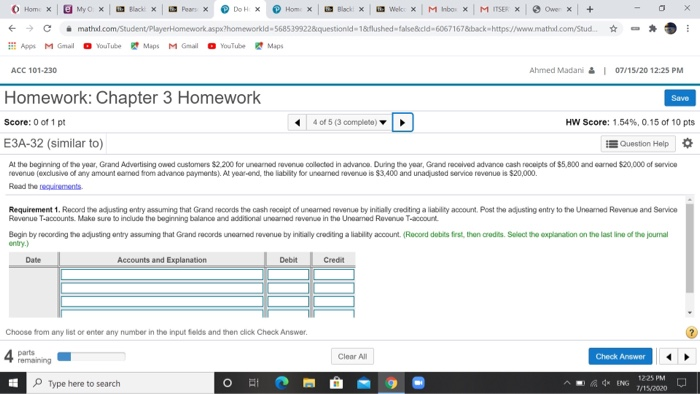

Home x Black X PearX Do H Hom. x Welcx M Inbox MITSEX X + . matrud.com/Student/PlayerHomework.aspx?homeworkld 568539922&questionid=1&tlushed-false&cid=6067167&back https://www.mathul.com/Stud.. YouTube Maps M Gmal YouTube Maps App M Gmail ACC 101-230 Ahmed Madani & 07/15/20 12:25 PM Save Homework: Chapter 3 Homework Score: 0 of 1 pt 4 of 5 (3 completo HW Score: 1.54%, 0.15 of 10 pts E3A-32 (similar to) Question Help At the beginning of the year, Grand Advertising oned customers $2.200 for urearned revenue collected in achance. During the year, Grand received advance cash recipes of $5,800 and earned $20,000 of service revenue (exclusive of any amount earned from advance payments). Al year-end, the liability for uncanned revenue is $3.400 and unadjusted service revenue is $20,000. Read the requirements Requirement 1. Record the adjusting entry assuming that Grand records the cash receipt of uneamed revenue by initially crediting a liability account. Post the adjusting entry to the Unearned Revenue and Service Revenue T-accounts. Make sure to include the beginning balance and additional unarned revenue in the Uneamed Revenue T-account Bogie by recording the adjusting entry assuming that Grand records uneared revenue by intially crediting a liability account. Record debits first, then credits. Select the explanation on the last line of the journal entry) Date Credit Accounts and Explanation Debit Choose from any list or enter any number in the input fields and then click Check Answer. parts remaining Clear All Check Answer 3 Type here to search . 1225 PM 7/15/20/20 Home x Black X PearX Do H Hom. x Welcx M Inbox MITSEX X + . matrud.com/Student/PlayerHomework.aspx?homeworkld 568539922&questionid=1&tlushed-false&cid=6067167&back https://www.mathul.com/Stud.. YouTube Maps M Gmal YouTube Maps App M Gmail ACC 101-230 Ahmed Madani & 07/15/20 12:25 PM Save Homework: Chapter 3 Homework Score: 0 of 1 pt 4 of 5 (3 completo HW Score: 1.54%, 0.15 of 10 pts E3A-32 (similar to) Question Help At the beginning of the year, Grand Advertising oned customers $2.200 for urearned revenue collected in achance. During the year, Grand received advance cash recipes of $5,800 and earned $20,000 of service revenue (exclusive of any amount earned from advance payments). Al year-end, the liability for uncanned revenue is $3.400 and unadjusted service revenue is $20,000. Read the requirements Requirement 1. Record the adjusting entry assuming that Grand records the cash receipt of uneamed revenue by initially crediting a liability account. Post the adjusting entry to the Unearned Revenue and Service Revenue T-accounts. Make sure to include the beginning balance and additional unarned revenue in the Uneamed Revenue T-account Bogie by recording the adjusting entry assuming that Grand records uneared revenue by intially crediting a liability account. Record debits first, then credits. Select the explanation on the last line of the journal entry) Date Credit Accounts and Explanation Debit Choose from any list or enter any number in the input fields and then click Check Answer. parts remaining Clear All Check Answer 3 Type here to search . 1225 PM 7/15/20/20