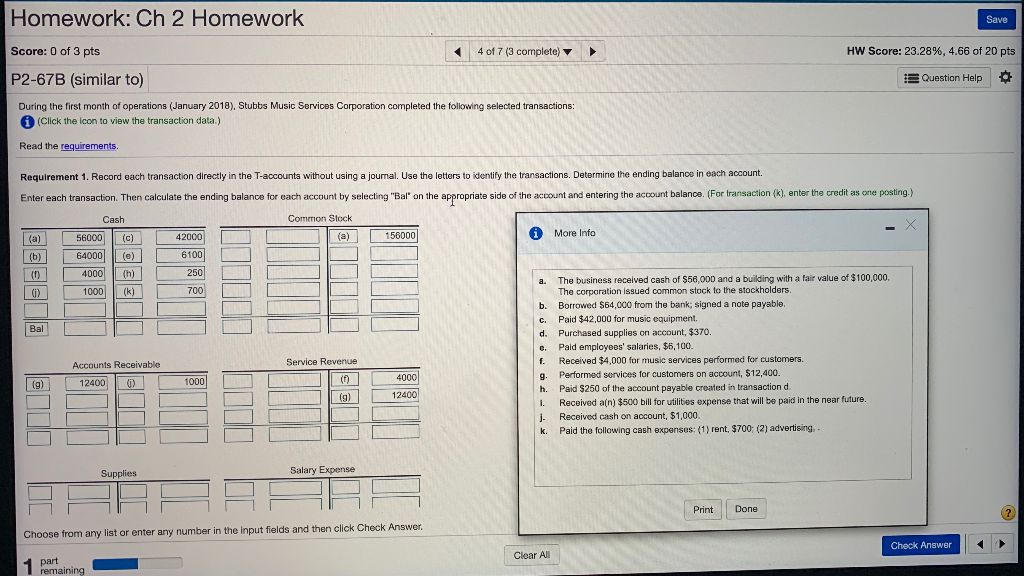

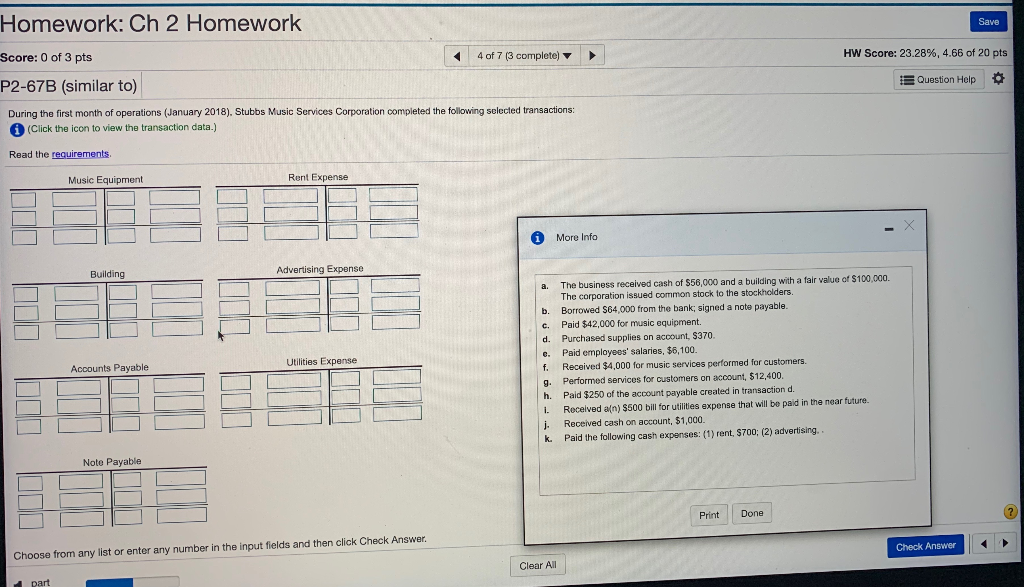

Homework: Ch 2 Homework Save Score: 0 of 3 pts 4 of 7 (3 complete) HW Score: 23.28%, 4.66 of 20 pts P2-67B (similar to) Question Help During the first month of operations (January 2018). Stubbs Music Services Corporation completed the following selected transactions: i (Click the icon to view the transaction data.) Read the requirements Requirement 1. Record each transaction directly in the T-accounts without using a journal. Use the letters to identify the transactions. Determine the ending balance in each account Enter each transaction. Then calculate the ending balance for each account by selecting "Bal" on the appropriate side of the account and entering the account balance. (For transaction (k), enter the credit as one posting.) Common Stock Cash 56000 (c) 64000 (a) 156000 i More Info 42000 6100 250 a. The business received cash of $56,000 and a building with a fair value of $100,000 The corporation issued common stock to the stockholders. b. Borrowed $64,000 from the bank; signed a note payable. c. Paid $42,000 for music equipment d. Purchased supplies on account, $370. e. Pald employees' salaries, $6,100. f. Received $4,000 for music services performed for customers. g. Performed services for customers on account, $12,400. h. Paid $250 of the account payable created in transaction d. L. Received a(n) $500 bill for utilities expense that will be paid in the near future. 1 Received cash on account, $1,000 k. Paid the following cash expenses: (1) rent, $700 (2) advertising Accounts Receivable Service Revenue 4000 12400 Supplies Salary Expense Print Done Choose from any list or enter any number in the input fields and then click Check Answer Check Answer Clear All 1 part remaining Save Homework: Ch 2 Homework Score: 0 of 3 pts P2-67B (similar to) 4 of 7 (3 complete) HW Score: 23.28%, 4.66 of 20 pts Question Help During the first month of operations (January 2018), Stubbs Music Services Corporation completed the following selected transactions: (Click the icon to view the transaction data.) Read the requirements Music Equipment Rent Expense 1 More Info Building Advertising Expense Utilities Expense a. The business received cash of $56,000 and a building with a fair value of $100,000. The corporation issued common stock to the stockholders. b. Borrowed $64,000 from the bank, signed a note payable. c. Paid $42,000 for music equipment. d. Purchased supplies on account, $370. e. Paid employees' salaries, $6,100. f. Received $4,000 for music services performed for customers. 9. Performed services for customers on account, $12,400. h. Paid $250 of the account payable created in transaction d. 1 Received a[n) $500 bill for utilities expense that will be paid in the near future j. Received cash on account, $1,000. k. Paid the following cash expenses: (1) rent. $700; (2) advertising. Accounts Payable Note Payable Print Done Check Answer Choose from any list or enter any number in the input fields and then click Check Answer. Clear All part