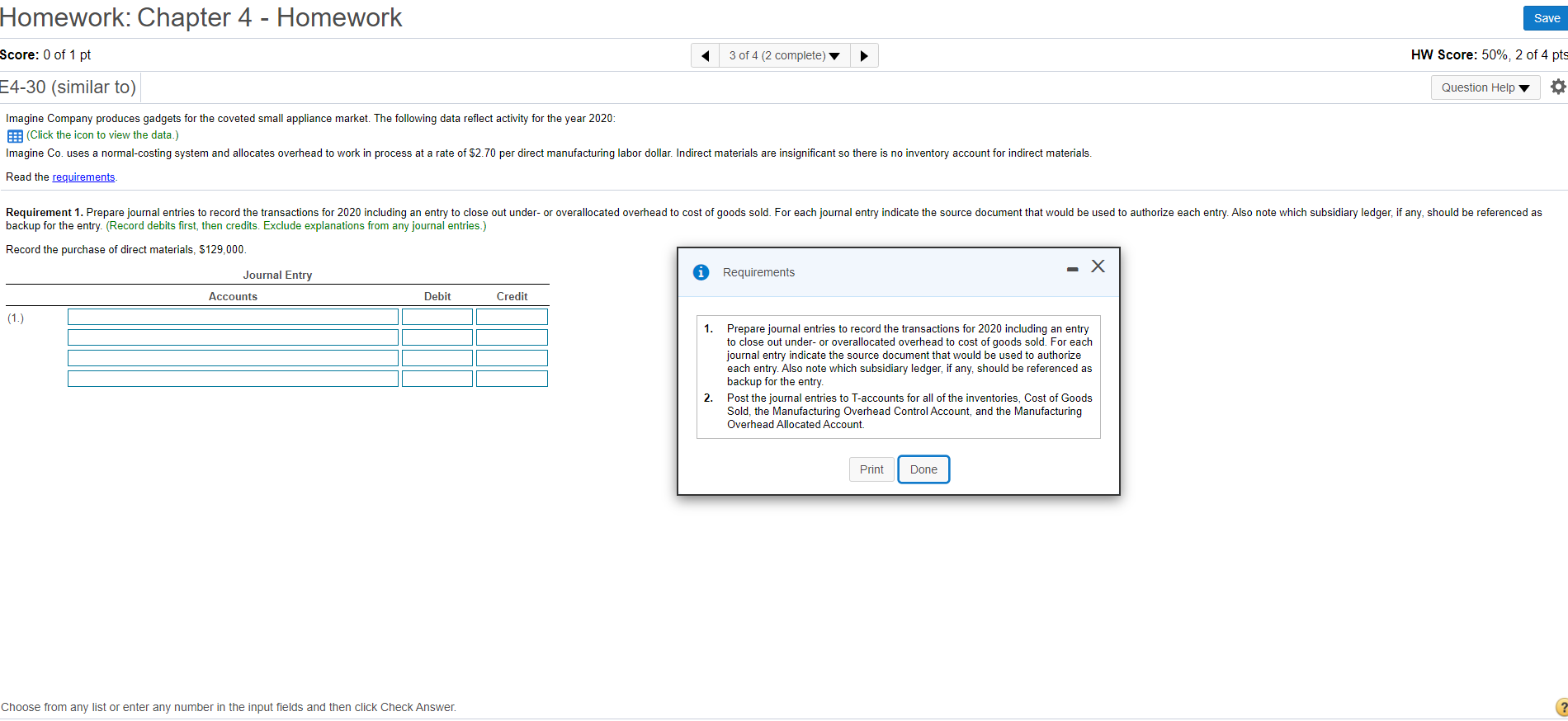

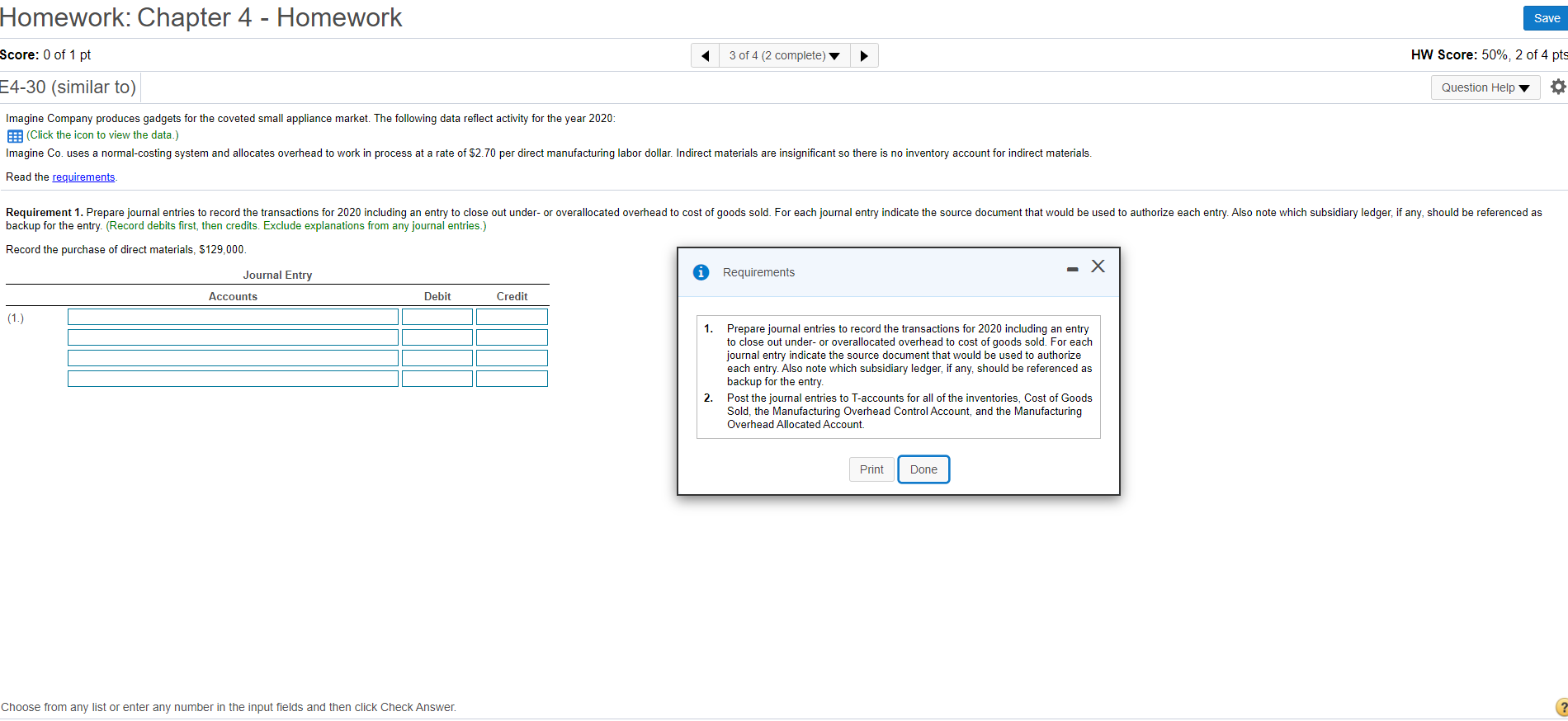

Homework: Chapter 4 - Homework Save Score: 0 of 1 pt 3 of 4 (2 complete) HW Score: 50%, 2 of 4 pts E4-30 (similar to) Question Help Imagine Company produces gadgets for the coveted small appliance market. The following data reflect activity for the year 2020: E: (Click the icon to view the data.) Imagine Co. uses a normal-costing system and allocates overhead to work in process at a rate of $2.70 per direct manufacturing labor dollar. Indirect materials are insignificant so there is no inventory account for indirect materials. Read the requirements Requirement 1. Prepare journal entries to record the transactions for 2020 including an entry to close out under-or overallocated overhead to cost of goods sold. For each journal entry indicate the source document that would be used to authorize each entry. Also note which subsidiary ledger, if any, should be referenced as backup for the entry. (Record debits first, then credits. Exclude explanations from any journal entries.) Record the purchase of direct materials, $129,000. Journal Entry Requirements Accounts Debit Credit (1.) 1. Prepare journal entries to record the transactions for 2020 including an entry to close out under- or overallocated overhead to cost of goods sold. For each journal entry indicate the source document that would be used to authorize each entry. Also note which subsidiary ledger, if any, should be referenced as backup for the entry. 2. Post the journal entries to T-accounts for all of the inventories, Cost of Goods Sold, the Manufacturing Overhead Control Account, and the Manufacturing Overhead Allocated Account. Print Done Choose from any list or enter any number in the input fields and then click Check Answer. ? Homework: Chapter 4 - Homework Save Score: 0 of 1 pt 3 of 4 (2 complete) HW Score: 50%, 2 of 4 pts E4-30 (similar to) Question Help Imagine Company produces gadgets for the coveted small appliance market. The following data reflect activity for the year 2020: E: (Click the icon to view the data.) Imagine Co. uses a normal-costing system and allocates overhead to work in process at a rate of $2.70 per direct manufacturing labor dollar. Indirect materials are insignificant so there is no inventory account for indirect materials. Read the requirements Requirement 1. Prepare journal entries to record the transactions for 2020 including an entry to close out under-or overallocated overhead to cost of goods sold. For each journal entry indicate the source document that would be used to authorize each entry. Also note which subsidiary ledger, if any, should be referenced as backup for the entry. (Record debits first, then credits. Exclude explanations from any journal entries.) Record the purchase of direct materials, $129,000. Journal Entry Requirements Accounts Debit Credit (1.) 1. Prepare journal entries to record the transactions for 2020 including an entry to close out under- or overallocated overhead to cost of goods sold. For each journal entry indicate the source document that would be used to authorize each entry. Also note which subsidiary ledger, if any, should be referenced as backup for the entry. 2. Post the journal entries to T-accounts for all of the inventories, Cost of Goods Sold, the Manufacturing Overhead Control Account, and the Manufacturing Overhead Allocated Account. Print Done Choose from any list or enter any number in the input fields and then click Check