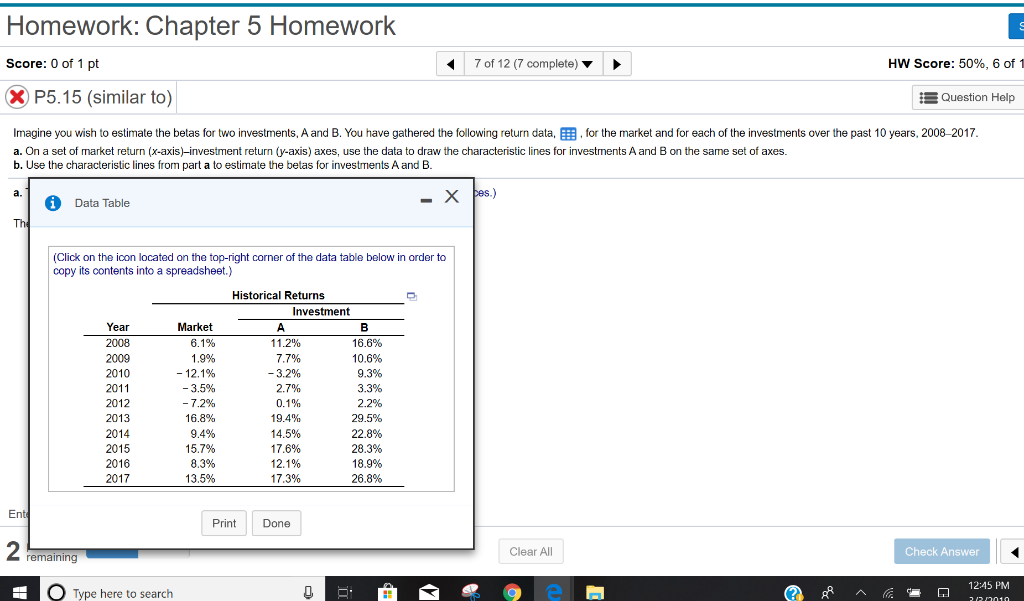

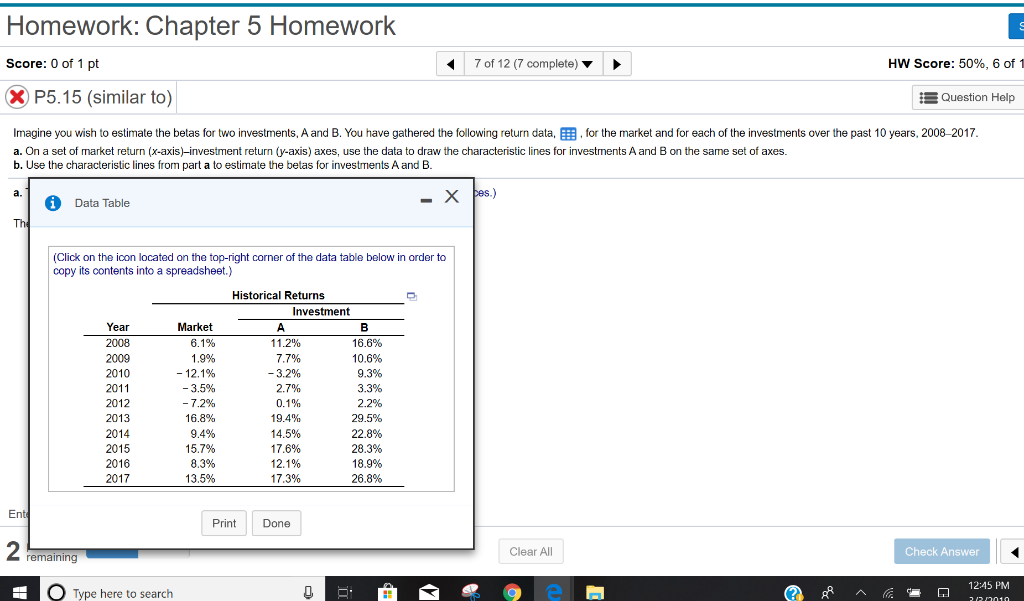

Homework: Chapter 5 Homework Score: 0 of 1 pt 7 of 12 (7 complete) HW Score: 50%, 6 of 1 P5.15 (similar to) Question Help Imagine you wish to estimate the betas for two investments, A and B. You have gathered the following return data, EEBfor the market and for each of the investments over the past 10 years, 2008-2017 a. On a set of market return (x-axis)-investment return (y-axis) axes, use the data to draw the characteristic lines for investments A and B on the same set of axes. b. Use the characteristic lines from part a to estimate the betas for investments A and B a. Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Historical Returns Investment Year 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Market 6.1% 1.996 -12.1% -3.5% -12% 16.8% 9.4% 15.7% 8.3% 13.5% 11.2% 77% -3.2% 27% 0.1% 19.4% 14.5% 17.6% 12.1% 17.3% 16.6% 10.6% 9.3% 3.3% 22% 29.5% 22.8% 28.3% 18.9% 26.8% En PrintDone 2 Clear All Check Answer remaining 12:45 PM Type here to search Homework: Chapter 5 Homework Score: 0 of 1 pt 7 of 12 (7 complete) HW Score: 50%, 6 of 1 P5.15 (similar to) Question Help Imagine you wish to estimate the betas for two investments, A and B. You have gathered the following return data, EEBfor the market and for each of the investments over the past 10 years, 2008-2017 a. On a set of market return (x-axis)-investment return (y-axis) axes, use the data to draw the characteristic lines for investments A and B on the same set of axes. b. Use the characteristic lines from part a to estimate the betas for investments A and B a. Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Historical Returns Investment Year 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Market 6.1% 1.996 -12.1% -3.5% -12% 16.8% 9.4% 15.7% 8.3% 13.5% 11.2% 77% -3.2% 27% 0.1% 19.4% 14.5% 17.6% 12.1% 17.3% 16.6% 10.6% 9.3% 3.3% 22% 29.5% 22.8% 28.3% 18.9% 26.8% En PrintDone 2 Clear All Check Answer remaining 12:45 PM Type here to search