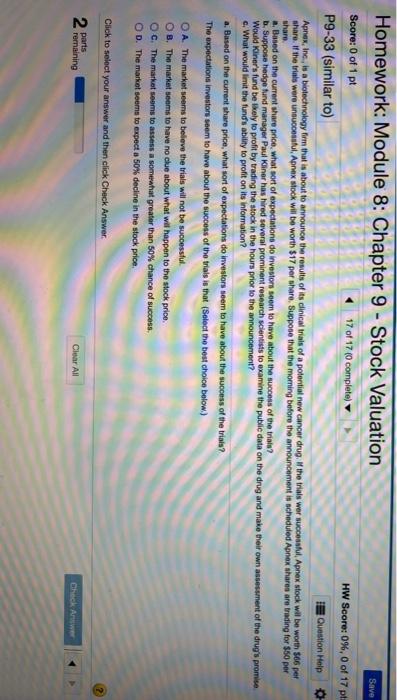

Homework: Module 8: Chapter 9 - Stock Valuation Save Score: 0 of 1 pt 17 of 17 (0 completo) HW Score: 0%, 0 of 17 pts P9-33 (similar to) Question Help Apnes, Inc. is a biotechnology firm that is about to announce the results of its clinical trials of a potential new cancer drug. If the trials wer successful Apnex stock will be worth $06 per share. If the trials were unsuccessful Apnex stock will be worth $17 per share. Suppose that the morning before the announcement is scheduled Apnak shares are trading for $50 per share. a. Based on the current share price, what sort of expectations do investors seem to have about the success of the trials? b. Suppose hedge fund manager Paul Kiner has hired several prominent research scientists to examine the public data on the drug and make their own assessment of the drug's promise Would Kiner's fund be likely to profit by trading the stock in the hours prior to the announcement? c. What would limit the funds ability to profit on its information? a. Based on the current shure price, what sort of expectations do investors seem to have about the success of the trials? The expectations Investors seem to have about the success of the trials in that (Select the best choice below) O A. The market seems to believe the trials will not be successful OB. The market seems to have no clue about what will happen to the stock price OC. The market soms to assess a somewhat greater than 80% chance of success OD. The market som to expect a 50% decline in the stock price Click to select your answer and then click Check Answer. 2 renaining Clear All Check Awer Homework: Module 8: Chapter 9 - Stock Valuation Save Score: 0 of 1 pt 17 of 17 (0 completo) HW Score: 0%, 0 of 17 pts P9-33 (similar to) Question Help Apnes, Inc. is a biotechnology firm that is about to announce the results of its clinical trials of a potential new cancer drug. If the trials wer successful Apnex stock will be worth $06 per share. If the trials were unsuccessful Apnex stock will be worth $17 per share. Suppose that the morning before the announcement is scheduled Apnak shares are trading for $50 per share. a. Based on the current share price, what sort of expectations do investors seem to have about the success of the trials? b. Suppose hedge fund manager Paul Kiner has hired several prominent research scientists to examine the public data on the drug and make their own assessment of the drug's promise Would Kiner's fund be likely to profit by trading the stock in the hours prior to the announcement? c. What would limit the funds ability to profit on its information? a. Based on the current shure price, what sort of expectations do investors seem to have about the success of the trials? The expectations Investors seem to have about the success of the trials in that (Select the best choice below) O A. The market seems to believe the trials will not be successful OB. The market seems to have no clue about what will happen to the stock price OC. The market soms to assess a somewhat greater than 80% chance of success OD. The market som to expect a 50% decline in the stock price Click to select your answer and then click Check Answer. 2 renaining Clear All Check Awer