Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Homework Complete and submit the case questions 4 and 5 below. Be prepared to discuss all case questions. On the next page, I present a

Homework

Complete and submit the case questions 4 and 5 below. Be prepared to discuss all case questions. On the next page, I present a template of how you should structure your analysis.

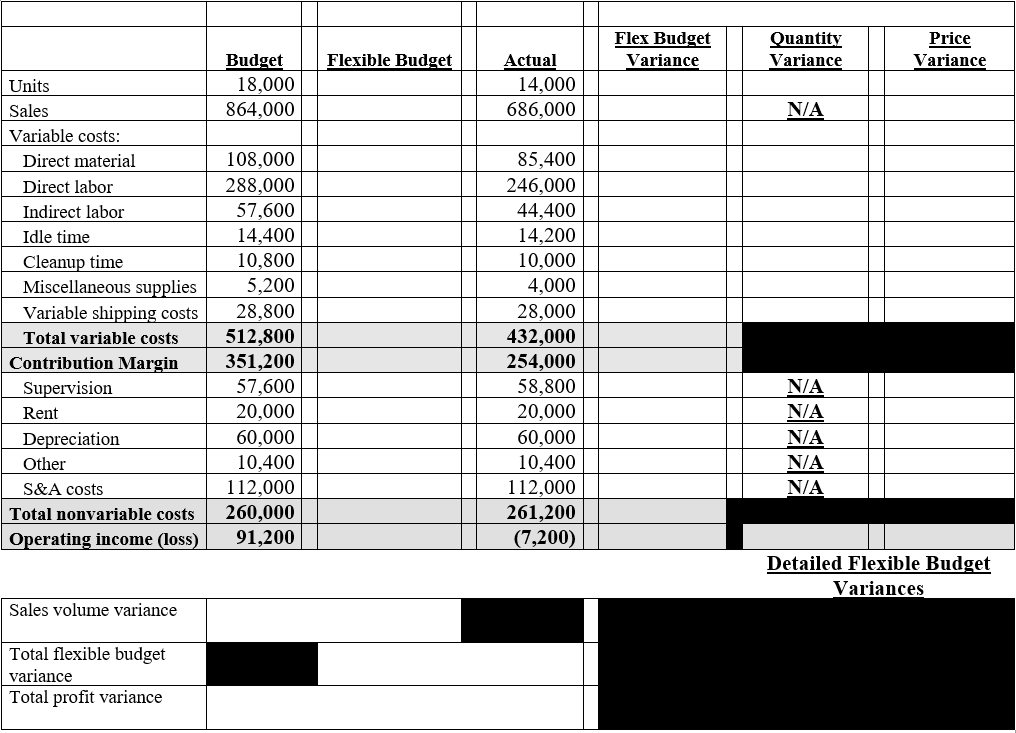

Waltham Motors

- Using budget data, how many motors would have to be sold for Waltham Motors Division to break even?

- Using budget data, what was the total expected cost per unit if all manufacturing and shipping overhead (both variable and fixed) was allocated to planned production? What was the actual per unit cost of production and shipping?

- Comment on the performance report and the plant accountants analysis of results. How, if at all, would you suggest the performance report be changed before sending it on to the division manager and Marco Corporation headquarters?

- Prepare your own analysis of the Waltham Divisions operations in May.

- Explain in as much detail as possible why income differed from what you would have expected. Use the following assumptions:

- All of the labor hours incurred at Walton Motors Division during May 1991 for direct labor, indirect labor, idle time, and cleanup time were paid at the same actual average rate mentioned in the case.

- The costs per unit for miscellaneous supplies and variable shipping costs are based on the companys experience with a standard mix of materials (and labor in the case of shipping) for each unit of product produced and shipped. Waste is minor, so the company always assumes one standard unit of each of these inputs for each unit produced and only a spending variance is calculated.

- Similarly, fixed overhead is not allocated directly to units of product so no volume variance is calculated but a spending variance is calculated.

- In your opinion, who should be held responsible for what variances? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started