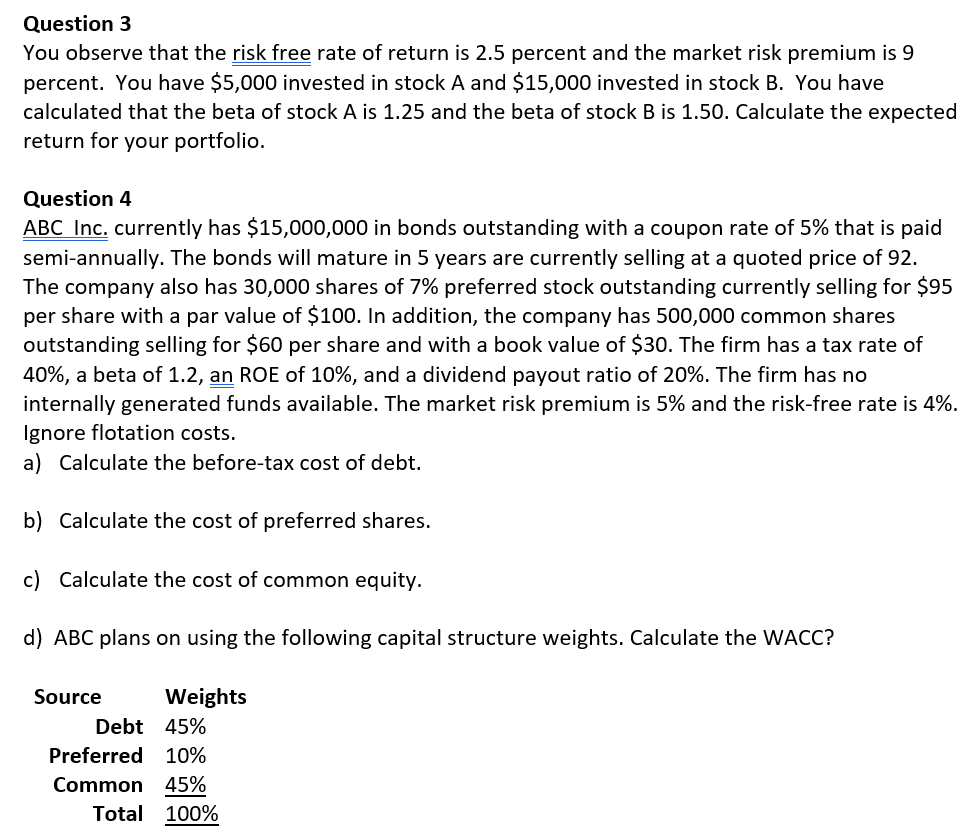

Home Work #3 Question 1 Classify the following events as mostly systematic or mostly un-systematic. Is the distinction clear in every case? a. Short term interest rates decrease expectantly. b. The interest rate a company pays on its short term debt borrowing is increased by the bank. c. Oil prices expectantly decline. d. An oil tanker runs aground creating a large oil spill. e. A major manufacturing company loses a multimillion dollar product liability suit. f. The Supreme Court of Canada decision substantially broadens producer liability for injuries suffered by product users. Question 2 You have done your research for the following investments and your friend has provided their expectations for the markets for next year. Probability of State of State of Stock Stock Economy Economy A B TSX Boom .30 30% -9% 18% Normal .40 16% 12% 10% Recession .30 -10% 20% -10% a. Calculate the expected return for stock A. b. Calculate the expected return for stock B. c. Calculate the expected return for the TSX. d. Calculate the risk for stock A. e. Calculate the risk for stock B. f. Calculate the risk for the TSX. g. Calculate the covariance and correlation of the returns for stock A and stock B. h. Calculate the covariance and correlation of the returns for stock A and the TSX i. Calculate the covariance and correlation of the returns for stock B and the TSX. j. Calculate the beta of Stock A. k. Calculate the beta of stock B. 1. Calculate the beta for the TSX. m. Using an excel spreadsheet and the calculations you have done above, prepare a spreadsheet that provides the expected returns and the risk for a portfolio that invests in stock A and stock B. Prepare the calculations using 4% increments in the weights. n. Using the excel spreadsheet and the information from part m, create a graph of your results. Question 3 You observe that the risk free rate of return is 2.5 percent and the market risk premium is 9 percent. You have $5,000 invested in stock A and $15,000 invested in stock B. You have calculated that the beta of stock A is 1.25 and the beta of stock B is 1.50. Calculate the expected return for your portfolio. Question 4 ABC Inc. currently has $15,000,000 in bonds outstanding with a coupon rate of 5% that is paid semi-annually. The bonds will mature in 5 years are currently selling at a quoted price of 92. The company also has 30,000 shares of 7% preferred stock outstanding currently selling for $95 per share with a par value of $100. In addition, the company has 500,000 common shares outstanding selling for $60 per share and with a book value of $30. The firm has a tax rate of 40%, a beta of 1.2, an ROE of 10%, and a dividend payout ratio of 20%. The firm has no internally generated funds available. The market risk premium is 5% and the risk-free rate is 4%. Ignore flotation costs. a) Calculate the before-tax cost of debt. b) Calculate the cost of preferred shares. c) Calculate the cost of common equity. d) ABC plans on using the following capital structure weights. Calculate the WACC? Source Weights Debt 45% Preferred 10% Common 45% Total 100%