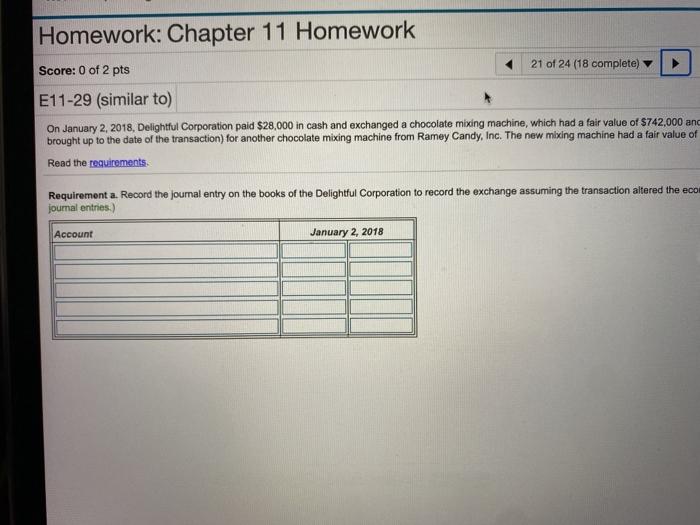

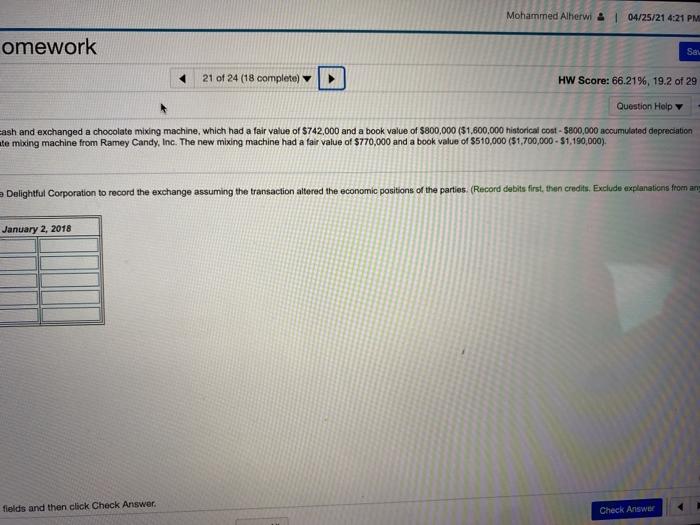

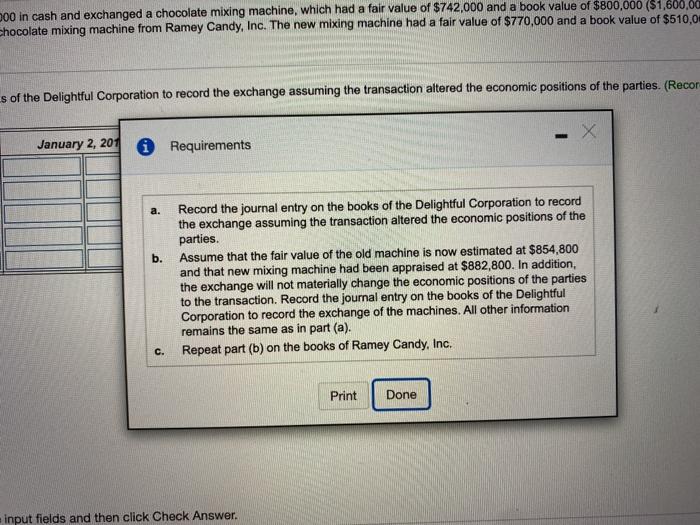

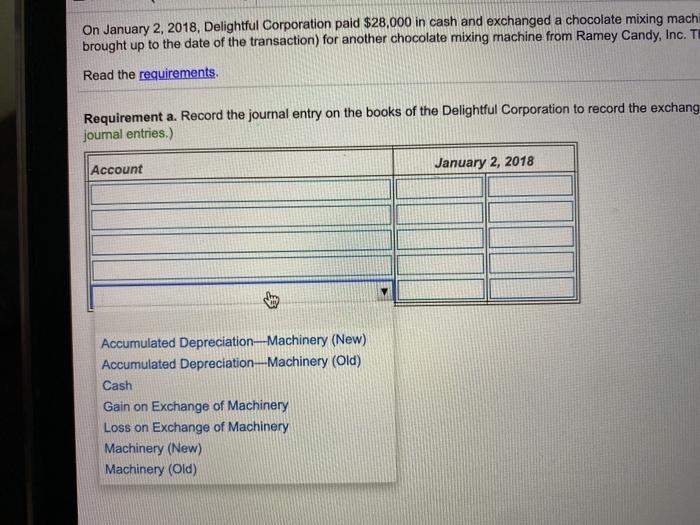

Homework: Chapter 11 Homework Score: 0 of 2 pts 21 of 24 (18 complete) E11-29 (similar to) On January 2, 2018, Delightful Corporation paid $28,000 in cash and exchanged a chocolate mixing machine, which had a fair value of $742,000 and brought up to the date of the transaction) for another chocolate mixing machine from Ramey Candy, Inc. The new mixing machine had a fair value of Read the requirements Requirement a. Record the journal entry on the books of the Delightful Corporation to record the exchange assuming the transaction altered the eco journal entries.) Account January 2, 2018 Mohammed Alherwi & 04/25/21 4:21 PM omework Sau 21 of 24 (18 complete) HW Score: 66.21%, 19.2 of 29 Question Help ash and exchanged a chocolate mixing machine, which had a fair value of $742,000 and a book value of $800,000 (51.600.000 historical cost - $800,000 accumulated depreciation ate mixing machine from Ramey Candy, Inc. The new mixing machine had a fair value of $770,000 and a book value of $510,000 (51,700,000 - $1,190,000). Delightful Corporation to record the exchange assuming the transaction altered the economic positions of the parties. (Record debits first, then credits. Exclude explanations from an January 2, 2018 fields and then click Check Answer Check Answer 000 in cash and exchanged a chocolate mixing machine, which had a fair value of $742,000 and a book value of $800,000 ($1,600,00 Chocolate mixing machine from Ramey Candy, Inc. The new mixing machine had a fair value of $770,000 and a book value of $510,0 s of the Delightful Corporation to record the exchange assuming the transaction altered the economic positions of the parties. (Recor X January 2, 201 Requirements a. b. Record the journal entry on the books of the Delightful Corporation to record the exchange assuming the transaction altered the economic positions of the parties. Assume that the fair value of the old machine is now estimated at $854,800 and that new mixing machine had been appraised at $882,800. In addition, the exchange will not materially change the economic positions of the parties to the transaction. Record the journal entry on the books of the Delightful Corporation to record the exchange of the machines. All other information remains the same as in part (a). Repeat part (b) on the books of Ramey Candy, Inc. C. Print Done input fields and then click Check Answer. On January 2, 2018, Delightful Corporation paid $28,000 in cash and exchanged a chocolate mixing machi brought up to the date of the transaction) for another chocolate mixing machine from Ramey Candy, Inc. To Read the requirements. Requirement a. Record the journal entry on the books of the Delightful Corporation to record the exchang journal entries.) Account January 2, 2018 Nov Accumulated Depreciation Machinery (New) Accumulated Depreciation Machinery (Old) Cash Gain on Exchange of Machinery Loss on Exchange of Machinery Machinery (New) Machinery (Old) Homework: Chapter 11 Homework Score: 0 of 2 pts 21 of 24 (18 complete) E11-29 (similar to) On January 2, 2018, Delightful Corporation paid $28,000 in cash and exchanged a chocolate mixing machine, which had a fair value of $742,000 and brought up to the date of the transaction) for another chocolate mixing machine from Ramey Candy, Inc. The new mixing machine had a fair value of Read the requirements Requirement a. Record the journal entry on the books of the Delightful Corporation to record the exchange assuming the transaction altered the eco journal entries.) Account January 2, 2018 Mohammed Alherwi & 04/25/21 4:21 PM omework Sau 21 of 24 (18 complete) HW Score: 66.21%, 19.2 of 29 Question Help ash and exchanged a chocolate mixing machine, which had a fair value of $742,000 and a book value of $800,000 (51.600.000 historical cost - $800,000 accumulated depreciation ate mixing machine from Ramey Candy, Inc. The new mixing machine had a fair value of $770,000 and a book value of $510,000 (51,700,000 - $1,190,000). Delightful Corporation to record the exchange assuming the transaction altered the economic positions of the parties. (Record debits first, then credits. Exclude explanations from an January 2, 2018 fields and then click Check Answer Check Answer 000 in cash and exchanged a chocolate mixing machine, which had a fair value of $742,000 and a book value of $800,000 ($1,600,00 Chocolate mixing machine from Ramey Candy, Inc. The new mixing machine had a fair value of $770,000 and a book value of $510,0 s of the Delightful Corporation to record the exchange assuming the transaction altered the economic positions of the parties. (Recor X January 2, 201 Requirements a. b. Record the journal entry on the books of the Delightful Corporation to record the exchange assuming the transaction altered the economic positions of the parties. Assume that the fair value of the old machine is now estimated at $854,800 and that new mixing machine had been appraised at $882,800. In addition, the exchange will not materially change the economic positions of the parties to the transaction. Record the journal entry on the books of the Delightful Corporation to record the exchange of the machines. All other information remains the same as in part (a). Repeat part (b) on the books of Ramey Candy, Inc. C. Print Done input fields and then click Check Answer. On January 2, 2018, Delightful Corporation paid $28,000 in cash and exchanged a chocolate mixing machi brought up to the date of the transaction) for another chocolate mixing machine from Ramey Candy, Inc. To Read the requirements. Requirement a. Record the journal entry on the books of the Delightful Corporation to record the exchang journal entries.) Account January 2, 2018 Nov Accumulated Depreciation Machinery (New) Accumulated Depreciation Machinery (Old) Cash Gain on Exchange of Machinery Loss on Exchange of Machinery Machinery (New) Machinery (Old)