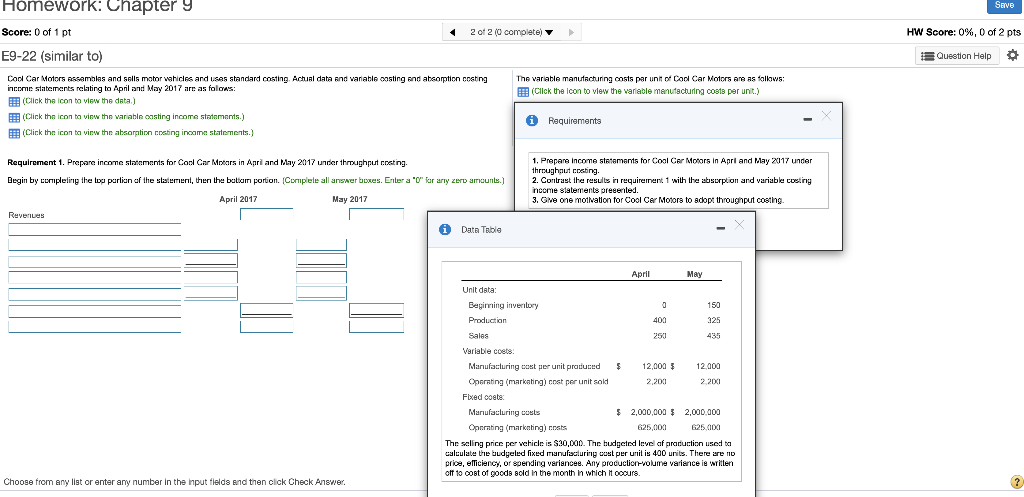

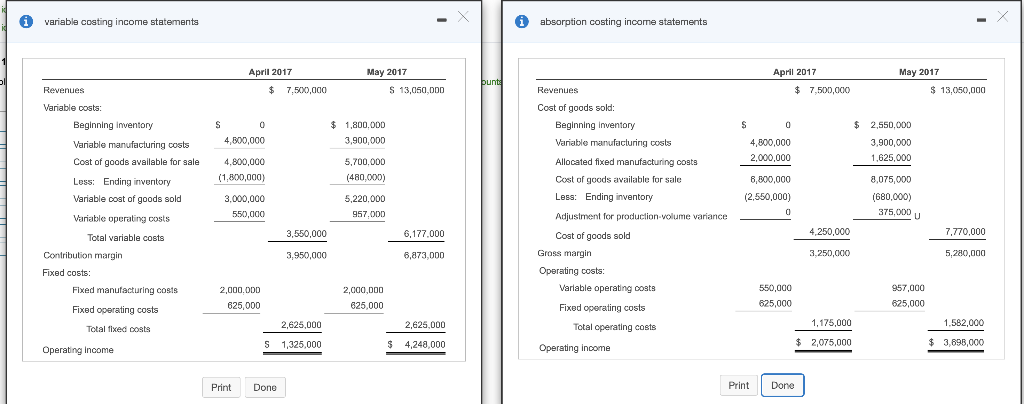

Homework: Chapter y Save Score: 0 of 1 pt 2 of 2 (0 complete) HW Score: 0%, 0 of 2 pts E9-22 (similar to) Question Help The variable manufacturing costs par unt of Cool Car Motors are as follows: (Click the icon to view the variable manufacturing costs per unit.) Cool Car Motors Assamlas and sells mator vahicles and USA standard coming Achial data and variable costing and absorption costing income statements relating to April and May 2017 are as follows: (Click the icon to view the data) PER (Click the icon to view the variabin casting income statements.) i Requirements ::: (Click the icon ba virw the absorption costing inoame statements. Requirement 1. Prepare income statements for Cool Car Motors in April and May 2017 under throughput rating. Begin by completing the log parlian of the statement, then the battu portion. (Cortiplele all answer boxes. Enter a "0" for arty zero amoun.) April 2017 May 2017 Revenues i Data Table 1. Prepare income statements for Coal Car Motors in Apri and May 2017 under throughout crabng. 2. Contrast the results in requirement 1 with the absorption and variable costing income statements presented. 3. Give one motivation for Cool Car Motors to adopt throughput costing 325 April May Unit data: Beginning invenilory 150 Production Sales 250 435 Variable coets. Manufacturing cost per unit produced $ 12,000 12.000 Operating (marketing) cost per unit sold 2,200 2200 Fixed coats Manufacturing costs $ 2,000,000 $ 2,000,000 Operating (marketing costs 6:25,000 625.000 The selling price per vehicle is $30,000. The budgeted level af pracuction used to calculate the budgeled fixed manufacturing cost per unit is 400 units. There are no price, elliciency, or spending variancee. Any procuclior volume variance is written off to cost of goods sold in the month in which it ooours. Choose from any list or enter any number in the input fields and then click Check Answer. i variable costing income statements i absorption costing income statements May 2017 $ 13,050,00D April 2017 $ 7,500,000 May 2017 $ 13,050,000 Revenues $ $ $ 1,800,000 3,900,000 0 4,800,000 2,000,000 Cost of goods sold: Beginning Inventory Variable manufacturing costs Allocated fixed manufacturing costs Cost of goods available for sale Less: Ending inventory Adjustment for production-volume variance 2,550,000 3,900,000 1,625,000 5,700.000 (480,000) 8,500,000 (2,550,000) April 2017 Revenues $ 7,500,000 Variable costs: Beginning inventory SO Variable manufacturing costs anufacturing costs 4,500,000 Cost of goods available for sale 4.800,000 Less: Ending inventory (1,800,000) Variable cost of goods sold 3,000,000 Variable operating costs 550,000 Total variable costs 3,550,000 Contribution margin 3,950,000 Fixed costs: Fixed manufacturing costs 2.000.000 Fixed operating costs 625,000 2,625,000 Total fixed costs S 1,325,000 Operating Income 8,075,000 (680,000) 5,220,000 957.000 375,000 6,177.000 4,250,000 7,770,000 6,873,000 3,250,000 5,280,000 Cost of goods sold Gross margin Operating costs: Variable operating costs 2,000,000 625,000 550,000 625,000 957,000 625,000 Fixed operating costs Total operating costs 2,625,000 1,175,000 2,075,000 1,582,000 3,898,000 $ 4,248,000 $ $ Operating income Print Done Print Done Homework: Chapter y Save Score: 0 of 1 pt 2 of 2 (0 complete) HW Score: 0%, 0 of 2 pts E9-22 (similar to) Question Help The variable manufacturing costs par unt of Cool Car Motors are as follows: (Click the icon to view the variable manufacturing costs per unit.) Cool Car Motors Assamlas and sells mator vahicles and USA standard coming Achial data and variable costing and absorption costing income statements relating to April and May 2017 are as follows: (Click the icon to view the data) PER (Click the icon to view the variabin casting income statements.) i Requirements ::: (Click the icon ba virw the absorption costing inoame statements. Requirement 1. Prepare income statements for Cool Car Motors in April and May 2017 under throughput rating. Begin by completing the log parlian of the statement, then the battu portion. (Cortiplele all answer boxes. Enter a "0" for arty zero amoun.) April 2017 May 2017 Revenues i Data Table 1. Prepare income statements for Coal Car Motors in Apri and May 2017 under throughout crabng. 2. Contrast the results in requirement 1 with the absorption and variable costing income statements presented. 3. Give one motivation for Cool Car Motors to adopt throughput costing 325 April May Unit data: Beginning invenilory 150 Production Sales 250 435 Variable coets. Manufacturing cost per unit produced $ 12,000 12.000 Operating (marketing) cost per unit sold 2,200 2200 Fixed coats Manufacturing costs $ 2,000,000 $ 2,000,000 Operating (marketing costs 6:25,000 625.000 The selling price per vehicle is $30,000. The budgeted level af pracuction used to calculate the budgeled fixed manufacturing cost per unit is 400 units. There are no price, elliciency, or spending variancee. Any procuclior volume variance is written off to cost of goods sold in the month in which it ooours. Choose from any list or enter any number in the input fields and then click Check Answer. i variable costing income statements i absorption costing income statements May 2017 $ 13,050,00D April 2017 $ 7,500,000 May 2017 $ 13,050,000 Revenues $ $ $ 1,800,000 3,900,000 0 4,800,000 2,000,000 Cost of goods sold: Beginning Inventory Variable manufacturing costs Allocated fixed manufacturing costs Cost of goods available for sale Less: Ending inventory Adjustment for production-volume variance 2,550,000 3,900,000 1,625,000 5,700.000 (480,000) 8,500,000 (2,550,000) April 2017 Revenues $ 7,500,000 Variable costs: Beginning inventory SO Variable manufacturing costs anufacturing costs 4,500,000 Cost of goods available for sale 4.800,000 Less: Ending inventory (1,800,000) Variable cost of goods sold 3,000,000 Variable operating costs 550,000 Total variable costs 3,550,000 Contribution margin 3,950,000 Fixed costs: Fixed manufacturing costs 2.000.000 Fixed operating costs 625,000 2,625,000 Total fixed costs S 1,325,000 Operating Income 8,075,000 (680,000) 5,220,000 957.000 375,000 6,177.000 4,250,000 7,770,000 6,873,000 3,250,000 5,280,000 Cost of goods sold Gross margin Operating costs: Variable operating costs 2,000,000 625,000 550,000 625,000 957,000 625,000 Fixed operating costs Total operating costs 2,625,000 1,175,000 2,075,000 1,582,000 3,898,000 $ 4,248,000 $ $ Operating income Print Done Print Done