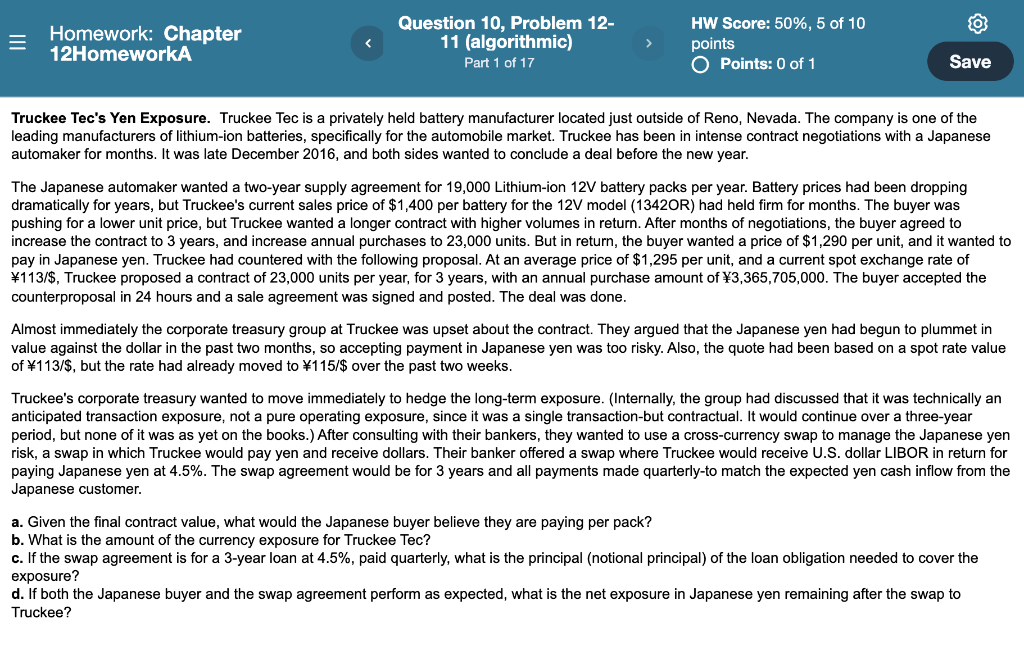

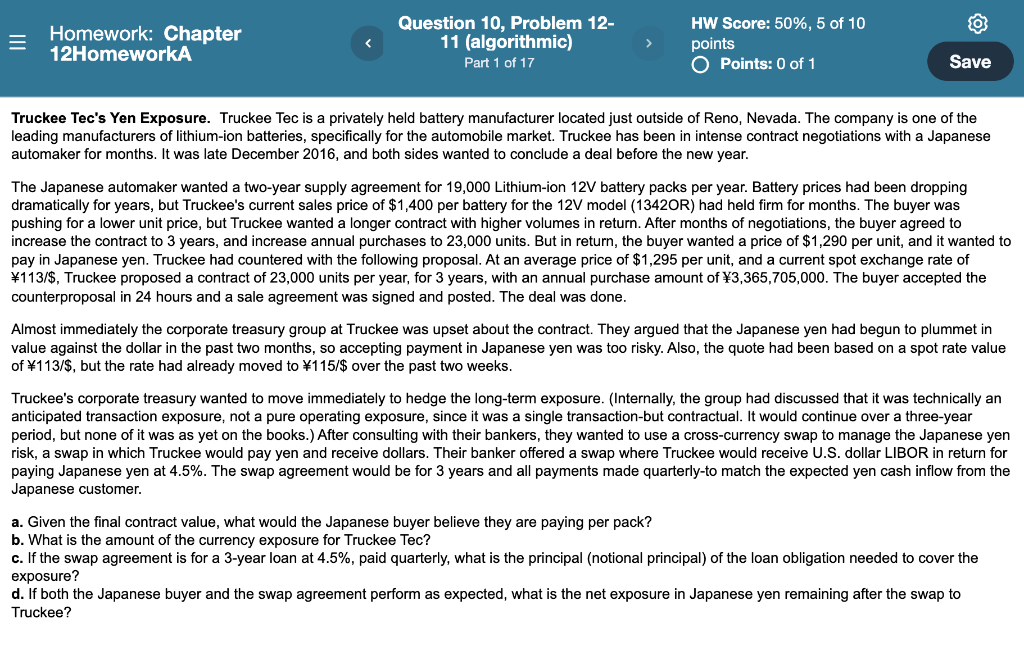

Homework: Chapter 12 HomeworkA Question 10, Problem 12- 11 (algorithmic) Part 1 of 17 HW Score: 50%, 5 of 10 points O Points: 0 of 1 Save Truckee Tec's Yen Exposure. Truckee Tec is a privately held battery manufacturer located just outside of Reno, Nevada. The company is one of the leading manufacturers of lithium-ion batteries, specifically for the automobile market. Truckee has been in intense contract negotiations with a Japanese automaker for months. It was late December 2016, and both sides wanted to conclude a deal before the new year. The Japanese automaker wanted a two-year supply agreement for 19,000 Lithium-ion 12V battery packs per year. Battery prices had been dropping dramatically for years, but Truckee's current sales price of $1,400 per battery for the 12V model (13420R) had held firm for months. The buyer was pushing for a lower unit price, but Truckee wanted a longer contract with higher volumes in return. After months of negotiations, the buyer agreed to increase the contract to 3 years, and increase annual purchases to 23,000 units. But in return, the buyer wanted a price of $1,290 per unit, and it wanted to pay in Japanese yen. Truckee had countered with the following proposal. At an average price of $1,295 per unit, and a current spot exchange rate of 113/$, Truckee proposed a contract of 23,000 units per year, for 3 years, with an annual purchase amount of 3,365,705,000. The buyer accepted the counterproposal in 24 hours and a sale agreement was signed and posted. The deal was done. Almost immediately the corporate treasury group at Truckee was upset about the contract. They argued that the Japanese yen had begun to plummet in value against the dollar in the past two months, so accepting payment in Japanese yen was too risky. Also, the quote had been based on a spot rate value of \113/$, but the rate had already moved to 115/$ over the past two weeks. Truckee's corporate treasury wanted to move immediately to hedge the long-term exposure. (Internally, the group had discussed that it was technically an anticipated transaction exposure, not a pure operating exposure, since it was a single transaction-but contractual. It would continue over a three-year period, but none of it was as yet on the books.) After consulting with their bankers, they wanted to use a cross-currency swap to manage the Japanese yen risk, a swap in which Truckee would pay yen and receive dollars. Their banker offered a swap where Truckee would receive U.S. dollar LIBOR in return for paying Japanese yen at 4.5%. The swap agreement would be for 3 years and all payments made quarterly-to match the expected yen cash inflow from the Japanese customer. a. Given the final contract value, what would the Japanese buyer believe they are paying per pack? b. What is the amount of the currency exposure for Truckee Tec? c. If the swap agreement is for a 3-year loan at 4.5%, paid quarterly, what is the principal (notional principal) of the loan obligation needed to cover the exposure? d. If both the Japanese buyer and the swap agreement perform as expected, what is the net exposure in Japanese yen remaining after the swap to Truckee? Homework: Chapter 12 HomeworkA Question 10, Problem 12- 11 (algorithmic) Part 1 of 17 HW Score: 50%, 5 of 10 points O Points: 0 of 1 Save Truckee Tec's Yen Exposure. Truckee Tec is a privately held battery manufacturer located just outside of Reno, Nevada. The company is one of the leading manufacturers of lithium-ion batteries, specifically for the automobile market. Truckee has been in intense contract negotiations with a Japanese automaker for months. It was late December 2016, and both sides wanted to conclude a deal before the new year. The Japanese automaker wanted a two-year supply agreement for 19,000 Lithium-ion 12V battery packs per year. Battery prices had been dropping dramatically for years, but Truckee's current sales price of $1,400 per battery for the 12V model (13420R) had held firm for months. The buyer was pushing for a lower unit price, but Truckee wanted a longer contract with higher volumes in return. After months of negotiations, the buyer agreed to increase the contract to 3 years, and increase annual purchases to 23,000 units. But in return, the buyer wanted a price of $1,290 per unit, and it wanted to pay in Japanese yen. Truckee had countered with the following proposal. At an average price of $1,295 per unit, and a current spot exchange rate of 113/$, Truckee proposed a contract of 23,000 units per year, for 3 years, with an annual purchase amount of 3,365,705,000. The buyer accepted the counterproposal in 24 hours and a sale agreement was signed and posted. The deal was done. Almost immediately the corporate treasury group at Truckee was upset about the contract. They argued that the Japanese yen had begun to plummet in value against the dollar in the past two months, so accepting payment in Japanese yen was too risky. Also, the quote had been based on a spot rate value of \113/$, but the rate had already moved to 115/$ over the past two weeks. Truckee's corporate treasury wanted to move immediately to hedge the long-term exposure. (Internally, the group had discussed that it was technically an anticipated transaction exposure, not a pure operating exposure, since it was a single transaction-but contractual. It would continue over a three-year period, but none of it was as yet on the books.) After consulting with their bankers, they wanted to use a cross-currency swap to manage the Japanese yen risk, a swap in which Truckee would pay yen and receive dollars. Their banker offered a swap where Truckee would receive U.S. dollar LIBOR in return for paying Japanese yen at 4.5%. The swap agreement would be for 3 years and all payments made quarterly-to match the expected yen cash inflow from the Japanese customer. a. Given the final contract value, what would the Japanese buyer believe they are paying per pack? b. What is the amount of the currency exposure for Truckee Tec? c. If the swap agreement is for a 3-year loan at 4.5%, paid quarterly, what is the principal (notional principal) of the loan obligation needed to cover the exposure? d. If both the Japanese buyer and the swap agreement perform as expected, what is the net exposure in Japanese yen remaining after the swap to Truckee