Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Homework 7: After Acquisition Question 4 of 4 View Policies Show Attempt History Current Attempt in Progress Your answer is partially correct. 1.65/2.5 Price

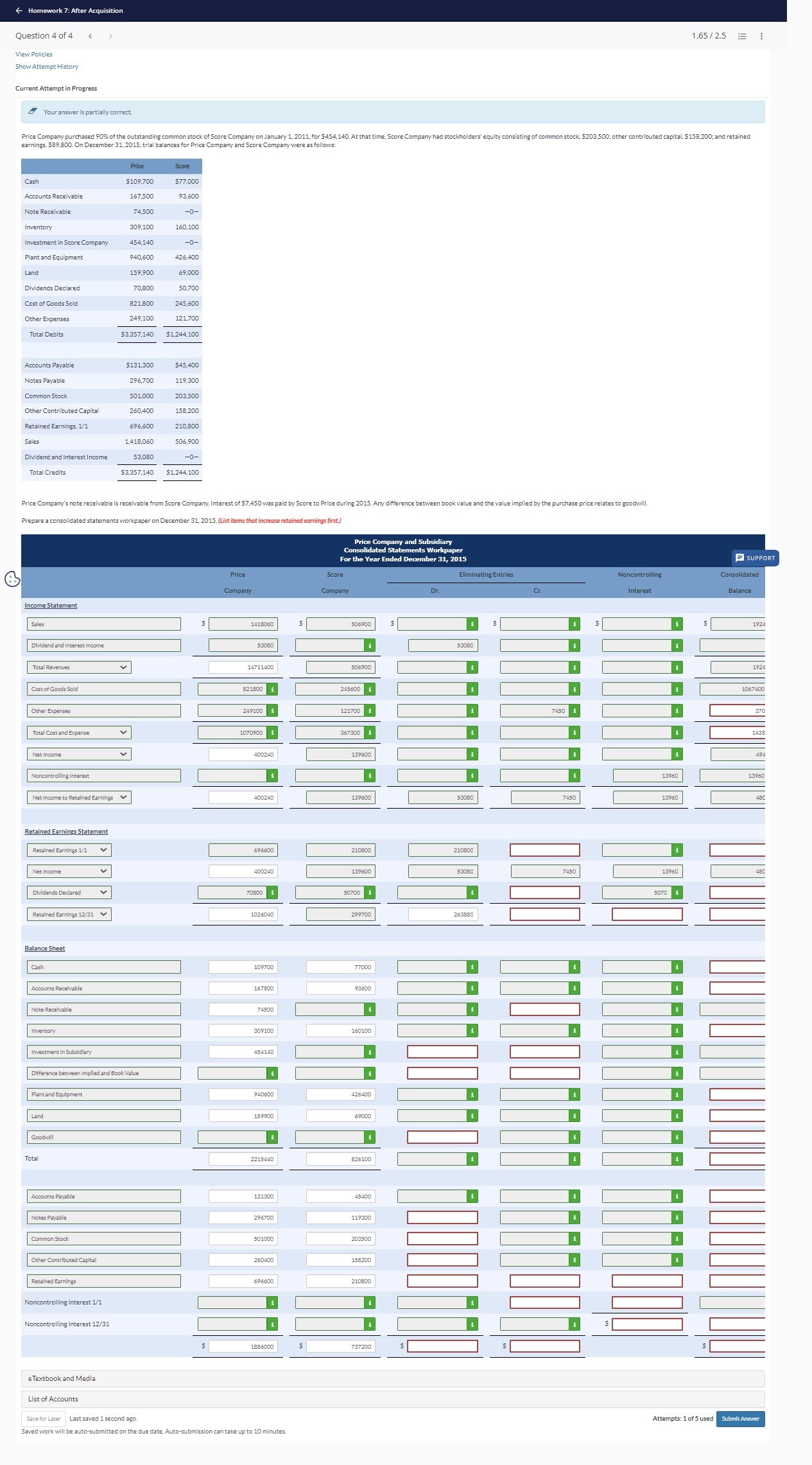

Homework 7: After Acquisition Question 4 of 4 View Policies Show Attempt History Current Attempt in Progress Your answer is partially correct. 1.65/2.5 Price Company purchased 90% of the outstanding common stock of Score Company on January 1, 2011, for $454,140. At that time, Score Company had stockholders' equity consisting of common stock, $203,500; other contributed capital, $158,200; and retained earnings, $89,800. On December 31, 2015, trial balances for Price Company and Score Company were as follows: Price Score Cash $109,700 $77,000 Accounts Receivable 167,500 93,600 Note Receivable 74,500 -0- Inventory 309,100 160,100 Investment in Score Company 454,140 Plant and Equipment 940,600 426,400 Land 159,900 69,000 Dividends Declared 70,800 50,700 Cost of Goods Sold 821,800 245,600 Other Expenses 249,100 121,700 Total Debits $3,357,140 $1,244,100 Accounts Payable $131,300 $45,400 Notes Payable 296,700 119,300 Common Stock 501,000 203,500 Other Contributed Capital 260,400 158,200 Retained Earnings, 1/1 696,600 210,800 Sales 1,418,060 506,900 Dividend and Interest Income 53,080 -0- Total Credits $3,357,140 $1,244,100 Price Company's note receivable is receivable from Score Company. Interest of $7,450 was paid by Score to Price during 2015. Any difference between book value and the value implied by the purchase price relates to goodwill. Prepare a consolidated statements workpaper on December 31, 2015. (List items that increase retained earnings first.) Price Company and Subsidiary Consolidated Statements Workpaper For the Year Ended December 31, 2015 Income Statement Sales Dividend and Interest Income Total Revenues Cost of Goods Sold Other Expenses Price Score Company Company 1418060 $ 506900 $ 53080 14711400 821800 506900 245600 249100 121700 Total Cost and Expense 1070900 Net Income Noncontrolling Interest 400240 367300 139600 SUPPORT Eliminating Entries Noncontrolling Consolidated Dr. Cr Interest Balance 53080 $ 7450 i $ i 1924 1067400 1438 494 13960 13960 Net Income to Retained Earnings 400240 139600 53080 7450 13960 Retained Earnings Statement Retained Earnings 1/1 696600 210800 210800 Net Income Dividends Declared Retained Earnings 12/31 Balance Sheet Cash Accounts Receivable Note Receivable Inventory Investment In Subsidiary Difference between Implied and Book Value Plant and Equipment Land Goodwill Total 400240 70800 1026040 139600 53080 7450 50700 299700 263880 109700 77000 167500 93600 74500 309100 160100 454140 940600 426400 159900 69000 2215440 826100 Accounts Payable 131300 45400 Notes Payable 296700 119300 Common Stock 501000 203500 Other Contributed Capital 260400 158200 Retained Earnings 696600 210800 Noncontrolling Interest 1/1 Noncontrolling Interest 12/31 $ 1886000 $ 737200 eTextbook and Media List of Accounts Save for Later Last saved 1 second ago. Saved work will be auto-submitted on the due date. Auto-submission can take up to 10 minutes. 13960 5070 Attempts: 1 of 5 used Submit Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started