Answered step by step

Verified Expert Solution

Question

1 Approved Answer

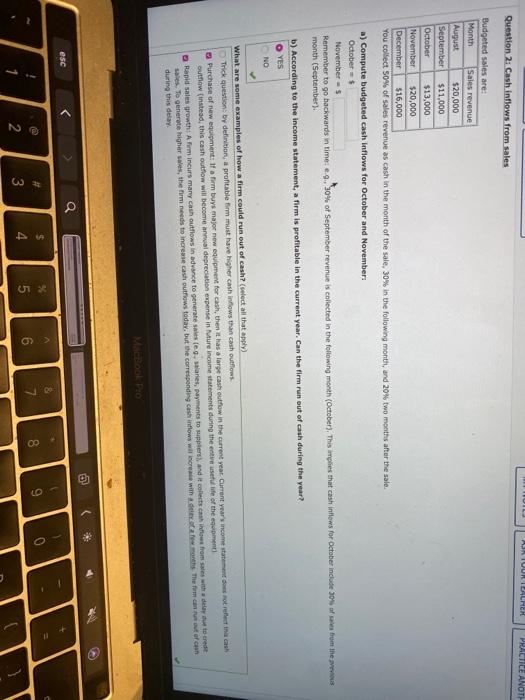

homework help HIL AKTUUR TEACHER PRACTICE ANOTH Question 2 Cash inflows from sales Budgeted sales are: Month Sales revenue August $20,000 September $11,000 October $13,000

homework help

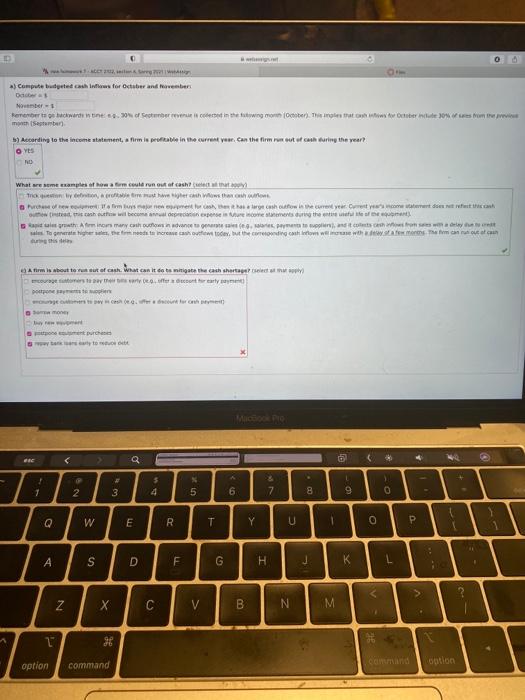

HIL AKTUUR TEACHER PRACTICE ANOTH Question 2 Cash inflows from sales Budgeted sales are: Month Sales revenue August $20,000 September $11,000 October $13,000 November $20,000 December 516,000 You collect 50% of sales revenue as cash in the month of the sale, 30% in the following month, and 20% two months after the sale. a) Compute budgeted cash inflows for October and November October =s November Remember to go backwards in time: 0.0.90% of September revenue is collected in the following month (October). This implies that cash inflows for October include 30% af from the grow month (September) b) According to the income statement, a firm is profitable in the current year. Can the firm run out of cash during the year? O YES NO What are some examples of how a firm could run out of cash? (select all that apply) Trick questions by definition, a profitable firm must have higher cash flows than cash outflows. Purchase of new equipment: If a firm buys major new equipment for cash, then it has a large cash outflow in the current year. Current year's income statement does not reach outflow (instead, this cash outflow will become annual depreciation expense in ure income statements during the entire suite of the game Rapid sales growth: A fum incurs many cash outflows in advance to generates (.es, payments to suppliers and collecte cash from somewheredit sales. To generate higher se, the firm needs to increase cast outflows today, but the corresponding inflows will increase with the form of during this delay Rok Pro 7 Q esc 4 $ 4 23 # 3 x 5 9 8 6 2 . > Compute budgeted cash for October and eventer Daca Notes Remember tackwardnie. Server in the towing monteret for stresom September According to the income statement, firm in profitable in the current year. Can the firm root cash toring the year! YES What are samt example of how a fum could run out of cash The Writer cth Wows thanh musonen went to the large cash out to rent year. Orest.com understa how to cash out will become an expenses are income starts our there is often arth Afriron many cachows dance to show To me higher edats incremento comercio e what most och firm is about to run surt of cash Wat can I do to mitigate the cash shortage er than other carly popote B Q o . 3 5 4 . 8 1 0 1 2 5 6 7 9 Q W E R T Y U 0 P S D F G H L N X C V B N M I option command option Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started