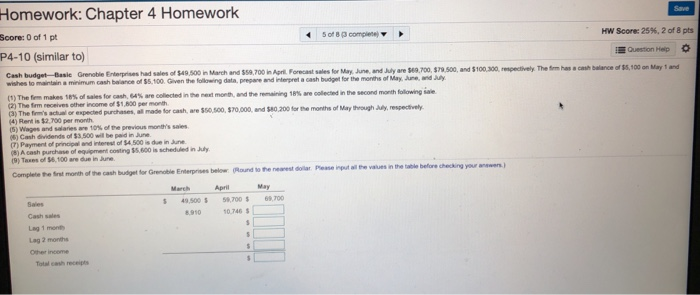

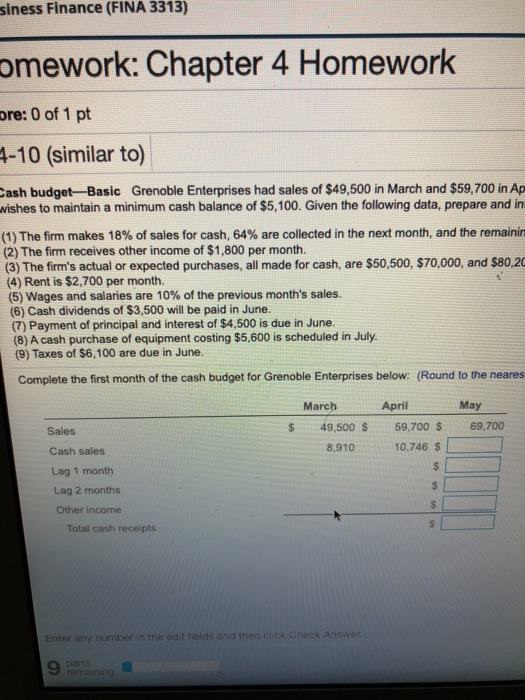

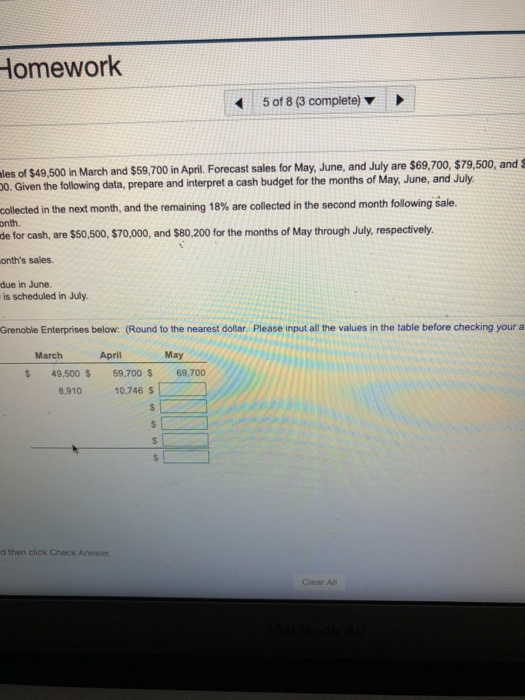

Homework: Chapter 4 Homework Save Score: 0 of 1 pt 5 of 8 complete HW Score: 25%, 2 of 8 pts P4-10 (similar to) Question Help Cash budget-Basie Grenoble Enterprises had sales of $40.00 in March and 550,700 in Aort. Forecast sales for May June and Jy are 540.700.79.500, and $100.000, respectively. The firm has a ch balance of 36,100 on May 1 and wishes to maintain a minimum cash balance of $5,100. Given the following data, prepare and interpreta cash budget for the months of May June und (1) The fem makes 18% of sales for cash, 64% are collected in the next month, and the remaining are collected in the second month following are (2) The firm receives the income of $1.500 per month a) The few's actual or expected purchases, al made for cash, we $60,500,570,000, and 580.200 for the months of May through y, respectively Was and salaries are 10% of the previous month's sales 0 Cash dividends of $3,500 will be paid in June Payment of principal and interest of $4.500 is due in June () A cash purchase of equipment costing 55.600 is scheduled in in July IST of 56,100 are due in ure Complete the first month of the cash budget for Grenoble Enterprises below Round to the door. Please input will the values in the table before checking you nee) May Sales $ 50.700 69.700 Cash sales 10.746 5 $ Lag 1 monts Lag 2 months Other income $ Touch recept $ siness Finance (FINA 3313) omework: Chapter 4 Homework pre: 0 of 1 pt 4-10 (similar to) Cash budget-Basic Grenoble Enterprises had sales of $49,500 in March and $59,700 in Ap wishes to maintain a minimum cash balance of $5,100. Given the following data, prepare and in (1) The firm makes 18% of sales for cash, 64% are collected in the next month, and the remainin (2) The firm receives other income of $1,800 per month. (3) The firm's actual or expected purchases, all made for cash, are $50,500, $70,000, and $80,20 (4) Rent is $2,700 per month. (5) Wages and salaries are 10% of the previous month's sales. (6) Cash dividends of $3,500 will be paid in June. (7) Payment of principal and interest of $4,500 is due in June. (8) A cash purchase of equipment costing $5,600 is scheduled in July. (9) Taxes of $6,100 are due in June. Complete the first month of the cash budget for Grenoble Enterprises below: (Round to the neares March May April 59,700 S Sales $ 69,700 49,500 S 8,910 Cash sales 10,746 $ $ Lag 1 month Lag 2 months $ S Other income S Total cash receipts Enter any number in the edit fields and then click Check Answer. 9 parts remaining Homework 5 of 8 (3 complete) bles of $49,500 in March and $59,700 in April. Forecast sales for May, June, and July are $69,700, $79,500, and 0. Given the following data, prepare and interpret a cash budget for the months of May, June, and July collected in the next month, and the remaining 18% are collected in the second month following sale. de for cash, are $50,500, $70,000, and $80,200 for the months of May through July, respectively. onth onth's sales due in June is scheduled in July. Grenoble Enterprises below. (Round to the nearest dollar. Please input all the values in the table before checking your a March 49,500 $ 8,910 $ May 69,700 April 59,700 $ 10,746 $ S $ $ d then click Check Answer Clear All Say HW Score: 25%, 2 of 8 8 (3 complete) Question Help for May, June, and July are $69,700, $79,500, and $100,300, respectively. The firm has a cash balance of $5,100 on May 1 and aget for the months of May, June, and July cted in the second month following sale. as of May through July, respectively. Hease input all the values in the table before checking your answers.)