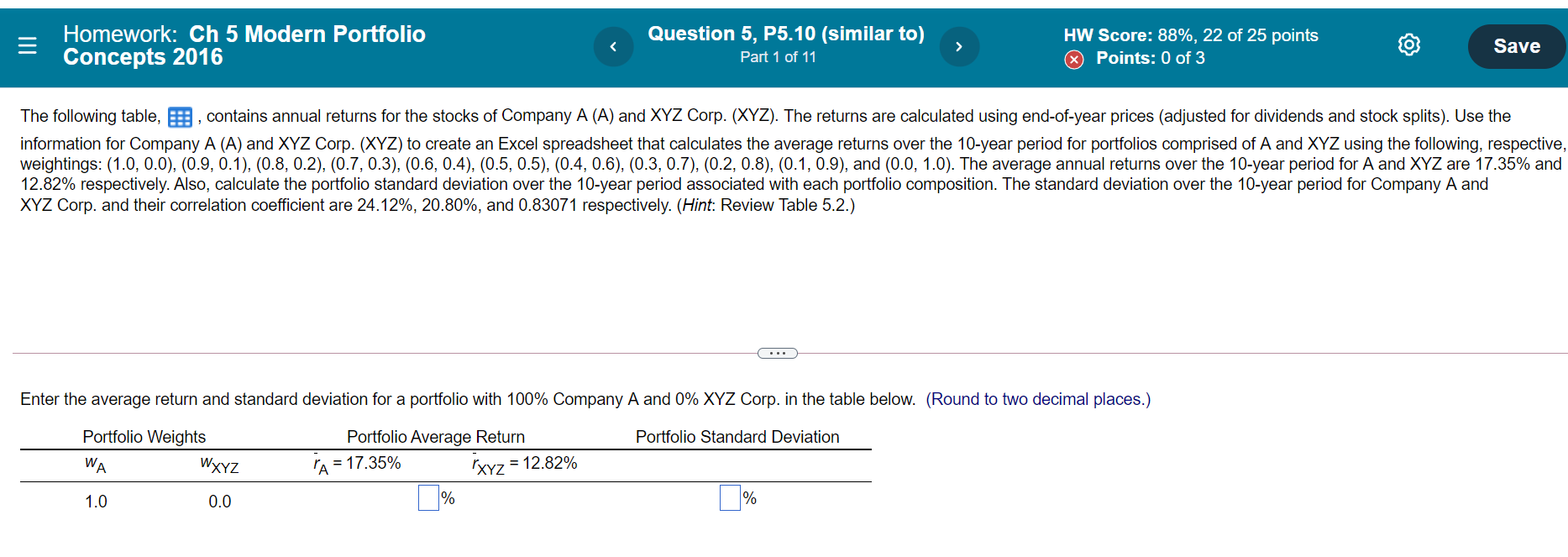

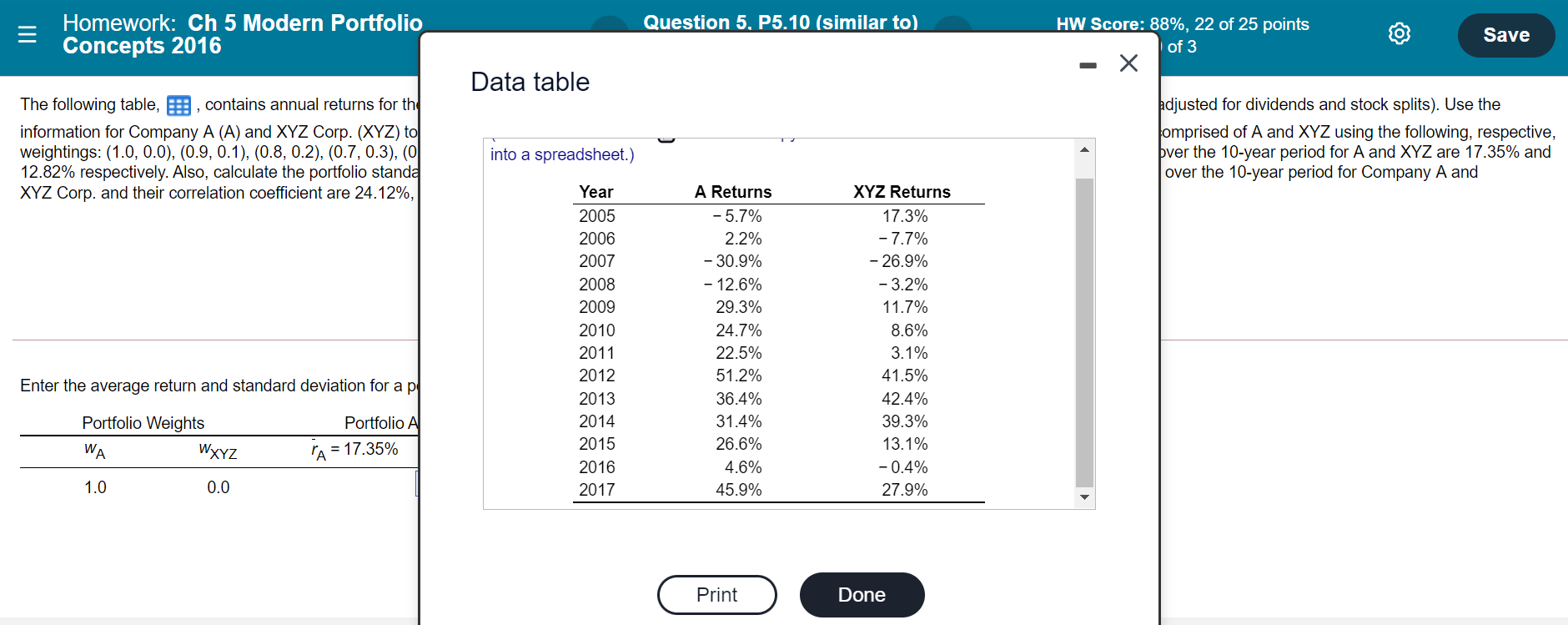

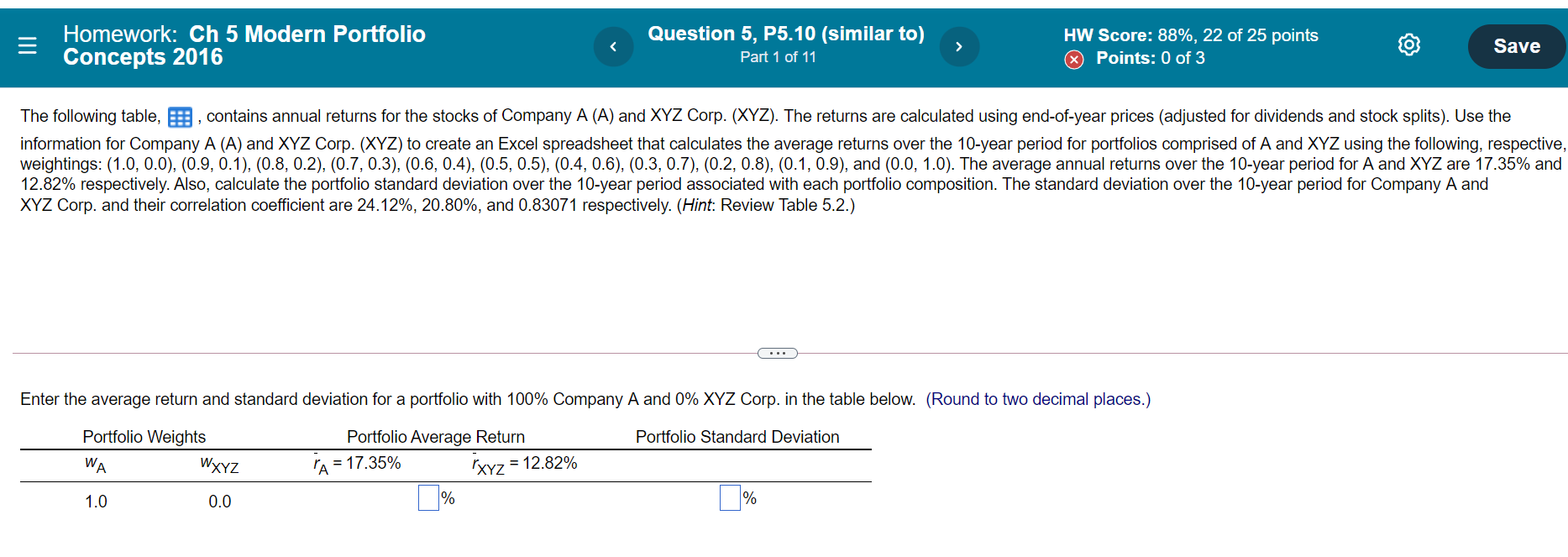

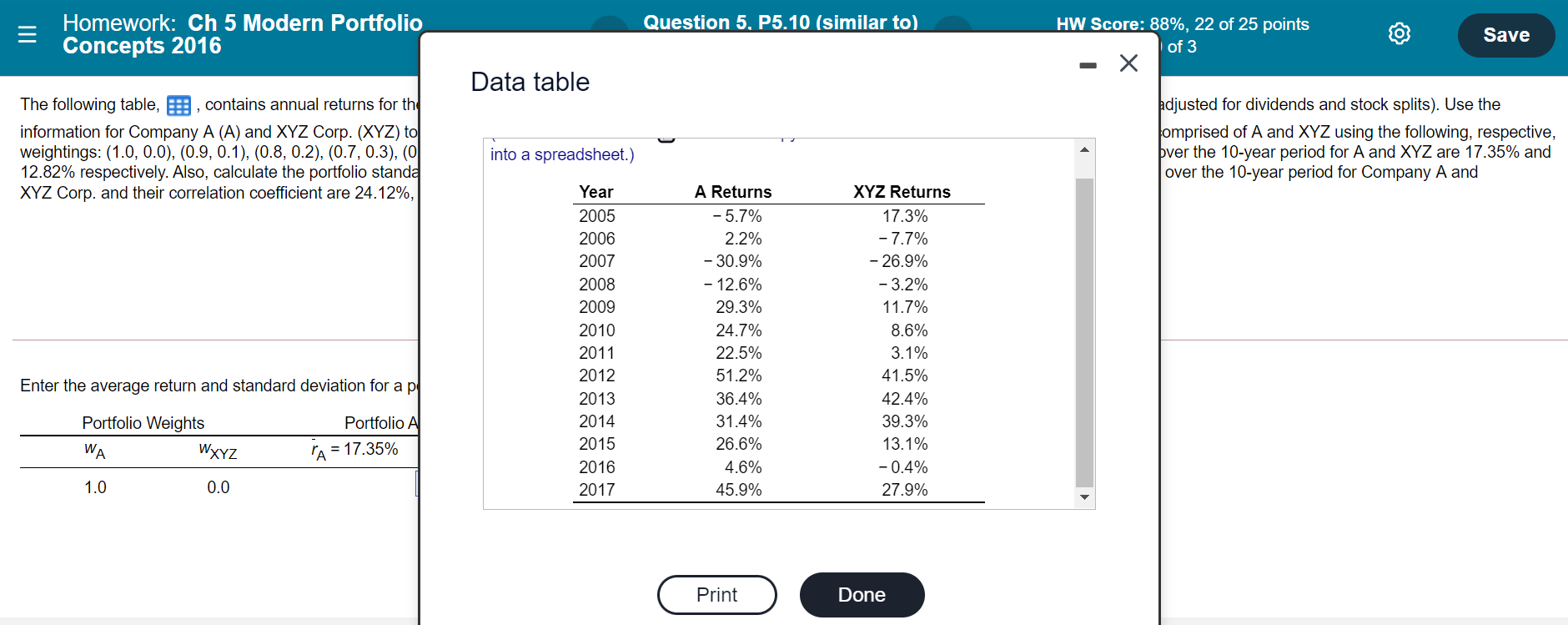

Homework: Ch 5 Modern Portfolio Concepts 2016 Question 5, P5.10 (similar to) Part 1 of 11 HW Score: 88%, 22 of 25 points Points: 0 of 3 Save The following table, contains annual returns for the stocks of Company A (A) and XYZ Corp. (XYZ). The returns are calculated using end-of-year prices (adjusted for dividends and stock splits). Use the information for Company A (A) and XYZ Corp. (XYZ) to create an Excel spreadsheet that calculates the average returns over the 10-year period for portfolios comprised of A and XYZ using the following, respective, weightings: (1.0, 0.0), (0.9, 0.1), (0.8, 0.2), (0.7, 0.3), (0.6, 0.4), (0.5, 0.5), (0.4, 0.6), (0.3, 0.7), (0.2, 0.8), (0.1, 0.9), and (0.0, 1.0). The average annual returns over the 10-year period for A and XYZ are 17.35% and 12.82% respectively. Also, calculate the portfolio standard deviation over the 10-year period associated with each portfolio composition. The standard deviation over the 10-year period for Company A and XYZ Corp. and their correlation coefficient are 24.12%, 20.80%, and 0.83071 respectively. (Hint: Review Table 5.2.) Enter the average return and standard deviation for a portfolio with 100% Company A and 0% XYZ Corp. in the table below. (Round to two decimal places.) Portfolio Standard Deviation Portfolio Weights WA WXYZ Portfolio Average Return PA = 17.35% FXYZ = 12.82% % 1.0 0.0 % Homework: Ch 5 Modern Portfolio Concepts 2016 Question 5, P5.10 (similar to) 5. HW Score: 88%, 22 of 25 points of 3 Save Data table The following table, B, contains annual returns for th information for Company A (A) and XYZ Corp. (XYZ) to weightings: (1.0, 0.0), (0.9, 0.1), (0.8, 0.2), (0.7,0.3), (o 12.82% respectively. Also, calculate the portfolio standa XYZ Corp. and their correlation coefficient are 24.12%, adjusted for dividends and stock splits). Use the omprised of A and XYZ using the following, respective, ver the 10-year period for A and XYZ are 17.35% and over the 10-year period for Company A and into a spreadsheet.) Year 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 A Returns -5.7% 2.2% - 30.9% - 12.6% 29.3% 24.7% 22.5% 51.2% 36.4% 31.4% 26.6% 4.6% 45.9% XYZ Returns 17.3% -7.7% - 26.9% -3.2% 11.7% 8.6% 3.1% 41.5% 42.4% 39.3% 13.1% -0.4% 27.9% Enter the average return and standard deviation for a pl Portfolio Weights WA WXYZ Portfolio All = 17.35% 1.0 0.0 Print Done