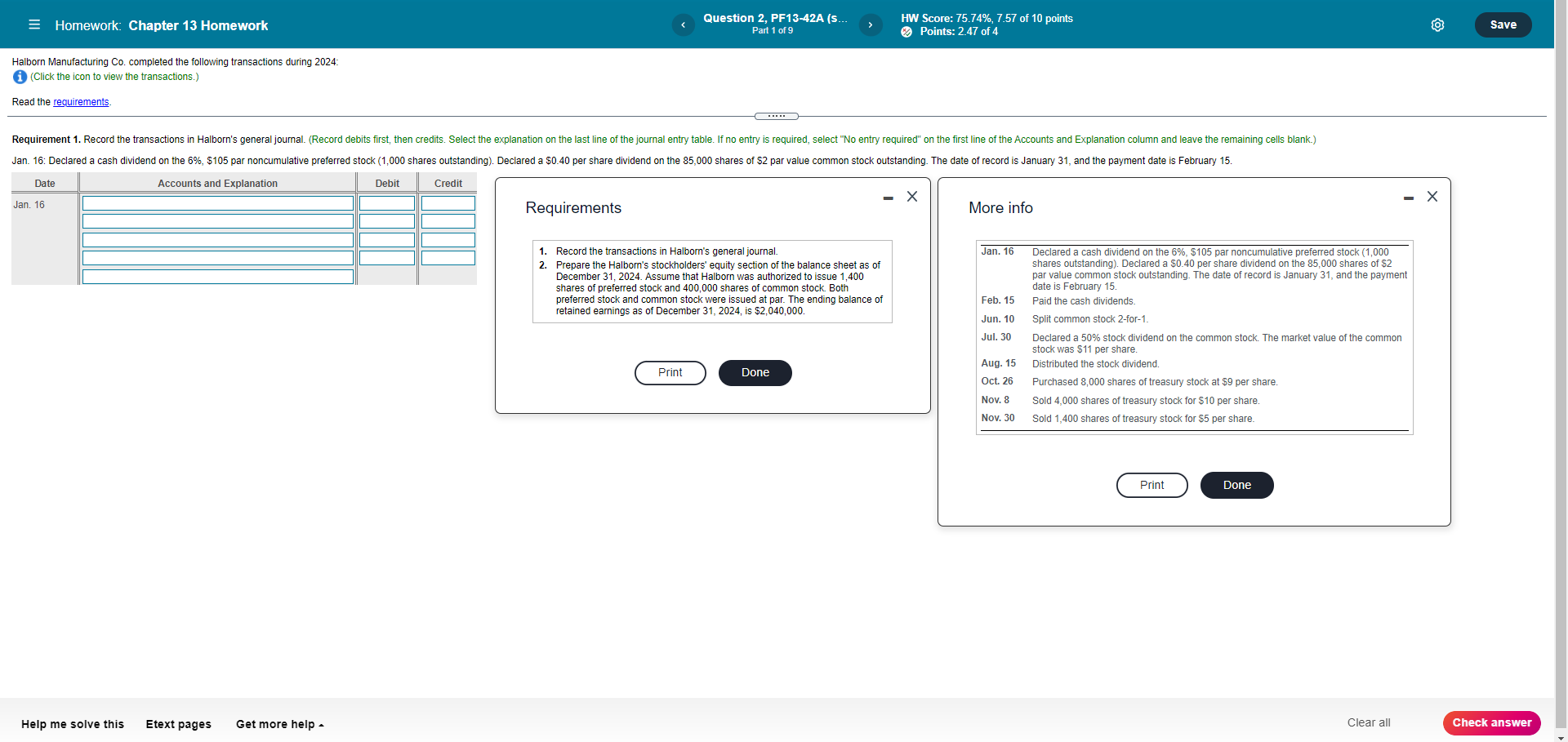

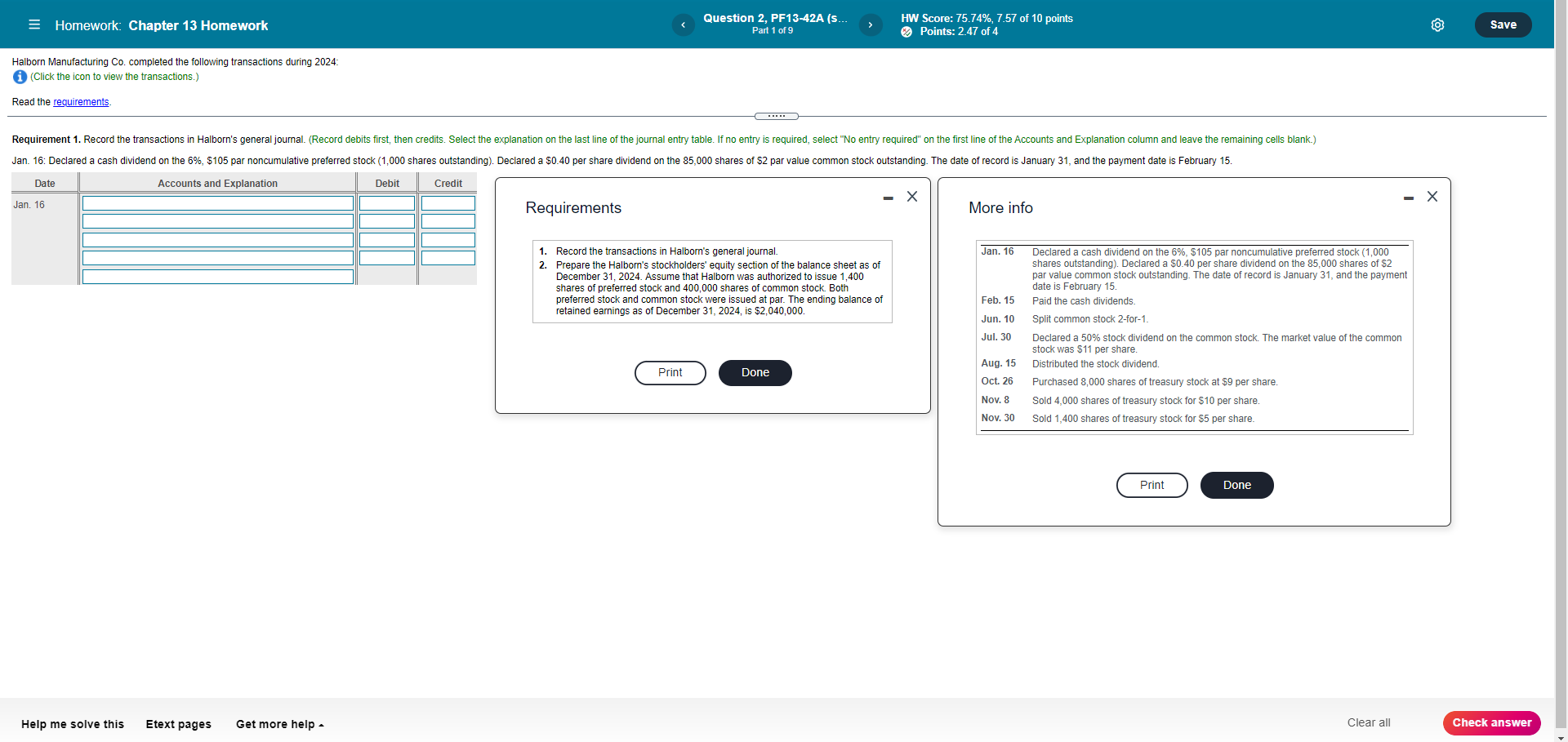

= Homework: Chapter 13 Homework Question 2, PF13-42A (S. Part 1 of 9 HW Score: 75.74%, 7.57 of 10 points Points: 2.47 of 4 Save Halborn Manufacturing Co. completed the following transactions during 2024: i (Click the icon to view the transactions.) Read the requirements C. Requirement 1. Record the transactions in Halborn's general journal. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. If no entry is required, select "No entry required" on the first line of the Accounts and Explanation column and leave the remaining cells blank.) Jan. 16: Declared a cash dividend on the 6%, $105 par noncumulative preferred stock (1,000 shares outstanding). Declared a $0.40 per share dividend on the 85,000 shares of $2 par value common stock outstanding. The date of record is January 31, and the payment date is February 15. Date Accounts and Explanation Debit Credit Jan. 16 Requirements More info Jan. 16 1. Record the transactions Halborn's general journal. 2. Prepare the Halbor's stockholders' equity section of the balance sheet as of December 31, 2024. Assume that Halborn was authorized to issue 1,400 shares of preferred stock and 400,000 shares of common stock. Both preferred stock and common stock were issued at par. The ending balance of retained earnings as of December 31, 2024, is $2,040,000. Feb. 15 Jun. 10 Jul. 30 Declared a cash dividend on the 6%, $105 par noncumulative preferred stock (1,000 shares outstanding). Declared a $0.40 per share dividend on the 85,000 shares of $2 par value common stock outstanding. The date of record is January 31, and the payment date is February 15. Paid the cash dividends. Split common stock 2-for-1. Declared a 50% stock dividend on the common stock. The market value of the common stock was $11 per share. Distributed the stock dividend. Purchased 8,000 shares of treasury stock at $9 per share. Sold 4,000 shares of treasury stock for $10 per share. Sold 1,400 shares of treasury stock for $5 per share. Aug. 15 Print Done Oct. 26 Nov. 8 Nov. 30 Print Done Help me solve this Etext pages Get more help Clear all Check