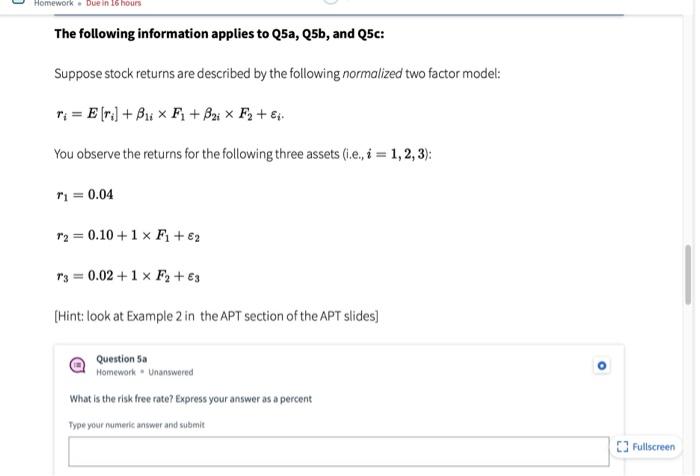

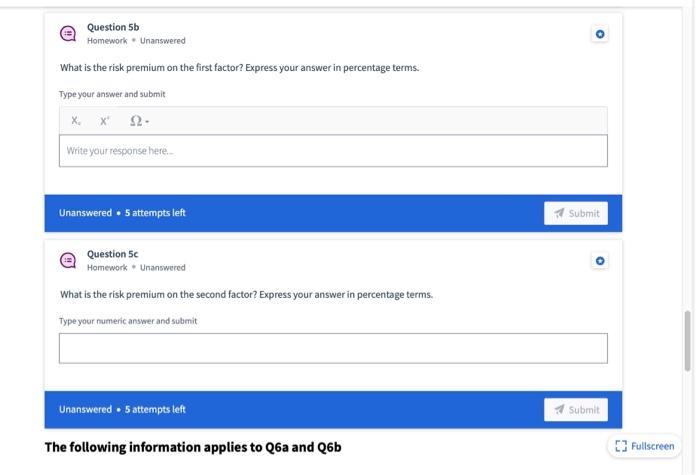

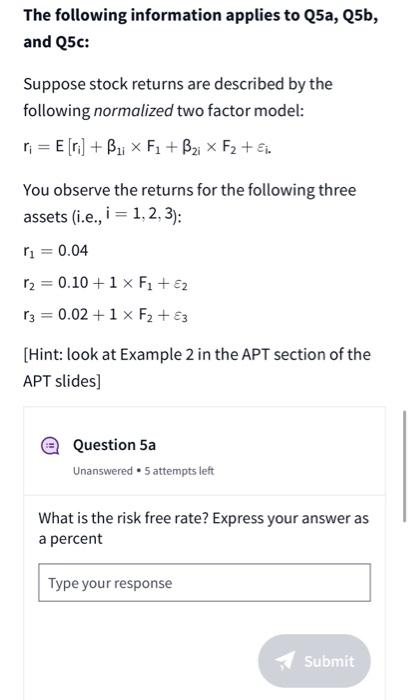

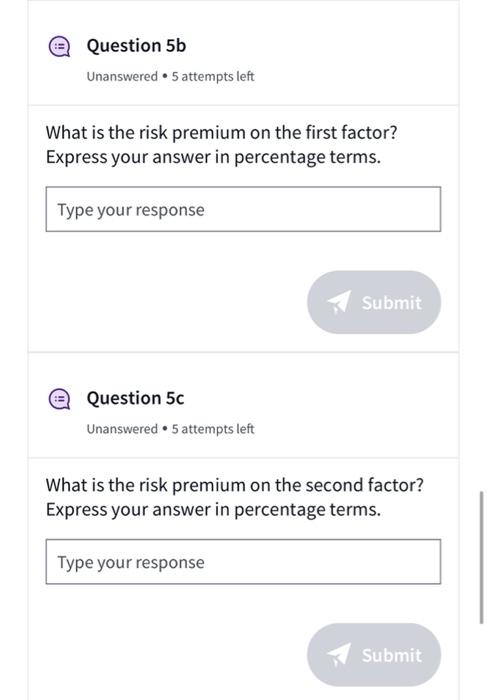

Homework - Due in 16 hours The following information applies to Q5a, Q5b, and Q5c: Suppose stock returns are described by the following normalized two factor model: ri = E (ri]+Bu Fi + B2: * F,+ Eir You observe the returns for the following three assets (ie, i = 1, 2, 3): ni = 0.04 r2 = 0.10 + 1 x Fi + E2 13 = 0.02+1 x F2 + E3 [Hint: look at Example 2 in the APT section of the APT slides) Question sa Homework. Unanswered What is the risk free rate? Express your answer as a percent Type your numeric answer and submit 3 Fullscreen Question 5b Homework. Unanswered o What is the risk premium on the first factor? Express your answer in percentage terms. Type your answer and submit X X* S2 Write your response here. Unanswered. 5 attempts left Submit Question 5c Homework Unanswered O What is the risk premium on the second factor? Express your answer in percentage terms. Type your numeric answer and submit Unanswered. 5 attempts left Submit The following information applies to Q6a and Q6b Fullscreen The following information applies to Q5a, Q5b, and Q5c: Suppose stock returns are described by the following normalized two factor model: r;= E [ri) + Bu x F1+Bzi F2+ &i. You observe the returns for the following three assets (i.e., i = 1,2,3): r = 0.04 r2 = 0.10+1 X Fi + 62 r3 = 0.02+1 x F2 + Ez [Hint: look at Example 2 in the APT section of the APT slides) Question 5a Unanswered 5 attempts left What is the risk free rate? Express your answer as a percent Type your response Submit Question 5b Unanswered 5 attempts left What is the risk premium on the first factor? Express your answer in percentage terms. Type your response Submit Question 5c Unanswered 5 attempts left What is the risk premium on the second factor? Express your answer in percentage terms. Type your response - Submit Homework - Due in 16 hours The following information applies to Q5a, Q5b, and Q5c: Suppose stock returns are described by the following normalized two factor model: ri = E (ri]+Bu Fi + B2: * F,+ Eir You observe the returns for the following three assets (ie, i = 1, 2, 3): ni = 0.04 r2 = 0.10 + 1 x Fi + E2 13 = 0.02+1 x F2 + E3 [Hint: look at Example 2 in the APT section of the APT slides) Question sa Homework. Unanswered What is the risk free rate? Express your answer as a percent Type your numeric answer and submit 3 Fullscreen Question 5b Homework. Unanswered o What is the risk premium on the first factor? Express your answer in percentage terms. Type your answer and submit X X* S2 Write your response here. Unanswered. 5 attempts left Submit Question 5c Homework Unanswered O What is the risk premium on the second factor? Express your answer in percentage terms. Type your numeric answer and submit Unanswered. 5 attempts left Submit The following information applies to Q6a and Q6b Fullscreen The following information applies to Q5a, Q5b, and Q5c: Suppose stock returns are described by the following normalized two factor model: r;= E [ri) + Bu x F1+Bzi F2+ &i. You observe the returns for the following three assets (i.e., i = 1,2,3): r = 0.04 r2 = 0.10+1 X Fi + 62 r3 = 0.02+1 x F2 + Ez [Hint: look at Example 2 in the APT section of the APT slides) Question 5a Unanswered 5 attempts left What is the risk free rate? Express your answer as a percent Type your response Submit Question 5b Unanswered 5 attempts left What is the risk premium on the first factor? Express your answer in percentage terms. Type your response Submit Question 5c Unanswered 5 attempts left What is the risk premium on the second factor? Express your answer in percentage terms. Type your response - Submit