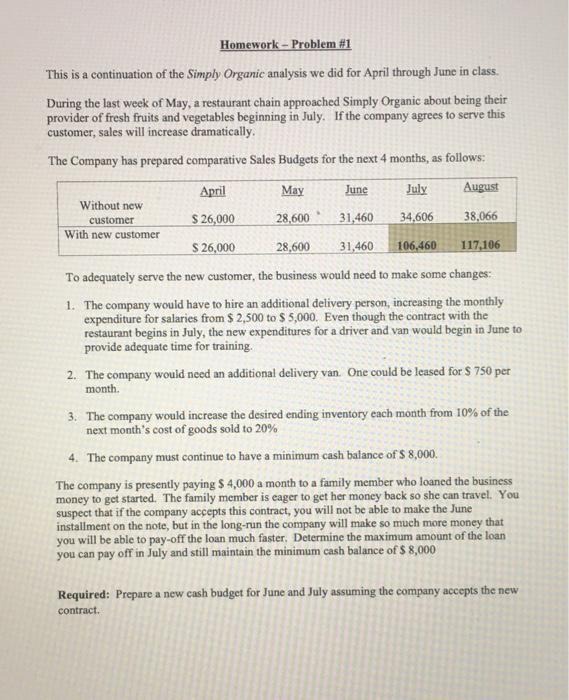

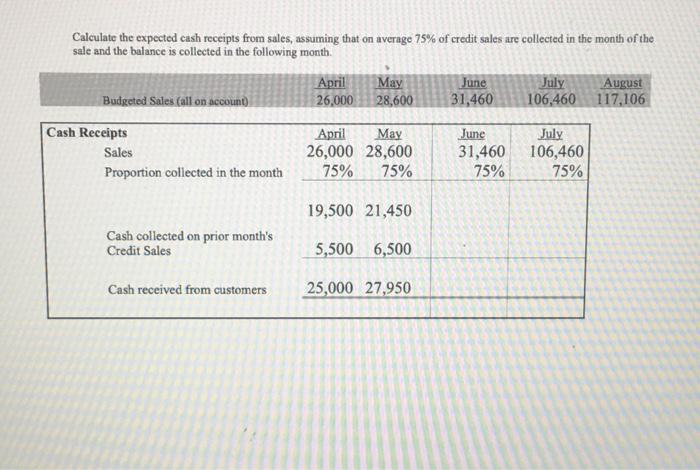

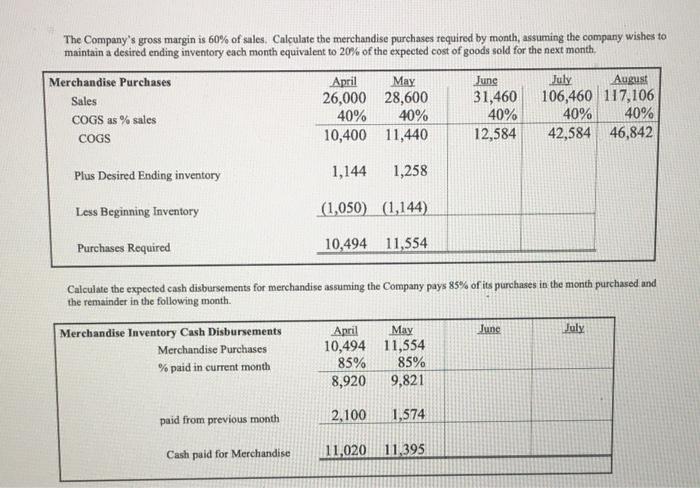

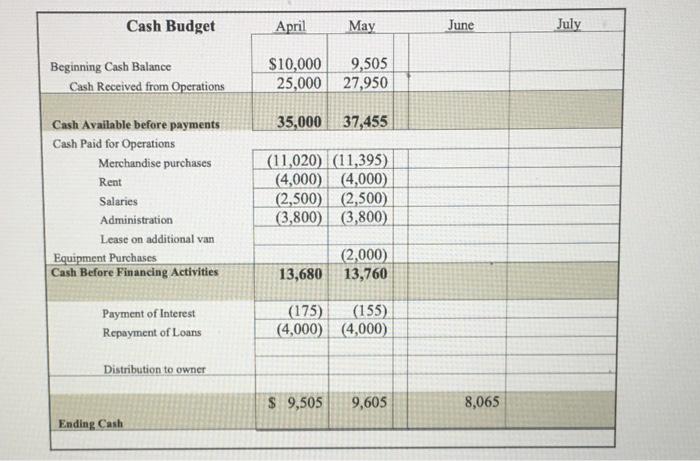

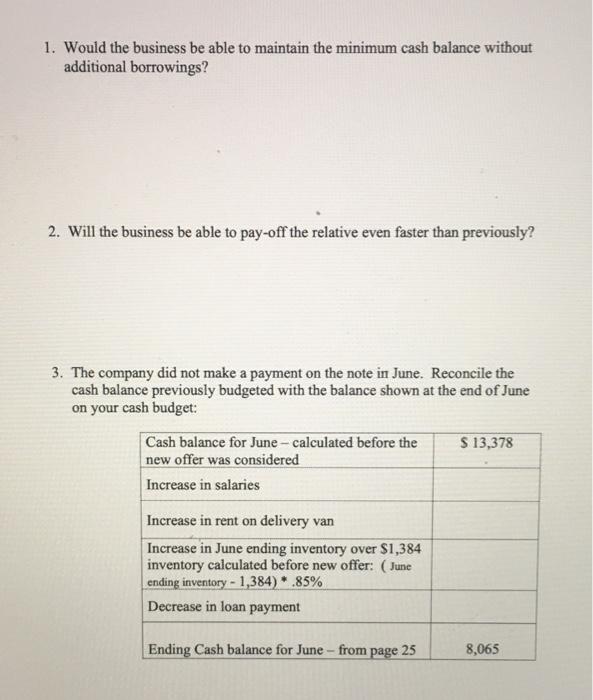

Homework - Problem #1 This is a continuation of the Simply Organic analysis we did for April through June in class. During the last week of May, a restaurant chain approached Simply Organic about being their provider of fresh fruits and vegetables beginning in July. If the company agrees to serve this customer, sales will increase dramatically The Company has prepared comparative Sales Budgets for the next 4 months, as follows: April May June July August Without new customer $ 26,000 28,600 31,460 34.606 38,066 With new customer $ 26,000 28,600 31,460 106,460 117,106 To adequately serve the new customer, the business would need to make some changes: 1. The company would have to hire an additional delivery person, increasing the monthly expenditure for salaries from $ 2,500 to $5,000. Even though the contract with the restaurant begins in July, the new expenditures for a driver and van would begin in June to provide adequate time for training. 2. The company would need an additional delivery van. One could be leased for $ 750 per month. 3. The company would increase the desired ending inventory each month from 10% of the next month's cost of goods sold to 20% 4. The company must continue to have a minimum cash balance of $ 8,000 The company is presently paying $ 4,000 a month to a family member who loaned the business money to get started. The family member is eager to get her money back so she can travel. You suspect that if the company accepts this contract, you will not be able to make the June installment on the note, but in the long-run the company will make so much more money that you will be able to pay-off the loan much faster. Determine the maximum amount of the loan you can pay off in July and still maintain the minimum cash balance of $ 8,000 Required: Prepare a new cash budget for June and July assuming the company accepts the new contract. Calculate the expected cash receipts from sales, assuming that on average 75% of credit sales are collected in the month of the sale and the balance is collected in the following month April May June July August Budgeted Sales (all on account) 26,000 28,600 31,460 106,460 117,106 Cash Receipts April May June July Sales 26,000 28,600 31,460 106,460 Proportion collected in the month 75% 75% 75% 75% 19,500 21,450 Cash collected on prior month's Credit Sales 5,500 6,500 Cash received from customers 25,000 27,950 The Company's gross margin is 60% of sales. Calculate the merchandise purchases required by month, assuming the company wishes to maintain a desired ending inventory each month equivalent to 20% of the expected cost of goods sold for the next month. Merchandise Purchases April May Jung July August Sales 26,000 28,600 31,460 106,460 117,106 COGS as % sales 40% 40% 40% 40% 40% COGS 10,400 11,440 12,584 42,584 46,842 Plus Desired Ending inventory 1,144 1,258 Less Beginning Inventory (1,050) (1,144) Purchases Required 10,494 11,554 Calculate the expected cash disbursements for merchandise assuming the Company pays 85% of its purchases in the month purchased and the remainder in the following month. June Joly Merchandise Inventory Cash Disbursements Merchandise Purchases % paid in current month April 10,494 85% 8,920 May 11,554 85% 9,821 paid from previous month 2,100 1,574 Cash paid for Merchandise 11,020 11,395 Cash Budget April May June July Beginning Cash Balance Cash Received from Operations $10,000 9,505 25,000 27,950 35,000 37,455 Cash Available before payments Cash Paid for Operations Merchandise purchases Rent Salaries Administration Lease on additional van Equipment Purchases Cash Before Financing Activities (11,020) (11,395) (4,000) (4,000) (2,500) (2,500) (3,800) (3,800) (2,000) 13,680 13,760 Payment of Interest Repayment of Loans (175) (155) (4,000) (4,000) Distribution to owner $ 9,505 9,605 8,065 Ending Cash 1. Would the business be able to maintain the minimum cash balance without additional borrowings? 2. W the business be able to pay-off the relative even faster than previously? 3. The company did not make a payment on the note in June. Reconcile the cash balance previously budgeted with the balance shown at the end of June on your cash budget: $ 13,378 Cash balance for June - calculated before the new offer was considered Increase in salaries Increase in rent on delivery van Increase in June ending inventory over $1,384 inventory calculated before new offer: (June ending inventory - 1,384) *.85% Decrease in loan payment Ending Cash balance for June - from page 25 8,065