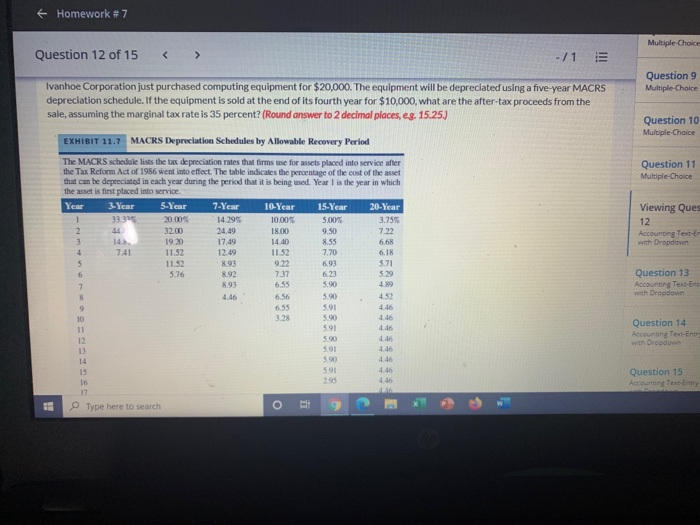

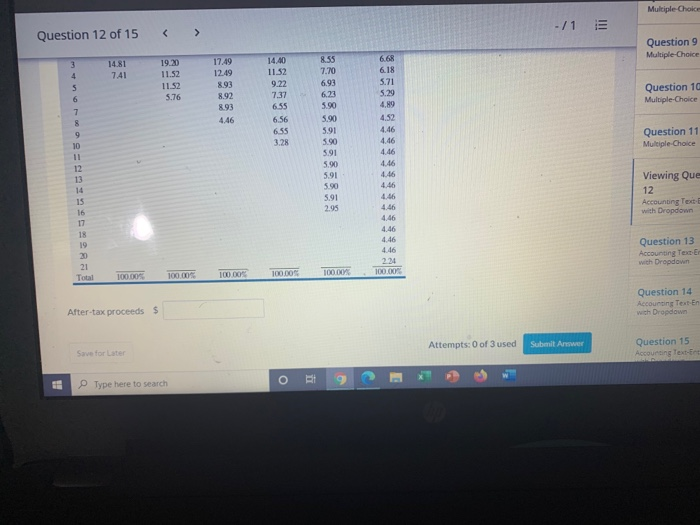

Homework #7 Multiple-Choice Question 9 Multiple-Choice Question 10 Multiple-Choice Question 11 Multiple-Choice Question 12 of 15 - / 1 Ivanhoe Corporation just purchased computing equipment for $20,000. The equipment will be depreciated using a five-year MACRS depreciation schedule. If the equipment is sold at the end of its fourth year for $10,000, what are the after-tax proceeds from the sale, assuming the marginal tax rate is 35 percent? (Round answer to 2 decimal places, es. 15.25) EXHIBIT 11.7 MACRS Depreciation Schedules by Allowable Recovery Period The MACRS schedule lists the tax depreciation rates that firms use for assets placed into service after the Tax Reform Act of 1986 went into effect. The table indicates the percentage of the cost of the asset that can be depreciated in each year during the period that it is being used. Year is the year in which the asset is first placed into service. Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year 33.33 20.00% 14299 10.00% 5.00% 3.75% 2 32.00 24.49 18.00 9.50 7.22 19.20 17.49 14.40 8.55 6.68 7:41 11.52 12.49 11.52 7.70 6.18 11.52 8.93 9.22 6.93 5.71 5.76 8.92 7:37 6.23 5.29 8.93 6.55 5.00 4.89 4.46 6.56 5.00 6.55 5.91 4.46 10 3.28 4.46 11 5.91 4.46 12 5.90 5.91 590 501 295 4.46 1 Viewing Ques 12 Accounting Text with Dropdown 3 4 5 6 7 8 Question 13 Accounting Text End with Dropdown 5.90 Question 14 Accounting Text.Et with Dropdown 4.46 4.46 14 15 16 12 Question 15 Accounting Text Entry Type here to search BI Multiple-Choice -11 Question 12 of 15 Question 9 Multiple-Choice 14.81 7.41 19.0 11.52 11.52 5.76 17.49 12.49 893 8.92 893 4.46 6.68 6.18 5.71 5.29 14.40 11.52 9.22 7.37 6.55 6.56 6.55 3.28 Question 10 Multiple-Choice 4.89 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 4.52 4.46 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Total Question 11 Multiple-Choice 4.46 4.46 4.46 4.46 4.46 4.46 4.46 4.46 4.46 4.46 2.24 100.00% Viewing Que 12 Accounting Text with Dropdown Question 13 Accounting Test with Dropdown 10000 100.00 100 DO 100.00 100.00 Question 14 Accounting Text En with Dropdown After-tax proceeds $ Attempts: 0 of 3 used Submit Answer Question 15 Accounting text- Save for Later FF Type here to search o