Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Homestead Oil Corp was incorporated on January 1, 2019. and issued the following stock for cash: 800,000 shares of no-par common stock were authorized. 150.000

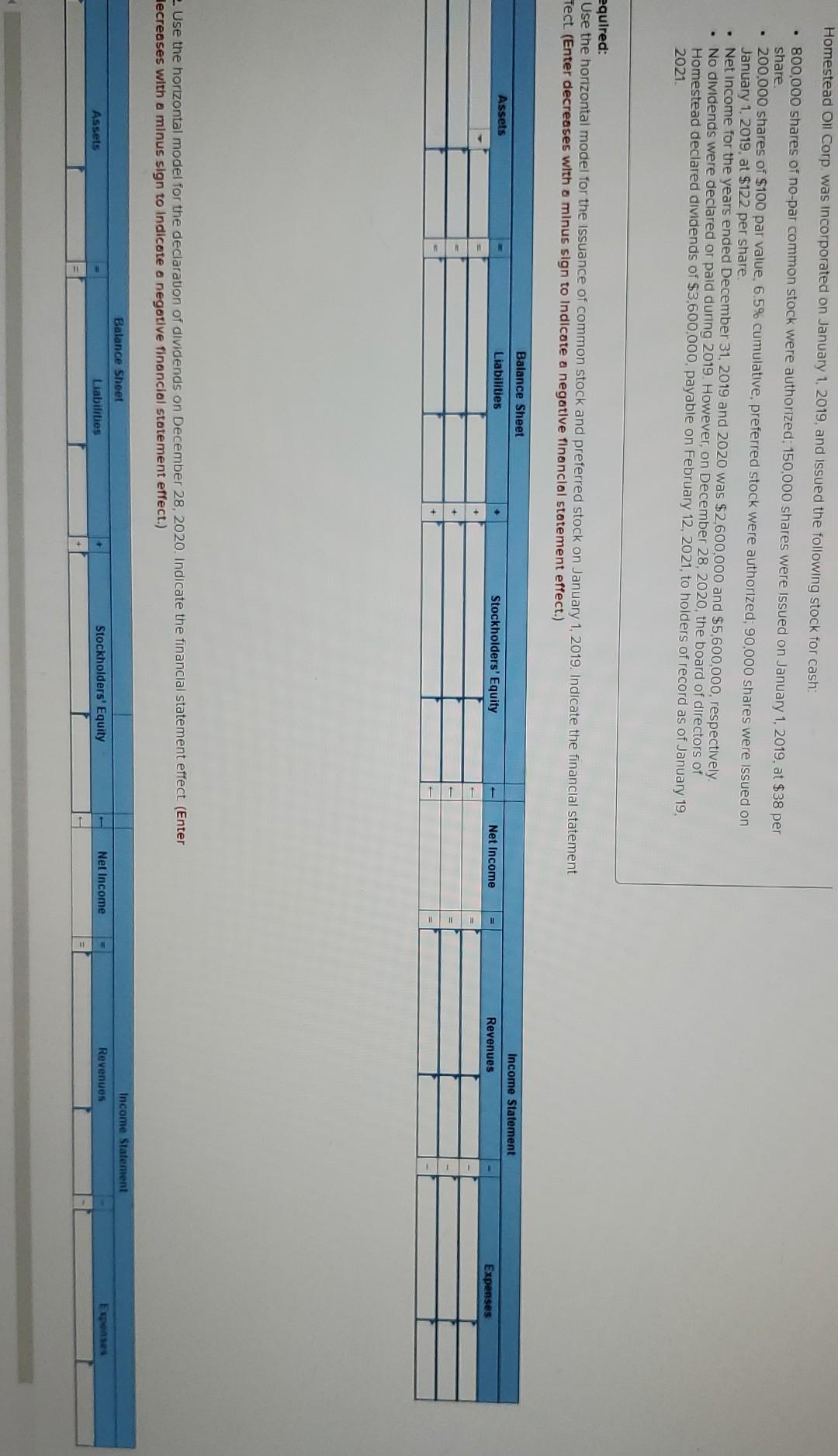

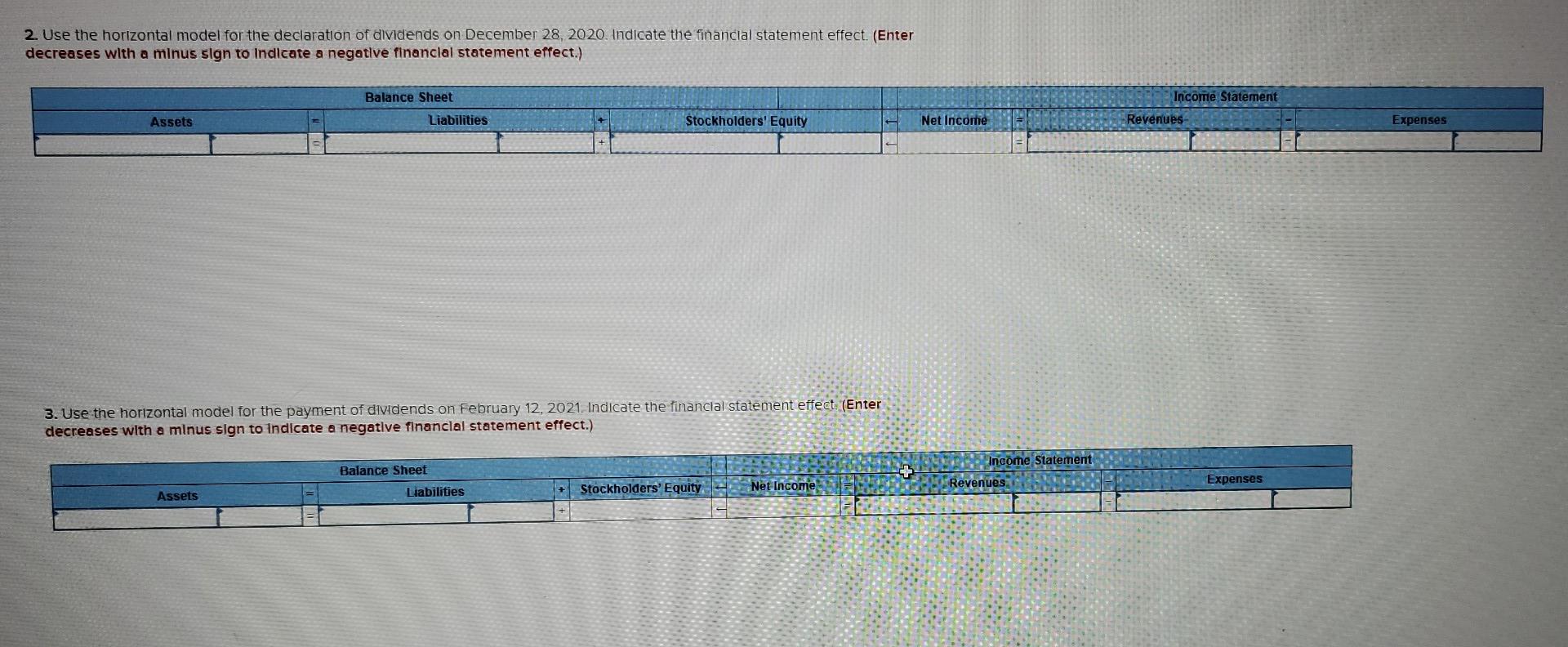

Homestead Oil Corp was incorporated on January 1, 2019. and issued the following stock for cash: 800,000 shares of no-par common stock were authorized. 150.000 shares were issued on January 1, 2019, at $38 per share 200.000 shares of $100 par value, 6.5% cumulative, preferred stock were authorized; 90,000 shares were issued on January 1, 2019, at $122 per share Net Income for the years ended December 31, 2019 and 2020 was $2,600,000 and $5,600,000, respectively. No dividends were declared or paid during 2019. However, on December 28, 2020, the board of directors of Homestead declared dividends of $3,600,000. payable on February 12, 2021, to holders of record as of January 19, 2021 equired: Use the horizontal model for the issuance of common stock and preferred stock on January 1, 2019. Indicate the financial statement Tect (Enter decreases with a minus sign to Indicate a negative financial statement effect.) Balance Sheet Income Statement Assets Liabilities Stockholders' Equity Net Income Revenues Expenses 2. Use the horizontal model for the declaration of dividends on December 28, 2020. Indicate the financial statement effect (Enter Tecreases with a minus sign to indicate a negative financial statement effect.) Income Statement Balance Sheet Liabilities Net Income Stockholders' Equity Assets Revenues 2. Use the horizontal model for the declaration of dividends on December 28, 2020. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Income Statement Balance Sheet Liabilities Assets Stockholders' Equity Net Income Revenues- Expenses 3. Use the horizontal model for the payment of dividends on February 12, 2021. Indicate the financial statement effect (Enter decreases with a minus sign to indicate a negative financial statement effect.) Balance Sheet Income Statement Revenues Expenses Stockholders' Equity Liabilities Net Income Assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started