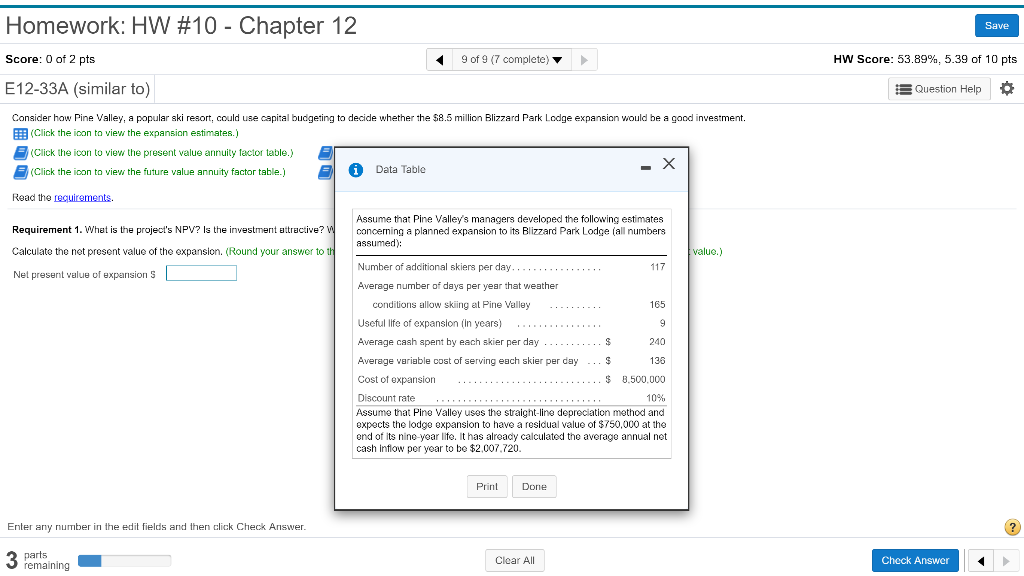

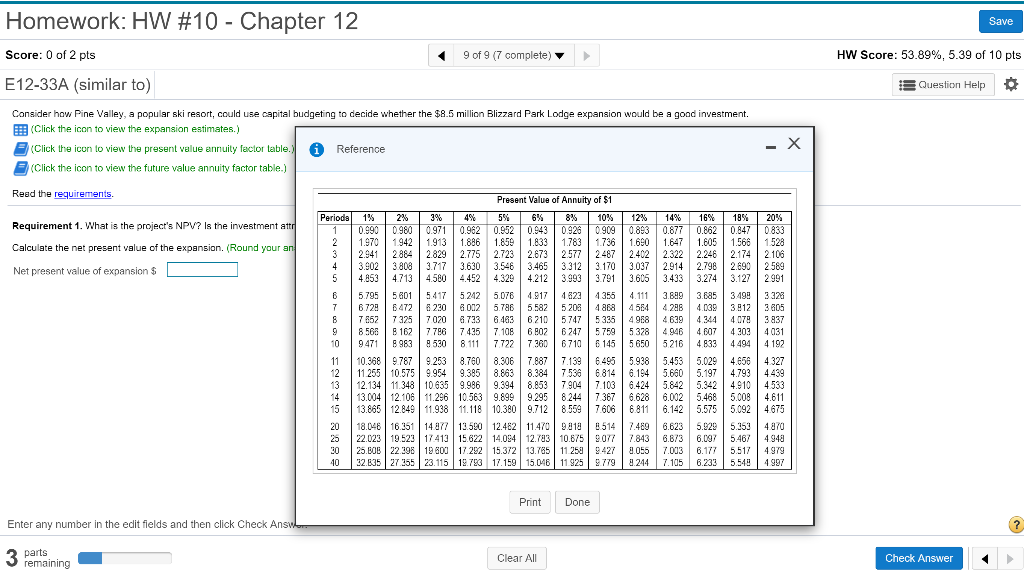

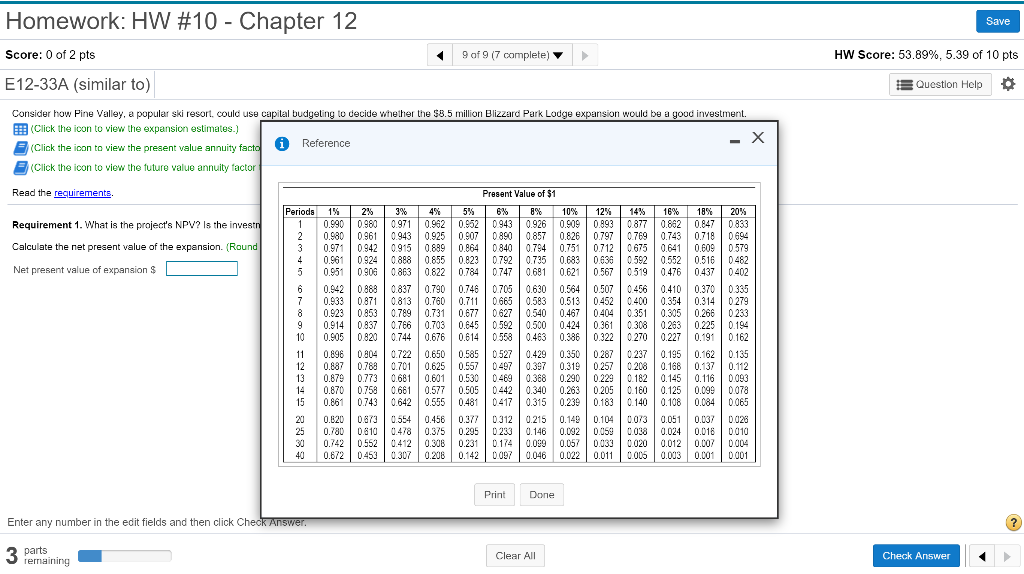

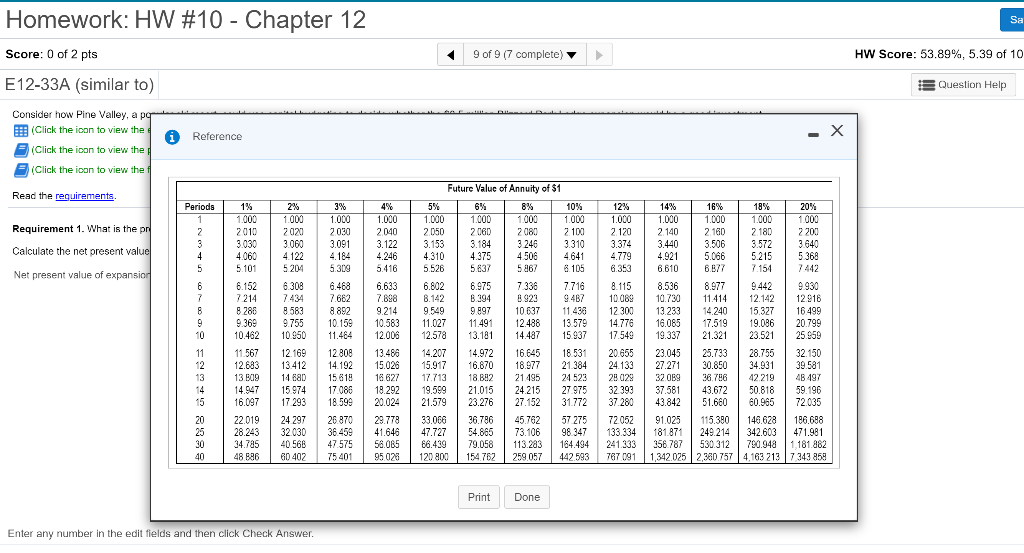

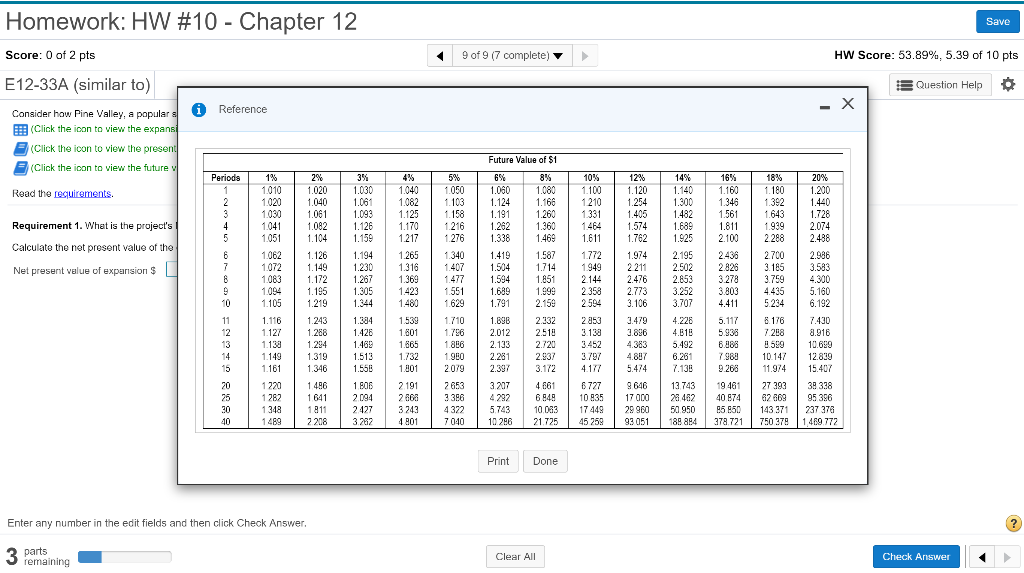

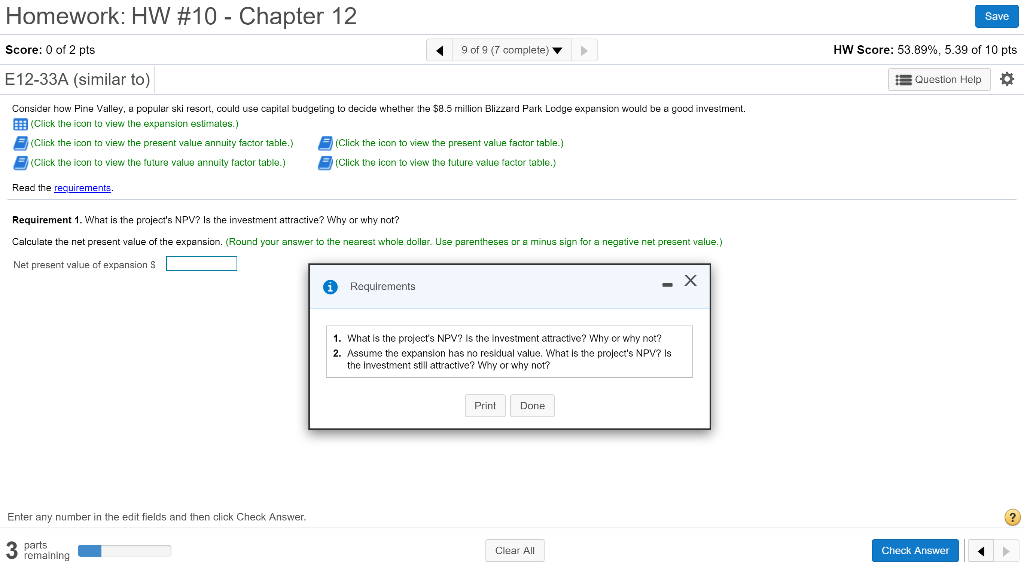

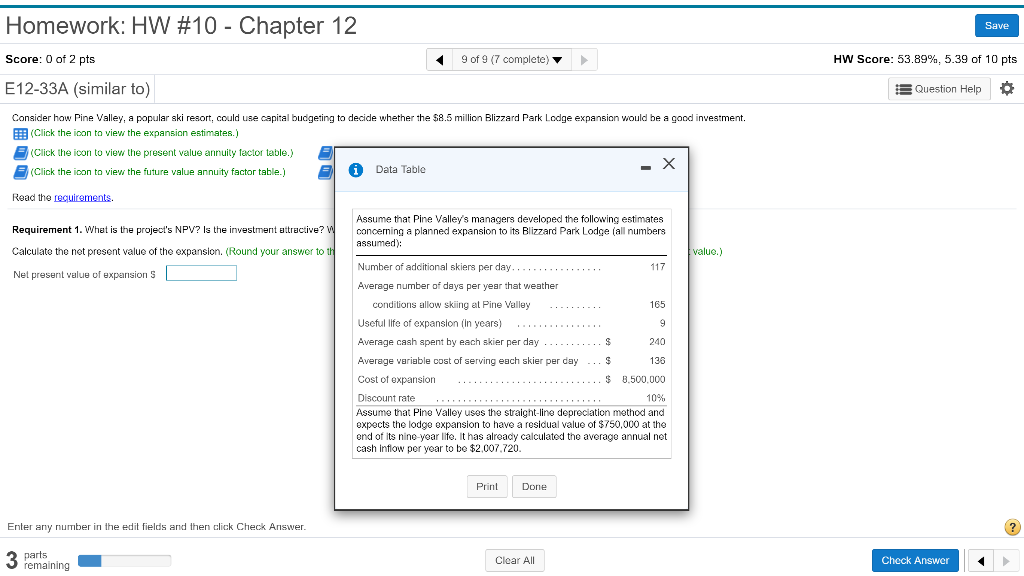

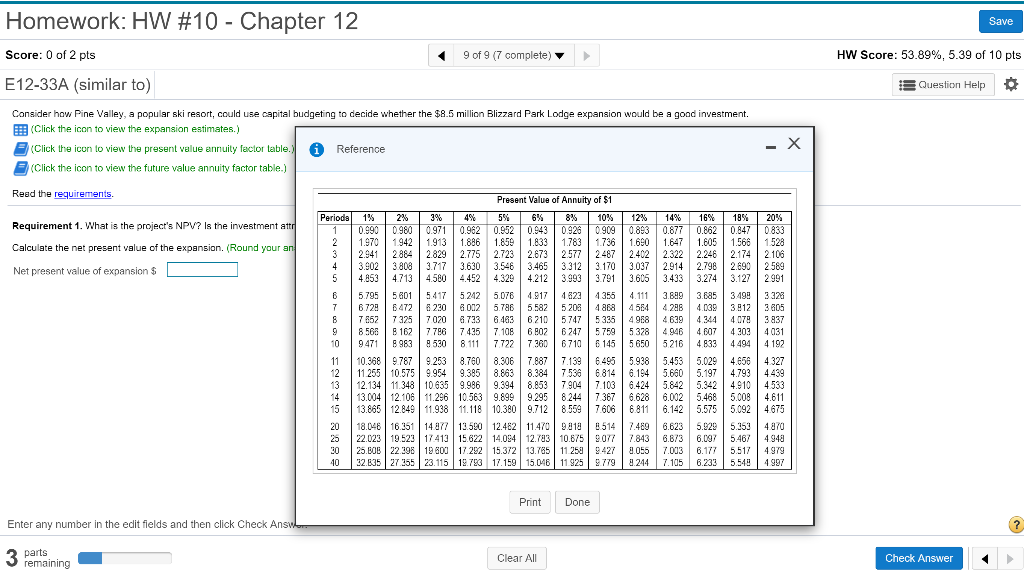

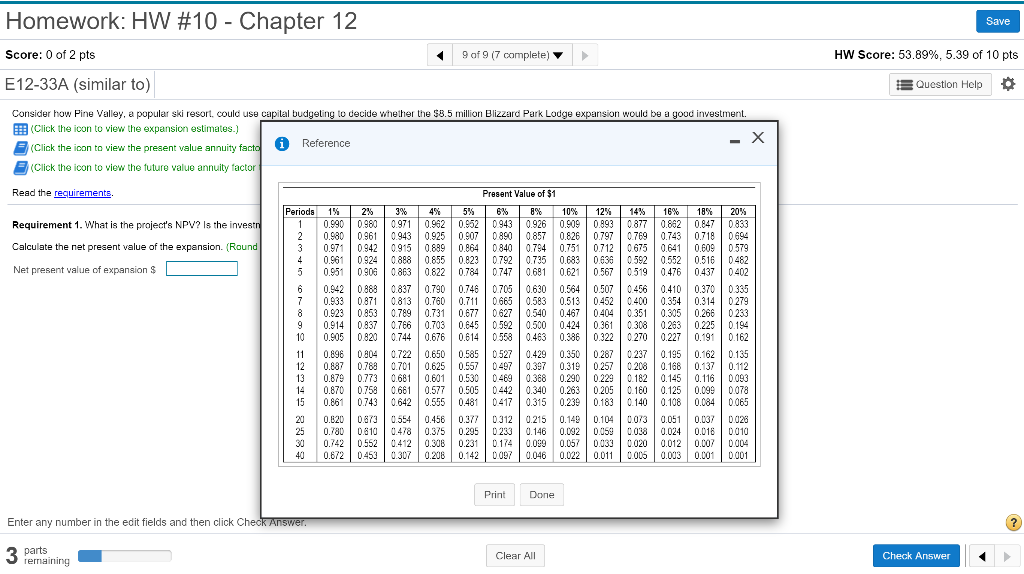

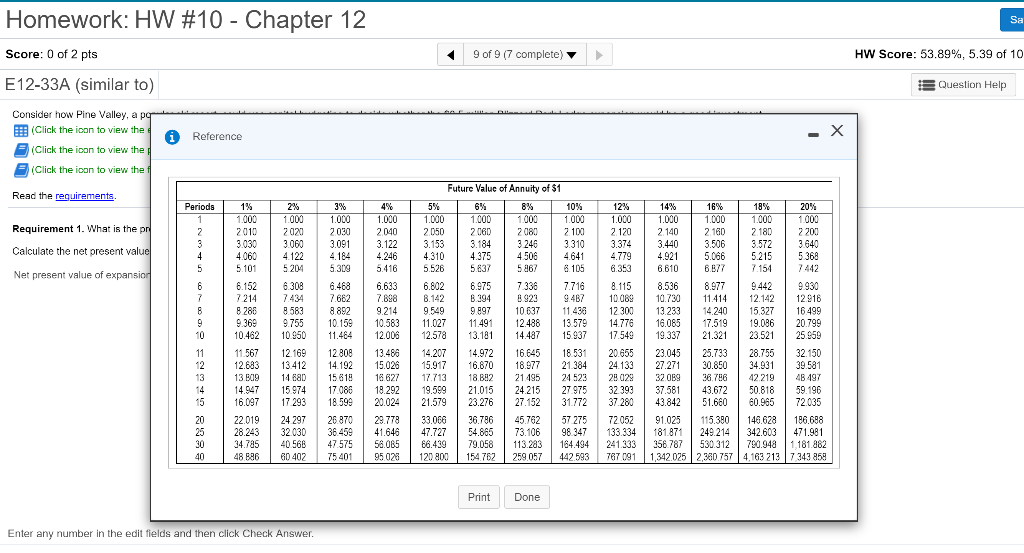

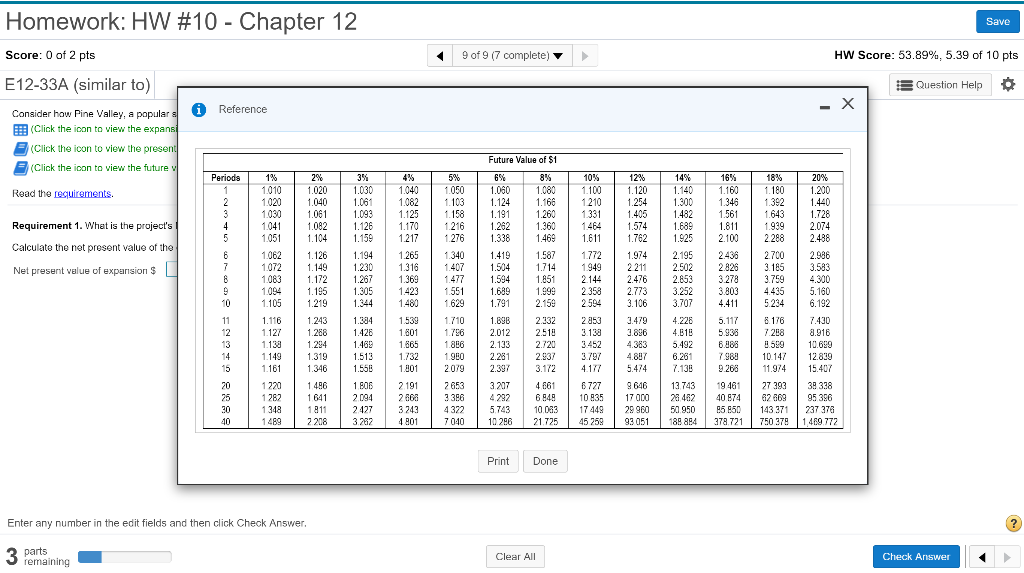

Homework: HW #10-Chapter 12 Score: 0 of 2 pts E12-33A (similar to) Save 49 of 9 (7 complete)> HW Score: 53.89%. 5.39 of 10 pts EQuestion Help Consider how Pine Valley. opular skl resort, could use capital budgeting o decide whether he $8.5 milion Blizzard Park Lodge expansion would be (Click the icon to view the expansion estimates.) good investment (Click the icon to view the present value annuity factor table.) Click the icon to view the future value annuity factor table. (Click the icon to view the future value factor table.) Click the icon to view the present valuefacto table.) Read the requirements. Requirement 1. What is the project's NPV? Is the investment attractive? Why or why not? Calculate the net present value of the expansion. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) Net present value of expansion S Requirements 1. What is the project's NPV? Is the investment attractive? Why or wny not? 2. Assume the expanslon has no resldual value. What ls the project's NPV? Is the investment stll attractive? Why or why not? Print Done Enter any number in the edit fields and then click Check Answer Clear All Check Answe Homework: HW #10-Chapter 12 Save Score: 0 of 2 pts 9of 9 (7 complete) HW Score: 53.89%: 5.39 of 10 pts EQuestion Help E12-33AG milar to) Consider how Pine Valley, a popular ski resort, could use capital budgeting to decide whether the $8.5 million Blizzard Park Lodge expansion would be a good investment. EEB (Click the icon to view the expansion estimates.) (Click the icon to view the present value annuity factor table.) (Click the ioon to view the future value annuity factor table. i Data Table Read the requirements. Assume that Pine Valley's managers developed the following estimates concerning a planned expansion to its Blizzard Park Lodge (all numbers assumed Requirement 1. What is the project's NPV? Is the investment tractive? Calculate the net prosent value of the expansion. Round your answer to Nel presernt value of expansion S alue.) Number of adcitional skiers per day Average e number of days per year hat weather 165 condilions allow skiing at Pine Valley Useful life of expanslon (in years) Average cash spent by each skier per day Average 240 133 $8.500,000 10% variable cost of serving e ach skier per day Cost of expansion Discount rate Assume that Pine Valley uses the straight-line depreciation method anc expects the lodge expansion to have a resicual value of $750,000 at the ond of its nine-year life. It has already calculated the average annual net cash infow per year to be $2,007,720. Done Print Enter r any number in the edit fields and then click Check Answer Cloar All Check Answer remaining Homework: HW #10-Chapter 12 Score: 0 of 2 pts E12-33A (similar to) Save HW Score: 53.89%, 5.39 of 10 pts 9 of 9 (7 complete) E Question Help Consider how Pine Valley, a popular ski resort, could use capital budgeting to decide whether the $8.5 million Blizzard Park Lodge expansion would be a goad investment. (Click the icon to view the expansion estimates.) Click the icon to view the present value annuity factor table Reference Click the icon to view the future value annuity factor table) Read the requirements Requirement 1. What is the project's NPV? Is the investment att Calculate the net present value of the expansion. (Round your a Net present value of expansion Present Value of Annuity of $1 Perioda 1% 18% | 20% 0.971 092 0.952 0.943 092 0909 0.83 0.877 0.8620.8470833 2 1.9719421.913 1.886 1.859 1833 17831736 60 1647 1.605 1566 1.528 3 2.941288428292775 2.723 2.673 25772487 2402 2.322 2.246 2.174 2106 4 3.9023803.7173.630 3.546 3.465 33123170 3.037 2.914 2.7982.690 2589 5 4.853 47134.5804452 4329 4.212 39933791 3605 3.433 3.274 3.1272991 6 5.795 5801 5417 5.242 5.076 4.17 4823 355 .111 3.89 3.685 349 3328 7 6726472 230 02 5.786 5582 520 4868 454.288 4.03 312 3805 8 7852 7325 7020733 643 62105747 5335 4958 4639 4344079 3837 9 85B162 77867435 7108 R06247 5759 5328 4946 4607 404031 10 9471 B9839520 811177273606710 145 5650 5216 48334494 4192 11 10.368 9787 9.253 8.7608.307.887 7.1336495 5.938 5.4535.0294.656 4327 12 1125 10.575 9.954 9.385 8.863 8.384 7536814 6.194 5.6605.197 4.793 4439 13 12.134 11.348 10635 9.986 9.394 8.8539047.1036.424 5.842 5.342414533 14 | 13.004 | 12.106 | 11.296| 10.563 9.899 | 9295 | 8244 | 7367 | 6.628 | 6.002 | 5.468 5,008 | 4.611 15 13.865 12.849 11.938 11.118 10.380 9.71285597.6066811 6.1425.5755.092 4675 20 | 18.046| 16.351 | 14877 | 135, 12.482| 11.47ul 9H18 | B514 | 7.489 | 6.623 | 5.229 | 5.353 | 487U 25 22.023| 19.523| 17413| 15622 14.084| 12.793| 10.875| 077 | 843 | 6.8/3 | 6.097 | 5.46/ | 4948 30 | 25.BOB | 22398 | 18800| 17.212 15.372| 13.785| 11258| 427 | 055 | 7.003 | 6.177 | 5.517 | 497g 40 | 32.635| 27355 | 23.115 | 153783 17.159 | 15.046| 11g25| 779 244 | 7.105 | 6233 | 5549 | 4g97 2% 0.990 0980 3% 4% 6% 8% | 10% | 12% 14% 16% Print Done Enter any number in the edit fields and then click Check A Clear All Check Answer remaining 1 Homework: HW #10-Chapter 12 Score: 0 of 2 pts E12-33A (similar to) Save HW Score: 53.89%, 5.39 of 10 pts 9 of 9 (7 complete) Question Help Consider how Pine Valley, a popular ski resort could use capital budgeting to decide whether the 8.5ion Blizzard Park Lodge expansion would be a good investment (Click the icon to view the expansion estimates.) (Click the icon to view the present value annuity Reference Click the icon to view the future value annuity factor Read the requirements. Present Value of $1 3% | 4% | 5% Periods 15 2% 6% 890 10% | 12% | 14% | 16% 18% | 20 0.990 0800.9710.9520.952 0943 0.926 0.909 0893 0877 082 0.847 0833 2 0.980 061943 0.925 0.907 0890 0.8570.8260.797 7690.743 0718 0694 3 0.971 0942 0.915 0.8890.86408400.74 0.751 0712 0675 0.641 0.6090579 4 0.9610924 0888 08550.823 07920.735 0683 063 0592 0.552 0.5160482 50.951 0900863 0.822 0784 07470680.6210567 519 0476 0437 0402 6 0.942 08880.837 0.790 0.746 0705 0.6300.540507 0456 0.410 0.370 0335 70.933 08710.813 0.760 0.711 0665 0.583 0513 0452 0400 0.354 0.314 0279 8 0.923 085307890.731 0677 062705400.467 0404 035 0.305 0.266 0233 9 0.914 0.8370766 0.703 0.645 0592 05000.424 0.361 0308 0.263 0.225 0.194 10 0.905 08200.744 0676 0614 0558 0463 0.3860.322 0270 0227 0.191 0.162 11 0.89 08040.7220.650 0.585 05270429 0.350 0.287 0237 0.195 0.1620.135 12 0.887 | 0788 | 0.701 | 0.625 | 0.557 | 0497 | 0.397 | 0.319 | 0.257 | 0206 | 0.168 | 0.137 | 0.112 13 0.879 07730.6810.601 0.530 04690.38 0.2900.229182 0.145 0.116 0093 14 0.870 0758 0.6610.5770.505 0442 0.340 0.263 0.2050.10 0.125 0.099 0078 15 0.861 0.743 0.642 0555 0481 0417 0.315 0.239 0.183 0140 0.108 0.084 0065 Requirement 1. What is the project's NPV? Is the in Calculate the net present value of the expansion. (Round Net present value of expansion $ 20 0.820 | 08/3 | 0.554 | 0.456 | 0.377 | 0312 | 0.215 | 0.149 | 0.104 | 0/3 | 0.051 | 0.033 | 0028 25 | 0.780 | 0 10 | .478 | 0.375 | 0.295 | 0233 | 0.146 | 0092 | 0.159 | 038 | 0.024 | 0.016 | 0010 31 | 0.742 | 0.552 | .412 | 0.3UB | 0.231 | 0174 | .029 | 0.057 | 0.133 | 020 | 0.012 | 0.007 | 0004 40 0.82 0453300.2080.142 00970.046 0.0220.011 O0 0.003 001 0001 Print Done Enter any number in the edit fields and then click C parts rermaining Clear All Check Answer Homework: HW #10-Chapter 12 Sa Score: 0 of 2 pts HW Score: 53.89%, 5.39 of 10 9 of 9 (7 complete) E 12-33A (similar to) Question Help Consider how Pine Valley, a p (Click the icon to view the Reference (Click the ioan to view the (Click the ioan to view the Future Value of Annuity of $1 Read the requirements 12% 1.000 16% 1000 8% 1.000 2010 | 202d | 2030 | 2040 | 2050 | 2060 | 2080 | 2100 | 2170 | 2140 | 2160 | 2180 | 2200 3.03030603093.1223.153 3.184 3246 3.310 3.374 3.4403.506 3.572 3640 4060 4.122 4184.246434375 450 4641 4.779 4921 5.066 52155368 5101 | 5204 | 530g | 5416 | 5526 | 5637 | 5867 | 105 | 6353 | 6610 | 6B77 | 7154 | 7442 1% 1000 4% 1.000 5% 1.000 6% 1.000 10% 1.000 14% 1.000 18% 1000 200% 1.000 1.000 .000 Requirement 1. What is the p Calculate the net present Net present value of ex 6.152 630864886.6336.802 6.975 7338 7.716 8.115 8.536 8.977 9442 9930 923 828 5838.892 9214 9549989706371143 12300 13.2334.24015.327 16499 9.369 975501590.583 11.027 1149112488 3579 14776 16.085 17.5199.086 20.799 10462 50 11.4841200 12.578 13.181 14.487 5 937 17.549 19.33721.32123.52125.59 214 7434 7.682 7.828 8.142 394 4B100 10.73 11.414 12.14212 16 11567 2169 28088614.20714.972 6.645 18531 20.655 23.045 25.73328.755 32.150 12.683 13412 14.1925.02615.917 16.870 18.977 21384 24.133 27.27130.85034.9339.581 13 B094 8151 162717 713 18.B221495 24523 280293209367642.219 4B497 4.947 597470882921.599 21.015 24.215 27975 32393 7.58 43.672 50818 59.196 12 13 15 16.097 17 293 18.59920.02421.57923.276 27.152 31772 37.280 43.842 51.680 60.96572035 20 22.01924 297 26 87O 23.778 3.06636.786 45.762 57275 72052 91.02515.380146.628 186.688 28.243 32030 3645941.64647.72754.865 73.106 98 347 133.334 181.871 249.214 342.603 471.981 34.785 405684757550856.439 79.058 113.283 184.494 241333 356 787 530.312 70.9481,181.882 488866040275401 95028120 80 154.762 259.057442.5931,342.025 2,380757 4,163 213 7343 859 30 40 PrintDone Enter any number in the edit fields and then click Check Answer Homework: HW #10-Chapter 12 Score: 0 of 2 pts E12-33A (similar to) Consider how Pine Valley, a po Reference 9 of 9 (7 complete) HW Score: 53.89%, 5.39 of 10 pts Question Help (Click the icon to view the expan Click the icon to view the presen (Click the icon to view the future Future Value of $1 Periods 12% 20% 1.200 2% 1.020 3% 1.030 4% 1.040 5% 1.050 6% 1.060 8% 1.080 10% 14% 1.140 16% 18% 1.010 1020 04001082031241166 1210 254 .300 13461.392 1440 1.030 1041 1051 1.1045 12171276338146 1611 1.160 1561 1.762 1925 2.1022882.488 Read the requirements. 1.061 1082 26.72161.2626046 1574 1689 .81 1939 2.074 1.093 1.125 1.158 1.260 1.331 1.405 1.482 1.643 1.728 Requirement 1. What is the project's Calculate the net present value of the Net present value of expansion 1062 | 1.126 | 1.194 | 1.265 | 1340 | 1.419 | 1.587 | 1772 | 1.974 | 2.195 | 2436 | 2700 | 2986 1072 1.149301316 1.4075041714 1949 2 211 2.502 2826 3.185 3.583 1083 722613691.477541851 2144 2476 2.853 3.278 3759 4.300 1094 53051423155.689 12358 2.773 3.252 3.803 4435 5.160 1105 12193414801.6291.7912.1592594 3.106 3.707 4.411 5234 6.192 1.116 124331531710 1.898233228533479 4.228 5.117 6 7430 1127 | 1.268 | 1.426 | 1201 | 17L6 | 2.012 | 2518 | 3138 | 3.896 | 4.B1B | 5 g38 | 288 | 8.916 1138 | 1.294 | 1.468 | 1865 | 18B6 | 2.133 | 2.320 | 3452 | 4.383 | 5.492 | 6886 | H5529 | 12.629 1149 1319 31.732 02.281 1161 1346 155801 209 2.3 3.172 15.47413674 15.407 293379V486.261 98 1014712.839 20 25 1220 1486 2191 653 3207 4666727 9646 13743 9461 2739339 338 1282 | 1641 | 2094 | 286 | 3386 | 4292 | 6B48 | 10835 | 17000 | 2a 482 | 40874 8286 9 | 95396 1348 | 1811 | 2427 | 3243 | 4322 | 5743 | 10083 | 1744g | 29960 | 50950 | B5B50 | 143 371 | 237 378 1489 2218 40 3.282 4 801 70401026 21.725 45 2593051 18 84 378 721750 3714E977 PrintDone Enter any number in the edit fields and then click Check Answer parts remaining Clear AI Check