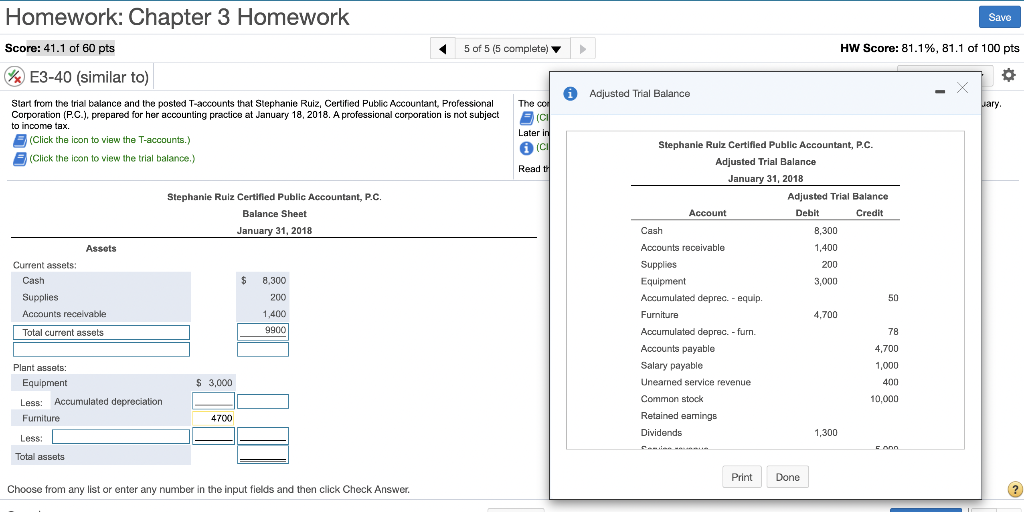

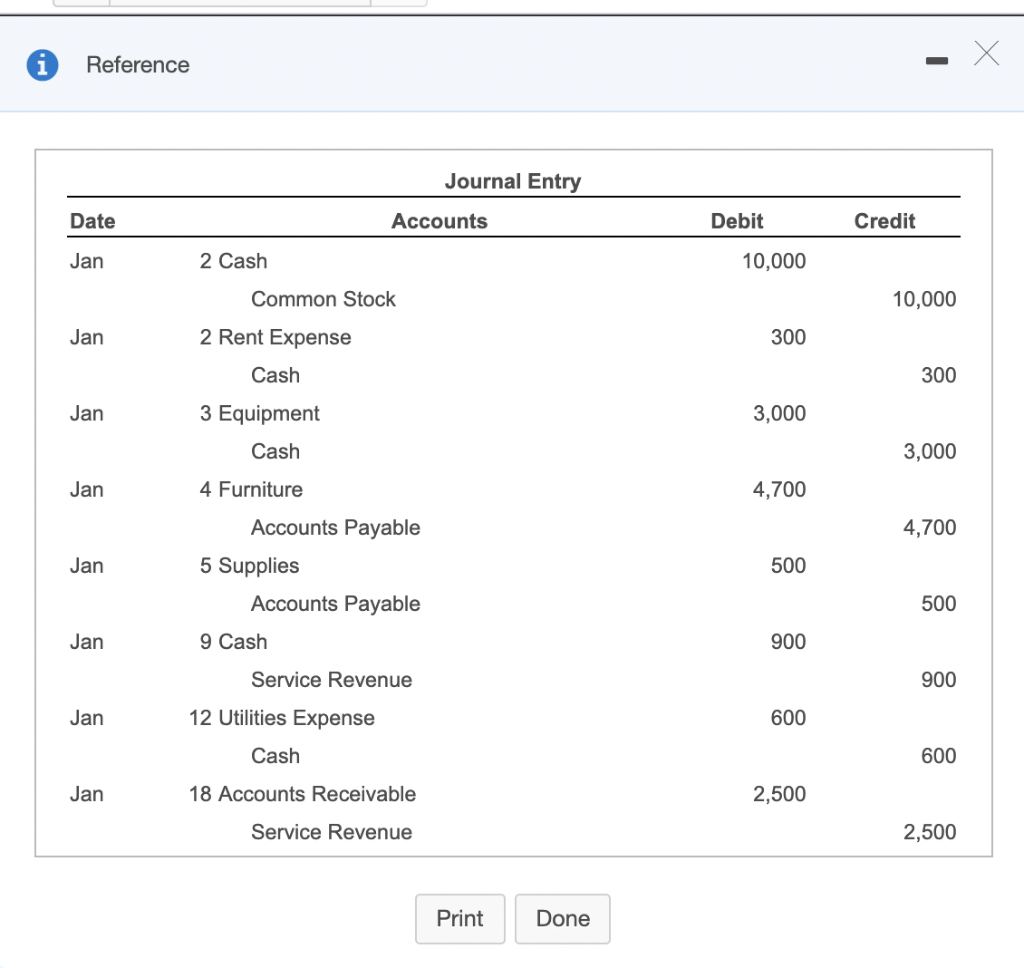

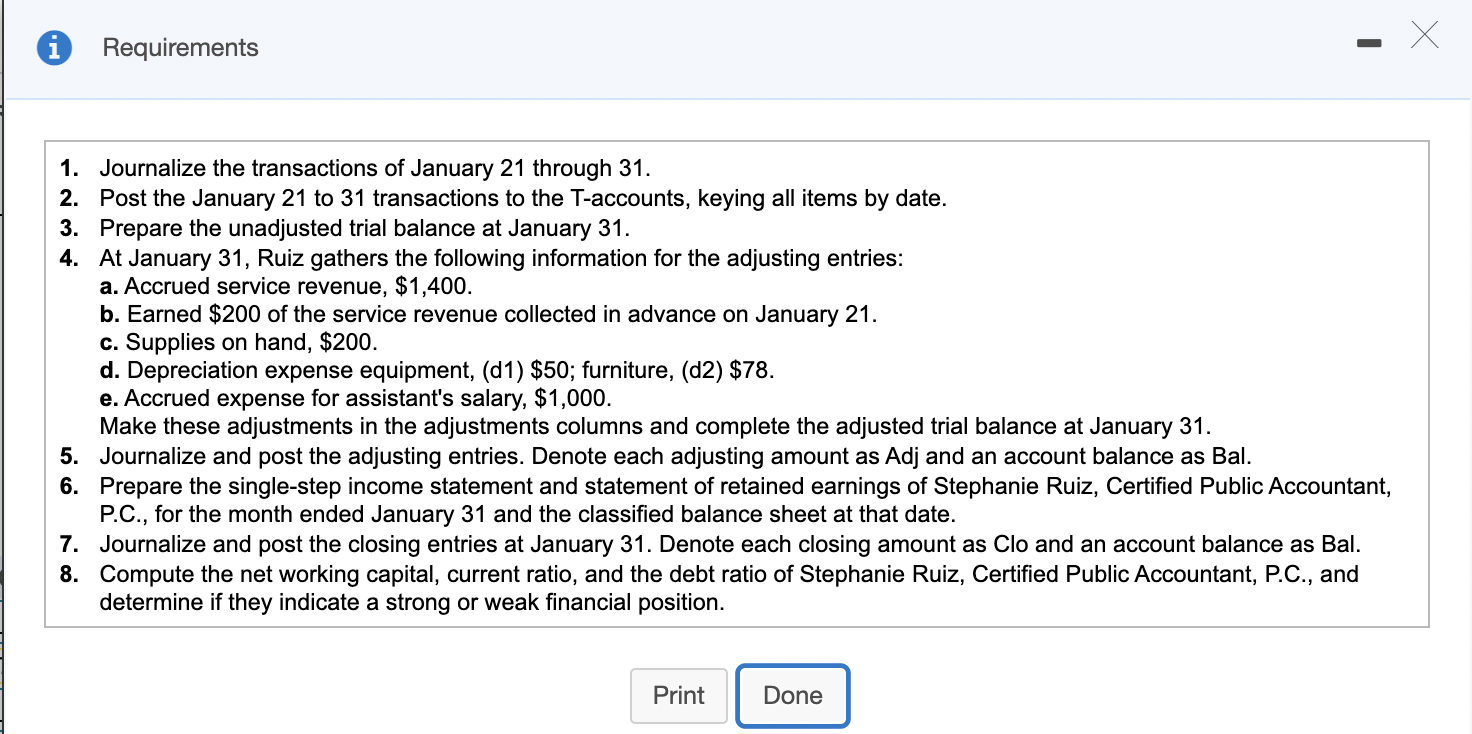

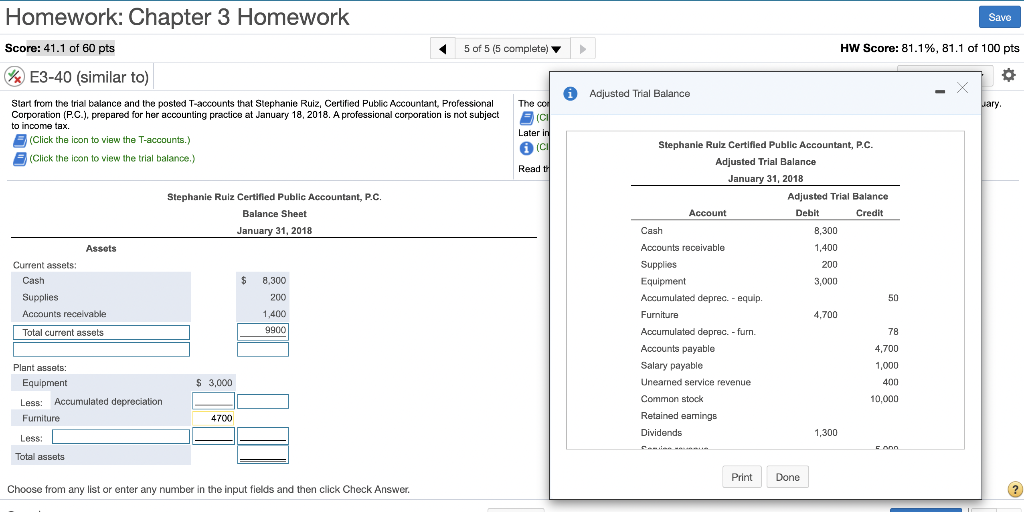

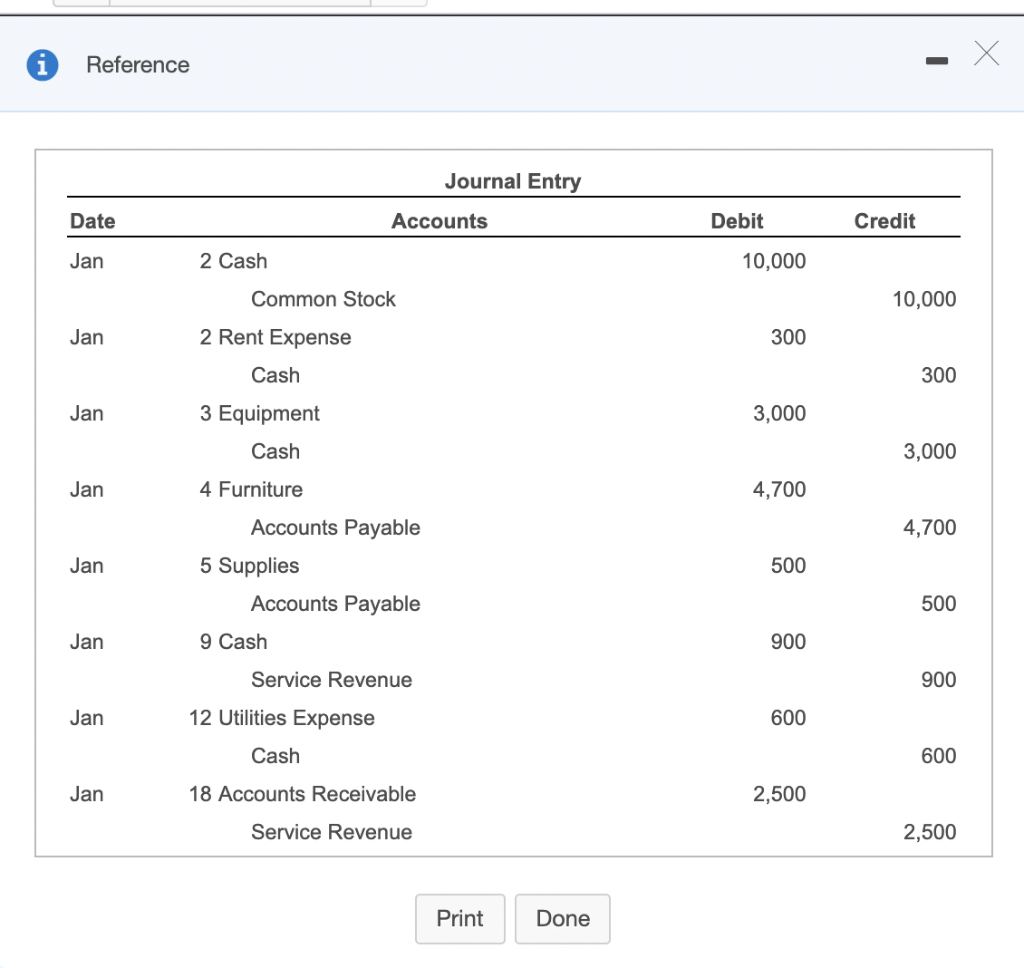

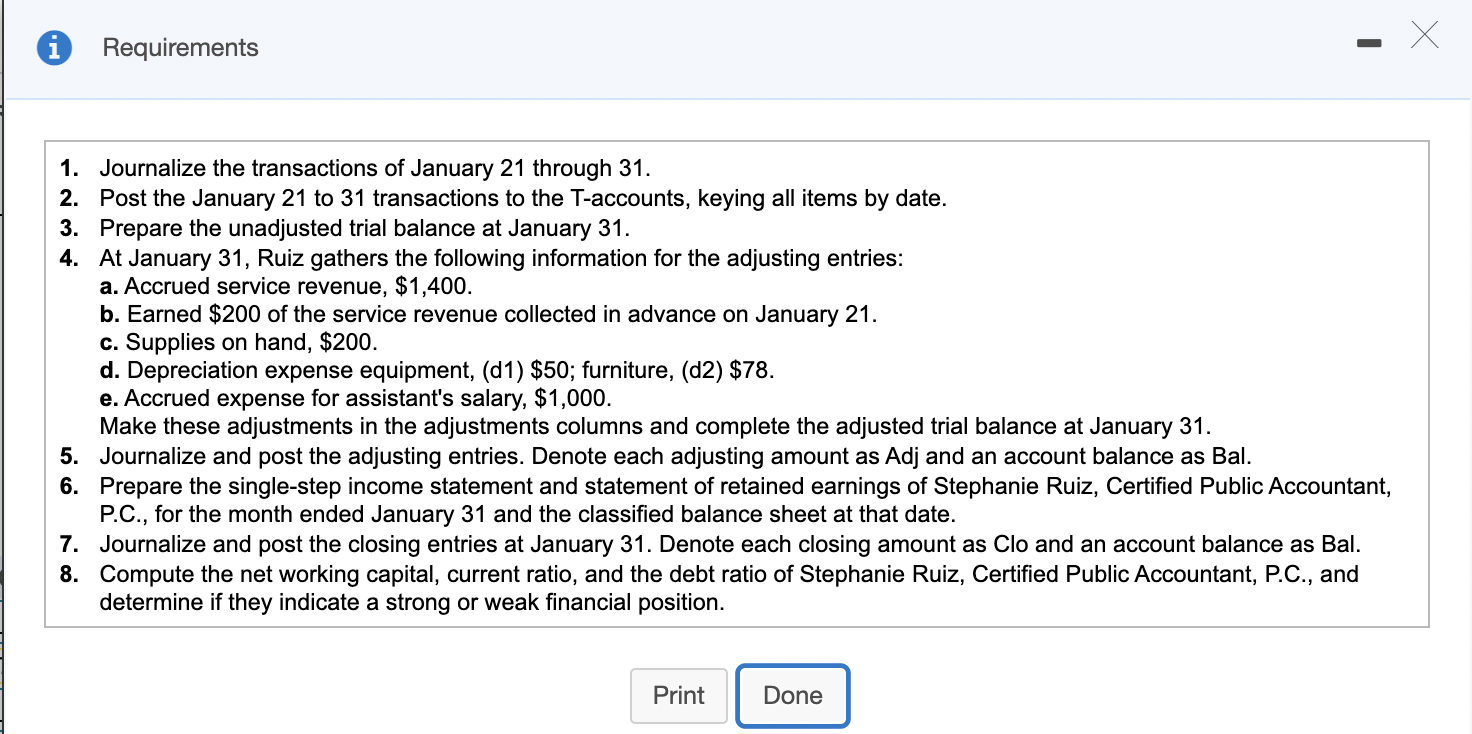

Homework: Chapter 3 Homework Save Score: 41.1 of 60 pts 5 of 5 (5 complete) HW Score: 81.1%, 81.1 of 100 pts W E3-40 (similar to) o i Adjusted Trial Balance The col Jary Start from the trial balance and the posted T-accounts that Stephanie Ruiz, Certified Public Accountant Professional Corporation (P.C.), prepared for her accounting practice at January 18, 2018. A professional corporation is not subject to income tax. (Click the icon to view the T-accounts.) (Click the icon to view the trial balance.) (Cil Later in (Cil Stephanie Ruiz Certified Public Accountant, P.C. Adjusted Trial Balance January 31, 2018 Read Stephanie Ruiz Certified Public Accountant, P.C. Balance Sheet January 31, 2018 Account Adjusted Trial Balance Debit Credit 8,300 1,400 200 3,000 $ Assets Current assets: Cash Supplies Accounts receivable Total current assets 50 8,300 200 1,400 9900 Cash Accounts receivable Supplies Equipment Accumulated deprec. - equip. Furniture Accumulated deprec. - furn. Accounts payable Salary payable Unearned service revenue Common stock 4,700 78 4,700 1,000 $ 3,000 400 Plant assets: Equipment Less: Accumulated depreciation Furniture 10,000 4700 Retained eamings Dividends 1,300 Less: EAN Total assets Print Done Choose from any list or enter any number in the input fields and then click Check Answer. ? Reference X Journal Entry Date Accounts Debit Credit Jan 2 Cash 10,000 Common Stock 10,000 Jan 2 Rent Expense 300 Cash 300 Jan 3 Equipment 3,000 Cash 3,000 Jan 4 Furniture 4,700 Accounts Payable 4,700 Jan 500 5 Supplies Accounts Payable 500 Jan 9 Cash 900 Service Revenue 900 Jan 12 Utilities Expense 600 Cash 600 Jan 18 Accounts Receivable 2,500 Service Revenue 2,500 Print Done Requirements - 1. Journalize the transactions of January 21 through 31. 2. Post the January 21 to 31 transactions to the T-accounts, keying all items by date. 3. Prepare the unadjusted trial balance at January 31. 4. At January 31, Ruiz gathers the following information for the adjusting entries: a. Accrued service revenue, $1,400. b. Earned $200 of the service revenue collected in advance on January 21. c. Supplies on hand, $200. d. Depreciation expense equipment, (d1) $50; furniture, (d2) $78. e. Accrued expense for assistant's salary, $1,000. Make these adjustments in the adjustments columns and complete the adjusted trial balance at January 31. 5. Journalize and post the adjusting entries. Denote each adjusting amount as Adj and an account balance as Bal. 6. Prepare the single-step income statement and statement of retained earnings of Stephanie Ruiz, Certified Public Accountant, P.C., for the month ended January 31 and the classified balance sheet at that date. 7. Journalize and post the closing entries at January 31. Denote each closing amount as Clo and an account balance as Bal. 8. Compute the net working capital, current ratio, and the debt ratio of Stephanie Ruiz, Certified Public Accountant, P.C., and determine if they indicate a strong or weak financial position. Print Done