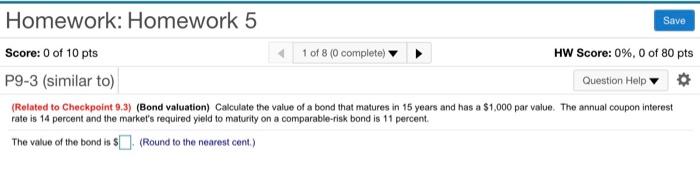

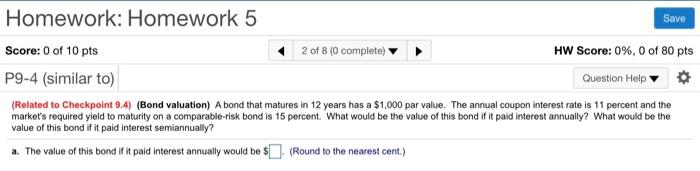

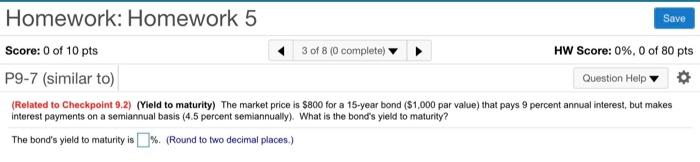

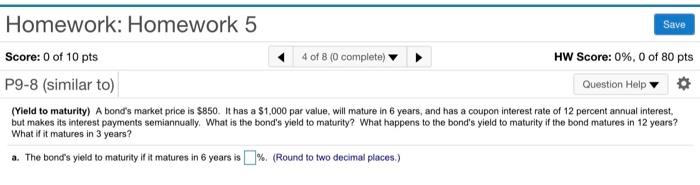

Homework: Homework 5 Save Score: 0 of 10 pts 1 of 8 (0 complete) HW Score: 0%, 0 of 80 pts P9-3 (similar to) Question Help (Related to Checkpoint 9.3) (Bond valuation) Calculate the value of a bond that matures in 15 years and has a $1,000 par value. The annual coupon interest rate is 14 percent and the market's required yield to maturity on a comparable-risk bond is 11 percent The value of the bond is $. (Round to the nearest cent) Homework: Homework 5 Save Score: 0 of 10 pts 2 of 8 (0 complete) HW Score: 0%, 0 of 80 pts P9-4 (similar to) Question Help (Related to Checkpoint 9.4) (Bond valuation) A bond that matures in 12 years has a $1,000 par value. The annual coupon interest rate is 11 percent and the market's required yield to maturity on a comparable-risk bond is 15 percent. What would be the value of this bond if it paid interest annually? What would be the value of this bond if it paid interest semiannually? a. The value of this bond if it paid interest annually would be $ . (Round to the nearest cent.) Homework: Homework 5 Save Score: 0 of 10 pts 3 of 8 (0 complete) HW Score: 0%, 0 of 80 pts Question Help P9-7 (similar to) (Related to Checkpoint 9.2) (Yield to maturity) The market price is $800 for a 15-year bond ($1,000 par value) that pays 9 percent annual interest, but makes interest payments on a semiannual basis (4.5 percent semiannually). What is the bond's yield to maturity? The bond's yield to maturity is % (Round to two decimal places.) Homework: Homework 5 Save Score: 0 of 10 pts 4 of 8 (0 complete) HW Score: 0%, 0 of 80 pts P9-8 (similar to) Question Help (Yield to maturity) A bond's market price is $850. It has a $1,000 par value, will mature in 6 years, and has a coupon interest rate of 12 percent annual interest, but makes its interest payments semiannually. What is the bond's yield to maturity? What happens to the bond's yield to maturity if the bond matures in 12 years? What if it matures in 3 years? a. The bond's yield to maturity if it matures in 6 years is 1% (Round to two decimal places.)