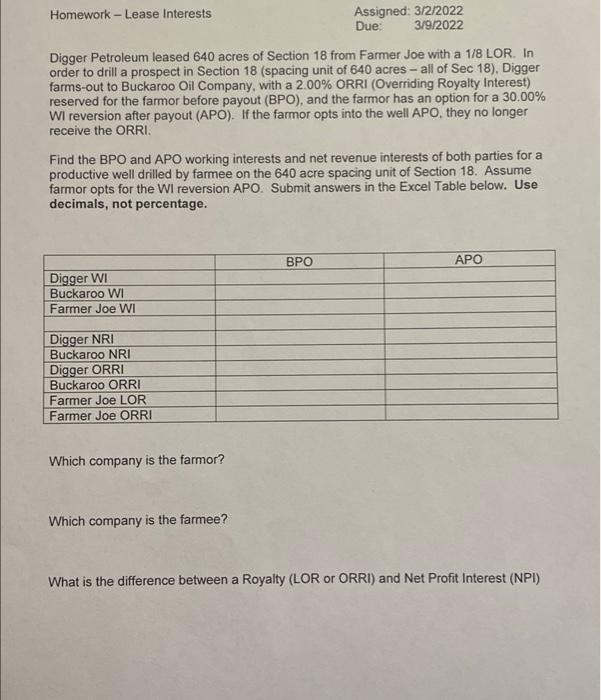

Homework - Lease Interests Assigned: 3/2/2022 Due: 3/9/2022 Digger Petroleum leased 640 acres of Section 18 from Farmer Joe with a 1/8 LOR. In order to drill a prospect in Section 18 (spacing unit of 640 acres - all of Sec 18), Digger farms-out to Buckaroo Oil Company, with a 2.00% ORRI (Overriding Royalty Interest) reserved for the farmor before payout (BPO), and the farmor has an option for a 30.00% Wi reversion after payout (APO). If the farmor opts into the well APO, they no longer receive the ORRI: Find the BPO and APO working interests and net revenue interests of both parties for a productive well drilled by farmee on the 640 acre spacing unit of Section 18. Assume farmor opts for the WI reversion APO. Submit answers in the Excel Table below. Use decimals, not percentage. BPO APO Digger WI Buckaroo WI Farmer Joe WI Digger NRI Buckaroo NRI Digger ORRI Buckaroo ORRI Farmer Joe LOR Farmer Joe ORRI Which company is the farmor? Which company is the farmee? What is the difference between a Royalty (LOR or ORRI) and Net Profit Interest (NPI) Homework - Lease Interests Assigned: 3/2/2022 Due: 3/9/2022 Digger Petroleum leased 640 acres of Section 18 from Farmer Joe with a 1/8 LOR. In order to drill a prospect in Section 18 (spacing unit of 640 acres - all of Sec 18), Digger farms-out to Buckaroo Oil Company, with a 2.00% ORRI (Overriding Royalty Interest) reserved for the farmor before payout (BPO), and the farmor has an option for a 30.00% Wi reversion after payout (APO). If the farmor opts into the well APO, they no longer receive the ORRI: Find the BPO and APO working interests and net revenue interests of both parties for a productive well drilled by farmee on the 640 acre spacing unit of Section 18. Assume farmor opts for the WI reversion APO. Submit answers in the Excel Table below. Use decimals, not percentage. BPO APO Digger WI Buckaroo WI Farmer Joe WI Digger NRI Buckaroo NRI Digger ORRI Buckaroo ORRI Farmer Joe LOR Farmer Joe ORRI Which company is the farmor? Which company is the farmee? What is the difference between a Royalty (LOR or ORRI) and Net Profit Interest (NPI)