Answered step by step

Verified Expert Solution

Question

1 Approved Answer

homework Exercise #6 (4 points) Greg died on July 1, 2022, and left Lea, his wife, a $45,000 life insurance policy which elects to receive

homework

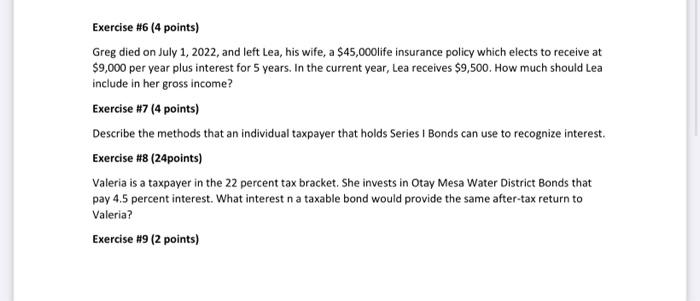

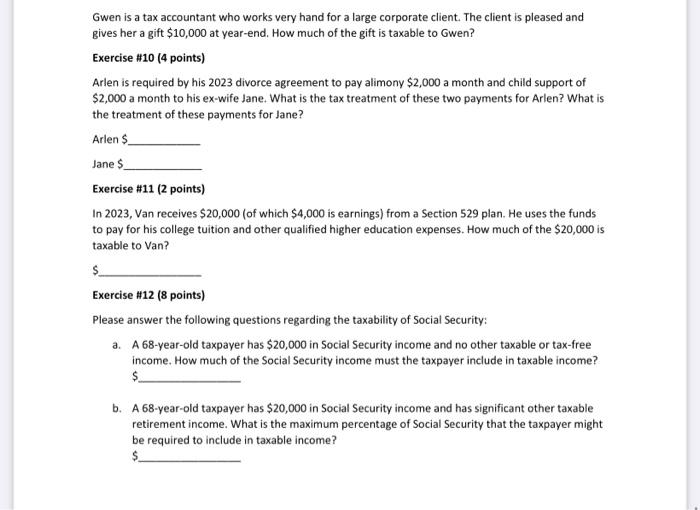

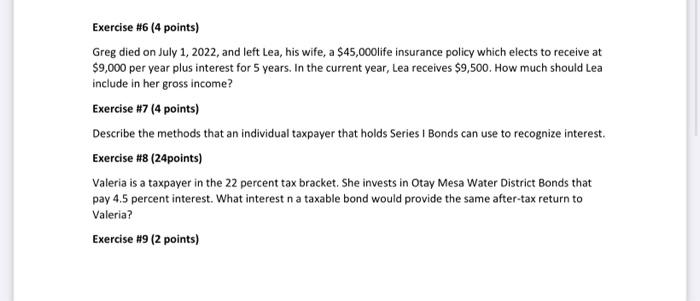

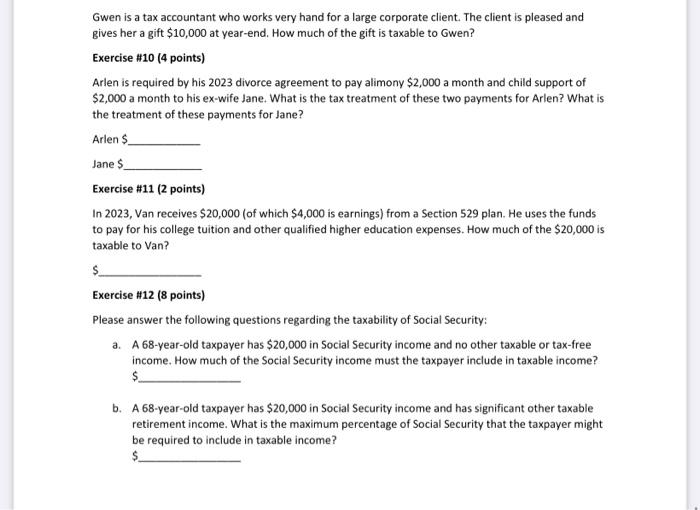

Exercise \#6 (4 points) Greg died on July 1, 2022, and left Lea, his wife, a $45,000 life insurance policy which elects to receive at $9,000 per year plus interest for 5 years. In the current year, Lea receives $9,500. How much should Lea include in her gross income? Exercise \#7 (4 points) Describe the methods that an individual taxpayer that holds Series I Bonds can use to recognize interest. Exercise #8 (24points) Valeria is a taxpayer in the 22 percent tax bracket. She invests in Otay Mesa Water District Bonds that pay 4.5 percent interest. What interest n a taxable bond would provide the same after-tax return to Valeria? Exercise \#9 (2 points) Gwen is a tax accountant who works very hand for a large corporate client. The client is pleased and gives her a gift $10,000 at year-end. How much of the gift is taxable to Gwen? Exercise \#10 (4 points) Arlen is required by his 2023 divorce agreement to pay alimony $2,000 a month and child support of $2,000 a month to his ex-wife Jane. What is the tax treatment of these two payments for Arlen? What is the treatment of these payments for Jane? Arlen $ Jane $ Exercise \#11 ( 2 points) In 2023, Van receives $20,000 (of which $4,000 is earnings) from a Section 529 plan. He uses the funds to pay for his college tuition and other qualified higher education expenses. How much of the $20,000 is taxable to Van? Exercise #12 ( 8 points) Please answer the following questions regarding the taxability of Social Security: a. A 68-year-old taxpayer has $20,000 in Social Security income and no other taxable or tax-free income. How much of the Social Security income must the taxpayer include in taxable income? b. A 68 -year-old taxpayer has $20,000 in Social Security income and has significant other taxable retirement income. What is the maximum percentage of Social Security that the taxpayer might be required to include in taxable income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started