Homework help

Topic is Nike

Please

Controlling - Evaluation

I got the last 2 annual financial statement

Here are the questions

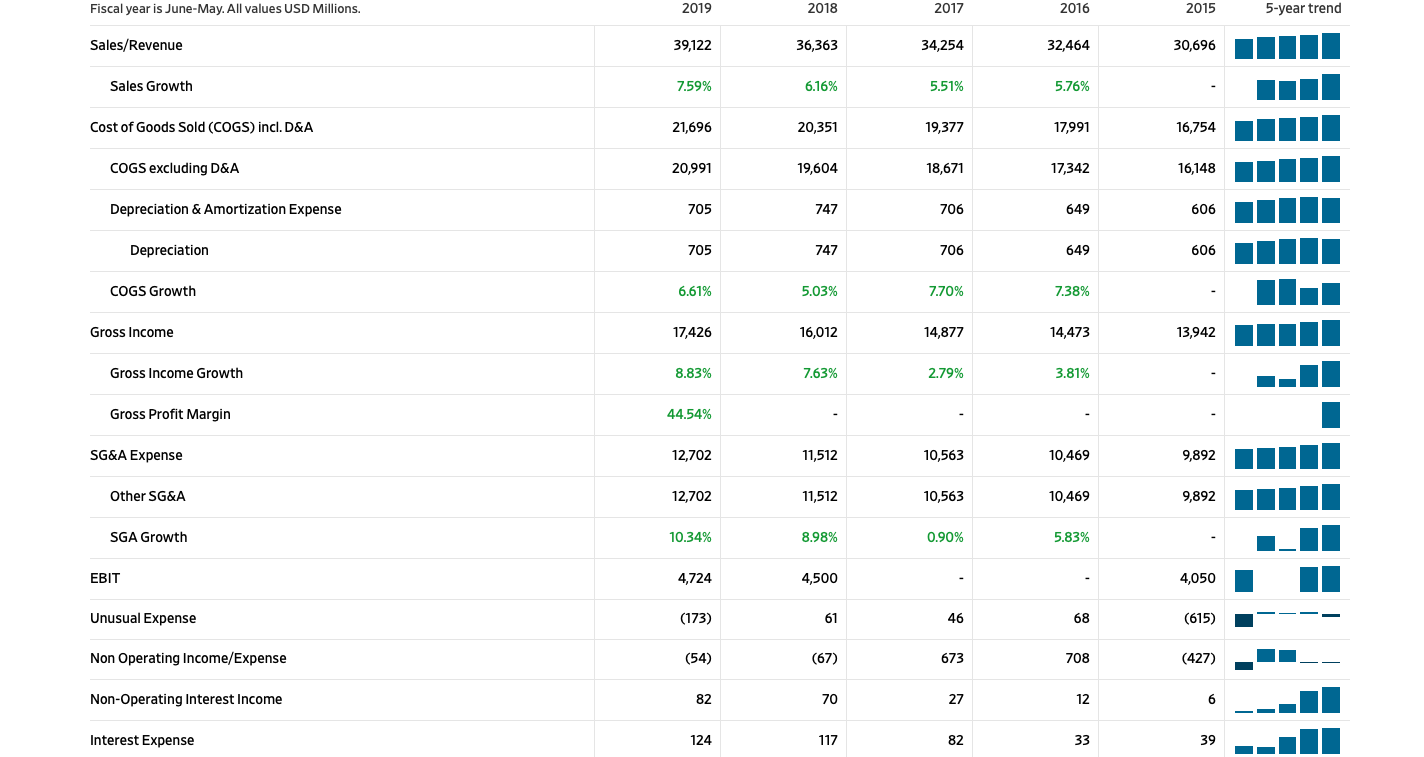

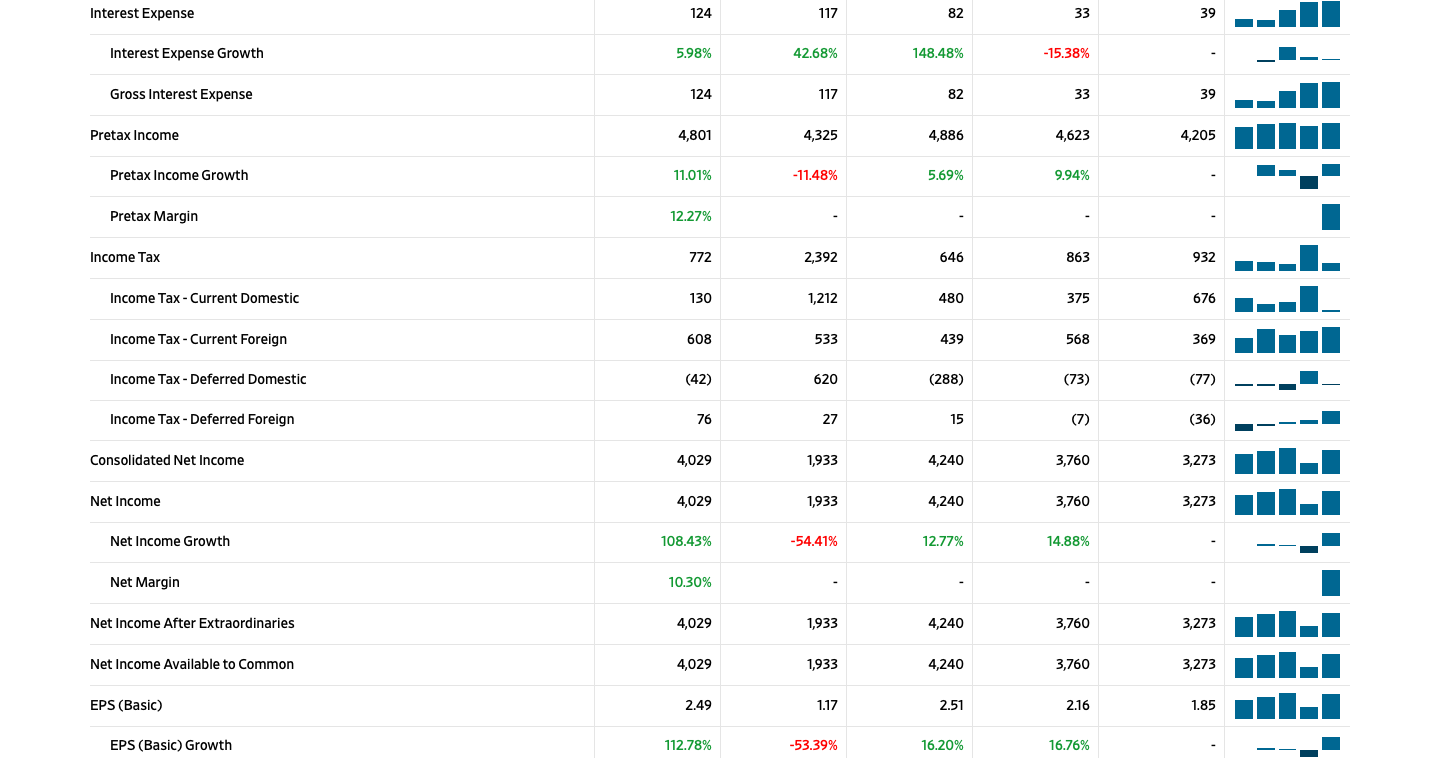

1. discuss profitability trends (sales, gross profit, net profit).

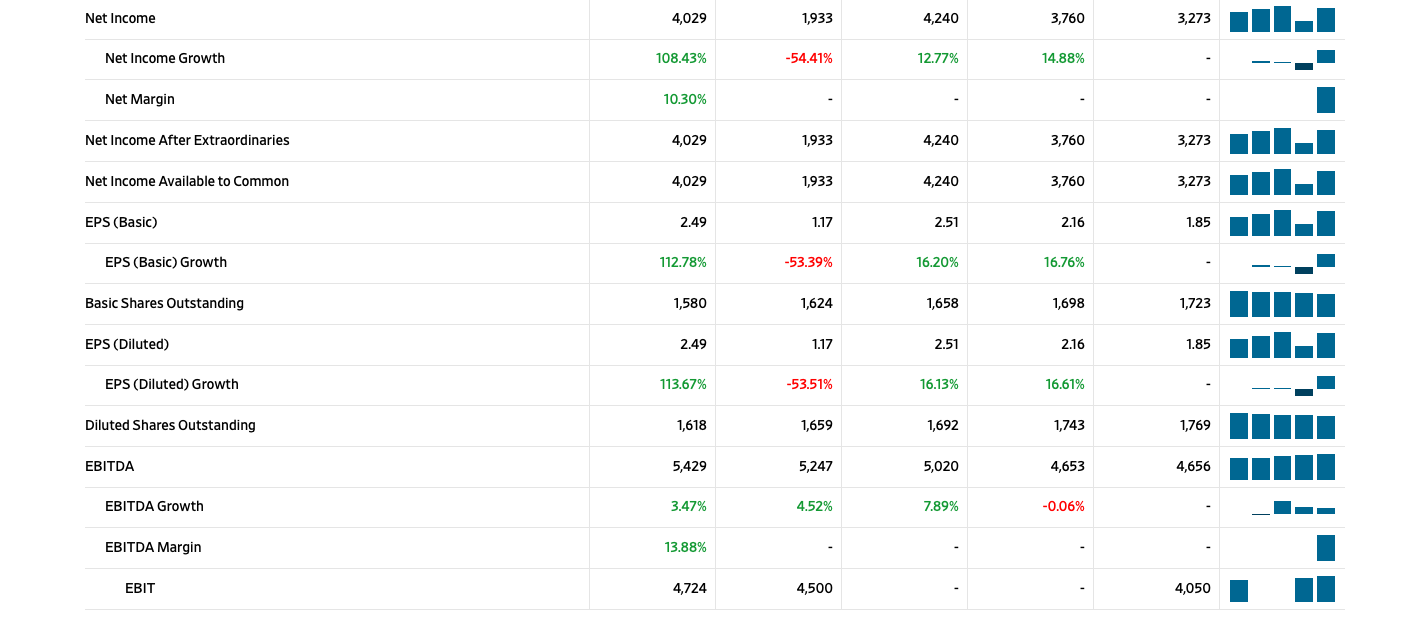

2. Calculate 3 liquidity ratios, Debt to Equity Ratio, GP Ratio, and

Net Profit ratio for three consecutive years, show graphically and discuss trends and insights.

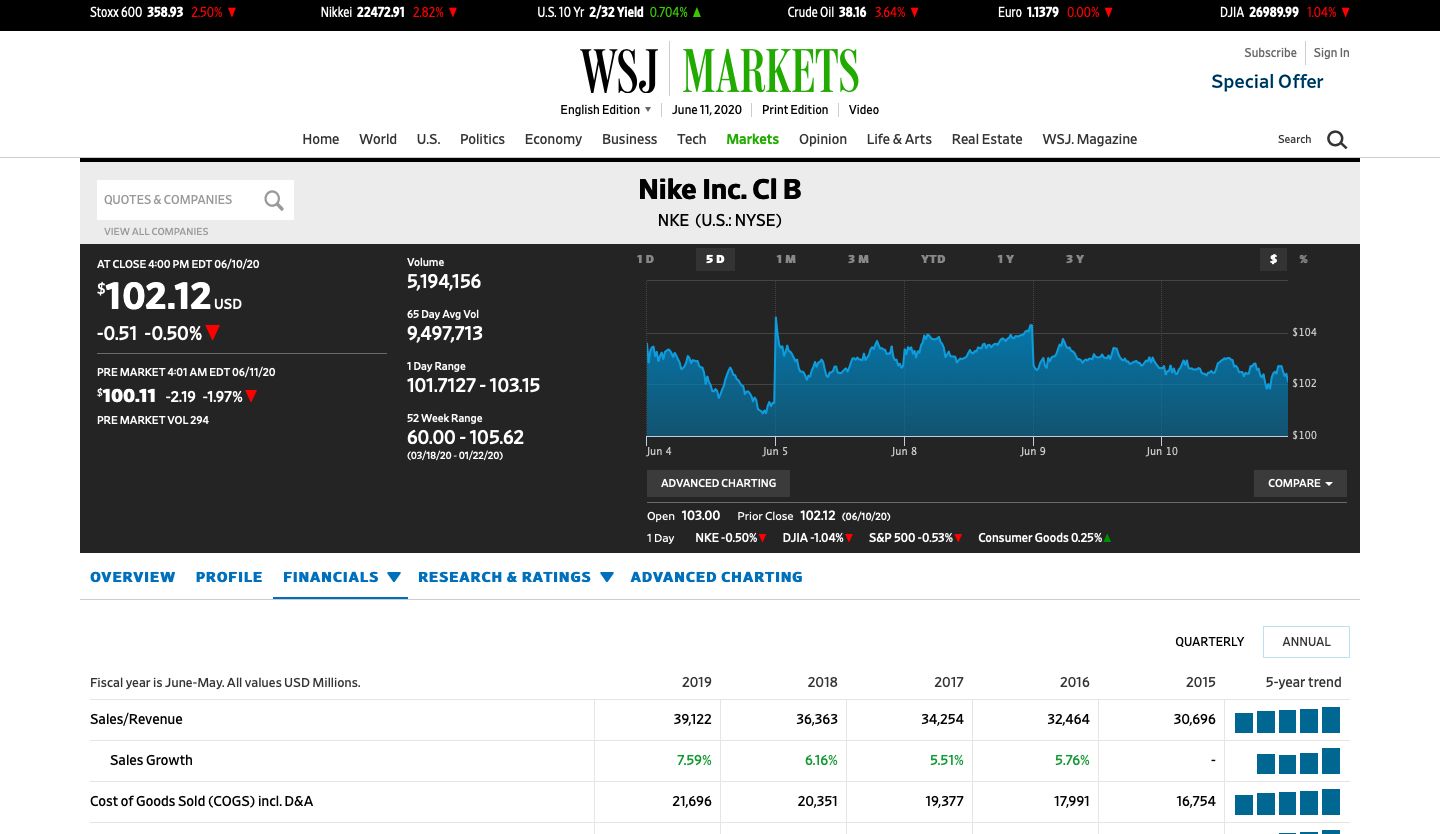

Stoxx 600 358.93 2.50% V Nikkei 22472.91 2.82% V U.S. 10 Yr 2/32 Yield 0.704% Crude Oil 38.16 3.64% V Euro 1.1379 0.00% V DJIA 26989.99 1.04% V WSJ MARKETS Subscribe Sign In Special Offer English Edition * June 11, 2020 Print Edition Video Home World U.S. Politics Economy Business Tech Markets Opinion Life & Arts Real Estate WSJ. Magazine Search Q QUOTES & COMPANIES Q Nike Inc. CI B VIEW ALL COMPANIES NKE (U.S.: NYSE) AT CLOSE 4:00 PM EDT 06/10/20 Volume 1 D 5D 1 M 3 M YTD 1Y 3 Y $102.12 USD 5,194,156 65 Day Avg Vol -0.51 -0.50% V 9,497,713 $104 PRE MARKET 4:01 AM EDT 06/11/20 1 Day Range $100.11 -2.19 -1.97% V 101.7127 - 103.15 $ 102 PRE MARKET VOL 294 52 Week Range 60.00 - 105.62 $ 100 (03/18/20 - 01/22/20) Jun 4 Jun 5 Jun 8 Jun 9 Jun 10 ADVANCED CHARTING COMPARE Open 103.00 Prior Close 102.12 (06/10/20) 1 Day NKE-0.50% V DJIA-1.04% Y S&P 500-0.53% Y Consumer Goods 0.25% A OVERVIEW PROFILE FINANCIALS V RESEARCH & RATINGS " ADVANCED CHARTING QUARTERLY ANNUAL Fiscal year is June-May. All values USD Millions. 2019 2018 2017 2016 2015 5-year trend Sales/Revenue 39,122 36,363 34,254 32,464 30,696 Sales Growth 7.59% 6.16% 5.51% 5.76% Cost of Goods Sold (COGS) incl. D&A 21,696 20,351 19,377 17,991 16,754Fiscal year is June-May. All values USD Millions. 2019 2018 2017 2016 2015 5-year trend Sales/Revenue 39,122 36,363 34,254 32,464 30,696 Sales Growth 7.59% 6.16% 5.51% 5.76% Cost of Goods Sold (COGS) incl. D&A 21,696 20,351 19,377 17,991 16,754 COGS excluding D&A 20,991 19,604 18,671 17,342 16,148 Depreciation & Amortization Expense 705 747 706 649 606 Depreciation 705 747 706 649 606 COGS Growth 6.61% 5.03% 7.70% 7.38% Gross Income 17,426 16,012 14,877 14,473 13,942 Gross Income Growth 8.83% 7.63% 2.79% 3.81% Gross Profit Margin 44.54% SG&A Expense 12,702 11,512 10,563 10,469 9,892 Other SG&A 12,702 11,512 10,563 10,469 9,892 SGA Growth 10.34% 8.98% 0.90% 5.83% EBIT 4,724 4,500 4,050 Unusual Expense (173) 61 46 68 (615) Non Operating Income/Expense (54) (67) 673 708 (427) Non-Operating Interest Income 82 70 27 12 6 Interest Expense 124 117 82 33 39Interest Expense 124 117 82 33 39 Interest Expense Growth 5.98% 42.68% 148.48% -15.38% Gross Interest Expense 124 117 82 33 39 Pretax Income 4,801 4,325 4,886 4,623 4,205 Pretax Income Growth 11.01% -11.48% 5.69% 9.94% Pretax Margin 12.27% Income Tax 772 2,392 646 863 932 Income Tax - Current Domestic 130 1,212 480 375 676 Income Tax - Current Foreign 608 533 439 568 369 Income Tax - Deferred Domestic (42) 520 (288) (73) (77) Income Tax - Deferred Foreign 76 27 15 (7) (36) Consolidated Net Income 4,029 1,933 4,240 3,760 3,273 Net Income 4,029 1,933 4,240 3,760 3,273 Net Income Growth 108.43% -54.41% 12.77% 14.88% Net Margin 10.30% Net Income After Extraordinaries 4,029 1,933 4,240 3,760 3,273 Net Income Available to Common 4,029 1,933 4,240 3,760 3,273 EPS (Basic) 2.49 1.17 2.51 2.16 1.85 EPS (Basic) Growth 112.78% -53.39% 16.20% 16.76%Net Income 4,029 1,933 4,240 3,760 3,273 Net Income Growth 108.43% -54.41% 12.77% 14.88% Net Margin 10.30% Net Income After Extraordinaries 4,029 1,933 4,240 3,760 3,273 Net Income Available to Common 4,029 1,933 4,240 3,760 3,273 EPS (Basic) 2.49 1.17 2.51 2.16 1.85 EPS (Basic) Growth 112.78% -53.39% 16.20% 16.76% Basic Shares Outstanding 1,580 1,624 1,658 1,698 1,723 EPS (Diluted) 2.49 1.17 2.51 2.16 1.85 EPS (Diluted) Growth 113.67% -53.51% 16.13% 16.61% Diluted Shares Outstanding 1,618 1,659 1,692 1,743 1,769 EBITDA 5,429 5,247 5,020 4,653 4,656 EBITDA Growth 3.47% 4.52% 7.89% -0.06% EBITDA Margin 13.88% EBIT 4,724 4,500 4,050