Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Homework due Aug 1 , 2 0 2 4 0 2 : 1 2 CDT Question 3 0 . 0 2 0 . 0 points

Homework due Aug : CDT

Question

points graded

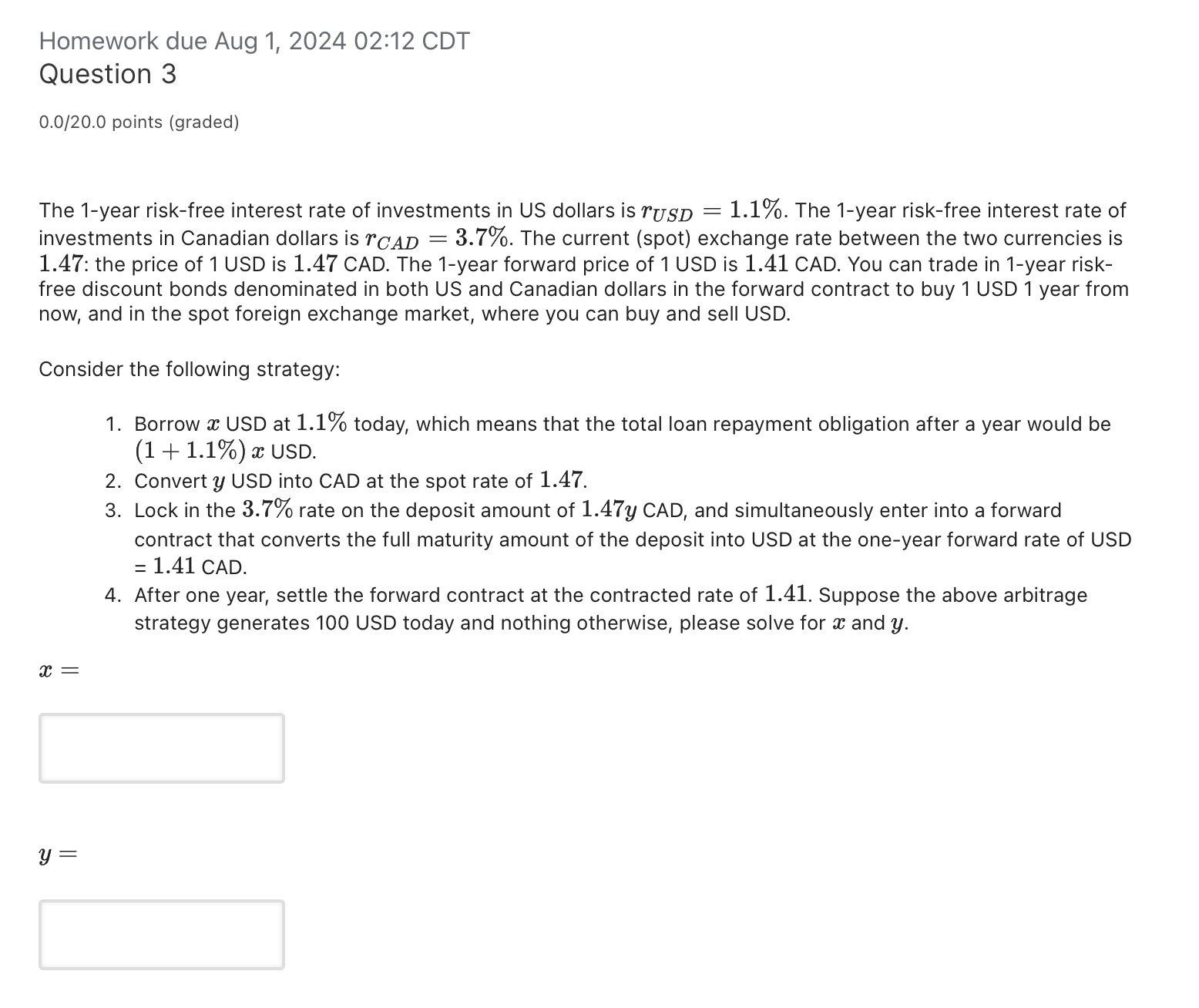

The year riskfree interest rate of investments in US dollars is The year riskfree interest rate of investments in Canadian dollars is The current spot exchange rate between the two currencies is : the price of USD is CAD. The year forward price of USD is CAD. You can trade in year riskfree discount bonds denominated in both US and Canadian dollars in the forward contract to buy USD year from now, and in the spot foreign exchange market, where you can buy and sell USD.

Consider the following strategy:

Borrow USD at today, which means that the total loan repayment obligation after a year would be USD.

Convert USD into CAD at the spot rate of

Lock in the rate on the deposit amount of CAD, and simultaneously enter into a forward contract that converts the full maturity amount of the deposit into USD at the oneyear forward rate of USD CAD.

After one year, settle the forward contract at the contracted rate of Suppose the above arbitrage strategy generates USD today and nothing otherwise, please solve for and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started