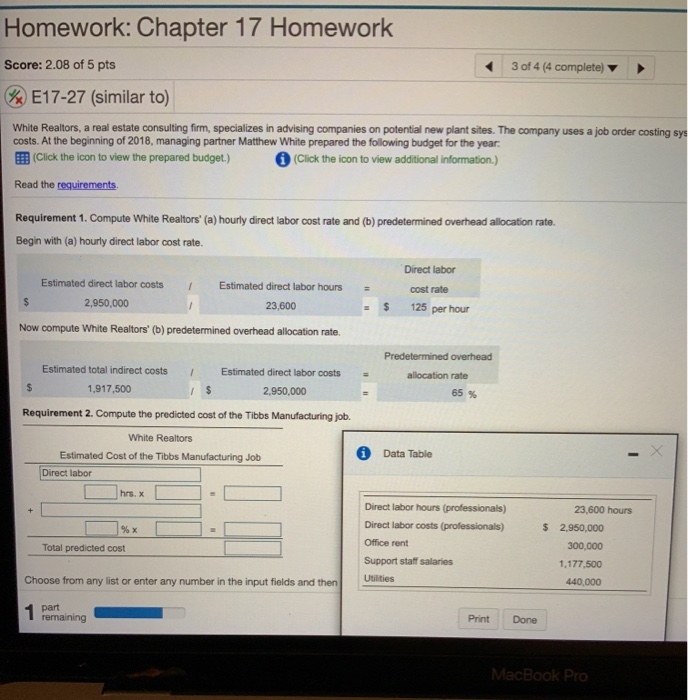

Homework: Chapter 17 Homework Score: 2.08 of 5 pts 3 of 4 (4 complete) E17-27 (similar to) White Realtors, a real estate consulting firm, specializes in advising companies on potential new plant sites. The company uses a job order costing sys costs. At the beginning of 2018, managing partner Matthew White prepared the following budget for the year. Click the icon to view the prepared budget.) Click the icon to view additional information.) Read the requirements. cost rate $ Requirement 1. Compute White Realtors' (a) hourly direct labor cost rate and (b) predetermined overhead allocation rate. Begin with (a) hourly direct labor cost rate. Direct labor Estimated direct labor costs Estimated direct labor hours 2,950,000 23,600 125 per hour Now compute White Realtors" (b) predetermined overhead allocation rate. Predetermined overhead Estimated total indirect costs Estimated direct labor costs 1,917,500 2,950,000 Requirement 2. Compute the predicted cost of the Tibbs Manufacturing job. White Realtors Estimated Cost of the Tibbs Manufacturing Job Data Table Direct labor allocation rate $ 65 % hrs. x Direct labor hours (professionals) Direct labor costs (professionals) Office rent % x Total predicted cost 23,600 hours $ 2,950,000 300,000 1,177,500 440,000 Support staff salaries Utilities Choose from any list or enter any number in the input fields and then 1 part remaining Print Done MacBook Pro Homework: Chapter 17 Homework Score: 2.08 of 5 pts 3 of 4 (4 complete) E17-27 (similar to) White Realtors, a real estate consulting firm, specializes in advising companies on potential new plant sites. The company uses a job order costing sys costs. At the beginning of 2018, managing partner Matthew White prepared the following budget for the year. Click the icon to view the prepared budget.) Click the icon to view additional information.) Read the requirements. cost rate $ Requirement 1. Compute White Realtors' (a) hourly direct labor cost rate and (b) predetermined overhead allocation rate. Begin with (a) hourly direct labor cost rate. Direct labor Estimated direct labor costs Estimated direct labor hours 2,950,000 23,600 125 per hour Now compute White Realtors" (b) predetermined overhead allocation rate. Predetermined overhead Estimated total indirect costs Estimated direct labor costs 1,917,500 2,950,000 Requirement 2. Compute the predicted cost of the Tibbs Manufacturing job. White Realtors Estimated Cost of the Tibbs Manufacturing Job Data Table Direct labor allocation rate $ 65 % hrs. x Direct labor hours (professionals) Direct labor costs (professionals) Office rent % x Total predicted cost 23,600 hours $ 2,950,000 300,000 1,177,500 440,000 Support staff salaries Utilities Choose from any list or enter any number in the input fields and then 1 part remaining Print Done MacBook Pro