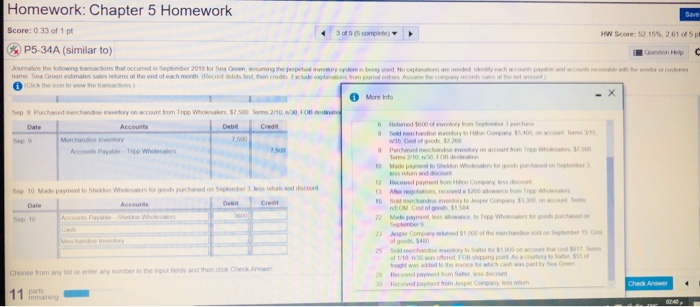

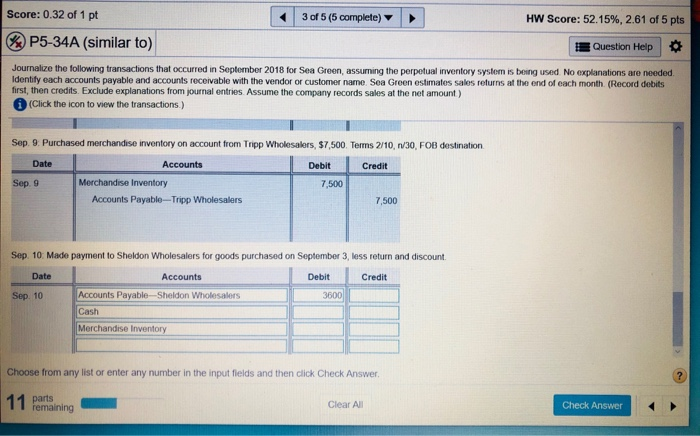

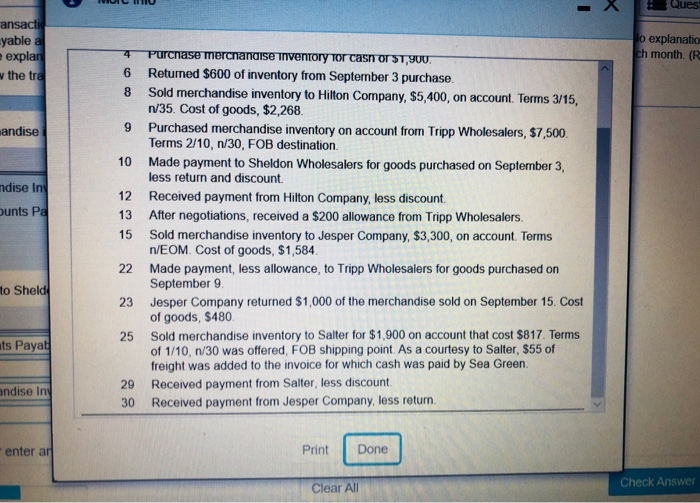

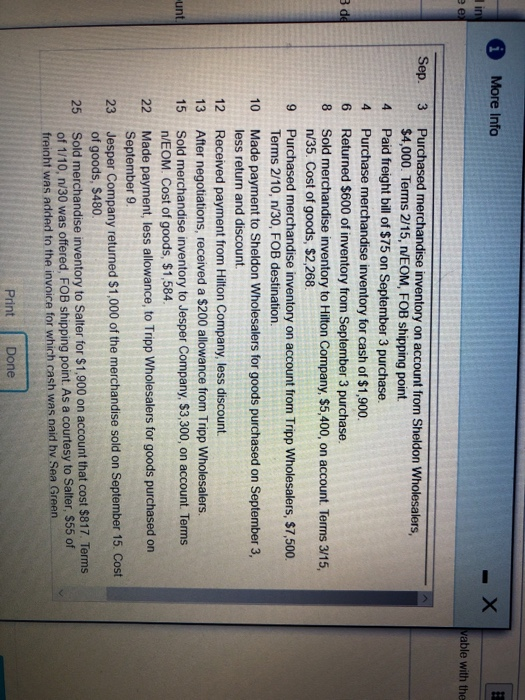

Homework: Chapter 5 Homework Save Score: 0.33 of 1 pt 305 compte HW Score: 52.15%, 2015 * P5-34A (similar to) Journalise the following transactions that occurred in September 2018 for Sea Genting the perpetux inventory system is being used No explanations are needed into accounts and written name Sea Groen estes es returns at the end of each month Record debts test the credits Federations from the Assume temps Click the konto vow the transactions - X More info Sep Purchased merchandise viventory on account trom Trop Wholesalers. 57.500 Terms 2/10,000 Ft Date Accounts Deba Credit 7100 w Cost of 22 Account To Who 7.500 Purchand merchandise yon moun from Top W Turms to Fonden Date Accounts De 15 Creat NEON Costogos 1584 1/10 Foto 555 Choose tomanyenyumbers and the Greek Check A 11 02:40 Score: 0.32 of 1 pt 3 of 5 (5 complete) HW Score: 52.15%, 2.61 of 5 pts P5-34A (similar to) Question Help Journalize the following transactions that occurred in September 2018 for Sea Green, assuming the perpetual inventory system is being used No explanations are needed Identify each accounts payable and accounts receivable with the vendor or customer name Sea Green estimates sales returns at the end of each month (Record debits first, then credits. Exclude explanations from journal entries. Assume the company records sales at the net amount) (Click the icon to view the transactions.) Date Debit Credit Sep. 9. Purchased merchandise inventory on account from Tripp Wholesalers, $7,500. Terms 2/10, 1/30, FOB destination Accounts Sep. 9 Accounts Payablo ---Tripp Wholesalers Merchandise Inventory 7,500 7,500 Sep 10 Made payment to Sheldon Wholesalers for goods purchased on September 3, less return and discount Date Accounts Debit Credit Sep. 10 3600 Accounts Payable-Sheldon Wholesalers Cash Merchandise Inventory Choose from any list or enter any number in the input fields and then click Check Answer, ? 11 parts remaining Clear All Check Answer Ques ansactie yable a explar the tra lo explanatio ch month. (R 4 9 andise 10 ndise in unts Pa Purchase merchandise inventory or cash or ST,900. 6 Returned $600 of inventory from September 3 purchase 8 Sold merchandise inventory to Hilton Company, $5,400, on account. Terms 3/15, 1/35. Cost of goods, $2,268. Purchased merchandise inventory on account from Tripp Wholesalers, $7,500. Terms 2/10, 1/30, FOB destination Made payment to Sheldon Wholesalers for goods purchased on September 3, less return and discount. 12 Received payment from Hilton Company, less discount 13 After negotiations, received a $200 allowance from Tripp Wholesalers. Sold merchandise inventory to Jesper Company, $3,300, on account. Terms n/EOM. Cost of goods, $1,584. Made payment, less allowance, to Tripp Wholesalers for goods purchased on September 9 23 Jesper Company returned $1,000 of the merchandise sold on September 15. Cost of goods, $480 25 Sold merchandise inventory to Salter for $1,900 on account that cost $817. Terms of 1/10, n/30 was offered, FOB shipping point. As a courtesy to Salter, $55 of freight was added to the invoice for which cash was paid by Sea Green 29 Received payment from Salter, less discount 30 Received payment from Jesper Company, less return 15 22 to Sheld ats Payat andise in enter ar Print Done Clear All Check Answer i More Info vable with the Sep 3 4 4 3 de 6 8 9 10 Purchased merchandise inventory on account from Sheldon Wholesalers, $4,000. Terms 2/15, VEOM, FOB shipping point Paid freight bill of $75 on September 3 purchase. Purchase merchandise inventory for cash of $1,900. Returned $600 of inventory from September 3 purchase. Sold merchandise inventory to Hilton Company, $5,400, on account. Terms 3/15, n/35. Cost of goods, $2,268. Purchased merchandise inventory on account from Tripp Wholesalers, $7,500 Terms 2/10, 1/30, FOB destination Made payment to Sheldon Wholesalers for goods purchased on September 3, less return and discount. Received payment from Hilton Company, less discount. After negotiations, received a $200 allowance from Tripp Wholesalers. Sold merchandise inventory to Jesper Company, $3,300, on account. Terms n/EOM. Cost of goods, $1,584 Made payment, less allowance, to Tripp Wholesalers for goods purchased on September 9 Jesper Company returned $1,000 of the merchandise sold on September 15. Cost of goods, $480 Sold merchandise inventory to Salter for $1,900 on account that cost $817 Terms of 1/10, n/30 was offered, FOB shipping point. As a courtesy to Salter, $55 of freight was added to the invoice for which cash was paid hv Sea Green 12 13 15 unt 22 23 25 Print Done