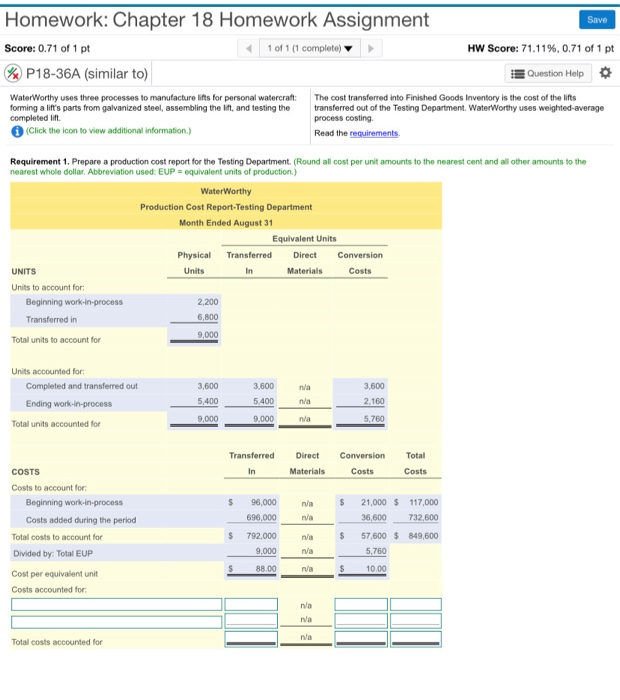

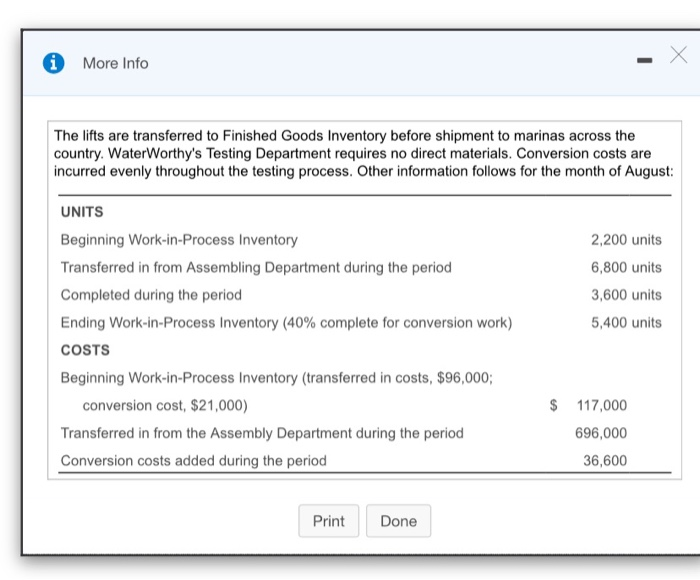

Homework: Chapter 18 Homework Assignment Save Score: 0.71 of 1 pt 1 of 1 (1 complete) HW Score: 71.11%, 0.71 of 1 pt P18-36A (similar to) Question Help Water Worthy uses three processes to manufacture lifts for personal watercraft: forming a lift's parts from galvanized steel, assembling the lift, and testing the completed lift (Click the icon to view additional information.) The cost transferred into Finished Goods Inventory is the cost of the lifts transferred out of the Testing Department. WaterWorthy uses weighted average process costing. Read the requirements Requirement 1. Prepare a production cost report for the Testing Department. (Round all cost per unit amounts to the nearest cent and all other amounts to the nearest whole dollar. Abbreviation used: EUP = equivalent units of production) WaterWorthy Production Cost Report-Testing Department Month Ended August 31 Equivalent Units Physical Transferred Direct Conversion Units in Materials Costs UNITS Units to account for: Beginning work-in-process 2,200 6,800 Transferred in 9,000 Total units to account for Units accounted for Completed and transferred out Ending work-in-process 3.600 3,600 5,400 3.600 5.400 nia na 2.160 9000 9,000 na 5.760 Total units accounted for Transferred In Direct Materials Conversion Costs Total Costs COSTS Costs to account for: Beginning work-in-process $ $ wa na Costs added during the period 96,000 696,000 792,000 9,000 117,000 732,600 849,600 Total costs to account for $ na $ 21,000 $ 36,600 57,600 $ 5.760 10.00 Divided by Total EUP wa $ 88.00 na $ Cost per equivalent unit Costs accounted for Total costs accounted for More Info The lifts are transferred to Finished Goods Inventory before shipment to marinas across the country. WaterWorthy's Testing Department requires no direct materials. Conversion costs are incurred evenly throughout the testing process. Other information follows for the month of August: UNITS 2,200 units 6,800 units 3,600 units 5,400 units Beginning Work-in-Process Inventory Transferred in from Assembling Department during the period Completed during the period Ending Work-in-Process Inventory (40% complete for conversion work) COSTS Beginning Work-in-Process Inventory (transferred in costs, $96,000; conversion cost, $21,000) Transferred in from the Assembly Department during the period Conversion costs added during the period $ 117,000 696,000 36,600 Print Done