Answered step by step

Verified Expert Solution

Question

1 Approved Answer

= Homework: Chapter 4 Homework Question list K Question 4, E4-3 (similar to) Part 1 of 18 Team United Games, Inc. is a new

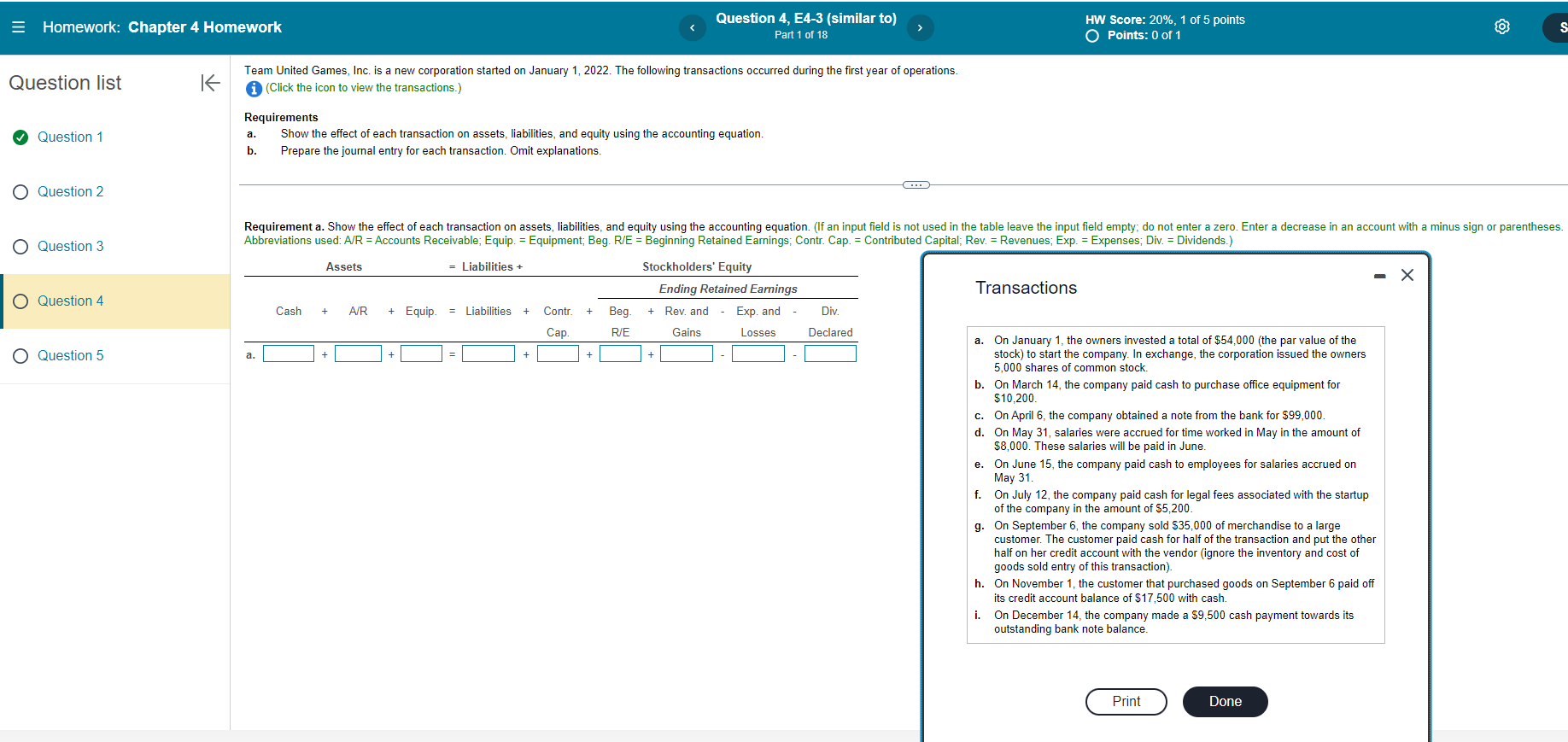

= Homework: Chapter 4 Homework Question list K Question 4, E4-3 (similar to) Part 1 of 18 Team United Games, Inc. is a new corporation started on January 1, 2022. The following transactions occurred during the first year of operations. (Click the icon to view the transactions.) Requirements Question 1 Question 2 Question 3 Question 4 a. Show the effect of each transaction on assets, liabilities, and equity using the accounting equation. b. Prepare the journal entry for each transaction. Omit explanations. HW Score: 20%, 1 of 5 points Points: 0 of 1 S Requirement a. Show the effect of each transaction on assets, liabilities, and equity using the accounting equation. (If an input field is not used in the table leave the input field empty; do not enter a zero. Enter a decrease in an account with a minus sign or parentheses. Abbreviations used: A/R = Accounts Receivable; Equip. = Equipment; Beg. R/E = Beginning Retained Earnings; Contr. Cap. = Contributed Capital; Rev. = Revenues; Exp. = Expenses; Div. = Dividends.) Question 5 a. Assets = Liabilities + Stockholders' Equity Ending Retained Earnings Cash + A/R + Equip. = Liabilities Contr. + Cap. Beg. R/E Gains + Rev. and - Exp. and - Losses Div. Declared Transactions a. On January 1, the owners invested a total of $54,000 (the par value of the stock) to start the company. In exchange, the corporation issued the owners 5,000 shares of common stock. b. On March 14, the company paid cash to purchase office equipment for $10,200. c. On April 6, the company obtained a note from the bank for $99,000 d. On May 31, salaries were accrued for time worked in May in the amount of $8,000. These salaries will be paid in June. e. On June 15, the company paid cash to employees for salaries accrued on May 31. f. On July 12, the company paid cash for legal fees associated with the startup of the company in the amount of $5,200. g. On September 6, the company sold $35,000 of merchandise to a large customer. The customer paid cash for half of the transaction and put the other half on her credit account with the vendor (ignore the inventory and cost of goods sold entry of this transaction). h. On November 1, the customer that purchased goods on September 6 paid off its credit account balance of $17,500 with cash. i. On December 14, the company made a $9,500 cash payment towards its outstanding bank note balance. Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started