Answered step by step

Verified Expert Solution

Question

1 Approved Answer

homework help please! co Questiono An article in the Wall Street Journal says that market interest rates just dropped by identical amounts across the board.

homework help please!

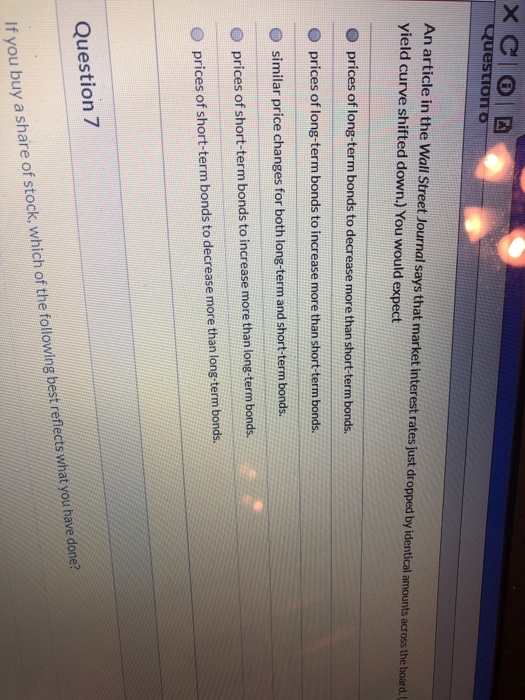

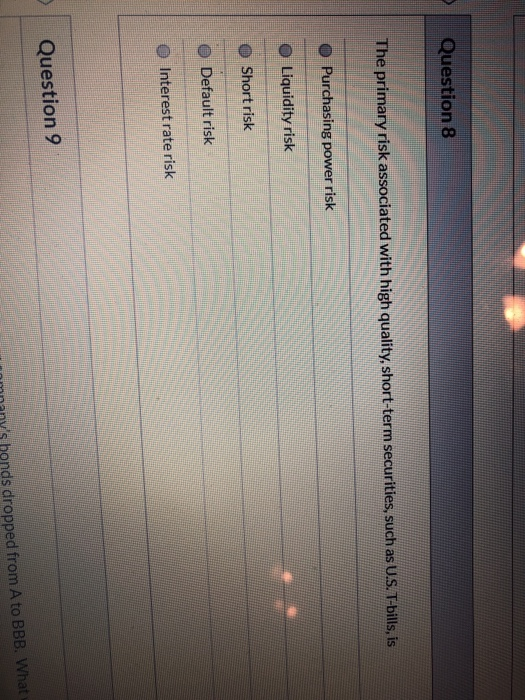

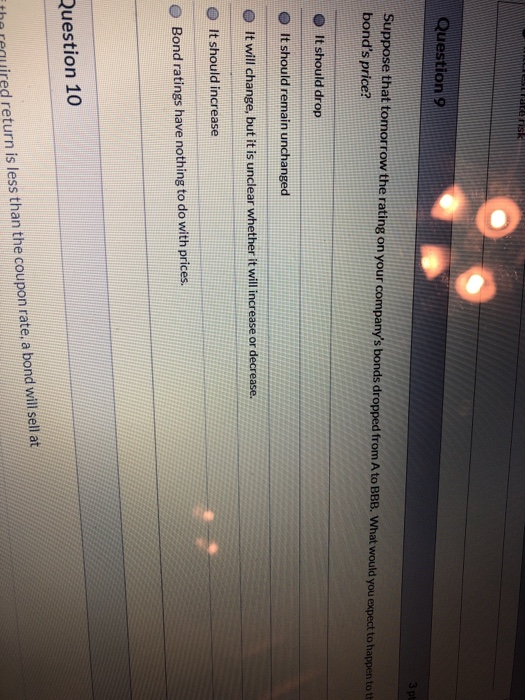

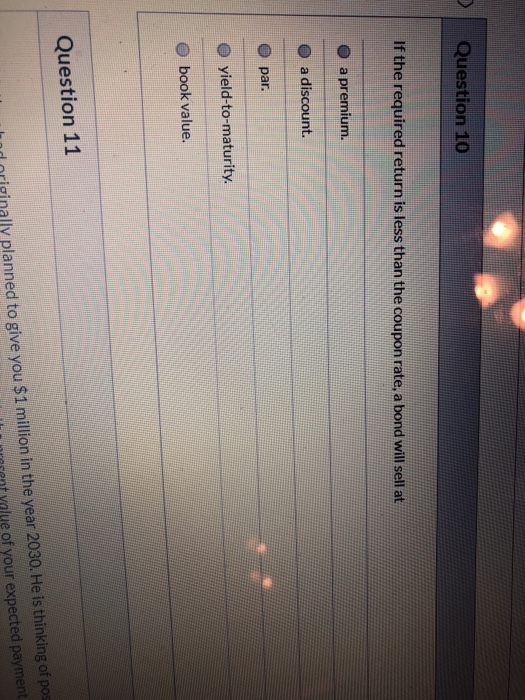

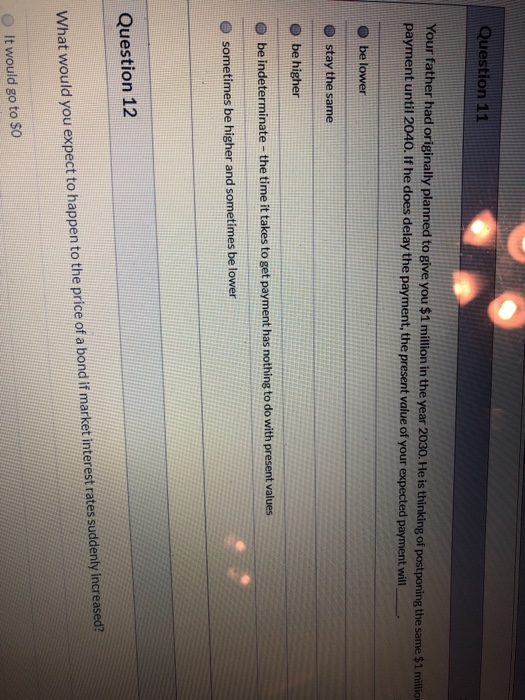

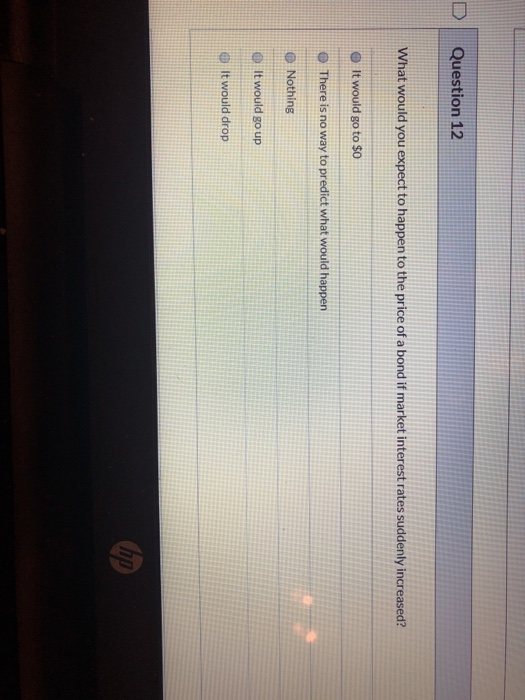

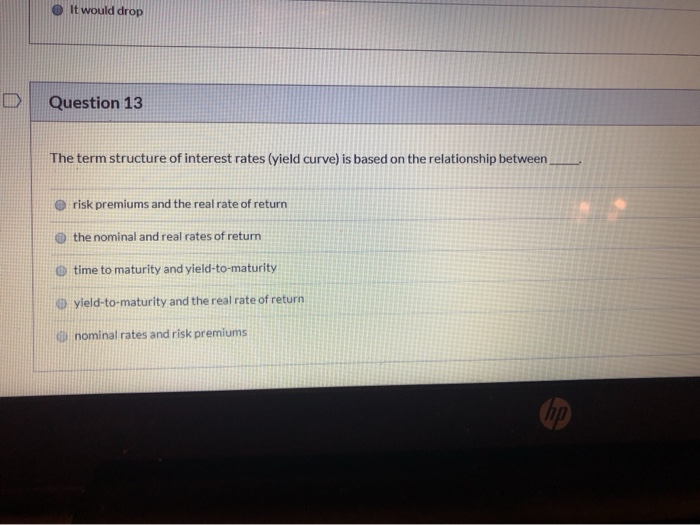

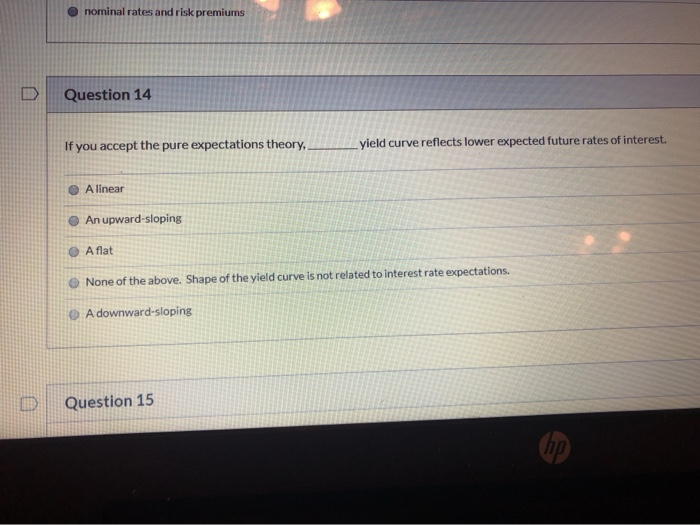

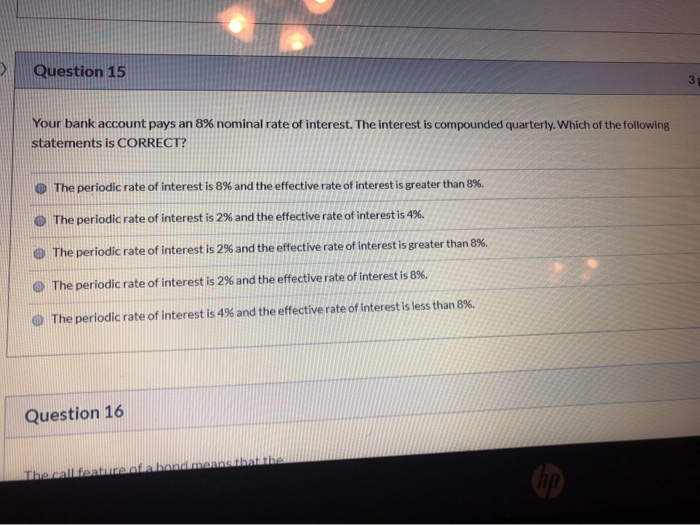

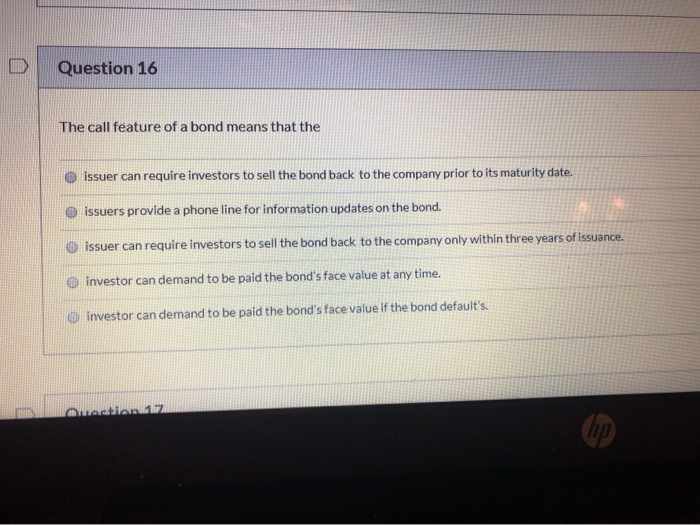

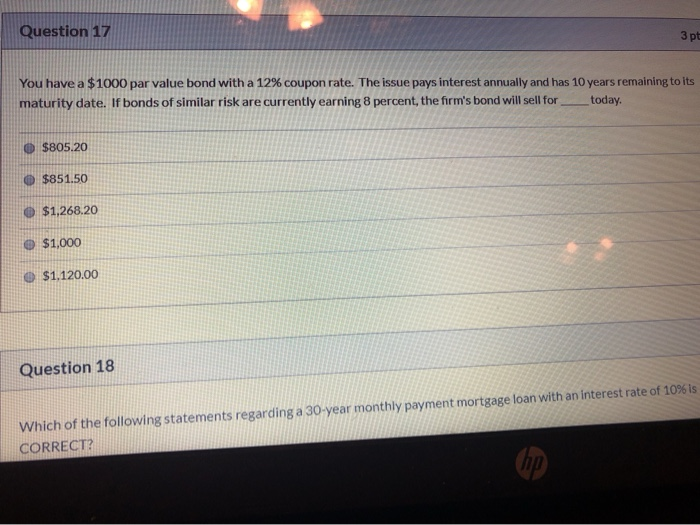

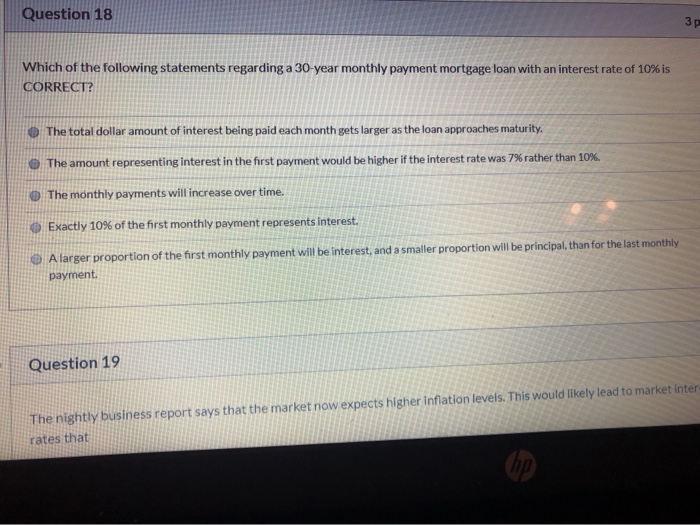

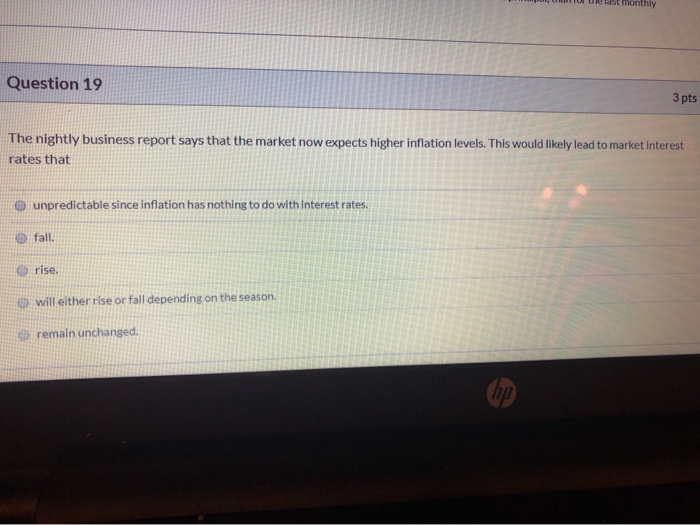

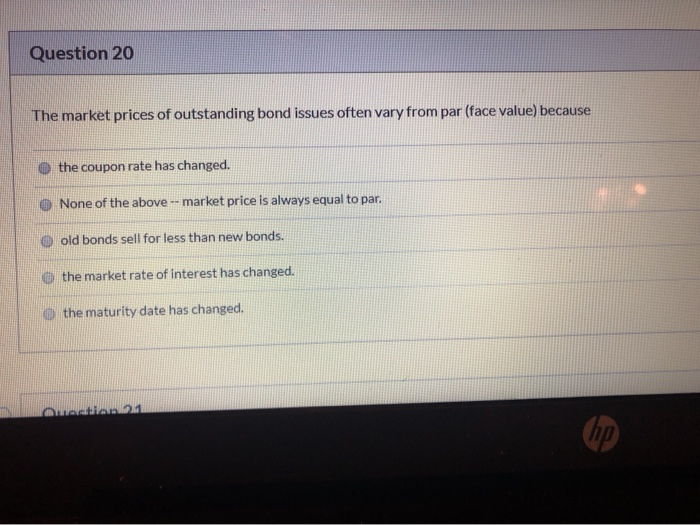

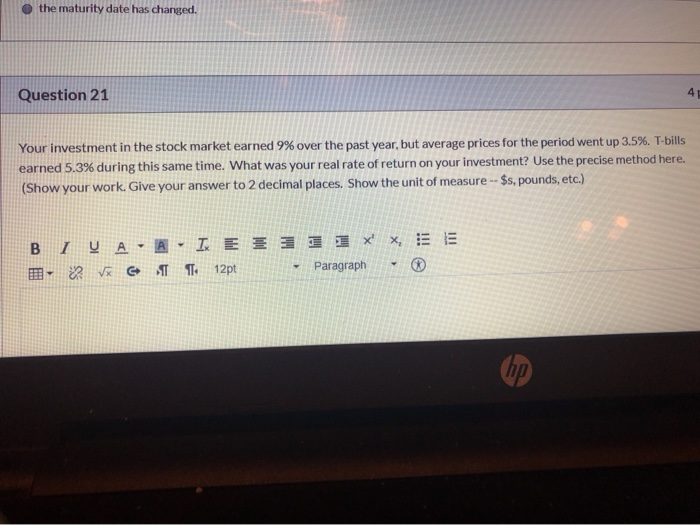

co Questiono An article in the Wall Street Journal says that market interest rates just dropped by identical amounts across the board. yield curve shifted down.) You would expect O prices of long-term bonds to decrease more than short-term bonds. e prices of long-term bonds to increase more than short-term bonds. similar price changes for both long-term and short-term bonds. prices of short-term bonds to increase more than long-term bonds. prices of short-term bonds to decrease more than long-term bonds. Question 7 If you buy a share of stock, which of the following best reflects what you have done? Question 8 The primary risk associated with high quality, short-term securities, such as U.S. T-bills, is O Purchasing power risk Liquidity risk Short risk Default risk Interest rate risk Question 9 mnany's honds dropped from A to BBB. What Question 9 3 pt Suppose that tomorrow the rating on your company's bonds dropped from A to BBB. What would you expect to happen to bond's price? It should drop It should remain unchanged It will change, but it is unclear whether it will increase or decrease. It should increase Bond ratings have nothing to do with prices. Question 10 the required return is less than the coupon rate, a bond will sell at Question 10 If the required return is less than the coupon rate, a bond will sell at O a premium. O a discount. par. yield-to-maturity. book value. Question 11 Inod originally planned to give you $1 million in the year 2030. He is thinking of por urrent yalue of your expected payment Question 11 Your father had originally planned to give you $1 million in the year 2030. He is thinking of postponing the same $1 million payment until 2040. If he does delay the payment, the present value of your expected payment will o be lower stay the same be higher O be indeterminate - the time it takes to get payment has nothing to do with present values sometimes be higher and sometimes be lower Question 12 What would you expect to happen to the price of a bond if market interest rates suddenly increased? It would go to $0 D Question 12 What would you expect to happen to the price of a bond if market interest rates suddenly increased? It would go to $0 There is no way to predict what would happen Nothing It would go up It would drop It would drop Question 13 The term structure of interest rates (yield curve) is based on the relationship between risk premiums and the real rate of return the nominal and real rates of return O time to maturity and yield-to-maturity yield-to-maturity and the real rate of return nominal rates and risk premiums nominal rates and risk premiurns D Question 14 If you accept the pure expectations theory, yield curve reflects lower expected future rates of interest. A linear An upward sloping Aflat None of the above. Shape of the yield curve is not related to interest rate expectations. A downward-sloping Question 15 Question 15 Your bank account pays an 8% nominal rate of interest. The interest is compounded quarterly. Which of the following statements is CORRECT? O The periodic rate of interest is 8% and the effective rate of interest is greater than 8%. The periodic rate of interest is 2% and the effective rate of interest is 4%. The periodic rate of interest is 2% and the effective rate of interest is greater than 8%. O The periodic rate of interest is 2% and the effective rate of interest is 8%. The periodic rate of interest is 4% and the effective rate of interest is less than 8%. Question 16 The call feature of bandlimuams that the Question 16 The call feature of a bond means that the issuer can require investors to sell the bond back to the company prior to its maturity date. issuers provide a phone line for information updates on the bond. issuer can require investors to sell the bond back to the company only within three years of issuance. O investor can demand to be paid the bond's face value at any time. investor can demand to be paid the bond's face value if the bond default's. O stian17 Question 17 3 pt You have a $1000 par value bond with a 12% coupon rate. The issue pays interest annually and has 10 years remaining to its maturity date. If bonds of similar risk are currently earning 8 percent, the firm's bond will sell for today. $805.20 $851.50 $1,268.20 $1,000 $1.120.00 Question 18 Which of the following statements regarding a 30-year monthly payment mortgage loan with an interest rate of 109 CORRECT? Question 18 Which of the following statements regarding a 30-year monthly payment mortgage loan with an interest rate of 10% is CORRECT? The total dollar amount of interest being paid each month gets larger as the loan approaches maturity The amount representing interest in the first payment would be higher if the interest rate was 7% rather than 10%. The monthly payments will increase over time. Exactly 10% of the first monthly payment represents interest. A larger proportion of the first monthly payment will be interest, and a smaller proportion will be principal, than for the last monthly payment Question 19 The nightly business report says that the market now expects higher inflation levels. This would likely lead to market inter rates that u Uest monthly Question 19 3 pts The nightly business report says that the market now expects higher inflation levels. This would likely lead to market interest rates that e unpredictable since inflation has nothing to do with interest rates. fall. rise. e will either rise or fall depending on the season. o remain unchanged. Question 20 The market prices of outstanding bond issues often vary from par (face value) because the coupon rate has changed. None of the above -- market price is always equal to par. O old bonds sell for less than new bonds. the market rate of interest has changed. the maturity date has changed. the maturity date has changed. Question 21 Your investment in the stock market earned 9% over the past year, but average prices for the period went up 3.5%. T-bills earned 5.3% during this same time. What was your real rate of return on your investment? Use the precise method here. (Show your work. Give your answer to 2 decimal places. Show the unit of measure -- $s, pounds, etc.) BIVA - AIEE 3 1 1 * *, EE - V G T 12pt Paragraph O words Question 22 4 p Argo Industries has issued a bond which has a $1,000 par value and a 15 percent annual coupon interest rate. The bond will mature in ten years and currently sells for $1,250. The expected return on the stock market is 10%. What is the bond's yield- to-maturity? (Show your answer to 2 decimal places. Show the appropriate unit of measure - i.e. $. pound, etc.) BI y A - A - I E331 . * , ! E 3. XV G T 12pt Paragraph O words Question 23 4 pts Let's suppose that you believe in the Pure Expectations Theory regarding the yield curve. Looking at today's Wall Street Journal, you see that a Treasury security with one year left until maturity is yielding 5% and a Treasury security with two years until maturity is yielding 6%. Based on this, what do you think the approximate yield will be on one year securities one year from now? You do not need to use the precise calculation here, but you may if you want. (Show your work. Give your answer to 2 decimal places. Show the unit of measure -- $s, pounds, etc.) BIVA - AI E 3 1x XEE Question 24 Your cousin Vinnie has agreed to lend you $3,000 to tide you over for the semester. He has said that you can pay $500 a month for the next 4 years. What interest rate is Vinnie charging? (Show your work or calculator input. G answer to 2 decimal places. Show the unit of measure -- $s, pounds, etc.) BIU A - A - IX E 31 11 x x - Vx G T 12pt Paragraph O wor Question 25 You already have $9,500 invested in your account and you plan to make 10 additional annual deposits of $7,000 each. You expect to earn 8% per year. The first deposit will be made one year from today. How much money would you have in the account after the last deposit? (Show your work or calculator input. Give your answer to 2 decimal places. Show the unit of measure -- $s, pounds, etc.) BIA - AI E 2 1 1, EE 1. V c s 12pt - Paragraph . IP O words Question 26 4 pts Today is January 1, 2101. You are expecting to receive $500 on December 31, 2101, $600 on December 31, 2102, and $700 on December 31, 2103. Your cousin offers to buy the rights to these cash flows today. Assuming the appropriate discount rate is 7%, what is the lowest amount you would be willing to take? Wait, don't calculate this - just show the formula set up with the precise numbers we would need to solve this problem. I am NOT looking for financial calculator input here. (That means putting something like NPV) will get no credit.) Be sure to use ()s where needed. BIVA - A - IEE311 XX, O words Question 27 4 pts You plan to buy a new auto with a 5-year, $15,000 loan at an interest rate of 6.25%. What will the monthly payment on your loan be? (Show your work or calculator input. Give your answer to 2 decimal places.) BIVA -A- IE3311XX, SE V G T 12pt - Paragraph - O words Question 28 4 pts You put $500 into an investment account that offers a competitive annual rate of 7% compounded quarterly. How much will you have in your account after six years? (Show your work or calculator input. Give your answer to 2 decimal places. Show the unit of measure -- $s, pounds, etc.) BIVA - AI E E 3 11 **, SE - V C T 12pt - Paragraph - O words Question 29 You received word of a great investment on which you would earn 9% per year. How long would it take to triple your money? (Show your work or calculator Input. Give your answer to 2 decimal places. Show the unit of measure -- $s, pounds, etc.) BIUAA. IE E 3 1 1 x x ! E 2. ?V G 12pt Paragraph Question 30 4 pts You plan to retire in 30 years, and you want to have $1 million at that time. How much must you put into an account at the end of each of the next 20 years to be able to meet your goal assuming you are expecting to earn 9% per year? Note: You only want to make contributions for 20 years, so no contributions will be made to your account in the 10 years immediately preceding your retirement. (Show your work or calculator input. Give your answer to 2 decimal places. Show the unit of measure -- Ss. pounds, etc.) BIU A - A - I E = 1 1 xx, EE 12V G T 12pt - Paragraph . co Questiono An article in the Wall Street Journal says that market interest rates just dropped by identical amounts across the board. yield curve shifted down.) You would expect O prices of long-term bonds to decrease more than short-term bonds. e prices of long-term bonds to increase more than short-term bonds. similar price changes for both long-term and short-term bonds. prices of short-term bonds to increase more than long-term bonds. prices of short-term bonds to decrease more than long-term bonds. Question 7 If you buy a share of stock, which of the following best reflects what you have done? Question 8 The primary risk associated with high quality, short-term securities, such as U.S. T-bills, is O Purchasing power risk Liquidity risk Short risk Default risk Interest rate risk Question 9 mnany's honds dropped from A to BBB. What Question 9 3 pt Suppose that tomorrow the rating on your company's bonds dropped from A to BBB. What would you expect to happen to bond's price? It should drop It should remain unchanged It will change, but it is unclear whether it will increase or decrease. It should increase Bond ratings have nothing to do with prices. Question 10 the required return is less than the coupon rate, a bond will sell at Question 10 If the required return is less than the coupon rate, a bond will sell at O a premium. O a discount. par. yield-to-maturity. book value. Question 11 Inod originally planned to give you $1 million in the year 2030. He is thinking of por urrent yalue of your expected payment Question 11 Your father had originally planned to give you $1 million in the year 2030. He is thinking of postponing the same $1 million payment until 2040. If he does delay the payment, the present value of your expected payment will o be lower stay the same be higher O be indeterminate - the time it takes to get payment has nothing to do with present values sometimes be higher and sometimes be lower Question 12 What would you expect to happen to the price of a bond if market interest rates suddenly increased? It would go to $0 D Question 12 What would you expect to happen to the price of a bond if market interest rates suddenly increased? It would go to $0 There is no way to predict what would happen Nothing It would go up It would drop It would drop Question 13 The term structure of interest rates (yield curve) is based on the relationship between risk premiums and the real rate of return the nominal and real rates of return O time to maturity and yield-to-maturity yield-to-maturity and the real rate of return nominal rates and risk premiums nominal rates and risk premiurns D Question 14 If you accept the pure expectations theory, yield curve reflects lower expected future rates of interest. A linear An upward sloping Aflat None of the above. Shape of the yield curve is not related to interest rate expectations. A downward-sloping Question 15 Question 15 Your bank account pays an 8% nominal rate of interest. The interest is compounded quarterly. Which of the following statements is CORRECT? O The periodic rate of interest is 8% and the effective rate of interest is greater than 8%. The periodic rate of interest is 2% and the effective rate of interest is 4%. The periodic rate of interest is 2% and the effective rate of interest is greater than 8%. O The periodic rate of interest is 2% and the effective rate of interest is 8%. The periodic rate of interest is 4% and the effective rate of interest is less than 8%. Question 16 The call feature of bandlimuams that the Question 16 The call feature of a bond means that the issuer can require investors to sell the bond back to the company prior to its maturity date. issuers provide a phone line for information updates on the bond. issuer can require investors to sell the bond back to the company only within three years of issuance. O investor can demand to be paid the bond's face value at any time. investor can demand to be paid the bond's face value if the bond default's. O stian17 Question 17 3 pt You have a $1000 par value bond with a 12% coupon rate. The issue pays interest annually and has 10 years remaining to its maturity date. If bonds of similar risk are currently earning 8 percent, the firm's bond will sell for today. $805.20 $851.50 $1,268.20 $1,000 $1.120.00 Question 18 Which of the following statements regarding a 30-year monthly payment mortgage loan with an interest rate of 109 CORRECT? Question 18 Which of the following statements regarding a 30-year monthly payment mortgage loan with an interest rate of 10% is CORRECT? The total dollar amount of interest being paid each month gets larger as the loan approaches maturity The amount representing interest in the first payment would be higher if the interest rate was 7% rather than 10%. The monthly payments will increase over time. Exactly 10% of the first monthly payment represents interest. A larger proportion of the first monthly payment will be interest, and a smaller proportion will be principal, than for the last monthly payment Question 19 The nightly business report says that the market now expects higher inflation levels. This would likely lead to market inter rates that u Uest monthly Question 19 3 pts The nightly business report says that the market now expects higher inflation levels. This would likely lead to market interest rates that e unpredictable since inflation has nothing to do with interest rates. fall. rise. e will either rise or fall depending on the season. o remain unchanged. Question 20 The market prices of outstanding bond issues often vary from par (face value) because the coupon rate has changed. None of the above -- market price is always equal to par. O old bonds sell for less than new bonds. the market rate of interest has changed. the maturity date has changed. the maturity date has changed. Question 21 Your investment in the stock market earned 9% over the past year, but average prices for the period went up 3.5%. T-bills earned 5.3% during this same time. What was your real rate of return on your investment? Use the precise method here. (Show your work. Give your answer to 2 decimal places. Show the unit of measure -- $s, pounds, etc.) BIVA - AIEE 3 1 1 * *, EE - V G T 12pt Paragraph O words Question 22 4 p Argo Industries has issued a bond which has a $1,000 par value and a 15 percent annual coupon interest rate. The bond will mature in ten years and currently sells for $1,250. The expected return on the stock market is 10%. What is the bond's yield- to-maturity? (Show your answer to 2 decimal places. Show the appropriate unit of measure - i.e. $. pound, etc.) BI y A - A - I E331 . * , ! E 3. XV G T 12pt Paragraph O words Question 23 4 pts Let's suppose that you believe in the Pure Expectations Theory regarding the yield curve. Looking at today's Wall Street Journal, you see that a Treasury security with one year left until maturity is yielding 5% and a Treasury security with two years until maturity is yielding 6%. Based on this, what do you think the approximate yield will be on one year securities one year from now? You do not need to use the precise calculation here, but you may if you want. (Show your work. Give your answer to 2 decimal places. Show the unit of measure -- $s, pounds, etc.) BIVA - AI E 3 1x XEE Question 24 Your cousin Vinnie has agreed to lend you $3,000 to tide you over for the semester. He has said that you can pay $500 a month for the next 4 years. What interest rate is Vinnie charging? (Show your work or calculator input. G answer to 2 decimal places. Show the unit of measure -- $s, pounds, etc.) BIU A - A - IX E 31 11 x x - Vx G T 12pt Paragraph O wor Question 25 You already have $9,500 invested in your account and you plan to make 10 additional annual deposits of $7,000 each. You expect to earn 8% per year. The first deposit will be made one year from today. How much money would you have in the account after the last deposit? (Show your work or calculator input. Give your answer to 2 decimal places. Show the unit of measure -- $s, pounds, etc.) BIA - AI E 2 1 1, EE 1. V c s 12pt - Paragraph . IP O words Question 26 4 pts Today is January 1, 2101. You are expecting to receive $500 on December 31, 2101, $600 on December 31, 2102, and $700 on December 31, 2103. Your cousin offers to buy the rights to these cash flows today. Assuming the appropriate discount rate is 7%, what is the lowest amount you would be willing to take? Wait, don't calculate this - just show the formula set up with the precise numbers we would need to solve this problem. I am NOT looking for financial calculator input here. (That means putting something like NPV) will get no credit.) Be sure to use ()s where needed. BIVA - A - IEE311 XX, O words Question 27 4 pts You plan to buy a new auto with a 5-year, $15,000 loan at an interest rate of 6.25%. What will the monthly payment on your loan be? (Show your work or calculator input. Give your answer to 2 decimal places.) BIVA -A- IE3311XX, SE V G T 12pt - Paragraph - O words Question 28 4 pts You put $500 into an investment account that offers a competitive annual rate of 7% compounded quarterly. How much will you have in your account after six years? (Show your work or calculator input. Give your answer to 2 decimal places. Show the unit of measure -- $s, pounds, etc.) BIVA - AI E E 3 11 **, SE - V C T 12pt - Paragraph - O words Question 29 You received word of a great investment on which you would earn 9% per year. How long would it take to triple your money? (Show your work or calculator Input. Give your answer to 2 decimal places. Show the unit of measure -- $s, pounds, etc.) BIUAA. IE E 3 1 1 x x ! E 2. ?V G 12pt Paragraph Question 30 4 pts You plan to retire in 30 years, and you want to have $1 million at that time. How much must you put into an account at the end of each of the next 20 years to be able to meet your goal assuming you are expecting to earn 9% per year? Note: You only want to make contributions for 20 years, so no contributions will be made to your account in the 10 years immediately preceding your retirement. (Show your work or calculator input. Give your answer to 2 decimal places. Show the unit of measure -- Ss. pounds, etc.) BIU A - A - I E = 1 1 xx, EE 12V G T 12pt - Paragraph Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

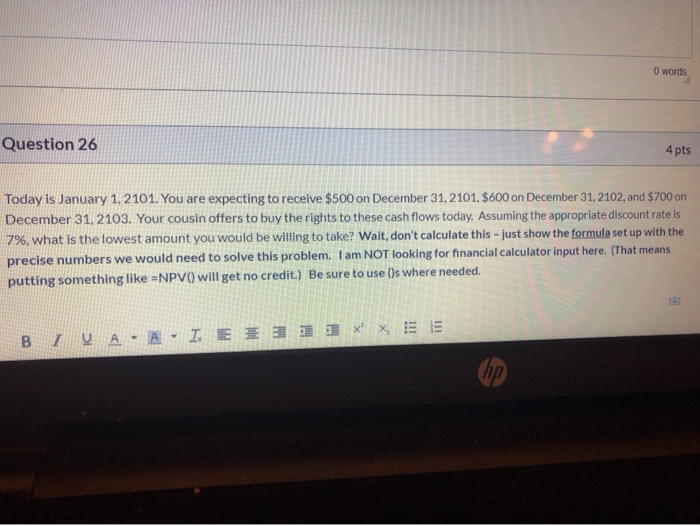

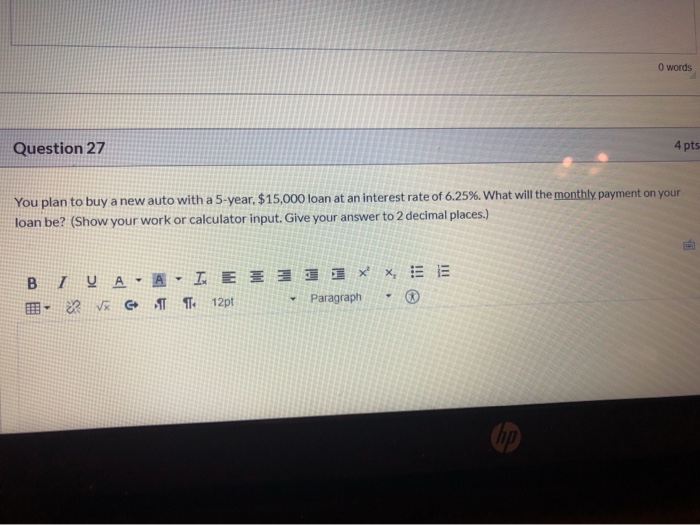

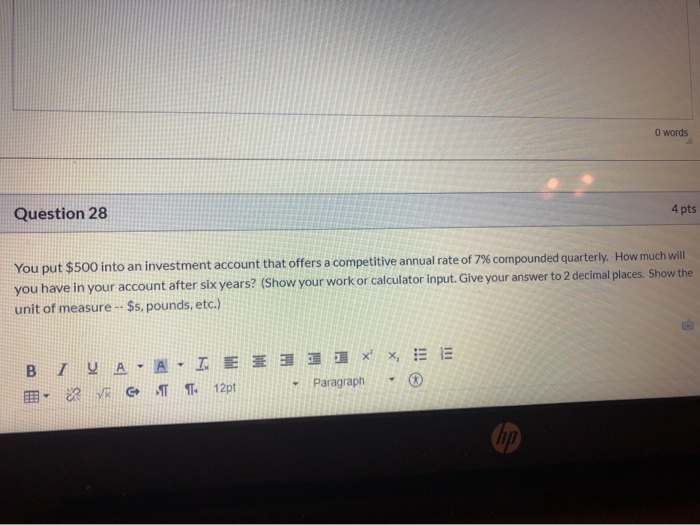

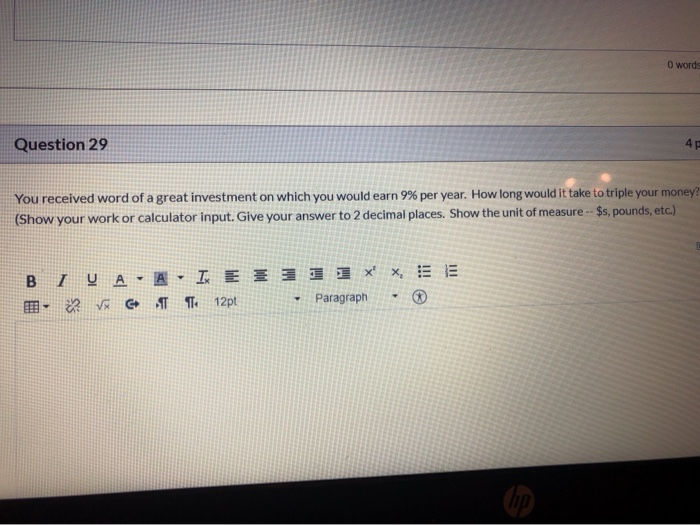

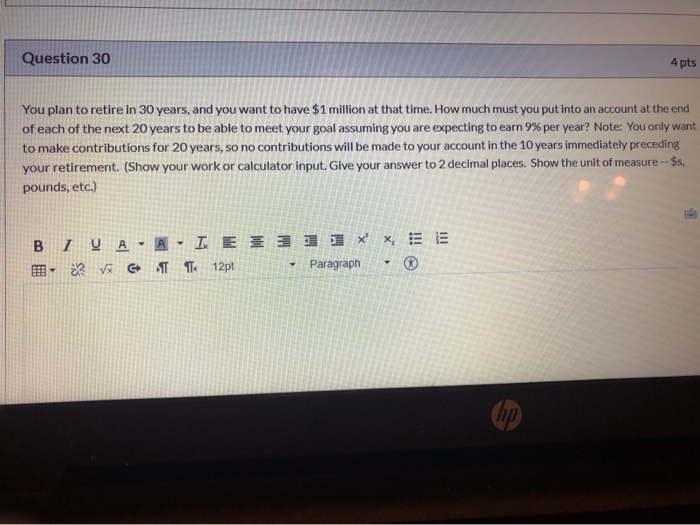

Get Started