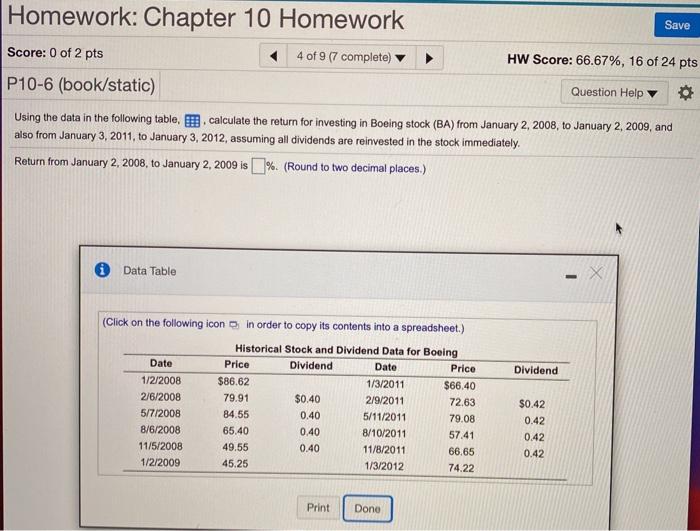

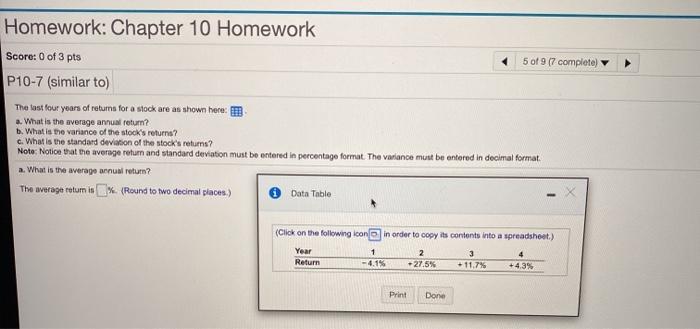

Homework: Chapter 10 Homework Save Score: 0 of 3 pts 5 of 9 (7 complete) HW Score: 66.67%, 16 of 24 pts P10-7 (similar to) Question Help The last four years of returns for a stock are as shown here: a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. a. What is the average annual return? The average return is %. (Round to two decimal places.) Homework: Chapter 10 Homework Save Score: 0 of 3 pts 3 of 9 (7 complete) HW Score: 66.67%, 16 of 24 pts X P10-4 (similar to) Question Help You bought a stock one year ago for $48.47 per share and sold it today for $59.28 per share. It paid a $1.13 per share dividend today. a. What was your realized return? b. How much of the return came from dividend yield and how much came from capital gain? a. What was your realized return? The realized return was%. (Round to two decimal places.) Homework: Chapter 10 Homework Save Score: 0 of 2 pts 4 of 9 (7 complete HW Score: 66.67%, 16 of 24 pts P10-6 (book/static) Question Help Using the data in the following table, calculate the return for investing in Boeing stock (BA) from January 2, 2008, to January 2, 2009, and also from January 3, 2011, to January 3, 2012, assuming all dividends are reinvested in the stock immediately. Return from January 2, 2008, to January 2, 2009 is % (Round to two decimal places.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Dividend Date 1/2/2008 2/6/2008 5/7/2008 8/6/2008 11/5/2008 1/2/2009 Historical Stock and Dividend Data for Boeing Price Dividend Date Price $86.62 1/3/2011 $66.40 79.91 $0.40 2/9/2011 72.63 84.55 0.40 5/11/2011 79.08 65.40 0.40 8/10/2011 57.41 49.55 0.40 11/8/2011 66.65 45.25 1/3/2012 74.22 $0.42 0.42 0.42 0.42 Print Dono Homework: Chapter 10 Homework Score: 0 of 3 pts 5 of 9 (7 complete) P10-7 (similar to) The last four years of retums for a stock are as shown here: 3. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns Note: Notice that the average return and standard deviation must be entered in percentage format The variance must be entered in decimal format. a. What is the average annual return? The werage ratum is x (Round to two decimal places) Data Table (Click on the following loon in order to copy its contents into a spreadsheet.) Year Return 1 -4.1% 2 +27,5% + 11.7% +4.3% Print Done Homework: Chapter 10 Homework Save Score: 0 of 3 pts 5 of 9 (7 complete) HW Score: 66.67%, 16 of 24 pts P10-7 (similar to) Question Help The last four years of returns for a stock are as shown here: a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. a. What is the average annual return? The average return is %. (Round to two decimal places.) Homework: Chapter 10 Homework Save Score: 0 of 3 pts 3 of 9 (7 complete) HW Score: 66.67%, 16 of 24 pts X P10-4 (similar to) Question Help You bought a stock one year ago for $48.47 per share and sold it today for $59.28 per share. It paid a $1.13 per share dividend today. a. What was your realized return? b. How much of the return came from dividend yield and how much came from capital gain? a. What was your realized return? The realized return was%. (Round to two decimal places.) Homework: Chapter 10 Homework Save Score: 0 of 2 pts 4 of 9 (7 complete HW Score: 66.67%, 16 of 24 pts P10-6 (book/static) Question Help Using the data in the following table, calculate the return for investing in Boeing stock (BA) from January 2, 2008, to January 2, 2009, and also from January 3, 2011, to January 3, 2012, assuming all dividends are reinvested in the stock immediately. Return from January 2, 2008, to January 2, 2009 is % (Round to two decimal places.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Dividend Date 1/2/2008 2/6/2008 5/7/2008 8/6/2008 11/5/2008 1/2/2009 Historical Stock and Dividend Data for Boeing Price Dividend Date Price $86.62 1/3/2011 $66.40 79.91 $0.40 2/9/2011 72.63 84.55 0.40 5/11/2011 79.08 65.40 0.40 8/10/2011 57.41 49.55 0.40 11/8/2011 66.65 45.25 1/3/2012 74.22 $0.42 0.42 0.42 0.42 Print Dono Homework: Chapter 10 Homework Score: 0 of 3 pts 5 of 9 (7 complete) P10-7 (similar to) The last four years of retums for a stock are as shown here: 3. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns Note: Notice that the average return and standard deviation must be entered in percentage format The variance must be entered in decimal format. a. What is the average annual return? The werage ratum is x (Round to two decimal places) Data Table (Click on the following loon in order to copy its contents into a spreadsheet.) Year Return 1 -4.1% 2 +27,5% + 11.7% +4.3% Print Done