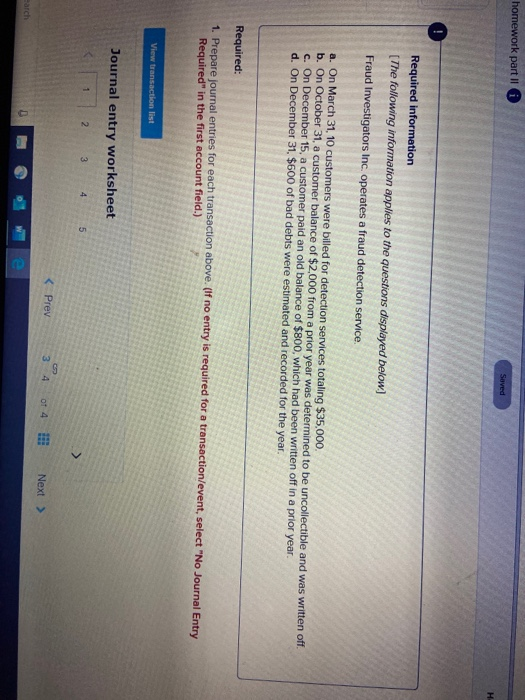

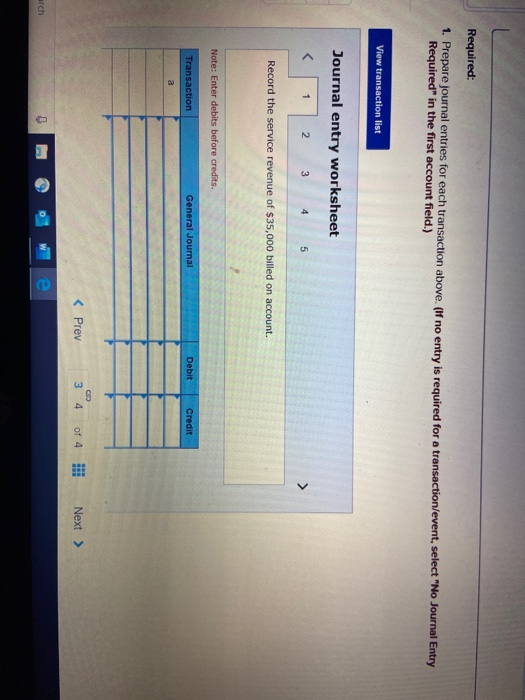

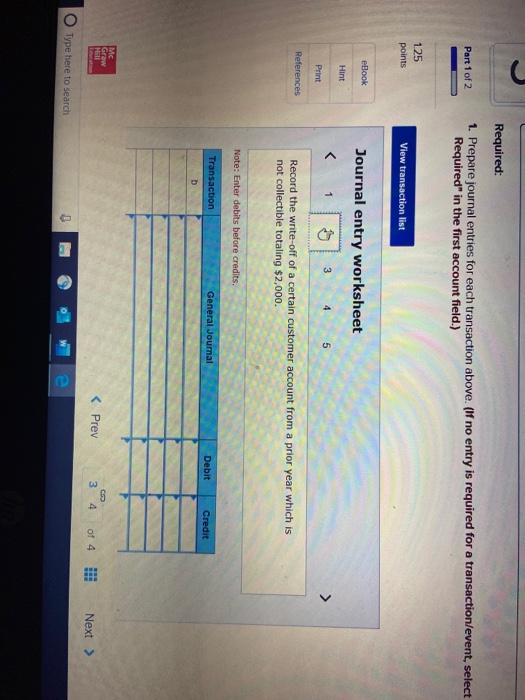

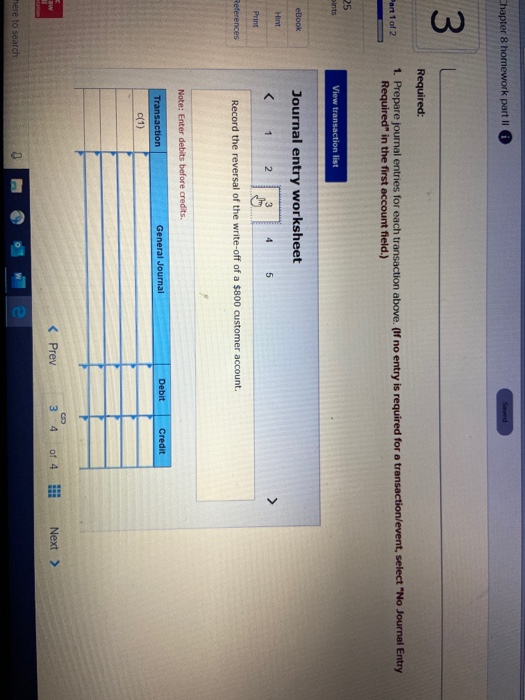

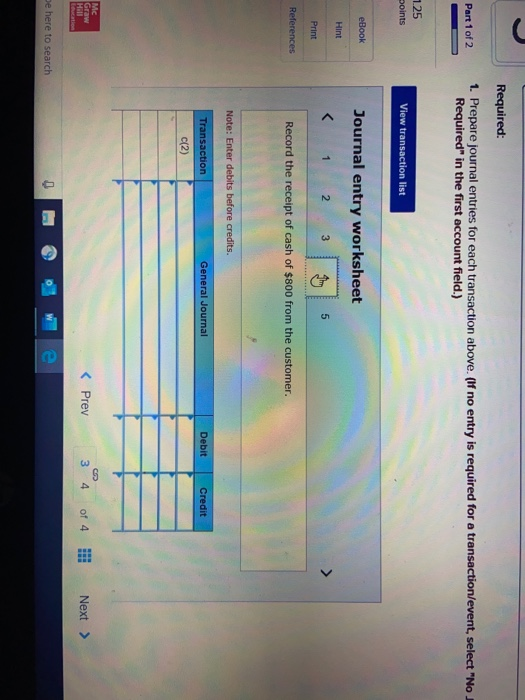

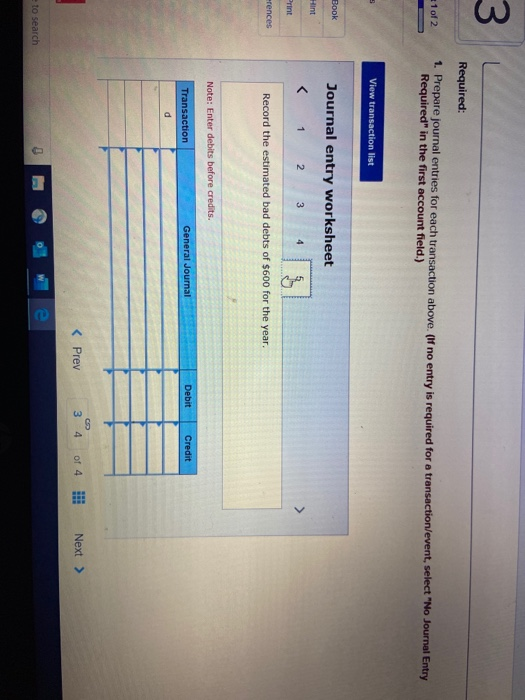

homework part II Required information (The following information applies to the questions displayed below) Fraud Investigators Inc. operates a fraud detection service a. On March 31, 10 customers were billed for detection services totaling $35.000. b. On October 31, a customer balance of $2.000 from a prior year was determined to be uncollectible and was written off c. On December 15, a customer paid an old balance of $800, which had been written off in a prior year. d. On December 31, $600 of bad debts were estimated and recorded for the year. Required: 1. Prepare journal entries for each transaction above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet earch Required: 1. Prepare journal entries for each transaction above. (if no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 Record the service revenue of $35,000 billed on account. Note: Enter debits before credits. Transaction General Journal Debit Credit arch Required: Part 1 of 2 1. Prepare journal entries for each transaction above. (If no entry is required for a transaction/event, select Required" in the first account field.) 1.25 points View transaction list eBook Journal entry worksheet Hint Print References Record the write-off of a certain customer account from a prior year which is not collectible totaling $2,000. Note: Enter debits before credits. Transaction General Journal Debit Credit O Type here to search w e Chapter 8 homework part II i 3 Required: 1. Prepare journal entries for each transaction above. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) Part 1 of 2 Pints View transaction list eBook Journal entry worksheet Hint Print References Record the reversal of the write-off of a $800 customer account. Note: Enter debits before credits. Transaction General Journal Debit Credit (1) here to search Required: Part 1 of 2 1. Prepare journal entries for each transaction above. (If no entry is required for a transaction/event, select "No Required" in the first account field.) 125 points View transaction list eBook Journal entry worksheet Hint Print References Record the receipt of cash of $800 from the customer. Note: Enter debits before credits. General Journal Debit Credit Transaction C(2) GE be here to search Required: 1. Prepare journal entries for each transaction above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 1 of 2 View transaction list Book Hint Journal entry worksheet to search