Answered step by step

Verified Expert Solution

Question

1 Approved Answer

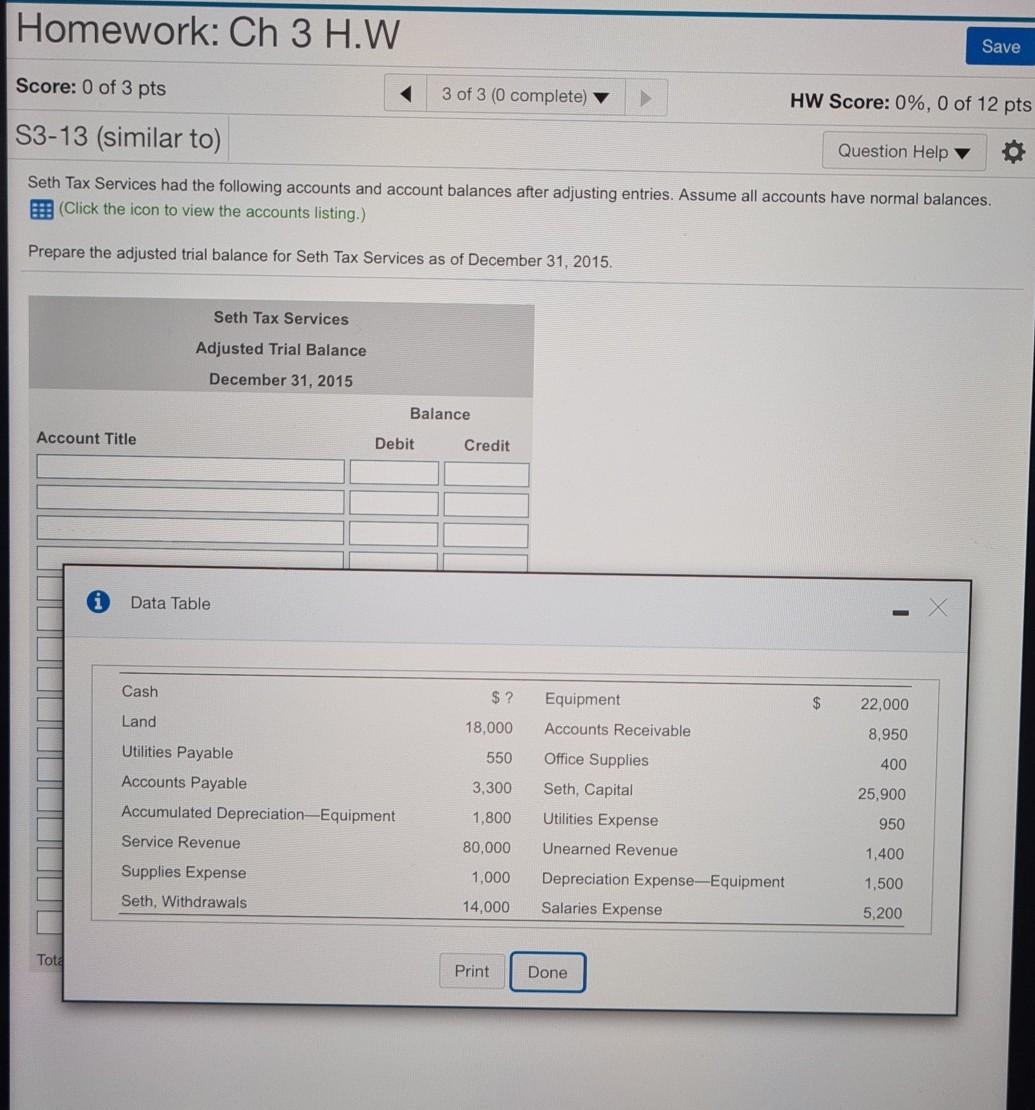

Homework: Ch 3 H.W Save Score: 0 of 3 pts 3 of 3 (0 complete) HW Score: 0%, 0 of 12 pts S3-13 (similar to)

Homework: Ch 3 H.W Save Score: 0 of 3 pts 3 of 3 (0 complete) HW Score: 0%, 0 of 12 pts S3-13 (similar to) Question Help Seth Tax Services had the following accounts and account balances after adjusting entries. Assume all accounts have normal balances. (Click the icon to view the accounts listing.) Prepare the adjusted trial balance for Seth Tax Services as of December 31, 2015. Seth Tax Services Adjusted Trial Balance December 31, 2015 Balance Account Title Debit Credit Data Table - Cash $? Equipment $ 22,000 Land 18.000 Accounts Receivable 8,950 550 400 Utilities Payable Accounts Payable Accumulated Depreciation-Equipment 3,300 Office Supplies Seth, Capital Utilities Expense 25,900 1,800 950 Service Revenue 80,000 Unearned Revenue 1,400 1,000 Supplies Expense Seth, Withdrawals 1,500 Depreciation Expense-Equipment Salaries Expense 14.000 5,200 Tota Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started