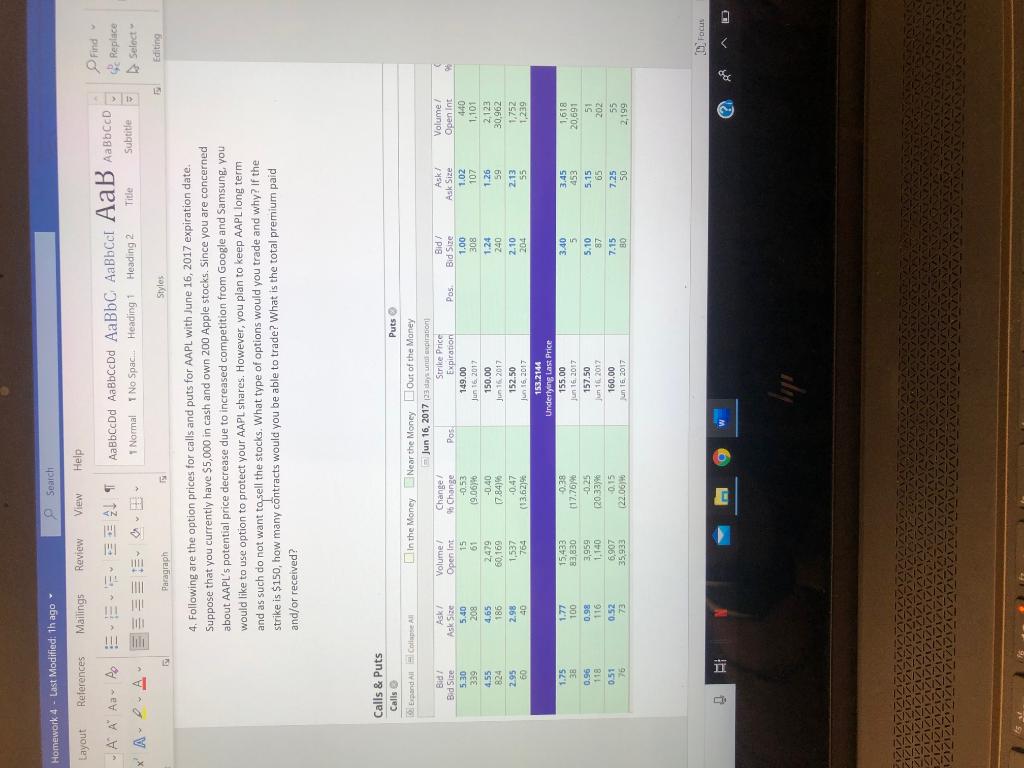

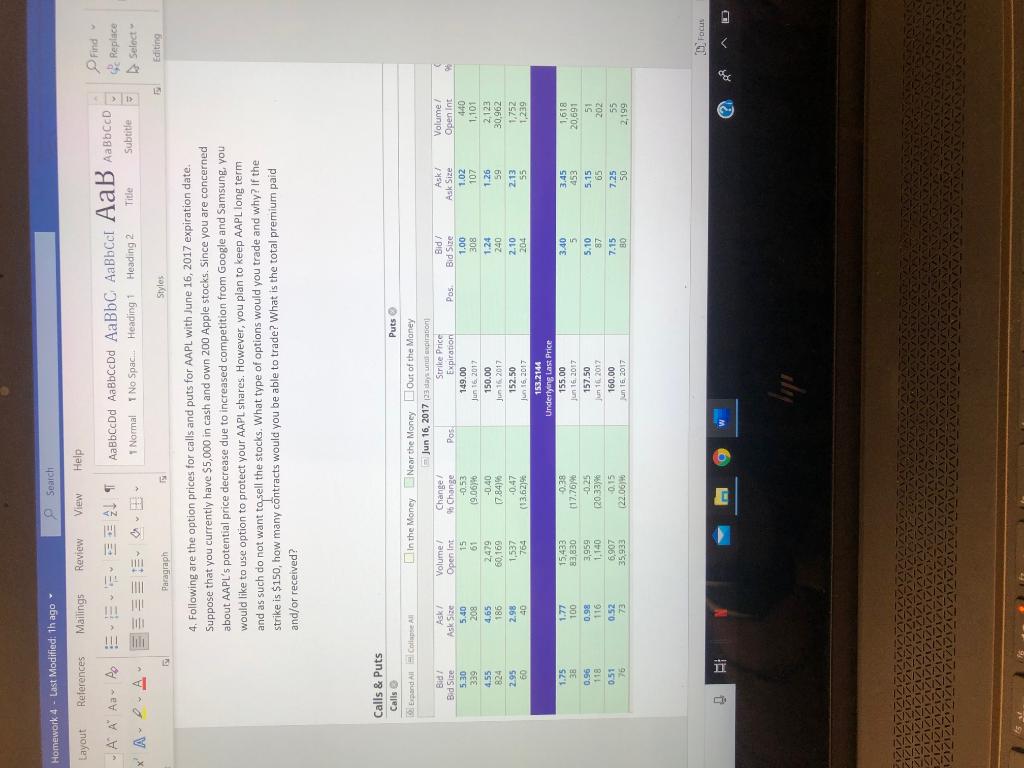

Homework 4 - Last Modified: 1h ago Search Layout References Mailings Review View Help , ct A A A A E ! I * APA e Find e Replace 5 Select Normal 1 No Spac. Heading Heading 2 Title Subtitle Paragraph Styles Editing 4. Following are the option prices for calls and puts for AAPL with June 16, 2017 expiration date. Suppose that you currently have $5,000 in cash and own 200 Apple stocks. Since you are concerned about AAPL's potential price decrease due to increased competition from Google and Samsung, you would like to use option to protect your AAPL shares. However, you plan to keep AAPL long term and such do not want to sell the stocks. What type of options would you trade and why? If the strike is $150, how many contracts would you be able to trade? What is the total premium paid and/or received? Calls & Puts Calls Expand All College All Volume/ Open Int Pos Ask/ Ask Size 5.40 208 Bid/ Bid Size 5.30 339 4.55 824 2.95 60 Bid/ Bid Size 1.00 308 1.24 240 Puts In the Money Near the Money Out of the Money Jun 16, 2017 23 days untilation Volume/ Change Strike Price Open Int * Change Pos Expiration 15 -0.53 149.00 01 19.06% Jun 16, 2017 2,479 -0.40 150.00 60,169 (7.84) Jun 16, 2017 1,537 -0.47 152.50 764 (13.62) Jun 16, 2017 153.2144 Underlying Last Price 15,433 0.38 155.00 83,830 (17.76% Jun 16, 2017 3,959 -0.25 157.50 1.140 (20.33% un 1 2017 6,907 0.15 35,933 (22.06% un 16 2017 Ask: Ask Size 1.OZ 107 1.26 59 2.13 55 4.65 186 2.98 40 1.101 2,123 30,962 1.752 1,239 10 204 3.40 1.75 36 0.96 118 0.51 76 1.77 100 0.98 116 0.52 78 3.45 453 5.15 65 7.25 50 5.10 87 7.15 BO 1,618 20,691 51 202 55 2,199 160.00 D Focus Hi 8 D Homework 4 - Last Modified: 1h ago Search Layout References Mailings Review View Help , ct A A A A E ! I * APA e Find e Replace 5 Select Normal 1 No Spac. Heading Heading 2 Title Subtitle Paragraph Styles Editing 4. Following are the option prices for calls and puts for AAPL with June 16, 2017 expiration date. Suppose that you currently have $5,000 in cash and own 200 Apple stocks. Since you are concerned about AAPL's potential price decrease due to increased competition from Google and Samsung, you would like to use option to protect your AAPL shares. However, you plan to keep AAPL long term and such do not want to sell the stocks. What type of options would you trade and why? If the strike is $150, how many contracts would you be able to trade? What is the total premium paid and/or received? Calls & Puts Calls Expand All College All Volume/ Open Int Pos Ask/ Ask Size 5.40 208 Bid/ Bid Size 5.30 339 4.55 824 2.95 60 Bid/ Bid Size 1.00 308 1.24 240 Puts In the Money Near the Money Out of the Money Jun 16, 2017 23 days untilation Volume/ Change Strike Price Open Int * Change Pos Expiration 15 -0.53 149.00 01 19.06% Jun 16, 2017 2,479 -0.40 150.00 60,169 (7.84) Jun 16, 2017 1,537 -0.47 152.50 764 (13.62) Jun 16, 2017 153.2144 Underlying Last Price 15,433 0.38 155.00 83,830 (17.76% Jun 16, 2017 3,959 -0.25 157.50 1.140 (20.33% un 1 2017 6,907 0.15 35,933 (22.06% un 16 2017 Ask: Ask Size 1.OZ 107 1.26 59 2.13 55 4.65 186 2.98 40 1.101 2,123 30,962 1.752 1,239 10 204 3.40 1.75 36 0.96 118 0.51 76 1.77 100 0.98 116 0.52 78 3.45 453 5.15 65 7.25 50 5.10 87 7.15 BO 1,618 20,691 51 202 55 2,199 160.00 D Focus Hi 8 D