Answered step by step

Verified Expert Solution

Question

1 Approved Answer

homework help here it is! thank you! Using your answers from the problem 1 and the following information, prepare a budget summary for the General

homework help

here it is! thank you!

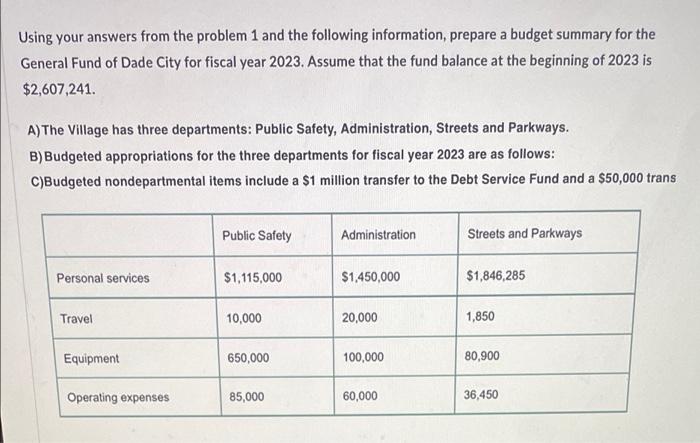

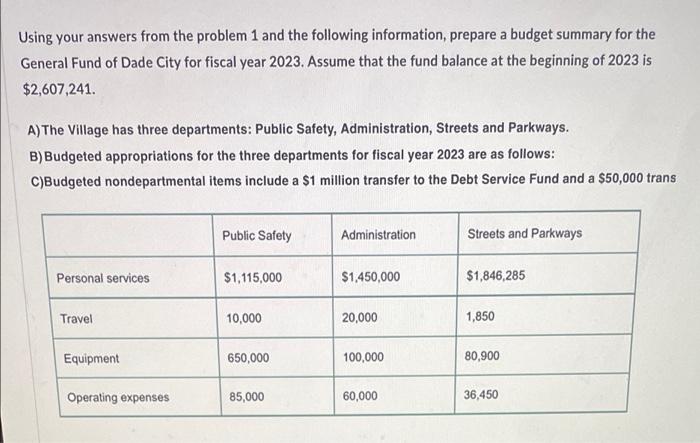

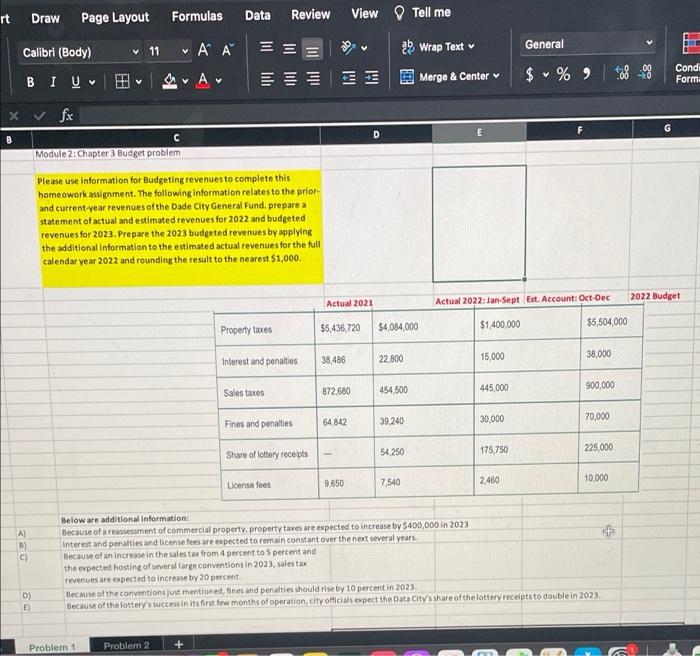

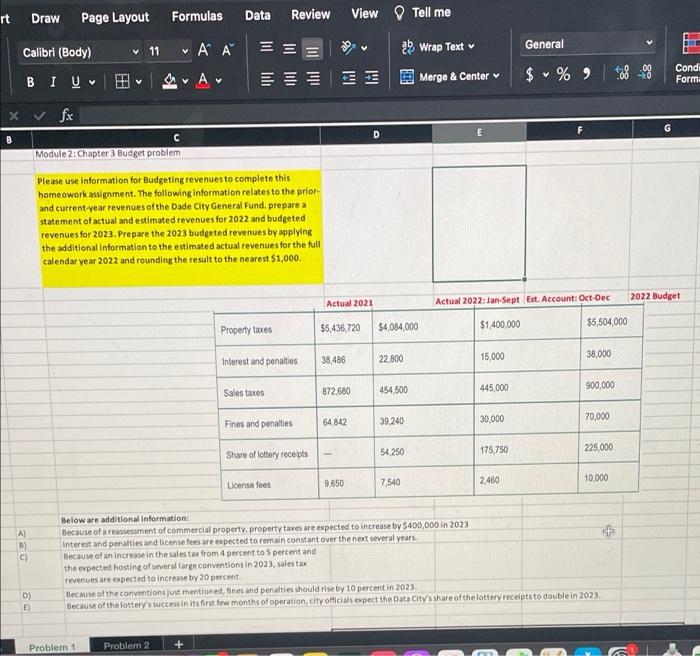

Using your answers from the problem 1 and the following information, prepare a budget summary for the General Fund of Dade City for fiscal year 2023. Assume that the fund balance at the beginning of 2023 is $2,607,241. A) The Village has three departments: Public Safety, Administration, Streets and Parkways. B)Budgeted appropriations for the three departments for fiscal year 2023 are as follows: C)Budgeted nondepartmental items include a $1 million transfer to the Debt Service Fund and a $50,000 trans Public Safety Administration Streets and Parkways Personal services $1,115,000 $1,450,000 $1,846,285 Travel 10,000 20,000 1,850 Equipment 650,000 100,000 80,900 Operating expenses 85,000 60,000 36,450 rt Draw Page Layout Data Review View Tell me Calibri (Body) 11 Wrap Text BI U E V V E Merge & Center C Module 2: Chapter 3 Budget problem prior- Please use information for Budgeting revenues to complete this homeowork assignment. The following information relates to the and current-year revenues of the Dade City General Fund. prepare a statement of actual and estimated revenues for 2022 and budgeted revenues for 2023. Prepare the 2023 budgeted revenues by applying the additional information to the estimated actual revenues for the full calendar year 2022 and rounding the result to the nearest $1,000. Actual 2022: Jan-Sept Est. Account: Oct-Dec Property taxes $5,436,720 $4,084,000 $1,400,000 $5,504,000 Interest and penalties 38,486 22,800 15,000 38,000 Sales taxes 872,680 454,500 445,000 900,000 64,842 Fines and penalties 39,240 70,000 30,000 Share of lottery receipts 175,750 54,250 225,000 - License fees 9,650 7,540 2,460 10,000 Below are additional information: Because of a reassessment of commercial property, property taxes are expected to increase by $400,000 in 2023 Interest and penalties and license fees are expected to remain constant over the next several years. Because of an increase in the sales tax from 4 percent to 5 percent and the expected hosting of several large conventions in 2023, sales tax revenues are expected to increase by 20 percent. D) Because of the conventions just mentioned, fines and penalties should rise by 10 percent in 2023. E Because of the lottery's success in its first few months of operation, city officials expect the Data City's share of the lottery receipts to double in 2023. Problem 11 Problem 2 (A) (B) Formulas C) V A Actual 2021 D General $ % 9 800 V Condi Forma G 2022 Budget

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started