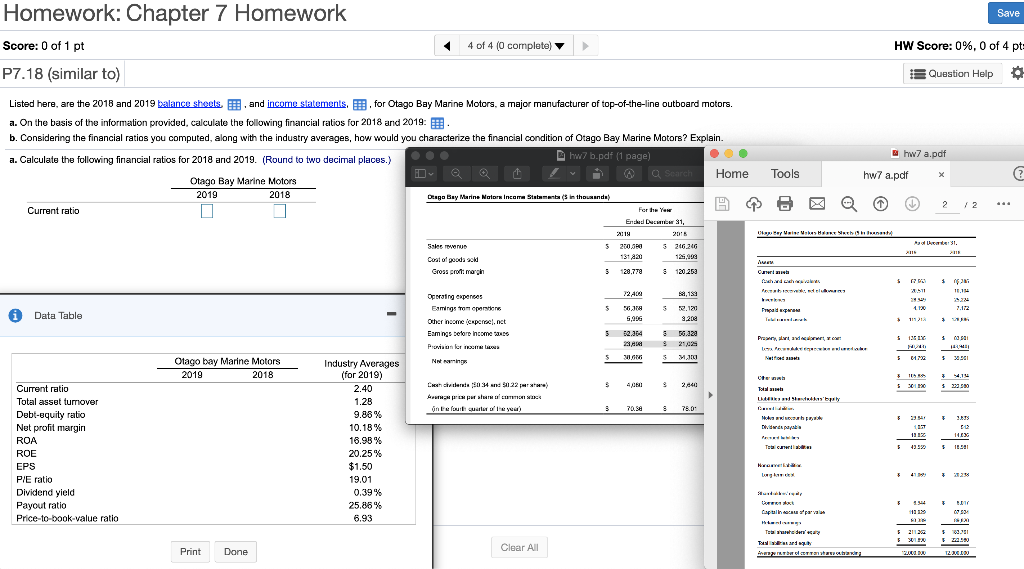

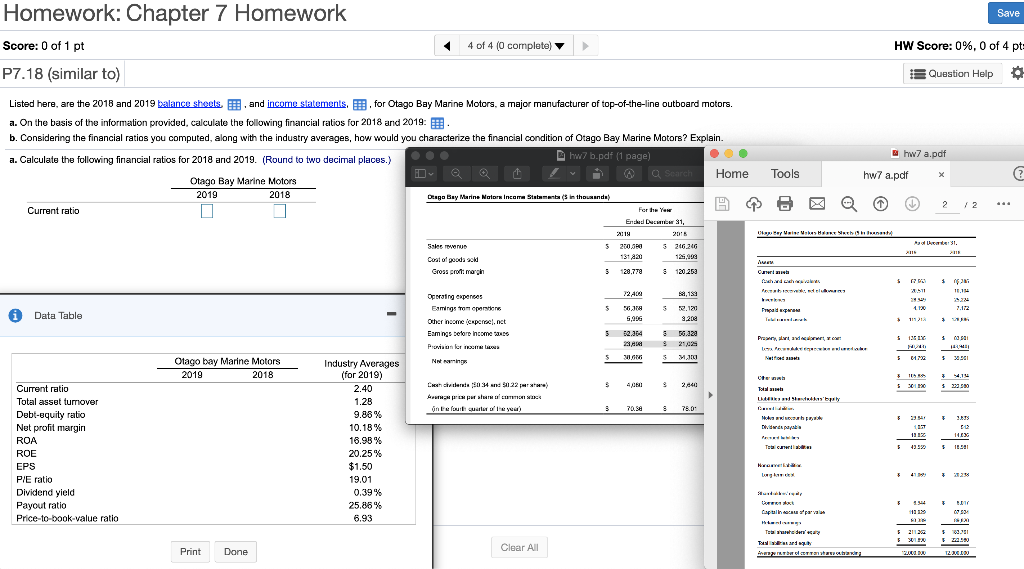

Homework: Chapter 7 Homework Save Score: 0 of 1 pt 4 of 4 (0 complete) HW Score: 0%, 0 of 4 pt= P7.18 (similar to) Question Help 0 Listed here, are the 2018 and 2019 balance sheets and income statements, for Otago Bay Marine Motors, a major manufacturer of top-of-the-line outboard motors. a. On the basis of the information provided, calculate the following financial ratios for 2018 and 2019: B. b. Considering the financial ratios you computed, along with the industry averages, how would you characterize the financial condition of Otago Bay Marine Motors? Explain. a. Calculate the following financial ratios for 2018 and 2019. (Round to two decimal places.) hw7 b.pdf (1 page) O Search Home Otago Bay Marine Motors 2019 2018 Draga Bay Marine Notors Income Statements in thousanda) Current ratio hw7 a.pdf Tools hw7 a.pdf @ For the Yew 2 / 2 Engel DNIMIEW S1 2119 20.5 3 216.146 131220 Seem Polca 31. 5 Coat of pooda M Gross croft morgen AVE Cher 5 128.778 8 120.252 5 3 16 1511 72,400 $9,11 5 3 Pripada 7.172 i Data Table 36. JA 5,996 110 1191 9262 > Operating expans Earingstrom Other income (expereenst Esmings before income Proxian or 5 $ 13 52.364 8 56.320 23, 921,025 VION 5 MJET Presarial and curio Puede Nang 5 5 X 0901 Otago bay Marine Motors 2019 2018 Chenah 5 5 011 5 7 4.14 $ 2.500 4,0 3 2,840 Concretlerde 804 31 22 ) Ar purul One louilt curar o'te you) 3 70. Se 9 75.0 9 * Mawah D. paba 1112 HEX Industry Averages (for 2019) 2.40 1.28 9.88% 10.18% 16.95% 20.25% $1.50 19.01 0.39% 25.86% 6.93 Teachers 5 43390 $ Current ratio Total asset tumover Debt-equity ratio Net profit margin ROA ROE EPS PIE ratio Dividend yield Payout ratio Price-to-book-value ratio 18:41 41 * 2238 5 Lapua para HE 1 5 2112 5 F Print Done Clear All Til BTTTTradi 123.COM Homework: Chapter 7 Homework Save Score: 0 of 1 pt 4 of 4 (0 complete) HW Score: 0%, 0 of 4 pt= P7.18 (similar to) Question Help 0 Listed here, are the 2018 and 2019 balance sheets and income statements, for Otago Bay Marine Motors, a major manufacturer of top-of-the-line outboard motors. a. On the basis of the information provided, calculate the following financial ratios for 2018 and 2019: B. b. Considering the financial ratios you computed, along with the industry averages, how would you characterize the financial condition of Otago Bay Marine Motors? Explain. a. Calculate the following financial ratios for 2018 and 2019. (Round to two decimal places.) hw7 b.pdf (1 page) O Search Home Otago Bay Marine Motors 2019 2018 Draga Bay Marine Notors Income Statements in thousanda) Current ratio hw7 a.pdf Tools hw7 a.pdf @ For the Yew 2 / 2 Engel DNIMIEW S1 2119 20.5 3 216.146 131220 Seem Polca 31. 5 Coat of pooda M Gross croft morgen AVE Cher 5 128.778 8 120.252 5 3 16 1511 72,400 $9,11 5 3 Pripada 7.172 i Data Table 36. JA 5,996 110 1191 9262 > Operating expans Earingstrom Other income (expereenst Esmings before income Proxian or 5 $ 13 52.364 8 56.320 23, 921,025 VION 5 MJET Presarial and curio Puede Nang 5 5 X 0901 Otago bay Marine Motors 2019 2018 Chenah 5 5 011 5 7 4.14 $ 2.500 4,0 3 2,840 Concretlerde 804 31 22 ) Ar purul One louilt curar o'te you) 3 70. Se 9 75.0 9 * Mawah D. paba 1112 HEX Industry Averages (for 2019) 2.40 1.28 9.88% 10.18% 16.95% 20.25% $1.50 19.01 0.39% 25.86% 6.93 Teachers 5 43390 $ Current ratio Total asset tumover Debt-equity ratio Net profit margin ROA ROE EPS PIE ratio Dividend yield Payout ratio Price-to-book-value ratio 18:41 41 * 2238 5 Lapua para HE 1 5 2112 5 F Print Done Clear All Til BTTTTradi 123.COM