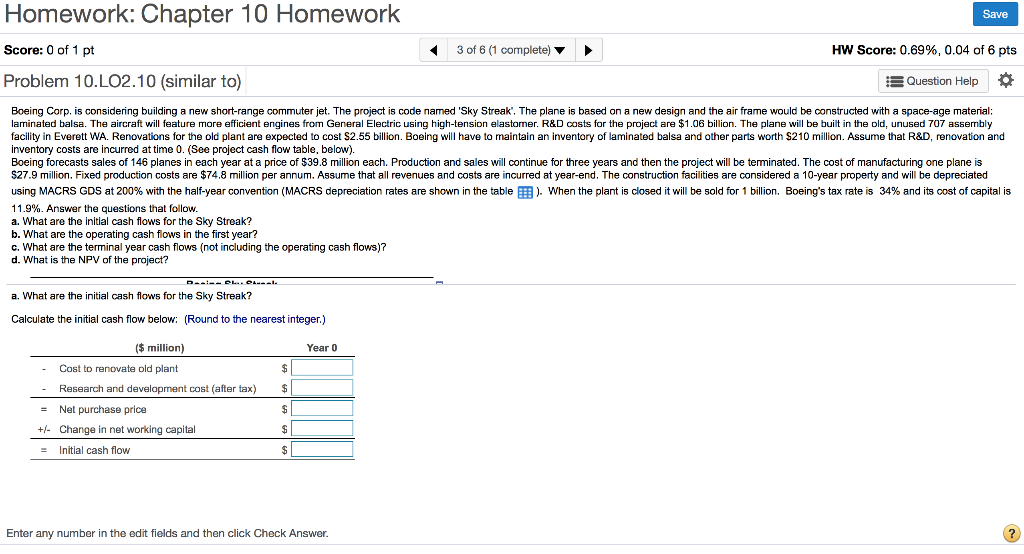

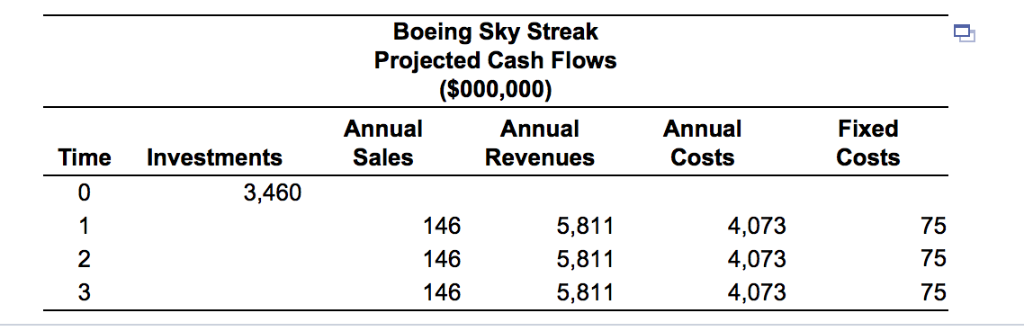

Homework: Chapter 10 Homework Save Score: 0 of 1 pt 3 of 6 (1 complete) Hw Score: 0.69%, 0.04 of 6 pts Problem 10.LO2.10 (similar to) Question Help Boeing Corp, is considering building a new short-range commuter jet. The project is code named 'Sky Streak. The plane is based on a new design and the air frame would be constructed with a space-age material: laminated balsa. The aircraft will feature more efficient engines from General Electric using high-tension elastoner. R&D costs for the project are $1.06 billion. The plane will be built in the old, unused 707 assembly facility in Everett WA. Renovations for the old plant are expected to cost S2.55 billion. Boeing will have to maintain an inventory of laminated balsa and other parts worth $210 million. Assume that R&D, renovation and inventory costs are incurred at time 0. (See project cash flow table, below) Boeing forecasts sales of 146 planes in each year at a price of $39.8 million each. Production and sales will continue for three years and then the project will be terminated. The cost of manufacturing one plane is $27.9 million. Fixed production costs are $74.8 milion per annum. Assume that all revenues and costs are incurred at year-end. The construction facilities are considered a 10-year property and will be depreciated using MACRS GDS at 200% with the half-year convention MACRS deprec ation rates are shown in the able when the plant s closed it wi e ld 1 billion Boeings ax te s 34%, and cost of apita 11.9%. Answer the questions that follow a. What are the initial cash flows for the Sky Streak? b. What are the operating cash flows in the first year? c. What are the terminal year cash flows (not including the operating cash flows)? d. What is the NPV of the project? a. What are the initial cash flows for the Sky Streak? Calculate the initial cash flow below Round to the nearest integer.) $ million) Year 0 Cost to renovate old plant Research and development cost (after tax) Net purchase price Change in net working capital Initial cash flow Enter any number in the edit fields and then click Check Answer. Boeing Sky Streak Projected Cash Flows ($000,000) Annual Sales Annual Revenues Annual Costs Fixed Costs Time Investments 3,460 146 146 146 5,811 5,811 5,811 4,073 4,073 4,073 75 75 75 2 Homework: Chapter 10 Homework Save Score: 0 of 1 pt 3 of 6 (1 complete) Hw Score: 0.69%, 0.04 of 6 pts Problem 10.LO2.10 (similar to) Question Help Boeing Corp, is considering building a new short-range commuter jet. The project is code named 'Sky Streak. The plane is based on a new design and the air frame would be constructed with a space-age material: laminated balsa. The aircraft will feature more efficient engines from General Electric using high-tension elastoner. R&D costs for the project are $1.06 billion. The plane will be built in the old, unused 707 assembly facility in Everett WA. Renovations for the old plant are expected to cost S2.55 billion. Boeing will have to maintain an inventory of laminated balsa and other parts worth $210 million. Assume that R&D, renovation and inventory costs are incurred at time 0. (See project cash flow table, below) Boeing forecasts sales of 146 planes in each year at a price of $39.8 million each. Production and sales will continue for three years and then the project will be terminated. The cost of manufacturing one plane is $27.9 million. Fixed production costs are $74.8 milion per annum. Assume that all revenues and costs are incurred at year-end. The construction facilities are considered a 10-year property and will be depreciated using MACRS GDS at 200% with the half-year convention MACRS deprec ation rates are shown in the able when the plant s closed it wi e ld 1 billion Boeings ax te s 34%, and cost of apita 11.9%. Answer the questions that follow a. What are the initial cash flows for the Sky Streak? b. What are the operating cash flows in the first year? c. What are the terminal year cash flows (not including the operating cash flows)? d. What is the NPV of the project? a. What are the initial cash flows for the Sky Streak? Calculate the initial cash flow below Round to the nearest integer.) $ million) Year 0 Cost to renovate old plant Research and development cost (after tax) Net purchase price Change in net working capital Initial cash flow Enter any number in the edit fields and then click Check Answer. Boeing Sky Streak Projected Cash Flows ($000,000) Annual Sales Annual Revenues Annual Costs Fixed Costs Time Investments 3,460 146 146 146 5,811 5,811 5,811 4,073 4,073 4,073 75 75 75 2