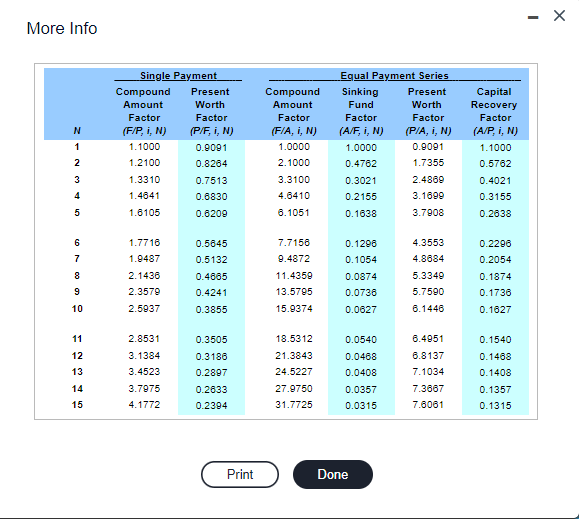

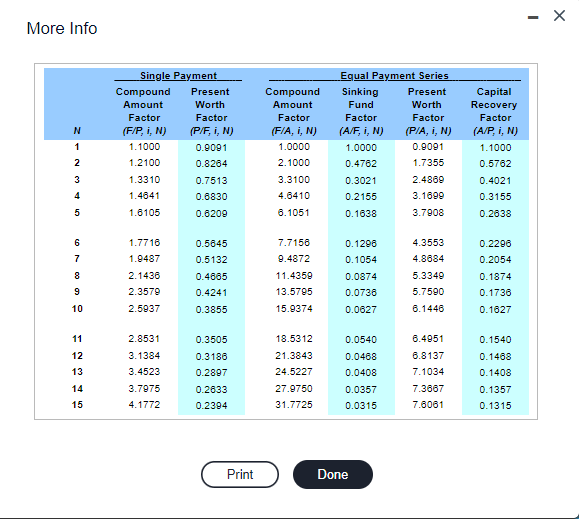

Homework: HW 10 - Chapter 12 A new asset is available for $250,000. O&M costs are $25,000 each year for the first five years, $30,000 in year six, $36,000 in year seven, and $42,000 in year eight. Salvage values are estimated to be $220,000 after one year and will decrease at the rate of 20% per year thereafter. At a MARR of 10%, determine the economic service life of the asset. Click the icon to view the interest factors for discrete compounding when MARR = 10% per year. The economic service life of the asset is Question 3, Problem 12-9 (algorithmic) > year(s) with an AEC value of S C HW Score: 33.33%, 1 of 3 points Points: 0 of 1 (Round to the nearest whole number.) {0} Save More Info N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Single Payment Compound Amount Factor (F/P, i, N) 1.1000 1.2100 1.3310 1.4641 1.6105 1.7716 1.9487 2.1436 2.3579 2.5937 2.8531 3.1384 3.4523 3.7975 4.1772 Present Worth Factor (P/F, i, N) 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4865 0.4241 0.3855 0.3505 0.3186 0.2897 0.2633 0.2394 Print Compound Amount Factor (F/A, i, N) 1.0000 2.1000 3.3100 4.6410 6.1051 7.7156 9.4872 11.4359 13.5795 15.9374 18.5312 21.3843 24.5227 27.9750 31.7725 Equal Payment Series Sinking Present Fund Worth Factor (A/F, i, N) 1.0000 0.4762 0.3021 0.2155 0.1638 0.1296 0.1054 0.0874 0.0738 0.0627 0.0540 0.0468 0.0408 0.0357 0.0315 Done Factor (P/A, i, N) 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 6.4951 6.8137 7.1034 7.3667 7.6061 Capital Recovery Factor (A/P, i, N) 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 X Homework: HW 10 - Chapter 12 A new asset is available for $250,000. O&M costs are $25,000 each year for the first five years, $30,000 in year six, $36,000 in year seven, and $42,000 in year eight. Salvage values are estimated to be $220,000 after one year and will decrease at the rate of 20% per year thereafter. At a MARR of 10%, determine the economic service life of the asset. Click the icon to view the interest factors for discrete compounding when MARR = 10% per year. The economic service life of the asset is Question 3, Problem 12-9 (algorithmic) > year(s) with an AEC value of S C HW Score: 33.33%, 1 of 3 points Points: 0 of 1 (Round to the nearest whole number.) {0} Save More Info N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Single Payment Compound Amount Factor (F/P, i, N) 1.1000 1.2100 1.3310 1.4641 1.6105 1.7716 1.9487 2.1436 2.3579 2.5937 2.8531 3.1384 3.4523 3.7975 4.1772 Present Worth Factor (P/F, i, N) 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4865 0.4241 0.3855 0.3505 0.3186 0.2897 0.2633 0.2394 Print Compound Amount Factor (F/A, i, N) 1.0000 2.1000 3.3100 4.6410 6.1051 7.7156 9.4872 11.4359 13.5795 15.9374 18.5312 21.3843 24.5227 27.9750 31.7725 Equal Payment Series Sinking Present Fund Worth Factor (A/F, i, N) 1.0000 0.4762 0.3021 0.2155 0.1638 0.1296 0.1054 0.0874 0.0738 0.0627 0.0540 0.0468 0.0408 0.0357 0.0315 Done Factor (P/A, i, N) 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 6.4951 6.8137 7.1034 7.3667 7.6061 Capital Recovery Factor (A/P, i, N) 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 X